Food, Beverage and Tobacco Manufacturing Award 2020 (MA000073)

This article provides guidelines about when to use the different work types and tags that are included as part of the pre-built Food, Beverage and Tobacco Manufacturing award package. For further information about this industry award, refer to Food, Beverage and Tabacco Manufacturing Award

Key Updates to Award

Last Updated: November 2023

Key_Updates

Installing and Configuring the Pre-Built Award Package

For details on how to install and configure this Pre-built Award Template, please review the detailed help article here.

While every effort is made to provide a high-quality service, YourPayroll does not accept responsibility for, guarantee or warrant the accuracy, completeness or up-to-date nature of the service. Before relying on the information, users should carefully evaluate its accuracy, currency, completeness and relevance for their purposes, and should obtain any appropriate professional advice relevant to their particular circumstances.

Work Types

Agreed to work less than 3 hours

Choose this work type if the employee and employer have agreed they can work a shift less than 4 hours in duration but no less than 3 hours.

Annual Leave

Choose this work type when annual leave is taken as per clause 34 of the Award.

Compassionate Leave

Choose this work type when compassionate leave is taken as per clause 35 of the Award.

Long Service Leave

Choose this work type when long service leave is taken.

Personal/Carer's Leave

Choose this work type when personal and/or carer's leave is taken as per clause 35 of the Award.

Unpaid Leave

Choose this work type when any unpaid leave is taken.

Community Services Leave

Choose this work type when community service leave is taken as per clause 36 of the Award.

Time in Lieu Taken

Choose this work type when time in lieu is taken.

TIL of Overtime*

Choose this work type if the employee elects to accrue time in lieu rather than be paid overtime for a shift. Refer to clause 33.1 (d) of the Award.

Cold Places

Choose this work type when an employee works for more than one hour in a place or places where the temperature is reduced by artificial means below zero degrees celsius. The employee will be paid an hourly allowance as per clause 26.3(b) of the Award.

Wet Places

Choose this work type when an employee is required to provide their own wet clothing or boots whilst working in a place where such clothing/boots become saturated by water, oil or another substance. The employee will be paid an hourly allowance as per clause 26.3(d) of the Award.

Confined Spaces

Choose this work type when an employee works in a confined space and needs to be paid an hourly allowance as per clause 26.3(e) of the Award.

Dirty/Dusty Work

Choose this work type when an employee performs works of an unusually dirty, dusty or offensive nature and needs to be paid an hourly allowance as per clause 26.3(f) of the Award.

Hot Places (46-54 degrees)

Choose this work type when an employee works for more than one hour in the shade in places where the temperature is raised by artificial means to between 46 degrees celsius and 54 degrees celsius. The employee will be paid an hourly allowance as per clause 26.3(c) of the Award.

Hot Places (over 54 degrees)

Choose this work type when an employee works for more than one hour in the shade in places where the temperature is raised by artificial means to over 54 degrees celsius. The employee will be paid an hourly allowance as per clause 26.3(c) of the Award.

Public Holiday not Worked

Choose this work type where an employee is not required to work on a shift falling on a gazetted public holiday that the employee would have otherwise worked had it not been a public holiday.

Call Back

Choose this work type when an employee is recalled to work overtime after leaving the workplace.

Stand By

Choose this work type where an employee is required to hold themselves in readiness to work after completing their ordinary hours. The employee will be paid at their ordinary rate of pay for the time they are standing by as per clause 33.5 of the Award.

No Meal Break

Half hour meal breaks are automatically deducted for shifts over 5 hours. Use this work type to indicate that no meal break was taken during the shift so that a meal break is not deducted from hours worked.

Vehicle Allowance

Choose this work type where an employee has reached agreement with the employer to use their own motor vehicle in the course of their duties. The kilometres travelled should be entered into the 'units' field. Refer to clause 26.2(a) of the Award.

Meal Allowance

Choose this work type in the following scenarios:

- in accordance with clauses 33.9 and 33.10;

- working away from the employee's usual workplace as reimbursement of meals.

