Closely held employees: reporting STP on a quarterly basis

This article relates specifically to closely held employees that are reporting STP on a quarterly basis only. This article does not apply to any closely held employee whose reporting option is "Report each employee each pay run". Rather, refer here on how to manage and report these employees. We also recommend reading this in conjunction with our STP Guide.

How do I set up closely held employees in the platform?

Refer to this article for instructions on setting up a closely held employee and general information on closely held reporting obligations from 1 July 2021.

How do I lodge a quarterly pay event via STP?

From the Single Touch Payroll home screen (accessed via Reports > ATO Reporting > Single Touch Payroll), click on the "Report closely held employees quarterly" button:

N.B. This button will only appear for businesses that have employees classified as closely held and are using the quarterly basis reporting method. If a business has closely held employees and all these employees are being reported on a per pay run basis then this button will not appear.

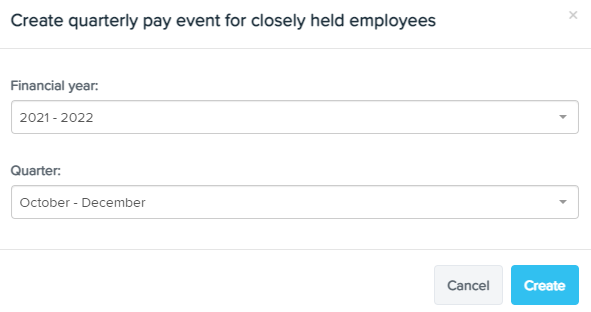

You will then be required to select the financial year (this defaults to the current financial year) and the quarter you want to report:

If you click on 'Cancel', the create pay event modal will disappear. If you click on 'Create' you will then be taken to the pay event screen with the quarterly reported closely held employees and their YTD earnings pre-populated, as per the following example:

Payroll earnings reported via pay events for closely held employees are accumulated YTD amounts up to the last pay date within the quarter being reported in the pay event. For eg, if a business is reporting a pay event for the July to Sept quarter (ie first quarter of the financial year), earnings from all pay runs with a date paid on or from 1 July up to 30 Sept will be included in this event. This includes any ad hoc pay runs using different pay schedules with a date paid of 1 July to 30 Sept. When a business then lodges their October to December quarterly pay event, earnings from all pay runs with a date paid on or from 1 July up to 31 December will be included in this event. This includes any ad hoc pay runs using different pay schedules with a date paid of 1 July to 31 December.

Marking employees as 'Is Final'

If an employee has terminated employment and a termination pay has been processed, the 'Is Final' checkbox will be ticked automatically. If the employee has not been terminated within a pay run but there will be no further payments for that employee in the financial year, you can tick the 'Is Final' checkbox. This will indicate to the ATO that no further payments for this closely held employee will be made. If an employee is reinstated and the same employee payroll ID is used, you will need to untick the 'Is Final' checkbox.

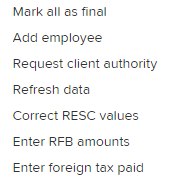

Pay event actions

You will notice there is an 'Actions' option on the right-hand side of the event table, where you can undertake the following actions:

- Mark all as final: If no further employee payments are to be made during the financial year, the pay event can be marked as final. When an employer reports the finalisation declaration during the financial year, this replaces the employer’s obligation to provide the employee with a part-year payment summary. Making this declaration will update the employee’s myGov display to show the STP information from the employer is final for the financial year. Pre-fill information will not be available until after 30 June. When clicking on "Mark all as final", the below popup will appear. Upon clicking "Accept", the "Is Final" checkbox will be automatically ticked for all employees in the pay event. If this was selected in error you can cancel the finalisation by clicking on Actions > Mark all as not final. N.B. Employees who were previously marked as "Is Final" (because of a termination pay) will remain marked as "Is Final".

- Mark all as not final: This action will only appear if there are employees in the event marked as "Is Final". Selecting this option will remove the checkbox from those employees, thereby denoting that the employees will still be receiving payments in that financial year.

- Add Employee: This action allows you to add employees missing from the pay event. You can only add employees that have been excluded because of validation issues, however the system will only allow you to add them if the validation issue has been rectified.

