Business Equipment Award 2020 (MA000021)

This article provides guidelines about when to use the different work types and tags that are included as part of the pre-built Business Equipment award package. For further information about the Business Equipment Award, refer to the award Business Equipment Award

Key Updates to Award

Last Updated: August 2023

Key_Updates

Installing and Configuring the Pre-Built Award Package

For details on how to install and configure this Pre-built Award Template, please review the detailed help article here.

While every effort is made to provide a high-quality service, YourPayroll does not accept responsibility for, guarantee or warrant the accuracy, completeness or up-to-date nature of the service. Before relying on the information, users should carefully evaluate its accuracy, currency, completeness and relevance for their purposes, and should obtain any appropriate professional advice relevant to their particular circumstances.

Coverage

This award covers the sale and lease of business equipment. It also covers any associated installation and servicing of this equipment. Examples of business equipment are:

- Computers

- Data processing equipment

- Photocopiers

- Facsimile machines

- Cash registers

- Accounting and adding machines

- Calculators

- Any peripheral equipment associated with the equipment above such as keyboards, monitors, printers, routers and multifunction devices.

Area Allowances

Area allowances are paid for work in certain zones and in place of paying for the cost of accommodation.

We have treated Area Allowances as a domestic travel allowances up to reasonable limits for tax purposes, meaning it does not form part of Ordinary Times Earnings (0% super guarantee), does not have tax withheld and is excluded from being reported in the income statement. If this does not align with your circumstances, you may wish to change these settings in the 'Pay Category' screen.

Work types

Annual Leave taken

Use this work type if the employee has taken annual leave. Enter the hours that would have otherwise been worked.

Call back & Call back (casual)

Use this work type if the employee is called back to work after they have completed their normal hours.

Call back while on stand-by & Call back while on stand-by (casual)

Use this work type if the employee is called back to work while they have been on stand-by

Community Service Leave taken

Use this work type if the employee has taken paid community service leave e.g. Jury Duty. Enter the hours that would have otherwise been worked.

Compassionate Leave taken

Use this work type if the employee has taken compassionate leave. A maximum of 2 days is available under the NES. Enter the hours that would have otherwise been worked.

Hours worked

Use this work type if there are ordinary hours worked and the other work types are not applicable

Kilometres travelled

Use this work type to record the use of the own motor vehicle. 1 unit = 1 kilometre.

Leave without pay

Use this work type if the employee has been on leave without pay

Long Service Leave taken

Use this work type if the employee has taken long-service leave. Enter the hours that would have otherwise been worked.

Personal/Carer's Leave taken

Use this work type if the employee has taken personal/carers leave. Enter the hours that would have otherwise been worked.

Phone or remote access support & Phone or remote access support (casuals)

Use this work type if the employee has provided phone support or remote access support i.e. not on-site.

Public holiday not worked

Use this work type if the employee has had a day off on a public holiday (permanent employees only)

RDO Leave taken

Use this work type if the employee has taken a roster day off. Enter the hours that would have otherwise been worked.

Stand-by & Stand-by (casuals)

Use this work type if the employee is on stand-by to be called to work.

TIL Leave taken

Use this work type if the employee has taken time offin lieu. Enter the hours that would have otherwise been worked.

Training course & Training course (casuals)

Use this work type if the employee has attended a training course

Work on a day off & Work on a day off (casuals)

Use this work type if the employee has worked on a day they'd normally have off.

Tags

Country employee part of the time

Use this tag if your employee works in a country area for part of the week on a regular basis.

Responsible for service centre

Use this tag if the employee is responsible for the management of a service centre.

Country employee

Use this tag if the employee is required to work in a country area.

Permanent Night Shift

Use this tag if the employee is required to work on a rotating night shift for longer than a month.

Works in Broken Hill

See section on Area Allowances

Works in Central WA

See section on Area Allowances

Works in Mount Isa

See section on Area Allowances

Works in Northern Territory

See section on Area Allowances

Works in North WA

See section on Area Allowances

Works in South WA

See section on Area Allowances

Saturday is ordinary hours

Use this tag if by agreement a Saturday is included in ordinary hours

Sunday is ordinary hours

Use this tag if by agreement a Sunday is included in ordinary hours

In charge of 2-5 employees

Use this tag if the employee is in charge of 2-5 employees

In charge of 6-10 employees

Use this tag if the employee is in charge of 6-10 employees

In charge of more than 10 employees

Use this tag if the employee is in charge of more than 10 employees

Uses vehicle on a casual basis

Use this tag if the employee is required to use their own motor vehicle, but on an irregular basis

Uses vehicle each day

Use this tag if the employee is required to use their own motor vehicle every day.