Fumigation Gas Allowance

Choose this work type on days where an employee uses methyl bromide gas in fumigation work as per clause 26.3(g) of the Award.

Travelling Time

Choose this work type to record the travelling time spent by an employee in reaching and/or returning from a job away from the employer's usual workplace which is in excess of the time normally spent by the employee in travelling between the employee’s usual residence and the employee’s usual workplace.

Work on an rostered day off

Choose this work type when employee is working on their rostered day off.

8 hr break between shift

Choose this work type when, by agreement between an employer and an employee, the break between shifts is 8 hours (rather than the usual minimum of 10 hours). Refer to clause 33.3(d) of the Award

Tags

Agreed Saturday as ordinary hours

Assign this tag if the employee and employer have agreed that the employee will work Saturday as ordinary hours.

Agreed Sunday as ordinary hours

Assign this tag if the employee and employer have agreed that the employee will work Sunday as ordinary hours.

Agreed to work less than 3 hours

Assign this tag if the employee and employer have agreed they can always work a shift less than 4 hours in duration but no less than 3 hours.

7 day shiftworker

Assign this tag if the employee is employed as a seven day shift worker who is regularly rostered to work on Sundays and public holidays for the purpose of accruing an additional 1 week of annual leave.

8 hour shift arrangement

Assign this tag when the ordinary hours for employees will not exceed 8 per day.

Baking Production Employee

Assign this tag to an employee engaged in baking production for the purposes of determining their shift times.

Boiler Attendant

Assign this tag to an employee holding a Boiler Attendants Certificate and appointed by the employer to act as a boiler attendant. This will activate the Boiler Attendant allowance that applies for all purposes of the Award.

Cold Places Work

Assign this tag to an employee who is permanently working in places where the temperature is reduced by artificial means below zero degrees celsius. If this tag is assigned to an employee, you will not be required to attach the Cold Places work type to the employee's timesheet.

Confined Spaces Work

Assign this tag to an employee who is permanently working in confined spaces. If this tag is assigned to an employee, you will not be required to attach the Confined Spaces work type to the employee's timesheet.

Continuous Shiftworker

Assign this tag to an employee whose work is carried on with consecutive shifts throughout the 24 hours of each of at least six consecutive days without interruption except for breakdowns or meal breaks or due to unavoidable causes beyond the control of the employer. This tag will apply the relevant penalties applicable to this type of shiftworker.

Dirty or Dusty Work

Assign this tag to an employee who is permanently performing working of an unusually dirty, dusty or offensive nature. If this tag is assigned to an employee, you will not be required to attach the Dirty/Dusty Work work type to the employee's timesheet.

First Aider

Assign this tag to an employee who has been trained to render first aid, is the holder of appropriate first aid qualifications and is appointed in writing to perform first aid duty on a regular ongoing basis. Refer to clause 26.2(b) of the Award.

Heavy Vehicle Driver - Semi Trailer

Assign this tag to an employee who is required to drive a semi-trailer in order to activate the Heavy Vehicle Driving allowance that applies for all purposes of the Award.

Heavy Vehicle Driver A

Assign this tag to an employee who is required to drive a vehicle of over 3 and up to 4.5 tonnes GVW in order to activate the Heavy Vehicle Driving allowance that applies for all purposes of the Award.

Heavy Vehicle Driver B

Assign this tag to an employee who is required to drive a vehicle of over 4.5 and up to 14.95 tonnes GVW in order to activate the Heavy Vehicle Driving allowance that applies for all purposes of the Award.

Heavy Vehicle Driver C

Assign this tag to an employee who is required to drive a vehicle of over 14.95 tonnes GVW in order to activate the Heavy Vehicle Driving allowance that applies for all purposes of the Award.