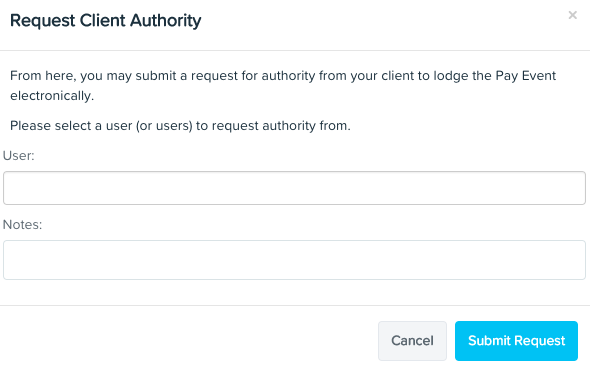

- Request Client Authority: This action will only appear to businesses that are using Tax/BAS Agents to submit STP information to the ATO, as determined via their ATO Settings. A Client Authority may be required if (a) there is no Standing Authority or (b) this event does not cover a standard pay run and so the employer must provide a declaration to the agent approving the lodgement. When clicking on "Request Client Authority", the following popup will appear and should be completed as

follows:

- User: When you click your mouse in the User field, a drop-down list of full access users and users with STP Pay Event Approver permission will appear. You can select one or more of these users to request client authority from. Take note that only one person is required to approve the event lodgement. Instructions on how to set up a user with STP Pay Event Approver permission can be found here.

- Notes: You can enter any notes here that you want the Client Authority to read when they are sent the request notification email. For example, advising the authoriser that the pay event relates to bonuses or commissions made for the month, etc.

When you click on "Submit Request", a notification email will be sent to the assigned Client Authority and the lodgement status will change from "Created" to "Waiting on client authority". The process thereafter is detailed further below.

- Refresh Data: This action can be used to refresh the payroll data contained in the pay event. For example, if you have unlocked a pay run (for an event that has already been created), changed employee payroll figures, finalised the pay run and then chosen to lodge with the ATO at a later date, you would then go back to the pay event and refresh the data to ensure it up to date with actual payroll figures.

- Correct RESC values: We made changes to the system on 4 November 2020 to prevent salary sacrifice payments being processed incorrectly. These changes are explained here. Payments that have been set up to be paid to a 'bank account' or 'manually' will not appear in the pay event as RESC. However, for historical payments that have been processed incorrectly, action can be taken to fixing incorrectly allocated payment methods against super salary sacrifice payments. See here. Note: The 'correct RESC values' action will only be available for 21/22 and prior STP Events.

- Enter RFB amounts: This action can be used to record RFB amounts for each employee. You can choose to report employee RFBA on an ongoing basis or at the end of the financial year. Enter in the grossed up RFBA value for each employee as required, and select the Save button. The RFBA should always be entered in as a YTD value.

- Enter foreign tax paid: This action will appear if any employees have the 'Foreign employment' income type selected (located in their Pay Run Defaults page). It is used to record the amount of foreign tax paid, if incurred. Further information on foreign employment income can be accessed here.

Client authority required to action a pay event

An assigned client authority will be notified that they are required to action a pay event via email. The email will include a link to the pay event where the client authority can perform any of the following actions:

- Approve lodgement; or

- Reject lodgement; and

- Export an excel report of the pay event.

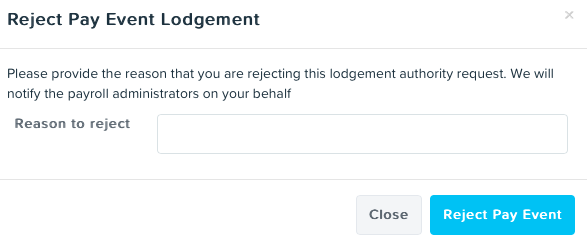

If the authoriser rejects the lodgement, they will need to add a reason for the rejection.

An email notification will then be sent advising that the pay event has been rejected and the reason why. If you sent a request to more than one client authority, there is still the opportunity that another client authority approves the lodgement. However, if you have not, you will need to send another client authority request. N.B. You cannot send the request again to the same client authority who rejected the lodgement.

If the authoriser approves the lodgement, an email notification will be sent advising the lodgement has been approved. The lodgement status will change from "Waiting on client authority" to "Client Authorised" and you can now start the lodgement process.

N.B. To clarify, the requirement for a client authority approval is only required for businesses using a BAS/Tax Agent to submit STP lodgements to the ATO on their behalf.

Lodging a pay event

To lodge a pay event, click on "Lodge with ATO".

At this stage, if Two-Factor Authentication has been set up, you will be required to enter a verification code before you can proceed any further.

