There are many reasons why you might need to change the ABN you pay your employees under but as I'm sure you are already aware, the impact of changing an ABN on STP reporting is significant and must be addressed.

We have several articles that cover different aspects of this topic, several of which I will refer to here, however all scenarios covered in this article involve you needing to use a "new" ABN, ie. one that doesn't currently exist in your payroll account. This article is an attempt to try to simplify the process for you, so you can "tick off" the steps you need to take to rectify the problem, depending on which scenario you're operating under.

If you already have multiple employing entities in your payroll account and the ABN you need to switch employees to has already been used for other employees, the following article will show you the processes to follow - Retrospectively changing an employee's employing entity during the financial year and the interaction with STP

If the ABN you to need to switch employees to is "new" to your payroll account, ie. you haven't started using it/reporting STP under it yet, then you must ensure that the new ABN is integrated with the ATO for STP reporting, if that's not set up you can't do anything - instructions on enabling integration can be accessed here - then once that's done, the timing of the change in ABN will determine the course of action required.

Please take the time to read the information provided here carefully to make sure you're using the correct process then, it's very important that you step through the appropriate process in the order provided.

These are the scenarios covered in this article:

For data lodged in the current financial year:

- the ABN you've been lodging STP under has changed as of 1 July

- the ABN you've been lodging STP under has changed mid financial year

- the ABN you've been lodging STP under is wrong (as opposed to changed)

For data lodged in the previous financial year:

Your ABN has changed as of 1 July in a financial year

The example scenario here is that:

- up to 30 June of the previous financial year you were operating/reporting STP under ABN 11 111 111 111

- you have changed your ABN and as of 1 July in the new financial year you will now be operating/reporting STP under ABN 22 222 222 222

- your employees should only have one Income Statement in their MyGov portal for the financial year and it should be under ABN 22 222 222 222 (previous financial year Income Statements remain under ABN 11 111 111 111)

This should be a simple fix because it's a "fresh" start for a new financial year but how you proceed depends on whether you've already been lodging pay events under the old ABN in the new financial year or not. Note it's important that previous financial year/s data stays in place, for both your and your employees' records (if the ABN has been wrong all along, ie. in the previous financial year/s too, then these steps are not for you, jump to these instructions).

If you have not lodged any pay events for the new financial year yet you need to:

- create a new Employing Entity for the new ABN - Employing Entities

-

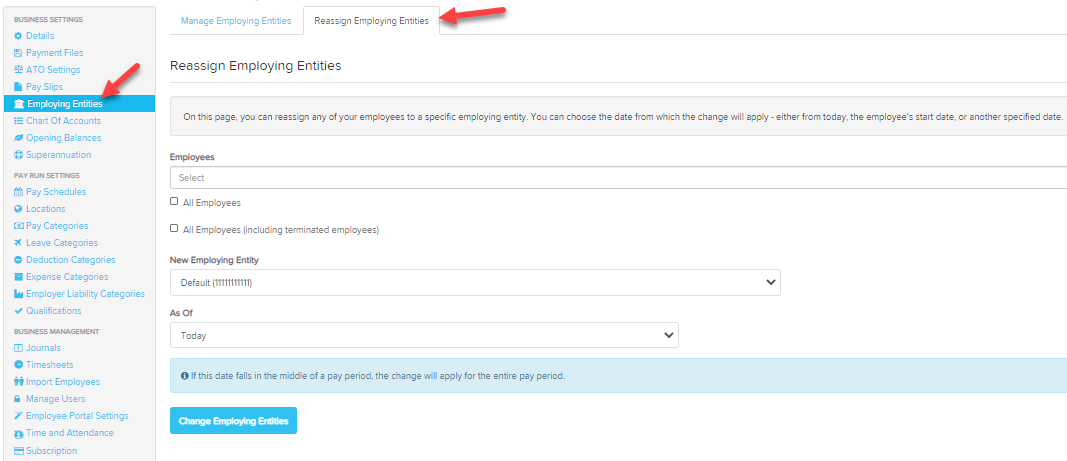

use the Reassign Employing Entities tab on the Employing Entities page to update the employing entity in bulk for affected employees to be as of 1 July

-

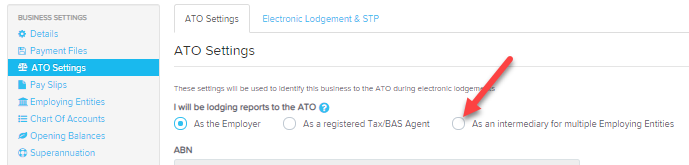

go to the ATO settings page, under the business settings heading on the payroll settings tab and change your "I will be lodging reports to the ATO" setting to As an intermediary for multiple Employing Entities...

as per the instructions under the heading 3. An intermediary for multiple employing entities in this this article - ATO Settings - create the pay event from your first pay run for the financial year, lodge it and carry on as usual processing pay runs and lodging pay events

If you have lodged pay events already for the financial year (and these are under the old ABN) you will need to:

- create and lodge an Earnings Reset Event - using an Earnings Reset event will clear incorrectly lodged information so far in this financial year at the ATO (this does not impact on the data in Employment Hero Payroll, it simply "clears the decks" at the ATO). Do not proceed until the earnings reset event has been successfully lodged

- create a new Employing Entity for the new ABN - Employing Entities

- use the Reassign Employing Entities tab on the Employing Entities page to update the employing entity in bulk for affected employees as of 1 July (see image here)

- go to the ATO settings page, under the business settings heading on the payroll settings tab and change your "I will be lodging reports to the ATO" setting to As an intermediary for multiple Employing Entities (see image here) as per the instructions under the heading 3. An intermediary for multiple employing entities in this this article - ATO Settings