Hot Places Work (46-54 degrees)

Assign this tag to an employee who is permanently working in places where the temperature is raised by artificial means to between 46 degrees celsius and 54 degrees celsius. If this tag is assigned to an employee, you will not be required to attach the Hot Places (46-54 degrees) work type to the employee's timesheet.

Hot Places Work (over 54 degrees)

Assign this tag to an employee who is permanently working in places where the temperature is raised by artificial means to over 54 degrees celsius. If this tag is assigned to an employee, you will not be required to attach the Hot Places (over 54 degrees) work type to the employee's timesheet.

Leading Hand A

Assign this tag to an employee who is a leading hand in charge of between 3 - 10 employees in order to activate the Leading Hand allowance that applies for all purposes of the Award.

Leading Hand B

Assign this tag to an employee who is a leading hand in charge of between 11 - 20 employees in order to activate the Leading Hand allowance that applies for all purposes of the Award.

Leading Hand C

Assign this tag to an employee who is a leading hand in charge of over 20 employees in order to activate the Leading Hand allowance that applies for all purposes of the Award.

Permanent Night Shift

Assign this tag to an employee where the night shifts worked do not rotate or alternate with other shifts or day work. A night shift is defined as (a) a shift finishing after midnight and at or before 8am or (b) a shift commencing between midnight and 3am (2am for baking production employees).

Regular Call-back

Assign this tag to an employee who is regularly required to hold themselves in readiness for a call-back.

TIL of OT*

Assign this tag to an employee who permanently elects to accrue time in lieu rather than be paid overtime. If this tag is assigned to an employee, you will not be required to attach the TIL of Overtime work type to the employee's timesheet.

Wet Places Work

Assign this tag to an employee who is permanently required to provide their own wet clothing or boots whilst working in a place where such clothing/boots become saturated by water, oil or another substance. If this tag is assigned to an employee, you will not be required to attach the Wet Places work type to the employee's timesheet.

*Time off instead of payment for overtime leave is accrued at the same rate as the number of overtime hours worked. EXAMPLE: an employee who worked two (2) overtime hours is entitled to two (2) hours’ time off. If time off for overtime is not taken and the time off is to be paid out, it must be paid at the overtime rate applicable to the overtime when worked. This also applies when an employee is terminated and the time off is to be paid out. In order to be paid out correctly, the overtime rate will need to be recorded manually at the same time as the time in lieu accrual is processed. It is suggested that you record the overtime details in the “notes” section of the leave accrual line in the pay run.

If you are required to pay out the time off for overtime either before termination or during termination, you can run a Pay Run Audit Report for the pay runs for the employee when Time in Lieu was accrued to determine the applicable rates (which will detail your notes) and run an Employee Payment History Report to determine if any of the time off for overtime has been taken. You can then determine the correct balance based on the number of hours by taking the equivalent to the overtime payment that would have been made EXAMPLE: an employee who worked two (2) overtime hour at what would have been the rate of time and a half, is then entitled to three (3) hours of time off leave to be accrued. In our above example (the first accrual line of the screen shot) you would take 0.5 hours x 1.5 = 0.75 hours. Therefore, you will need to adjust the time in lieu balance by adding a further 0.25 hours (0.75 hours – 0.5 hours = 0.25 hours).

Key Updates

November 2023

10th

Casual Public Holiday - continuous shiftworker TIL of Overtime6th

We have updated the following standard hours pay categories to accrue leave:

- Casual - Public Holiday - continuous shiftworker

- Casual - Travelling Time

- Public - Travelling Time

August 2023

1st

From 1 August, all employees are entitled to 10 days of paid family and domestic violence leave each year. The (Unpaid) Family and Domestic Violence Leave configuration settings under awards have been updated - the leave category is disabled from award leave allowance templates, and the work type is not enabled automatically for all employees. Please ensure that employees no longer use the unpaid leave category or work type.

July 2023

20th

We have updated the award to ensure that the work type "No Meal Break" will apply the correct pay category.

