PAYG amounts are calculated on leave payouts using the guidelines set out by the ATO here.

Once you have chosen to terminate an employee from within the pay run there are two methods for calculating the withholding amount when paying out unused leave that has accrued on or after 18th August 1993. The methods used depend on the value of the unused leave:

- Where the value of unused leave is $300 or more, PAYG is calculated using marginal tax rates. Refer to this article for further details on this method.

- Where the value of unused leave is less than $300, the system will compare the marginal rate and the flat rate of 32% and apply the lesser of the two. This article will discuss this method in more detail.

Keep in mind, the marginal tax rate is calculated as per the below steps.

- Using the relevant PAYG withholding tax table, work out the amount to withhold from your employee’s normal gross earnings for a regular pay period.

- Divide the amount of the payment by the number of normal pay periods in 12 months (12 monthly payments, 26 fortnightly payments or 52 weekly payments).

- Ignore any cents.

- Add the amount at step 3 to the normal gross earnings for a single pay period.

- Use the same PAYG withholding tax tables used at step 1 to work out the amount to withhold for the amount at step 4.

- Subtract the amount at step 1 from the amount at step 5.

- Multiply the amount obtained at step 6 by the number of normal pay periods in 12 months (12 monthly payments, 26 fortnightly payments or 52 weekly payments).

To help clarify, here is an example:

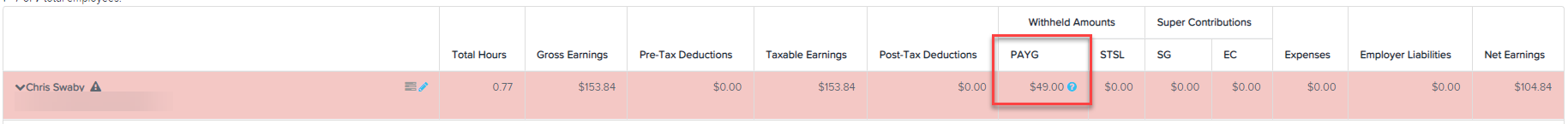

Chris is a full time employee who is being paid out 0.7692 hours of unused leave, at a rate of $200 per hour. The PAYG amount calculates to $49.00:

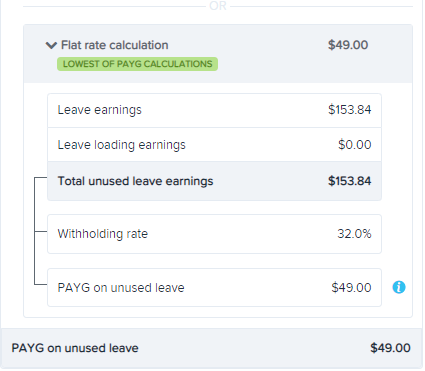

The below calculations can be viewed when clicking on the "?" icon in the employee's PAYG field:

The marginal tax rate calculation produces a PAYG figure of $52 whereas the flat rate calculation (total unused earnings x 32% less any cents) produces a lower rate of $49.

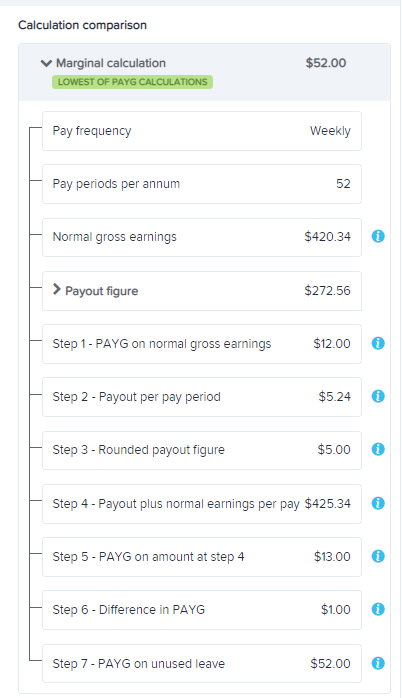

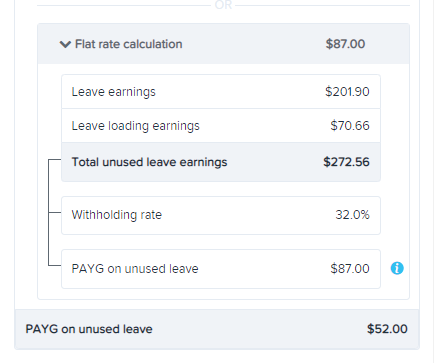

An alternative example can be seen below where Gabriel is being paid his unused leave of 10 hours at a rate of $20.19/hr:

Based on Gabriel's normal gross earnings of $420.34 per week, the marginal tax rate calculation provides a final PAYG figure of $52 which is lower than the flat rate calculation of $87, hence it is applied to the pay run.

NB: you can also override the normal gross earnings figure in the pay run, as you can for the marginal calculation on amounts over $300.

For information on PAYG calculations on unused leave on redundancy and ETP unused leave see:

Unused leave classified as an ETP

PAYG on Genuine Redundancy, Invalidity and Early Retirement Scheme Payments

For more information on PAYG on termination pay see: PAYG on Termination - Overview

If you have any questions/comments please contact us via support@yourpayroll.com.au