This article outlines the steps involved in calculating the withholding amount (PAYG and STSL) on a lump sum payment when using Method B(ii). Instructions on using Method A are found here.

In accordance with the ATO, the Method B(ii) option should be used when either processing:

- back payments relating to a prior financial year; and/or

- any additional payments (including commissions, bonuses or similar payments) that don’t relate to a single pay period regardless of the financial year the additional payment applies to.

This method calculates withholding by averaging all additional payments made in the current financial year over the number of pay periods in a financial year, and applying that to the average total earnings to date.

It's important to ensure you are using the correct pay category with the correct payment classification when entering the lump sum payment. If the system categories for lump sum payments do not apply to a specific scenario (such as paying Lump Sum E), a new pay category can be easily created. You can find more information on creating and managing pay categories here.

N.B.: Employees engaged in the seasonal worker program and who have the 'Is a seasonal worker (and business is an approved employer of the SWP)' checkbox ticked in their Tax File Declaration screen are withheld tax at a flat rate of 15% on all payments made to them. This includes lump sum payments and, as a result, applying the lump sum action for these employees will have no effect on their tax, ie they will still be taxed at the 15% rate.

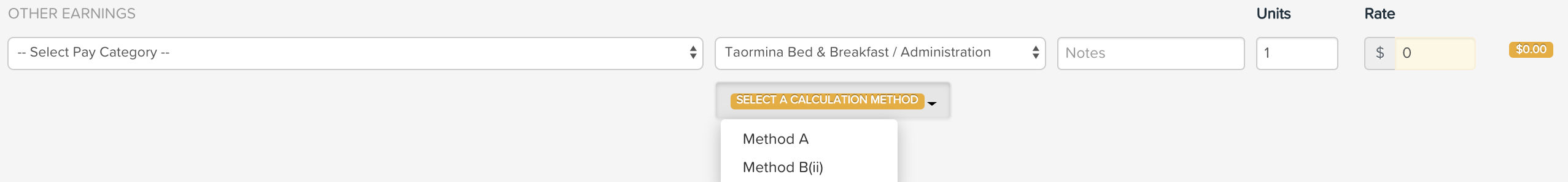

To process a lump sum payment for an employee in a pay run using this method, click on Actions > Add Lump Sum Payment. An earnings line will appear as follows:

Ensure the following actions are completed:

- Select the pay category,

- Ensure the correct location is selected,

- Enter any notes if applicable (optional),

- Enter the unit(s) if it differs to the default value of "1",

- Enter the lump sum rate/amount,

- Select "Method B(ii)" from the calculation method dropdown.

Once you save the employee's pay, a tooltip will appear to the right of the "Method B(ii)" label.

Interpreting the data in the context panel

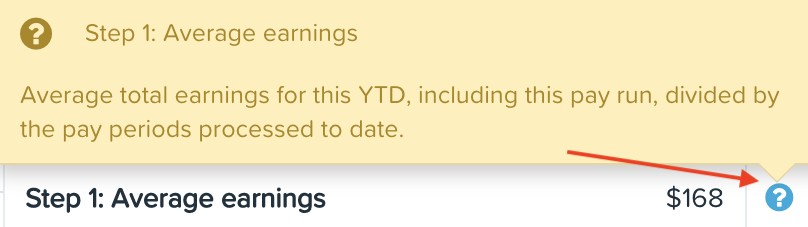

Each step includes a tooltip that explains how each value was determined as per the below screenshot:

We will provide more detail here on the steps used to calculate the withholding amount.

Step 1: Average earnings

Average earnings are calculated by applying the employee's YTD earnings, including the current pay run, excluding termination payments and lump sum payments processed using Method B (ii) ("normal earnings"). This amount is then divided by the number of pay runs, including the current pay run, in the financial year. When determining the number of pay runs in the financial year, this also includes pay runs that an employee has not been paid, for eg say an employee has a weekly pay schedule and there were 10 pay runs that had been processed since the start of the financial year. The employee had only been paid in 8 of these pay runs (as did not work any hours to be paid in 2 pay runs), the number of pay runs would still be deemed 10.