1st

We have updated the award to reflect the Fair Work Commission’s National Minimum Wage increase detailed in the Annual Wage Review 2022-23 decision and also includes updates to expense-related allowances. You can find information on the Determinations here and here. These changes come into effect from the first full pay period on or after the 1st July 2023. Please install these updates after you have finalised your last pay run before the first full pay period beginning on or after the 1st July 2023.

June 2023

We have updated the Food, Bev & Tobacco Permanent Shiftworkers and Food, Bev & Tobacco Permanent Day Workers rule set, where the following allowances with tags would apply the correct interpretation when used with Public Holiday Not Worked, Stand By or Travelling Time work types:

-

Wet Place Allowance, Hot Place Work, Cold Place Allowances, Confined Spaces Allowance, and Dirty/Dusty Work Allowance

January 2023

31st

We have updated the award to reflect changes made as part of the Fair Work Decision regarding Paid Family and Domestic Violence Leave. Further information on what changes have been applied to the platform and what you should be aware of can be found within this article.

We have created the following new categories:

- New Leave Category: Paid Family and Domestic Violence Leave.

- New Pay Category: Paid Family and Domestic Violence Leave.

- New Work Type: Paid Family and Domestic Violence Leave taken.

We have updated the Leave Allowance Templates to disable the existing unpaid Family and Domestic Violence and we have enabled the new Paid Family and Domestic Violence Leave. We also updated any impacted rule conditions.

As part of Fair Work's ruling, an employee must be paid their full pay rate; this includes their base rate plus any incentive-based payments and bonuses, loadings, monetary allowances, overtime or penalty rates, and any other separately identifiable amount.

October 2022

The Award has been updated to correct the rounding methods used on rates within the pay rate templates.

July 2022

The Award has been updated to reflect the Fair Work Commission’s National Minimum Wage increase of detailed in the Annual Wage Review 2021-22 decision. This also includes updates to expense-related allowances. Information on the Determinations can be found here and here. These changes come into effect from the first full pay period on or after 1 July 2022. Please install these updates AFTER you have finalised your last pay run prior to the first full pay period commencing on or after 1 July 2022.

Unpaid Pandemic Leave has been disabled as this entitlement has now expired within this award. Additional information can be found on the Fairwork website.

February 2022

Updates have been made to the maximum daily engagement conditions in the pay condition ruleset Food, Bev & Tobacco Casual Shiftworkers.

January 2022

The Unpaid Pandemic Leave pay category has been updated and counts as service for entitlements under awards and the National Employment Standards.

If any staff have used this category previously, please adjust their Annual, Personal and Long Service Leave balances for any period of unpaid pandemic leave previously taken.

To identify affected employees and enter the leave accrual see: Calculating Missing Leave Accrual for Unpaid Pandemic Leave Taken

30 November 2021

Important Notice: Please review the information relating to this update carefully as it involves significant changes to the rulesets in regards to clause 24.1(d), Non-Continuous Afternoon or Night Shift and may require the addition of tags to existing employees or the use of work types where previously no work type was required.

We have recently received updated advice from Fair Work in regards to the interpretation of whether a afternoon or night shift is successive in the Food & Beverage Manufacturing Award. Whether an afternoon or night shift is successive or not depends on the pattern of shifts at the workplace. Workplaces as a whole set the pattern of shifts. An individual employee’s work pattern doesn’t impact whether the shifts are successive. Refer to this article for more information.

The rulesets, Food, Bev & Tobacco Permanent Shiftworkers and Food, Bev & Tobacco Casual Shiftworkers, have been updated so that the Non-Continuous Afternoon or Night Shift rates outlined in clause 24.1(d) will only be applied if the employee has the tag Non-Continuous Afternoon Shift or Non-Continuous Night Shift or if the work type or shift condition Non-Continuous Afternoon/Night Shift is assigned to a timesheet.

