Generating the Payment Summary Annual Report via an EMPDUPE file

This article should be read in conjunction with the EOFY Payment Summary Guide.

Note: This only applies to businesses that are exempt from reporting STP, and have therefore chosen not to during the financial year. For the 2021/22 financial year, exemptions only apply to:

- WPN holders (until 1st July 2023) or;

- Businesses that have been granted a deferral or special exemption from the ATO. If this scenario applies to you, you will need to send an email to the support email address provided at the end of this article and attach written proof from the ATO so that we can switch on the payment summary functionality for your business.

If any exempt businesses (as stated above) have gone ahead and lodged a successful (or partially successful) STP event during the financial year then they will not be given the option of publishing payment summaries. Rather, businesses will need to complete their end of year process by lodging an STP finalisation event.

If you choose not to lodge the payment summary annual report electronically or cannot (due to the fact you are a WPN holder), you can automatically generate an EMPDUPE file which then allows you to upload via Online Services for businesses or Online Services for agents. If you are lodging your payment summary annual report electronically as per these instructions, this support article does not apply to you.

Please remember that the EMPDUPE file must be lodged to the ATO by August 14.

Lodging the EMPDUPE file

Firstly, you must generate the EMPDUPE file by following these simple steps:

- Make sure you have published the payment summaries for your employees.

- Make sure your business details have been configured in the ATO Settings screen, accessed via Payroll Settings > ATO Settings.

- Navigate to the Payment Summaries screen from your payroll dashboard via Reports > Payment Summaries (listed under 'ATO Reporting').

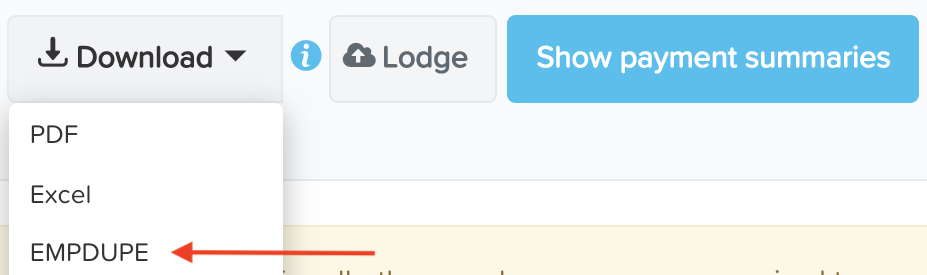

- Within the payment summaries section, click on "Show Payment Summaries". This will display a list of all payment summaries. Then click on "Download" > "EMPDUPE":

If there are multiple employing entities set up in your payroll business, ensure you filter by a specific employing entity first before you download the EMPDUPE file. You cannot generate one EMPDUPE file for all employing entities - rather, you must do this on a per employing entity basis.

- The EMPDUPE file will then download to your browser. Save this file to your desktop or some other location.

- Log in to the relevant ATO online service and import the EMPDUPE file.

What if I need to lodge amended payment summaries?

If an error has been made on a payment summary already published, then this must be rectified as soon as possible. Errors can include incorrect employee earnings/PAYG and/or allocation of such earnings, deductions and allowances.

Once you have corrected the employee amounts, you will need to:

Step 1: Unpublish affected payment summaries

- You can unpublish payment summaries on an individual basis by clicking on "Actions" > "Un-publish". The "Actions" button is located to the right of the employee's payment summary earnings line. Alternatively, if you need to unpublish all payment summaries, you can do this in bulk by clicking on the "Actions" button located on the top menu bar.

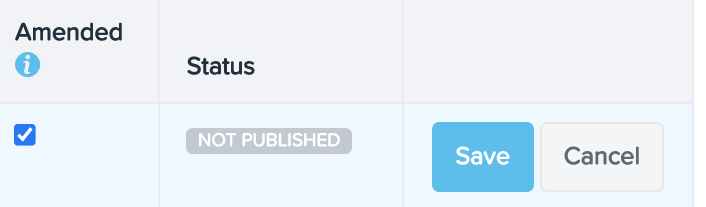

- Click on the "Show payment summaries" button to refresh the earnings. For each affected employee, click on "Edit" (to the right of the employee's payment summary earnings line) and click on the Amended checkbox. This is essential as it will indicate to the employee and the ATO that this is the amended version of the employee's payment summary. Then click on "Save".

- Alternatively, if the amendment you need to make relates to entering reportable fringe benefits (RFB), you can click on "Edit" and enter the RFB amount, click on the Amended checkbox and then click on "Save".

