Deductions Report

Deduction reports show the breakdown of deductions per employee over a given period of time, and is available from the 'Reports' home page under the 'Payroll Reports' section.

The deductions search function requires you to enter the following information:

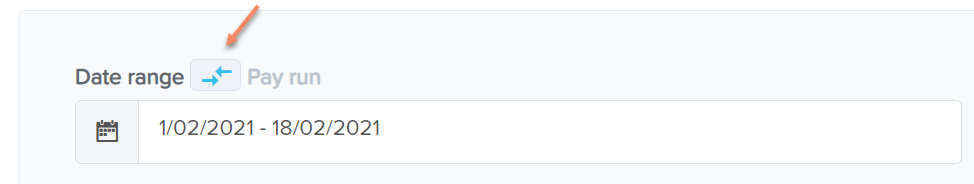

- Date range - There are multiple frequencies to choose from as well as a 'custom range'. Additionally, if you want to select a specific pay run instead of a date range, you can change to that filter by clicking the toggle button:

- Pay Schedule (drop down box);

- Employee Default Location (drop down box);

- Employee - You are able to select a singular employee to filter for. You cannot select multiple employees. The search field allows for employee name, employee Id, external Id and payroll Id;

- Deduction Category (drop down box);

- Employing Entity (if applicable)

Remember that report results are based on DATE PAID.

From the results, you are able to display it in a number of ways.

- Expand all - Will show each employee and their locations along with details of deductions. Please note that when 'Expand all' has been selected the option will change to 'Collapse all'.

- Show all employees - Will show each employee and the total value of their deductions

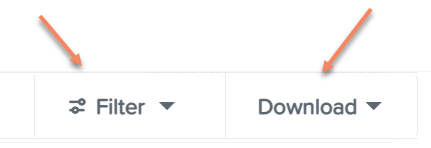

You are also able to export this report to CSV, Excel and PDF via the 'Download' button.

You can easily access the report filter and download button whilst scrolling through the report via a sticky filter, without having to scroll back to the top of the page. The sticky filter buttons will appear on the top right-hand side of the report when you scroll down the report:

Using this sticky filter, you can choose to change the filter parameters by clicking on the 'Filter' button and making the changes then clicking the 'Update' button. You also have the option to clear the filter completely to default by clicking the 'Clear filters' option at the bottom right-hand side of the sticky filter.

If you have any questions or feedback, please let us know via support@yourpayroll.com.au

![Pay Cat Logo New 2.png]](https://www.paycat.com.au/hs-fs/hubfs/Pay%20Cat%20Logo%20New%202.png?height=50&name=Pay%20Cat%20Logo%20New%202.png)