Action Needed: Consider the pattern of your workplace and assign the tag, Non-Continuous Afternoon Shift or Non-Continuous Night Shift, to employees where needed. Alternatively, the work type or shift condition, Non-Continuous Afternoon/Night Shift, can be assigned to specific timesheets to enable the system to apply the Non-Continuous Afternoon/Night Shift rates. Where the tag has not been assigned and the work type has not been used, the afternoon shift or night shift rate will be paid regardless of the number of successive shifts an employee works.

20 November 2021

The Award has been updated in line with the ATO's requirements for STP Phase 2 reporting. The reporting of gross earnings are now being disaggregated into distinguishable categories. The Pay Category payment classifications have been updated in line with the ATO specification categories found here . For further information please see our STP support article .

Following corrected advice from Fair Work, the change made to the system on 19 November 2021 has been reversed. The pay condition rule sets Food, Bev & Tobacco Casual Day Workers and Food, Bev & Tobacco Casual Shiftworkers have been updated to remove penalty payments for Casual employees that have less than a 10 hour break between shifts, as per clause 23.10 of the award.

The following expense categories have been added to the system; Training Costs, Special clothing and equipment allowance and Apprentice training fees in line with clause 11, 20.3g and 20.3e.

19 November 2021

Following updated advice from Fair Work, the pay condition rule sets Food, Bev & Tobacco Casual Day Workers and Food, Bev & Tobacco Casual Shiftworkers have been updated to reinstate penalty payments for Casual employees that have less than a 10 hour break between shifts, as per clause 23.10 of the award.

September 2021

The pay condition rule sets for Food, Bev & Tobacco Permanent Day Workers, Food, Bev & Tobacco Casual Day Workers, Food, Bev & Tobacco Permanent Shiftworkers, and Food, Bev & Tobacco Casual Shiftworkers have been updated to include rules for employees who are employed to work a maximum 8 hour daily engagement as part of clause 12.2(b), 12.3(c), and 12.4(b). A tag, 8 hour shift arrangement, has been created to apply to any employee working under these clauses if no agreement has been arranged in accordance with clause 12.5.

August 2021

Updates have been made to the Unpaid Pandemic Leave allowance Templates so that the balance is displayed in weeks instead of hours in line with the Fair Work Commission's guidelines.

Once the award update is installed, all employee’s Unpaid Pandemic leave balances will be displayed in weeks not hours. This will mean that an employee’s balance may now show as 76 weeks. In order to correct the balance please see How to Fix Unpaid Pandemic Leave Balance Data.

July 1 2021

The Award has been updated to reflect the Fair Work Commission’s National Minimum Wage increase of 2.5% detailed in the Annual Wage Review 2020-21 decision. This also includes updates to expense-related

allowances. Information on the Determinations can be found here and here.

These changes come into effect from the first full pay period on or after 1 July 2021. Please install these updates AFTER you have finalised your last pay run prior to the first full pay period commencing on or after 1 July 2021.

Updates have also been made to the Leave Category Family & Domestic Violence Leave, so that the balance is displayed in days instead of hours in line with the National Employment Standards.

Once the update is installed, all employee’s FDV leave balances will be displayed in days not hours. This will mean that an employee’s balance may now show as 38 days. In order to correct the balance please see How to Fix Family & Domestic Violence Leave Balance Data.

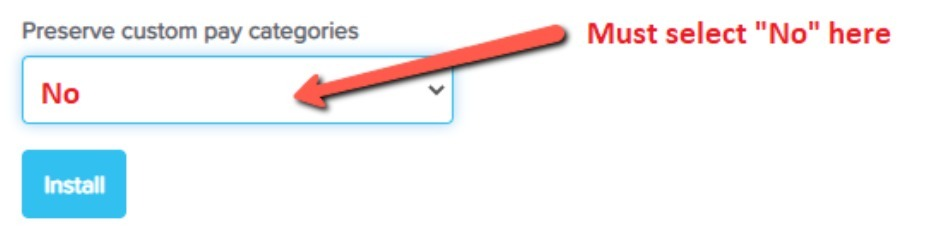

This update is to ensure that any new installs of this award conducted since 1 July are now captured with the SG increase from 9.5% to 10% for all pay categories. If you have installed this award between 1 July 2021 to 8 July 2021 for the first time, please ensure you select "NO" to preserve custom pay categories. If you were using this award prior to 1 July 2021, then you do not need to select "NO." Further information can be found in Incorrect SG rate used in pay runs article here.