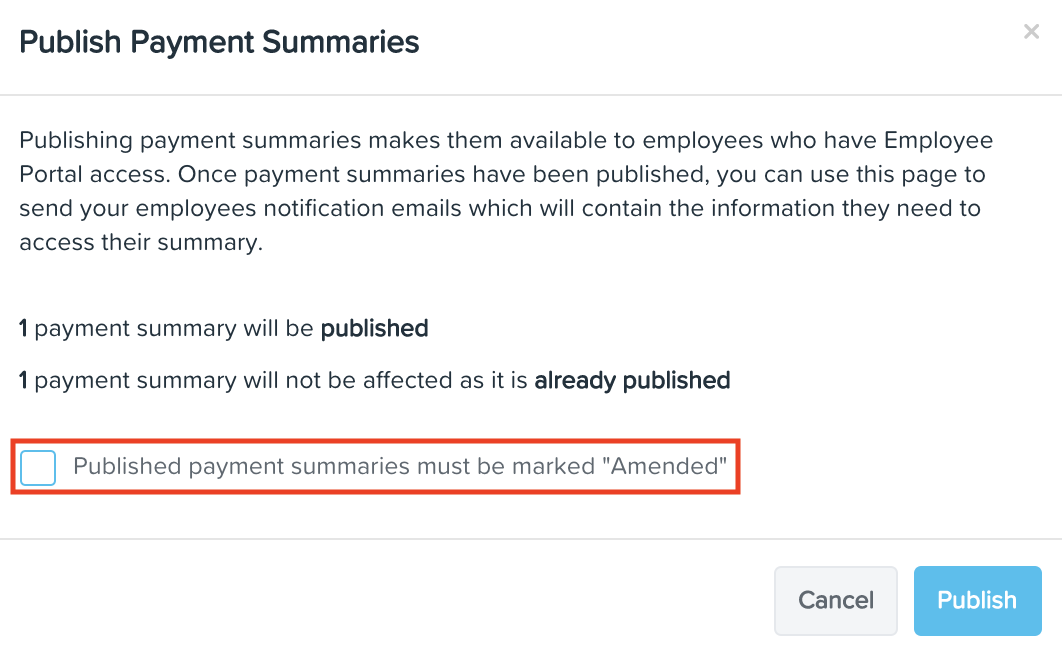

- You will then need to publish the payment summaries again. To do this, click on "Actions" (top menu) > "Publish x payment summaries". At this stage, the following modal will appear:

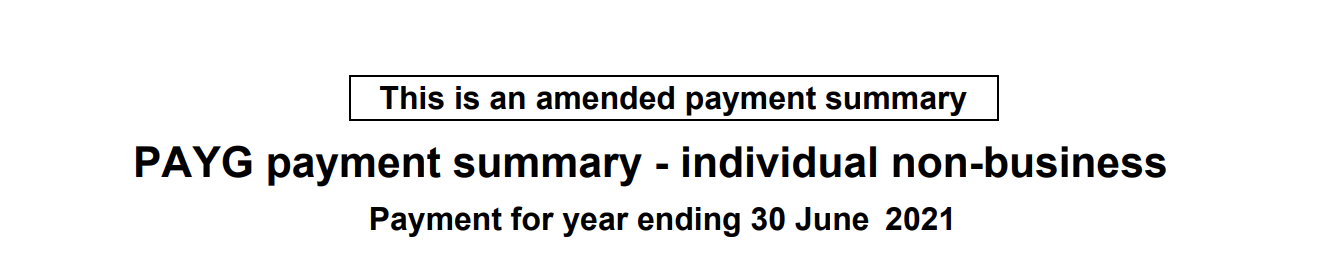

You must tick the highlighted checkbox to again indicate the payment summaries need to be marked as 'Amended'. Then click on "Publish". At this stage, the 'Amended' column in the employee's payment summary earnings line will display as "Yes" and when downloading the employee's payment summary, the header will look as follows:

Step 2: Lodge payment summary annual report

Once the amended payment summaries have been published, you will need to lodge the payment summary annual report to the ATO. The process here depends on whether you have not yet lodged a payment summary annual report at all to the ATO for the financial year or whether you have lodged the original payment summary annual report and just need to lodge the amended report.