A lodgement declaration will need to be completed before the lodgement is complete and sent to the ATO. The instructions here are different depending on your ATO Settings:

-

I will be lodging reports to the ATO as a registered Tax/BAS Agent

- I will be lodging reports to the ATO as an intermediary for multiple Employing Entities

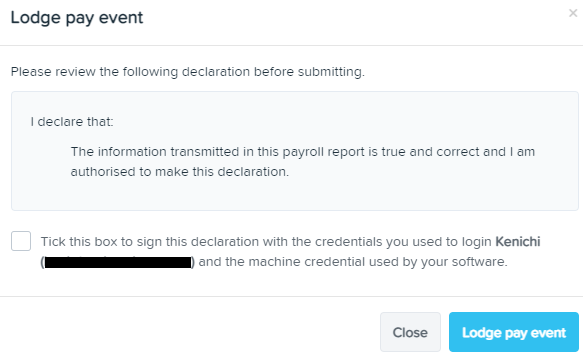

I will be lodging reports to the ATO as the Employer

The following modal will appear:

Tick the declaration checkbox and then click on "Lodge Pay Event". The lodgement is then queued for ATO submission.

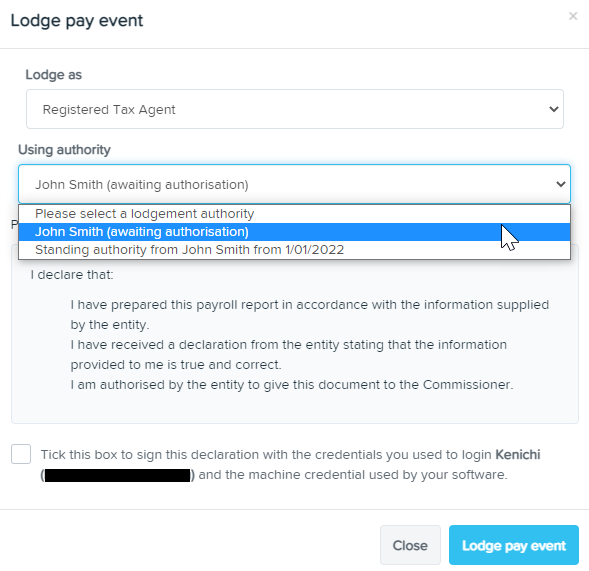

I will be lodging reports to the ATO as a registered Tax/BAS Agent

The following modal will appear:

When completing the "Using authority" requirement, the drop down list will show you any Standing Authority, along with any Client Authority who has either rejected the lodgement and/or approved the lodgement. You cannot select the authority who has rejected the lodgement. You should only be selecting a Standing Authority or Client Authority who has approved the lodgement. If there is no Standing Authority or Client Authority who has approved the lodgement, you cannot proceed with the lodgement and will need to obtain that authority beforehand.

Once the relevant authority has been selected in the drop down list, the only requirement thereafter is to tick the declaration checkbox and then click on "Lodge Pay Event".

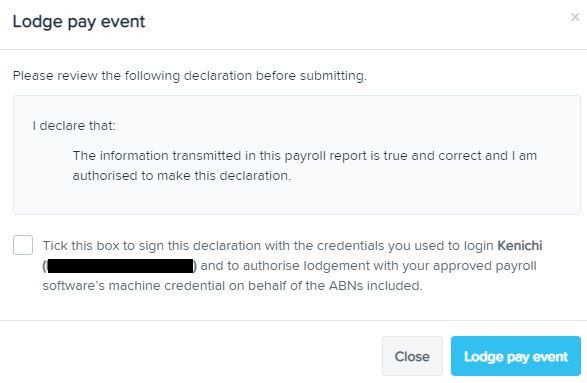

I will be lodging reports to the ATO as an intermediary for multiple Employing Entities

The following modal will appear:

Tick the declaration checkbox and then click on "Lodge Pay Event". The lodgement is then queued for ATO submission.

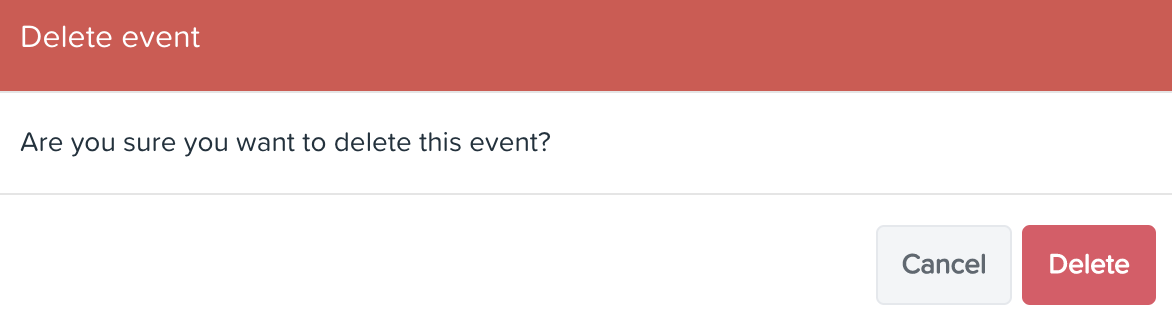

Deleting a pay event

Pay events can only be deleted if their status is 'created', waiting on client authority', 'client authorised' or 'failed'. To delete a pay event, simply click on the 'Delete event' option from within the pay event screen. A confirmation modal will appear:

When you click on 'Delete' the pay event will be removed from the Single Touch Payroll page > events list.