May 2021

The award pay rate templates have been updated to ensure that the legislated superannuation guarantee (SG) rate will increase automatically from 9.5% to 10% effective from 1 July 2021. Please ensure you install this update prior to 1 July 2021 for this change to take effect.

What does this mean? Any pay run with a date paid on or from 1 July 2021 will automatically calculate SG at 10% of OTE. Additionally, on the 1st of July, we will update references to 9.5% on all applicable screens in Employment Hero Payroll. For more information, including any exclusions, check out this article from the ATO.

April 2021

The pay condition rule sets Casual Shiftworkers and Permanent Shiftworkers have been updated in line with clause 23.7 to include public holiday overtime pay categories and clause 23.10 to include a new rule for when a permanent shiftworker employee has less than 10 hour break between shifts.

March 2021

The pay condition rule sets Casual Day Workers and Casual Shiftworkers have been updated to remove penalty payments when an employee has less than a 10 hour break between shifts, as per clause 23.10 of the award.

January 2021

New pay categories for Permanent - Public Holiday - continuous shiftworker, Permanent - Public Holiday - non-continuous shiftworker, Casual - Public Holiday - non-continuous shiftworker, and Casual - Public Holiday - continuous shiftworker were created and corresponding rules were updated.

The following work types have been mapped to the employee's primary pay category: Cold Places, Wet Places, Confined Spaces, Dirty/Dust Work, and Hot Places.

The pay condition rule sets for Food, Bev & Tobacco Permanent Shiftworkers and Food, Bev & Tobacco Casual Shiftworkers have been updated to include clauses 24.5(c) & (d); special conditions for shiftworkers working on a Sunday or Public Holiday, when shifts span midnight. New rules have been created.

New pay categories for Permanent - Sunday - continuous shiftworker and Casual - Sunday - continuous shiftworker were created.

December 2020

The award has been updated to reflect changes made as part of a Fair Work Decision. The overtime, Saturday, Sunday and public holiday rates for casuals have been up updated in line with the Determination. These new rate are effective from the first full pay period on or after 20 November 2020.

The award has been varied as part of the Fair Work Commission's four yearly review of modern awards. The determination comes into operation on 11 December 2020. In accordance with s.165(3) of the Fair Work Act 2009, this determination does not take effect in relation to a particular employee until the start of the employee's first full pay period that starts on or after 11 December 2020.

The following changes have been updated in the award pay condition rule sets for Food, Bev & Tobacco Permanent Day Workers, Food, Bev & Tobacco Casual Day Workers, Food, Bev & Tobacco Permanent Shiftworkers, and Food, Bev & Tobacco Casual Shiftworkers.

- Working through a meal break rule in line with clause 32.5

- New tags for agreement to work Saturday and/or Sunday as ordinary hours, will be paid as ordinary hours not as overtime at their penalty rates. If no agreement has been made, then the weekend will be paid as overtime.

- Minimum break between shift and spread of hours rules will exclude leave taken work types.

- New pay categories for afternoon or night shift - less than 5 successive shifts (6 in six day enterprise) - first 3 hours and afternoon or night shift - less than 5 successive shifts (6 in six day enterprise) - after 3 hours and a new rule in line with clause 31.3(c)

- New pay categories for Work on an unrostered shift - non-continuous shiftworker - first 3 hours, Work on an unrostered shift - non-continuous shiftworker - after 3 hours, and Work on an unrostered shift - continuous shiftworker and new rules in line with clause 30.5(d)(i) & (ii)

1 November 2020

The Award, as part of Group 2 Awards, has been updated to reflect the Fair Work Commission’s National Minimum Wage increase of 1.75% detailed in the Annual Wage Review 2019-20 decision. This also includes updates to expense-related allowances. Information on the Determinations can be found here and here.

