Ensure BAS W1/W2 Codes are enabled

If you're having trouble exporting journals to QBO, it could be because your BAS related tax codes have been disabled.

To check if the BAS tax codes are enabled, follow these steps:

- Log into QBO and click on the GST menu

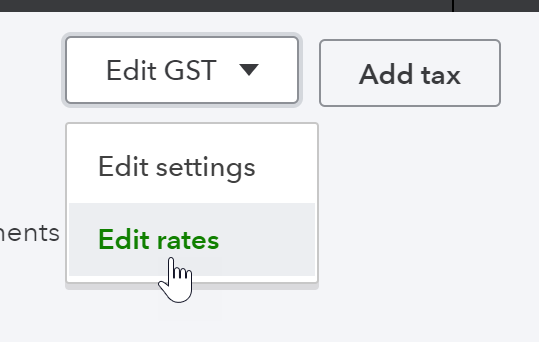

- From the top right hand corner, click "Edit GST" -> "Edit Rates"

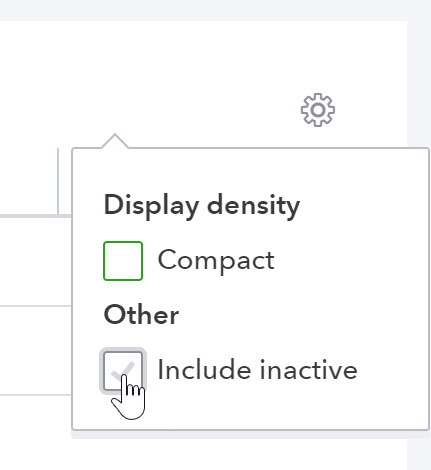

- Click on the cog above the rates table and ensure the "include inactive" option is selected

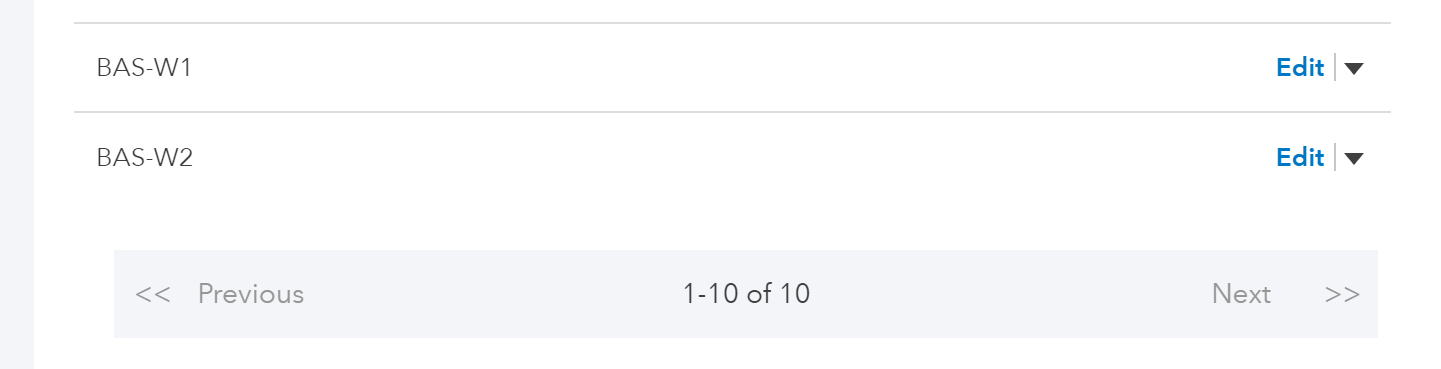

- Scroll to the bottom of the list and ensure that the BAS-W1 and BAS-W2 codes are active. If they're not active, you'll need to activate them.

Once you have activated your tax codes, you should be able to export the journals.

![Pay Cat Logo New 2.png]](https://www.paycat.com.au/hs-fs/hubfs/Pay%20Cat%20Logo%20New%202.png?height=50&name=Pay%20Cat%20Logo%20New%202.png)