This article outlines the steps involved in calculating the withholding amount (PAYG and STSL) on a lump sum payment when using Method A. Instructions on using Method B(ii) are found here.

In accordance with the ATO, the Method A option can be used when processing any additional payments regardless of the financial year the additional payment applies to. This includes all back payments, commissions, bonuses or similar payments.

This method calculates withholding by apportioning additional payments made in the current pay period over the number of pay periods in a financial year, and applying that average amount to the gross earnings in the current pay period.

N.B.: Employees engaged in the seasonal worker program and who have the 'Is a seasonal worker (and business is an approved employer of the SWP)' checkbox ticked in their Tax File Declaration screen are withheld tax at a flat rate of 15% on all payments made to them. This includes lump sum payments and, as a result, applying the lump sum action for these employees will have no effect on their tax, ie they will still be taxed at the 15% rate.

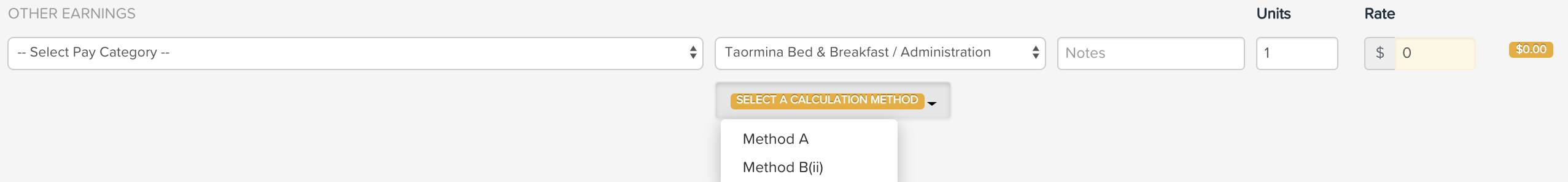

To process a lump sum payment for an employee in a pay run using this method, click on Actions > Add Lump Sum Payment. An earnings line will appear as follows:

Ensure the following actions are completed:

- Select the pay category,

- Ensure the correct location is selected,

- Enter any notes if applicable (optional),

- Enter the unit(s) if it differs to the default value of "1",

- Enter the lump sum rate/amount,

- Select "Method A" from the calculation method dropdown,

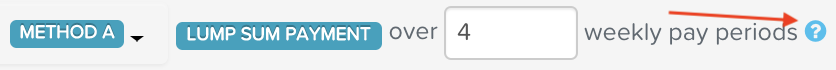

- Enter the number of pay periods the lump sum amount relates to. The number entered here will be what is used to determine the number of pay periods in steps 3 and 7 for Method A calculation per the ATO guideline.

Once you save the employee's pay, a tooltip will appear to the right of the "Method A" label:

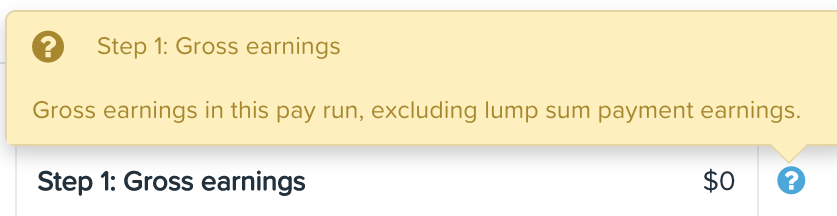

Clicking the tooltip will open a context panel containing details of how the withholding amount has been calculated as per the ATO's guidelines.

Interpreting the data in the context panel

Each step includes a tooltip that explains how each value was determined as per the below screenshot:

You can also export the data in excel or pdf.

Maximum amount withheld on lump sum payments

There is a withholding limit of 47% on tax withheld from any lump sum payments using Method A. As such, you will notice the final amount withheld will never be higher than the amount calculated in this step.

Applying this withholding limit may result in withholding not being sufficient to cover some employees' end of year tax liability. In these situations, an employee can ask their employer to increase their withholding for the remainder of the financial year. To do this, you would need to process a PAYG adjustment in the employee's pay.

Working Holiday Makers & Lump Sum Payments

Employees defined as working holiday makers are not subject to this method when calculating the withholding amount on lump sum payments. Rather, working holiday makers are taxed in accordance with the Tax table for working holiday makers . As such, when entering a lump sum amount for a working holiday maker, you will not be asked to select a calculation method.

If you have any questions or feedback, please let us know via support@yourpayroll.com.au.