These changes come into effect from the first full pay period on or after 1 November 2020. Please install these updates AFTER you have finalised your last pay run prior to the first full pay period commencing on or after 1 November 2020.

October 2020

The pay condition rule sets for Food, Bev & Tobacco Permanent Shiftworkers and Food, Bev & Tobacco Casual Shiftworkers have been updated for clause 30.3(b) where a continuous shiftworker is entitled to paid meal breaks.

September 2020

The pay condition rule sets for Food, Bev & Tobacco Permanent Day Workers, Food, Bev & Tobacco Casual Day Workers, Food, Bev & Tobacco Permanent Shiftworkers, and Food, Bev & Tobacco Casual Shiftworkers have been updated for clause 32.5 when no meal break is provided for an employee, then 150% must be paid for all work done during meal hours and thereafter until a meal break is taken.

August 2020

The award has been updated to reflect the High Court's decision on the accrual of personal/carer's leave which overturns the decision made by the Full Federal Court of Australia, with personal/carer's leave being calculated on working days not hours. Information on the decision can be found here. As such, we have removed the Personal/Carer's (10 days) Leave Allowance Templates and updated associated Employment Agreements. Please note, this update will not remove any of the above from a business where the award was already installed prior to 25 August 2020. However, any new award installs from 25 August 2020 will not display personal/carer's (10 days) leave details.

For further information on migrating from daily personal/carers leave accruals to hourly please refer here

July 2020

Pay Category Casual Ordinary Hours has been updated to ensure casual leave entitlements accrue on all hours worked.July 2020

The pay rates have been updated for 1st and 2nd year apprentices who started their apprenticeships before 1 January 2014 and who completed year 12

30 June 2020

The award pay rate templates have been updated to reflect the Australian Taxation Office's decision to increase the cents per kilometre rate for work-related car expense deductions to 72 cents per kilometre. The new rate applies from the first paid date in the 2020-21 financial year.

April 2020

The award has been updated to reflect changes made as part of the Fair Work Decision around flexibility during coronavirus. The new schedule allows employees to take up to two (2) weeks unpaid pandemic leave. A new pay category (Unpaid Pandemic Leave Taken), leave category and work type (Unpaid Pandemic Leave) have been created. Also, the rule sets have been updated, where necessary, to include/exclude the work type and leave category to some pay conditions. Further, the Leave Allowance Templates have been updated to ensure this new leave category is enabled and is now accessible for employees to take this leave when required.

Further, under this new schedule employees can take up to twice as much annual leave at a proportionally reduced rate if their employer agrees. The employee's pay rate and leave balance will need to be manually adjusted to half in each pay run for the period of leave.

February 2020

Due to recent changes to the interpretation of personal/carer's leave accrual under the National Employment Standards, updates have been made to the setup of the Award. Further information can be found here.

A new Leave Category called Personal/Carer's (10 days) Leave has been created. Also, new Leave Allowance Templates (LATs) have been created specific to 10 days accrual per year for each state and the LATs have been attached to the current Employment Agreements for selection options for an employee's LAT in their Employee Default Pay Run screen. Any rules impacted by Personal/Carer's Leave have also been updated with the new leave category.

Instructions on converting the accruals to the 10 day method can be found here.

30 June 2019

The Award has been updated to reflect the Fair Work Commission’s National Minimum Wage increase of 3% from its Annual Wage Review 2018-19 decision. This also includes updates to expense-related allowances. Information on the Determinations can be found here and here.

These changes come into effect from the first full pay period on or after 1 July 2019. Please install these updates AFTER you have finalised your last pay run prior to the first full pay period commencing on or after 1 July 2019.

