Changes to the Super Guarantee Rate

From July 1 2013 to 2025, super guarantee rates will increase gradually from 9% to 12%.

What you need to do?

For all users, there is nothing that needs to be done - we will automatically update all Super Rates within the system that are currently set at the default rate each time it increases.

What about rates that aren’t the default

Some employers have higher SG rates for various reasons and as such, we will not automatically update any SG rate that is not currently set at the default. If you need help adjusting your super rates then please let us know via support@yourpayroll.com.au.

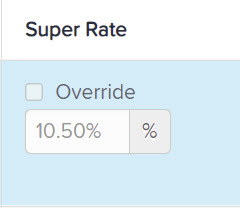

What if I want to set a non-default rate for some employees only ?

Just go to the employee record, pay rates page - you can choose to override the SG rate here

This will affect the SG rate for earnings paid using this pay category for this employee only. You can also choose to do this for a specific group of employees by using pay rate templates... How to create pay rate templates

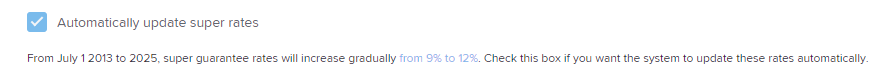

What if I don’t want my super rates updated automatically?

If, for some reason, you do not want to automatically update your super rates, then you can opt out of the super rate updates by following these step:

- Select the Payroll Settings tab on your payroll dashboard

- Go to the Details page under the Business Settings heading, at the bottom of this page you will see an option to “Automatically update super rates”

- If you do not wish to have your super rates automatically updated, simply uncheck this option and click save.

You can find out more about the changes to the super guarantee rate from the ATO website

If you have any questions or feedback on the upcoming changes to the automatic super guarantee changes you can contact us via support@yourpayroll.com.au

![Pay Cat Logo New 2.png]](https://www.paycat.com.au/hs-fs/hubfs/Pay%20Cat%20Logo%20New%202.png?height=50&name=Pay%20Cat%20Logo%20New%202.png)