Are you processing a termination pay and need to include a payment in lieu of notice? This article will show you what steps to take to ensure the payment is paid and reported correctly. It has the following sections:

What is a payment in lieu of notice?

Often when your worker’s employment is terminated they may not work through the whole notice period or at all. In this case you will make a payment in lieu of notice as part of the termination pay. A payment in lieu of notice is an employment termination payment and, important to note, is superable – this will impact how you process the payment.

What to do

So, how do you go about processing payment in lieu of notice?

You need to:

- Terminate the employee

- Tick the Redundancy/ETP checkbox

- Add a Type O or Type P lump sum payment

- Ensure the payment is marked 'superable'

- Tax reporting

1. Terminate the employee

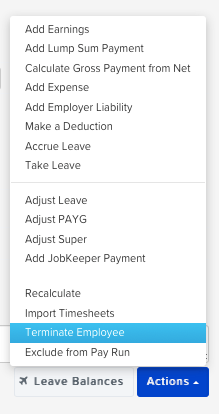

Ensure the employee has been added to the pay run, click on the employee within the pay run, then click the 'Actions' button and select 'Terminate employee'.

See our article Terminating an Employee, in particular, Section 1: Terminating an employee via the pay run, for more information.

NB If you have already terminated the employment and are making another termination payment for the same termination, you still need to add the employee to the pay run and follow the procedure above. The employee will appear in the dropdown as inactive and the termination date will default to the date on file.

2. Tick the Redundancy/ETP checkbox

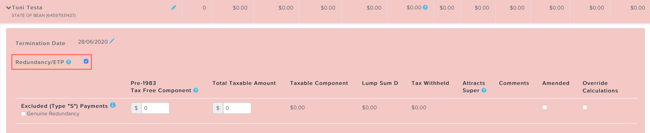

Once the ‘Terminate employee’ action has been selected, tick the ‘ETP/Redundancy’ checkbox to activate the ETP earnings lines:

This will allow you to enter the lump sum amount for the payment in lieu of notice and ensures that tax is correctly withheld and the payment is accurately reported to the ATO.

Late termination warning

If the current pay run paid date is more than 12 months after the termination date recorded on the employee file, then a warning will display when the 'Redundancy/ETP' checkbox is ticked. Users can choose to continue by clicking 'OK'. Clicking 'Cancel' will revert to a non-ETP termination. See our article, Processing Employment Termination Payments – Type S and Type P for more information.

3. Add Type O or Type P lump sum payment

A payment in lieu of notice is added as a lump sum payment. When you've worked out the lump sum based on the applicable period of notice and how much, if any, your employee will work, add a Type O or Type P lump sum payment, depending on the date of termination. Specifically,

- If you are making the payment in the same financial year as date of termination, then select Type O.

- If an ETP was made in a previous financial year for the same termination and you are making the payment in lieu of notice in the current financial year, then select Type P. See our article, Processing Employment Termination Payments – Type S and Type P for more information.

To add a Type O lump sum, click on 'Actions' > 'Add Type 'O' ETP'. This action will only display if the "Redundancy/ETP" checkbox has been ticked. The process is the same for Type P lump sum payments.

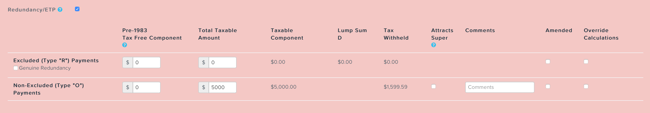

This will generate a new pay run line. Enter the total taxable amount and click ‘Save’.

The system will then calculate the tax to withhold on the taxable amount in accordance with the Schedule 11 tax tables and display this under 'Tax withheld':

If you have other Type O or Type P payments to add, you will need to add another lump sum using the above process.

NB Type O or Type P unused leave payments do not generally need to be added as a lump sum and will be added automatically if you have set up the leave category as ETP and ticked the 'Pay out' check box in the pay run.

A Type O payment may not always be the correct option in this circumstance, however, and doesn't prompt the client to consider if the lieu of notice forms part of a genuine redundancy. If this is the case, they may need to process this differently. Please readthis articlefor further information.

4. Ensure Payment is Superable

Because a payment in lieu of notice is superable, you need to tick the ‘Attracts super’ checkbox to calculate the superannuation guarantee (SG) on the amount entered in this row.

The general rules of SG eligibility still apply. Effective 1 July 2022 you need to pay super to an eligible employee's super fund regardless of how much they are paid. Employees under 18 must work more than 30 hours in a week.

5. Tax reporting

5.1 STP reporting

When a pay run containing an ETP is finalised, the corresponding STP pay event will specify:

- the total taxable components;

- any tax free component

- total tax withheld

- ETP code

These will be reported to the ATO once lodged. If there are multiple Type O or Type P payments these will be reported as one amount, including superable Type O or Type P.

The employee is automatically marked as 'is final' within the STP pay event.

5.2 Employment termination payment summaries

Businesses which are exempt from STP reporting – ie WPN holders – must provide the employee with a 'PAYG payment summary – employment termination payment’ (ETP payment summary) within 14 days of making the payment.

Once the pay run has been finalised an ETP payment summary is generated. A separate payment summary is created for each ETP type, although multiple Type O or Type P payments are reported together. The payment summary will display:

- the total taxable component;

- any tax free component

- total tax withheld

- ETP code

ETP payment summaries are available on the employee portal under ‘Documents’ > ‘Payment summaries’. Businesses can send a notification to the employee from the employee file under ‘Employee management’ > ‘Payment summaries’ or from Reports > ATO reporting > Payment summaries under the ‘Employment termination payment’ tab.

Tips

Make a note

Add a comment to the Type O superable payment so you can quickly and easily see what it is for:

To include the comment on the employee's pay slip, tick the ‘Show line notes’ setting in ‘Payroll settings’ > ‘Business settings’ > ‘Pay slips’ screen.

Override calculations

If users need to override ETP values, they can tick the ‘Override calculations’ checkbox. For more information on overriding ETP amounts, see this article.

Amended payments

When a payment summary has already been lodged with the ATO but there has been an error in the calculations, users are able to correct the error in the pay run and tick the ‘Amended’ checkbox which will mark the payment summary as amended once the pay run is finalised.

If you have any questions or feedback, please let us know via support@yourpayroll.com.au.