Provides field technical service/support

Use this tag if the employee is required to provide technical services or technical support on-site.

Performs first aid duties

Use this tag if the employee has a relevant qualification and is required to perform first aid duties.

10 hour shiftwork

Use this tag if, by agreement, an employee can work up to 10 hours per day as part of ordinary hours.

12 hour shiftwork

Use this tag if, by agreement, an employee can work up to 12 hours per day as part of ordinary hours.

Key Updates

August 2023

1st

From 1 August, all employees are entitled to 10 days of paid family and domestic violence leave each year. The (Unpaid) Family and Domestic Violence Leave configuration settings under awards have been updated - the leave category is disabled from award leave allowance templates, and the work type is not enabled automatically for all employees. Please ensure that employees no longer use the unpaid leave category or work type.

July 2023

1st

We have updated the award to reflect the Fair Work Commission’s National Minimum Wage increase detailed in the Annual Wage Review 2022-23 decision and also includes updates to expense-related allowances. You can find information on the Determinations here and here. These changes come into effect from the first full pay period on or after the 1st July 2023. Please install these updates after you have finalised your last pay run before the first full pay period beginning on or after the 1st July 2023.

May 2023

23rd

We have updated the award to make sure that the leading hand allowance will apply correctly as an all-purpose allowance as per clause 17.2(b).

January 2023

31st

We have updated the award to reflect changes made as part of the Fair Work Decision regarding Paid Family and Domestic Violence Leave. Further information on what changes have been applied to the platform and what you should be aware of can be found within this article.

We have created the following new categories:

- New Leave Category: Paid Family and Domestic Violence Leave.

- New Pay Category: Paid Family and Domestic Violence Leave.

- New Work Type: Paid Family and Domestic Violence Leave taken.

We have updated the Leave Allowance Templates to disable the existing unpaid Family and Domestic Violence and we have enabled the new Paid Family and Domestic Violence Leave. We also updated any impacted rule conditions.

As part of Fair Work's ruling, an employee must be paid their full pay rate; this includes their base rate plus any incentive-based payments and bonuses, loadings, monetary allowances, overtime or penalty rates, and any other separately identifiable amount.

July 2022

The Award has been updated to reflect the Fair Work Commission’s National Minimum Wage increase of detailed in the Annual Wage Review 2021-22 decision. This also includes updates to expense-related allowances. Information on the Determinations can be found here and here. These changes come into effect from the first full pay period on or after 1 July 2022. Please install these updates AFTER you have finalised your last pay run prior to the first full pay period commencing on or after 1 July 2022.

Unpaid Pandemic Leave has been disabled as this entitlement has now expired within this award. Additional information can be found on the Fairwork website.

January 2022

The Unpaid Pandemic Leave pay category has been updated and counts as service for entitlements under awards and the National Employment Standards.

If any staff have used this category previously, please adjust their Annual, Personal and Long Service Leave balances for any period of unpaid pandemic leave previously taken.

To identify affected employees and enter the leave accrual see: Calculating Missing Leave Accrual for Unpaid Pandemic Leave Taken

November 2021

The Award has been updated in line with the ATO's requirements for STP Phase 2 reporting. The reporting of gross earnings are now being disaggregated into distinguishable categories. The Pay Category payment classifications have been updated in line with the ATO specification categories found here. For further information please see our STP support article.

September 2021

The award has been updated to ensure all conditions under clause 20.6, Rest period after working overtime, are correctly applied.

The following changes have been made to the Permanent (shiftwork) and Permanent (daywork) rulesets. The rule Stop Processing Allowances has been added to ensure the motor vehicle allowance rules are not overridden by the rule 30.6(c) Less than 10 hour break between shifts. The 30.6(c) Less than 10 hour break between shifts rule has been edited so that it will now only apply to Full Time employees and will also exclude the work types Phone or remote access support and Phone or remote access support (casuals).