1 October 2018

The Award has been updated to reflect changes made as part of the Fair Work Decision 4 year review of modern awards. The change is an update of clause 12.2 and 13.2 - part-time and casual minimum engagement and agreements. This now provides for part-time and casual employees to be paid for at least 4 consecutive hours of work per day or shift. Also that a part-time or casual employee may request and the employer may agree to an engagement for no less than 3 consecutive hours per day or shift.

Work Type and a Tag have been created to action the employee and employer request for no less than 3 hours "Agreed to work no less than 3 hours".

This change is reflected in the “Food, Bev & Tobacco Permanent Day Workers “ and “ Food, Bev & Tobacco Casual Day Workers” and “Food, Bev & Tobacco Permanent Shiftworkers” and “Food, Bev & Tobacco Casual Shiftworkers” rule sets.

Please note that the change comes into effect on the first full pay period on or after 1 October 2018. This means that you should only install this update once you've completed the last pay period for hours worked during September 2018. The Fair Work Determination can be found here.

August 2018

Allowance rate update for Kilometre Allowance - Car (above and below ATO limit). Further information can be found at ATO.

1 August 2018

The award has been updated to reflect changes made as part of the Fair Work Decision 4 year review of modern awards. The determination for the new clause in the modern award allowing employees to take unpaid leave to deal with family and domestic violence can be found here. Family and Domestic Violence leave applies from the first full pay period on or after 1 August 2018. Further information can be found at Fair Work.

Employees, including part-time and casual employees are entitled to 5 days unpaid family and domestic violence leave each year of their employment. The 5 days renews each 12 months of their employment but does not accumulate if the leave is not used.

A new leave category has been created - “Family and Domestic Violence Leave” and a new Work Type - “Family and Domestic Violence Leave taken”. The Leave Allowance Templates and any impacted rule conditions have also been updated.

28 June 2018

The Award has been updated to reflect the Fair Work Commission’s national minimum wage increase of 3.5% from its Annual Wage Review 2017-18 decision. This also includes updates to expense-related allowances.

These changes come into effect from the first full pay period on or after 1 July 2018. Please install these updates AFTER you have finalised your last pay run prior to the first full pay period commencing on or after 1 July 2018.

Additionally, the following changes have been made as part of this update:

- The Payment Classification settings for Allowance based pay categories have been updated as per STP requirements.

- We have created a new rule - 12.8 Apply Overtime - Over Advanced Standard Hours - Part-Time. This rule reflects the following provisions of clause 12.3:

- the hours worked each day;

- which days of the week the employee will work;

- the actual starting and finishing times of each day.

Previously we could only assess the number of hours worked per week for overtime purposes using the existing 12.8 Additional OT for PT rule. Now, however, we can assess the Advanced Standard Work Hours as set up within the employee's Pay Run Defaults screen.

For example, if an employee's Advanced Standard Work Hours were as follows:

The rule will assess hours as follows:

- Any time worked on Wednesday, Thursday and Saturday will be deemed overtime;

- Any time worked before the start times on Monday, Tuesday, Friday and Sunday will be deemed overtime; and

- Any time worked after the end times on Monday, Tuesday, Friday and Sunday will be deemed overtime.

N.B:

(a) This rule only works where Advanced Standard Work Hours have been set up using start and finish times, NOT hours only;

(b) If no Advanced Standard Work Hours have been set up for a part time employee, then all hours will be deemed overtime.

March 2018

- Update rules around all purpose allowances to use the all purpose allowance option instead of rate multipliers

- Fix any auto meal break rules so that they don't apply to leave requests

- Updated allowance pay categories configuration. e.g. changed payment classifications.

- Created Kilometre allowance pay categories - above and below ATO limits

If you have any feedback or questions please contact us via support@yourpayroll.com.au

Article is closed for comments.

Search for a feature, function or article…![Pay Cat Logo New 2.png]](https://www.paycat.com.au/hs-fs/hubfs/Pay%20Cat%20Logo%20New%202.png?height=50&name=Pay%20Cat%20Logo%20New%202.png)