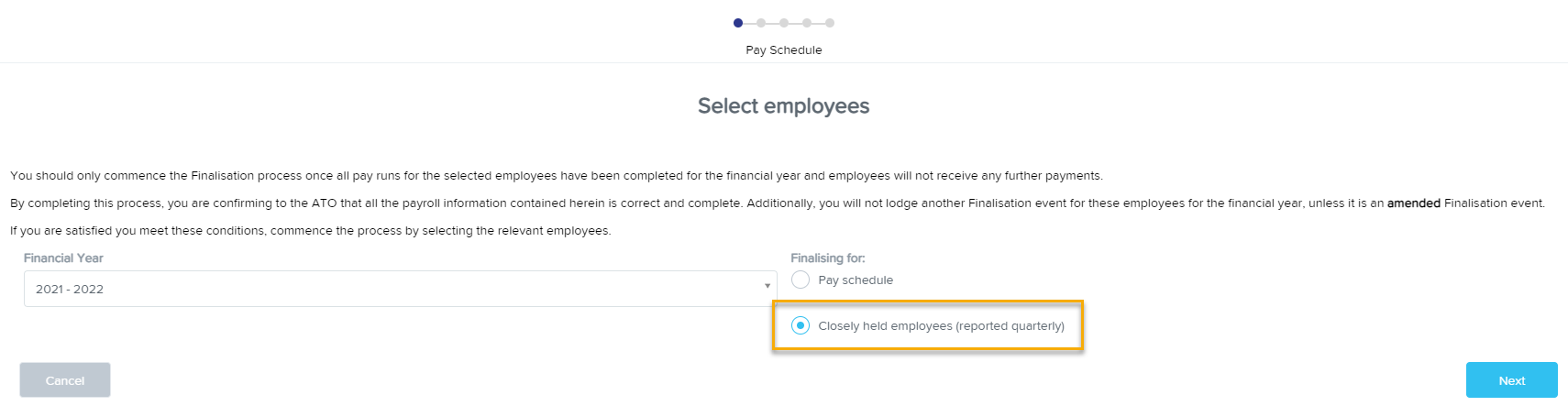

Finalisation Events

Closely held payees who are reported on a quarterly basis will be included in a separate finalisation event at the end of the financial year. Select start finalisation process and under 'finalising for' choose 'Closely held employees (reported quarterly)'.

The remaining steps are the same as the standard finalisation event, outlined here.

Closely held payees who are reported 'per pay run' will be included in the same finalisation event as your arm's length employees.

What if I have made a mistake with the data reported in the pay event?

When reporting closely held employees on a quarterly basis, you have until the due date of your next quarterly STP report to correct a closely held employee's YTD information. This is when you identify a need for a correction throughout the financial year.

If a closely held payee will not be included in your next quarterly STP report, you must either:

- include them in your current quarterly STP pay event with corrected year to date amounts, or

- lodge an update event by the relevant due date for quarterly activity statement with the corrected year to date amount for that employee. Instructions on lodging an update event can be accessed here.

Quarterly reporting due dates

The quarterly STP event must be successfully lodged on or before the due date of your quarterly activity statements. If your activity statement is due later than the regular due date (for example, because you are entitled to a concession or have a deferral), then the quarterly STP event must be lodged by your later activity statement due date.

If you report your PAYG withholding on monthly activity statements, your quarterly STP report, including amounts paid to your closely held payees, is due on the same day as your activity statement for the final month of the quarter. If your activity statement is due later than the regular due date (for example, because you are entitled to a concession or have a deferral) then your quarterly STP report is still due by your later activity statement due date.

If you are reporting actual payments on a quarterly basis, you only need to lodge an STP event in the quarters where you have made a payment that you need to report. For example, if you only make a payment that you need to report through STP in the December and June quarters, you only need to lodge an STP event for those two quarters (and finalise your STP reporting at the end of the financial year).

If you have chosen to report estimates on a quarterly basis, you must lodge an STP event in each quarter of the financial year.

If you have any questions or feedback, please let us know via support@yourpayroll.com.au.

![Pay Cat Logo New 2.png]](https://www.paycat.com.au/hs-fs/hubfs/Pay%20Cat%20Logo%20New%202.png?height=50&name=Pay%20Cat%20Logo%20New%202.png)