In the Casual (shiftwork) and Casual (daywork) rulesets, the rule 30.6(c) Less than 10 hour break between shifts has been removed as this penalty payment only applies to Full Time employees.

July 1 2021

The Award has been updated to reflect the Fair Work Commission’s National Minimum Wage increase of 2.5% detailed in the Annual Wage Review 2020-21 decision. This also includes updates to expense-related

allowances. Information on the Determinations can be found here and here.

These changes come into effect from the first full pay period on or after 1 July 2021. Please install these updates AFTER you have finalised your last pay run prior to the first full pay period commencing on or after 1 July 2021.

Updates have also been made to the Leave Category Family & Domestic Violence Leave, so that the balance is displayed in days instead of hours in line with the National Employment Standards.

Once the update is installed, all employee’s FDV leave balances will be displayed in days not hours. This will mean that an employee’s balance may now show as 38 days. In order to correct the balance please see How to Fix Family & Domestic Violence Leave Balance Data.

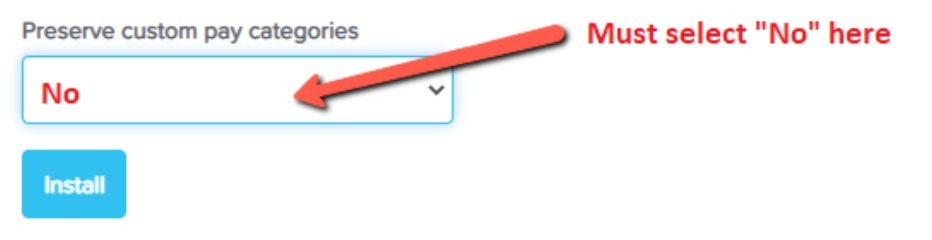

This update is to ensure that any new installs of this award conducted since 1 July are now captured with the SG increase from 9.5% to 10% for all pay categories. If you have installed this award between 1 July 2021 to 8 July 2021 for the first time, please ensure you select "NO" to preserve custom pay categories. If you were using this award prior to 1 July 2021, then you do not need to select "NO." Further information can be found in Incorrect SG rate used in pay runs article here.

November 2020

The award has been updated to reflect changes made as part of the Fair Work Decision around overtime for casual employees. In this update overtime rates for casuals have been updated to 187.5% of the ordinary rate for the first 3 hours and 250% after 3 hours

1 November 2020

The Award, as part of Group 2 Awards, has been updated to reflect the Fair Work Commission’s National Minimum Wage increase of 1.75% detailed in the Annual Wage Review 2019-20 decision. This also includes updates to expense-related allowances. Information on the Determinations can be found here and here.

These changes come into effect from the first full pay period on or after 1 November 2020. Please install these updates AFTER you have finalised your last pay run prior to the first full pay period commencing on or after 1 November 2020.

28 Sept 2020

The pay condition rule sets Permanent (shiftwork), Permanent (daywork), Casual (shiftwork) and Casual (daywork) have been updated in line with FairWork changes to remove penalties and overtime from Salesperson Classifications. New leave allowance templates have been assigned to the Salesperson Employment Agreement Classifications. Further information on these changes can be found under clause 16.3 of the Award

August 2020

The award has been updated to reflect the High Court's decision on the accrual of personal/carer's leave which overturns the decision made by the Full Federal Court of Australia, with personal/carer's leave being calculated on working days not hours. Information on the decision can be found here. As such, we have removed the Personal/Carer's (10 days) Leave Allowance Templates and updated associated Employment Agreements. Please note, this update will not remove any of the above from a business where the award was already installed prior to 25 August 2020. However, any new award installs from 25 August 2020 will not display personal/carer's (10 days) leave details.

For further information on migrating from daily personal/carers leave accruals to hourly please refer here

30 June 2020

The award pay rate templates have been updated to reflect the Australian Taxation Office's decision to increase the cents per kilometre rate for work-related car expense deductions to 72 cents per kilometre. The new rate applies from the first paid date in the 2020-21 financial year.

April 2020

The award has been updated to reflect changes made as part of the Fair Work Decision around flexibility during coronavirus. The new schedule allows employees to take up to two (2) weeks unpaid pandemic leave. A new pay category (Unpaid Pandemic Leave Taken), leave category and work type (Unpaid Pandemic Leave) have been created. Also, the rule sets have been updated, where necessary, to include/exclude the work type and leave category to some pay conditions. Further, the Leave Allowance Templates have been updated to ensure this new leave category is enabled and is now accessible for employees to take this leave when required.