Scenario 1: The original payment summary annual report has not yet been lodged to the ATO

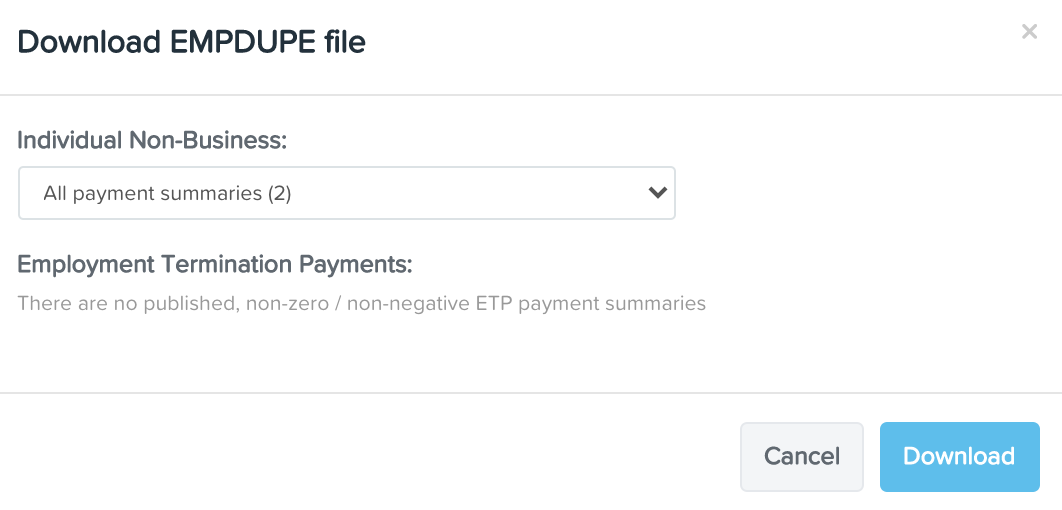

If this is the case, you can lodge both the original payment summaries and amended payment summaries within the one EMPDUPE file. To do this, click on "Download" (top menu) > "EMPDUPE". A modal will appear where the default selection is to lodge all payment summaries - this option also includes any amended payment summary. Keep this option selected and click on "Download".

The EMPDUPE file will then download to your browser. Save this file to your desktop or some other location. Log in to the relevant ATO online service and import the EMPDUPE file.

Scenario 2: The original payment summary annual report has already been lodged to the ATO

If you already have lodged the original payment summary annual report, the ATO will only require the amended payment summary annual report be lodged. The ATO specifically state "Do not include payment summaries that were previously sent and were not amended."

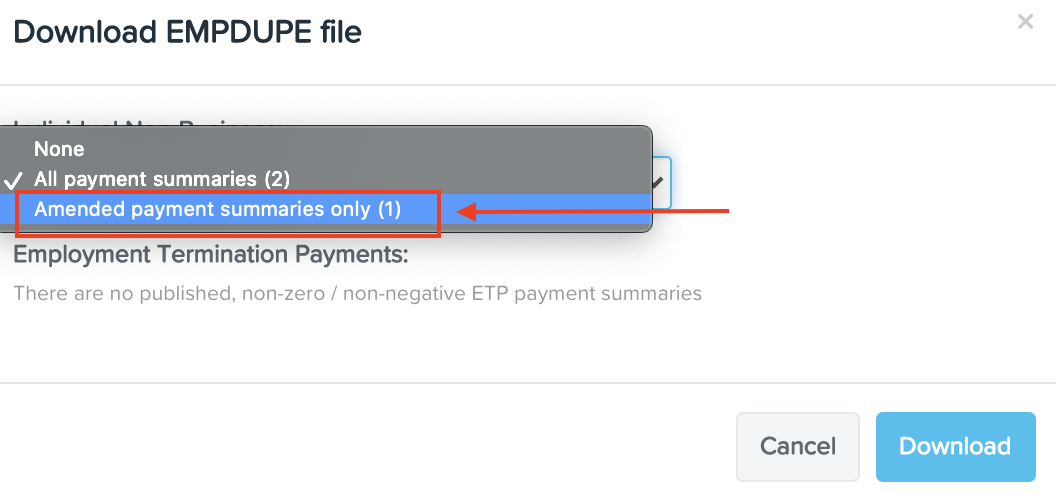

To download only the amended file, click on "Download" (top menu) > "EMPDUPE". A modal will appear where the default selection is to lodge all payment summaries - you must change this option so that only the amended payment summaries are downloaded.

Select the 'Amended payment summaries only' option and click on "Download".

The EMPDUPE file will then download to your browser. Save this file to your desktop or some other location. Log in to the relevant ATO online service and import the EMPDUPE file.

If you have any questions or feedback, please let us know via support@yourpayroll.com.au.

![Pay Cat Logo New 2.png]](https://www.paycat.com.au/hs-fs/hubfs/Pay%20Cat%20Logo%20New%202.png?height=50&name=Pay%20Cat%20Logo%20New%202.png)