Where a lump sum payment is being processed for an existing employee in the first pay run of the financial year, the normal earnings will be calculated using the previous financial year's earnings.

Where a lump sum payment is being processed for a new employee in the first pay run of the financial year, the normal earnings will be calculated using the employee's expected earnings for the year. This is determined using the employee's hourly rate of pay x hours per pay period x pay frequency, as detailed in the employee's Pay Run Defaults screen.

Opening balances are also applied when determining normal earnings - to clarify this is only the case where the opening balances financial year setting is the same as the financial year for the pay run being processed.

You can override the normal earnings calculated by the system. To do this, click on the 'Override normal gross earnings' checkbox, enter the desired normal earnings amount and then click on 'Save'.

Ensure you enter the YTD amount in this field as the system will then calculate the average earnings.

Step 2: Amount withheld on average earnings (including STSL)

The amount of PAYG (and STSL, if applicable) calculated on the average earnings obtained in Step 1.

Step 3: Average additional earnings

Additional earnings include any YTD lump sum payments, including the current pay run, that were processed using the Method B(ii) option. This will also incorporate any opening balance amount entered in the employee's "Additional Payments (Opening Balance)" field (Opening Balances screen > Earnings tab).

This amount is then divided by the number of pay periods in the financial year, for eg if the employee is on a weekly pay schedule the amount will be divided by 52; if on a monthly pay schedule the amount will be divided by 12.

Step 4: Total eligible earnings

The eligible earnings are made up of the average earnings (Step 1) and the average additional earnings (Step 3).

Step 5: Amount withheld on eligible earnings (including STSL)The amount of PAYG and STSL, if applicable, calculated on the total eligible earnings (average earnings plus average additional earnings) obtained in Step 4.

Step 6: Net amount withheld (including STSL)Deduct the amount withheld on average earnings (Step 2) from the amount withheld on eligible earnings (Step 5).

Step 7: Annual net amount withheld (including STSL)Multiply the net amount withheld (Step 6) by the number of pay periods in the financial year (eg monthly = 12, fortnightly = 26, weekly = 52)

Step 8: Deduct previous amounts withheld (including STSL)Subtract any PAYG, including STSL if applicable, that was previously withheld from additional payments in the current FY, from the annual net amount withheld (Step 7). If processing more than one lump sum payment using Method b(ii) in the one pay period, please see If you are making multiple additional payments in one period.

Step 9: Maximum amount withheldThere is a withholding limit of 47% on tax withheld from any lump sum payments using Method B(ii). As such, you will notice the final amount withheld will never be higher than the amount calculated in this step.

Applying this withholding limit may result in withholding not being sufficient to cover some employees' end of year tax liability. In these situations, an employee can ask their employer to increase their withholding for the remainder of the financial year. To do this, you would need to process a PAYG adjustment in the employee's pay.

Step 10: Amount withheld on lump sum payment (including STSL)Uses the lesser amount of Step 8 and Step 9 for the withholding on the payment.

If you are making multiple additional payments in one pay period

As per the ATO, if making multiple back pay payments ('additional' payments) in one pay period you first need to calculate the withholding on the total of any current financial year back payments then calculate the withholding on any other additional payments.

This is important to remember if processing a pay run with more than one lump sum payment calculated using Method B(ii). In other words, Step 8: Deduct previous amounts withheld will total the amounts withheld on all lump sum payments using Method B(ii) in that pay run.

Working Holiday Makers & Lump Sum Payments

Employees defined as working holiday makers are not subject to this method when calculating the withholding amount on lump sum payments. Rather, working holiday makers are taxed in accordance with the Tax table for working holiday makers . As such, when entering a lump sum amount for a working holiday maker, you will not be asked to select a calculation method.

If you have any questions or feedback, please let us know via support@yourpayroll.com.au.