- Knowledge Base AU

- Reporting

- Payroll Reports

-

Payroll

-

NoahFace

-

Your training

-

Reporting

-

Add Ons (AU)

-

Awards and Employment Agreements

-

Partners (AU)

-

Time and Attendance (AU)

-

Timesheets (AU)

-

Timesheets (MY)

-

Video Tutorials

-

Director Pays

-

Pay Runs (AU)

-

Business Settings

-

General (NZ)

-

General (AU)

-

Business Settings (SG)

-

Business Settings (NZ)

-

Getting Started (AU)

-

Rostering (AU)

-

Pay Conditions

-

Timesheets

-

Brand/Partners (NZ)

-

Business Settings (AU)

-

Product Release Notes

-

Timesheets (SG)

-

API (AU)

-

Swag

-

Partners (SG)

-

Timesheets (NZ)

-

Business Settings (MY)

-

Partners (UK)

-

Partners (MY)

-

ShiftCare

-

Employees

Expense Reimbursements Report

The Expense Reimbursements Report provides a report on the different expenses processed in a pay run.

The report can be found on the report homepage, under the 'Payroll Reports' heading.

You are able to set the following parameters when running the report:

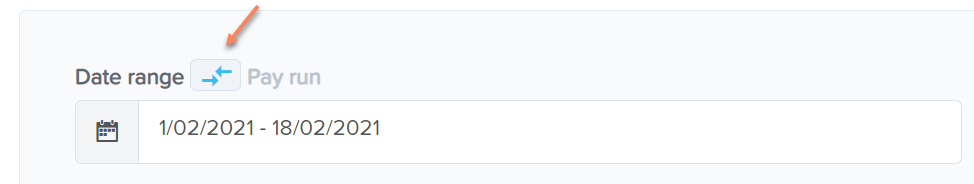

- Date range - There are multiple frequencies to choose from as well as a 'custom range'. Additionally, if you want to select a specific pay run instead of a date range, you can change to that filter by clicking the toggle button:

- Pay Schedule

- Employee Default Location

- Employee: You are able to select a singular employee to filter for. You cannot select multiple employees. The search field allows for employee name, employee Id, external Id and payroll Id;

- Expense Category

- Employing Entity

- Whether to include Tax Codes

Remember that report results are based on DATE PAID.

The report results are broken up (when expanded) into:

- Employee name

- The pay run that the expense was processed in

- The type of expense reimbursement

- The amount of reimbursement

- Any notes added to the expense line in the pay run

- The total reimbursement for that employee (for the chosen period)

- The total reimbursement for the business (for the chosen period)

The report can be exported as Excel, CSV or PDF.

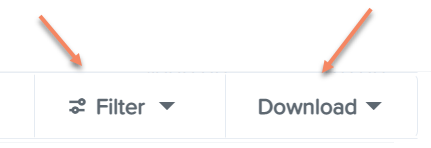

You can easily access the report filter and download button whilst scrolling through the report via a sticky filter, without having to scroll back to the top of the page. The sticky filter buttons will appear on the top right-hand side of the report when you scroll down the report:

Using this sticky filter, you can choose to change the filter parameters by clicking on the 'Filter' button and making the changes then clicking the 'Update' button. You also have the option to clear the filter completely to default by clicking the 'Clear filters' option at the bottom right-hand side of the sticky filter.

If you have any questions or feedback please let us know via support@yourpayroll.com.au