Further, under this new schedule employees can take up to twice as much annual leave at a proportionally reduced rate if their employer agrees. The employee's pay rate and leave balance will need to be manually adjusted to half in each pay run for the period of leave.

March 2020

The rule set pay conditions for Permanent (daywork), Permanent (Shiftwork), Casual (daywork), and Casual (Shiftwork) have been updated in relation to the minimum break between shifts, as part of clause 30.6(c), to include the first shift of the day and to exclude leave work types.

February 2020

Due to recent changes to the interpretation of personal/carer's leave accrual under the National Employment Standards, updates have been made to the setup of the Award. Further information can be found here.

A new Leave Category called Personal/Carer's (10 days) Leave has been created. Also, new Leave Allowance Templates (LATs) have been created specific to 10 days accrual per year for each state and the LATs have been attached to the current Employment Agreements for selection options for an employee's LAT in their Employee Default Pay Run screen. Any rules impacted by Personal/Carer's Leave have also been updated with the new leave category.

Instructions on converting the accruals to the 10 day method can be found here.

30 June 2019

The Award has been updated to reflect the Fair Work Commission’s National Minimum Wage increase of 3% from its Annual Wage Review 2018-19 decision. This also includes updates to expense-related allowances. Information on the Determinations can be found here and here.

These changes come into effect from the first full pay period on or after 1 July 2019. Please install these updates AFTER you have finalised your last pay run prior to the first full pay period commencing on or after 1 July 2019.

December 2018

The setup of the Payroll Tax Exempt field in Payroll Settings>Pay Categories was replicating the PAYG Exempt field rather than creating a unique identity; when installed into the business settings. An audit has been carried out across the system and the issue has now been resolved with this update.

1 October 2018

The Award has been updated to reflect changes made as part of the Fair Work Decision 4 year review of modern awards. The change is a newly created clause 13.3 - casual minimum engagement. This now provides for casual employees to be paid for at least 2 consecutive hours of work on each occasion they are required to attend work.

This change is reflected in the "Casual (shiftwork)" and "Casual (daywork)" rule set.

Please note that the change comes into effect on the first full pay period on or after 1 October 2018. This means that you should only install this update once you've completed the last pay period for hours worked during September 2018. The Fair Work Determination can be found here.

August 2018

Casual Loading rates updated to 23% for all penalty and overtime payments in line with the Award update effective from 1 July 2018.

1 August 2018

The award has been updated to reflect changes made as part of the Fair Work Decision 4 year review of modern awards. The determination for the new clause in the modern award allowing employees to take unpaid leave to deal with family and domestic violence can be found here. Family and Domestic Violence leave applies from the first full pay period on or after 1 August 2018. Further information can be found at Fair Work.

Employees, including part-time and casual employees are entitled to 5 days unpaid family and domestic violence leave each year of their employment. The 5 days renews each 12 months of their employment but does not accumulate if the leave is not used.

A new leave category has been created - “Family and Domestic Violence Leave” and a new Work Type - “Family and Domestic Violence Leave taken”. The Leave Allowance Templates and any impacted rule conditions have also been updated.

28 June 2018

The Award has been updated to reflect the Fair Work Commission’s national minimum wage increase of 3.5% from its Annual Wage Review 2017-18 decision. This also includes updates to expense-related allowances.

These changes come into effect from the first full pay period on or after 1 July 2018. Please install these updates AFTER you have finalised your last pay run prior to the first full pay period commencing on or after 1 July 2018.

Additionally, the following changes have been made as part of this update:

- New laundry allowance pay categories and rule conditions were created to reflect the ATO threshold maximum limits for claiming of laundry (not dry cleaning) for deductible clothing under the Award. Further information can be found in the “Cleaning of Work Clothing” section of this ATO article.

If you have any feedback or questions please contact us via support@yourpayroll.com.au

Article is closed for comments.

Search for a feature, function or article…![Pay Cat Logo New 2.png]](https://www.paycat.com.au/hs-fs/hubfs/Pay%20Cat%20Logo%20New%202.png?height=50&name=Pay%20Cat%20Logo%20New%202.png)