- create and lodge the pay event from your next pay run (OR the oldest pay run that should be under the new EE but has not been lodged to the ATO yet)

- once the pay event in Step 5 has been successfully lodged then create and lodge an Update event - Creating & Lodging an Update Event - this will ensure YTD totals for employees are reset and accurate - there should be one line only for each employee and the YTD total should match their total earnings in pay runs paid in this financial year (as per the Detailed Activity Report)

- carry on as usual processing pay runs and lodging pay events

Your ABN has changed mid financial year

The example scenario here is that:

- up to 31 October in this financial year you were operating/reporting STP under ABN 11 111 111 111

- you have changed your ABN and as of 1 November in this new financial year will be operating/reporting STP under ABN 22 222 222 222

- your employees will need to have two Income Statements (one for each ABN) in their MyGov portal for this financial year

If you have not lodged any pay events for the period your new ABN is effective from yet you need to:

- create a new Employing Entity for the new ABN - Employing Entities

- use the Reassign Employing Entities tab to update the employing entity in bulk for affected employees as of the effective date (see image here)

- go to the ATO settings page, under the business settings heading on the payroll settings tab and change your "I will be lodging reports to the ATO" setting to As an intermediary for multiple Employing Entities (see image here) as per the instructions under the heading 3. An intermediary for multiple employing entities in this this article - ATO Settings

- create and lodge the pay event from your next pay run (OR the oldest pay run that should be under the new EE but has not been lodged to the ATO yet)

- once the pay event in Step 4 has been successfully lodged then create and lodge an Update event - Creating & Lodging an Update Event - this will ensure YTD totals for employees are reset and accurate - there should be two lines for each employee, split accurately to reflect earnings that should be under each ABN, the YTD total should match their total earnings in pay runs paid in this financial year (as per the Detailed Activity Report)

- carry on as usual processing pay runs and lodging pay events

If you have already lodged pay events under the old ABN but these should be under the new ABN, you will need to:

- create and lodge an Earnings Reset Event - using an Earnings Reset event will clear incorrectly lodged information so far in this financial year at the ATO (this does not impact on the data in Employment Hero Payroll, it simply "clears the decks" at the ATO). Do not proceed until the earnings reset event has been successfully lodged

- create a new Employing Entity for the new ABN - Employing Entities

- use the Reassign Employing Entities tab to update the employing entity in bulk for affected employees as of the effective date (see image here)

- go to the ATO settings page, under the business settings heading on the payroll settings tab and change your "I will be lodging reports to the ATO" setting to As an intermediary for multiple Employing Entities (see image here) as per the instructions under the heading 3. An intermediary for multiple employing entities in this this article - ATO Settings

- create and lodge the pay event from your next pay run (OR the oldest pay run that should be under the new EE but has not been lodged to the ATO yet)

- once the pay event in Step 5 has been successfully lodged create and lodge an Update event - Creating & Lodging an Update Event - this will ensure YTD totals for employees are reset and accurate - there should be two lines for each employee, split accurately to reflect earnings that should be under each ABN, the YTD total should match their total earnings in pay runs paid in this financial year (as per the Detailed Activity Report)

- carry on as usual processing pay runs and lodging pay events

The ABN you've been lodging STP under in this financial year is wrong (as opposed to changed)

The example scenario here is:

- up to now you've been operating/reporting STP under ABN 11 111 111 111

- your ABN is actually 10 111 111 111 - NB. this scenario also applies if you find out that it's not the ABN but the branch code attached to your ABN that's wrong

- your employees should only have one Income Statement in their MyGov portal for the financial year

This should also be a simple fix because it's a "fresh" start.

- create and lodge an Earnings Reset Event for all employees - using an Earnings Reset event will clear incorrectly lodged information so far in the financial year at the ATO (this does not impact on the data in Employment Hero Payroll, it simply "clears the decks" at the ATO)

- change the ABN and/or branch code and any other details as required on the Details page, under the business settings heading on the payroll settings tab of your payroll account

- create and lodge the pay event from your next pay run (OR the oldest pay run that has not been lodged to the ATO yet)

- once the pay event in Step 3 has been successfully lodged create and lodge an update event - Creating & Lodging an Update Event - you should see one YTD earnings line for each employee, when you lodge this an income statement will be created for each employee under the correct ABN - this will be the only income statement each employee sees

- carry on as usual processing pay runs and lodging pay events

The ABN used to lodge STP in the previous financial year was wrong

The example scenario here is:

- you lodged all data for the previous financial year under ABN 11 111 111 111

- your ABN is actually 10 111 111 111 - NB. this scenario also applies if you find out that it's not the ABN but the branch code attached to your ABN that's wrong

- your employees should only have one Income Statement in their MyGov portal for the financial year

How you proceed will depend on where your STP reporting is at.

If you have NOT lodged a Finalisation Event for the financial year yet:

- create and lodge an Earnings Reset Event for all employees - using an Earnings Reset event will clear incorrectly lodged information so far in the financial year at the ATO (this does not impact on the data in Employment Hero Payroll, it simply "clears the decks" at the ATO)

- change the ABN and/or branch code and any other details as required on the Details page, under the Business Settings heading on the Payroll Settings tab of your payroll account

- if you have an unlodged pay run for the financial year in question then lodge that now (it doesn't matter what date it is for, you simply need to have lodged "something" in the financial year before you're permitted to finalise)

- if there are no "unlodged" pay runs

- you will need to create a "dummy" pay run with period and paid date on or before 30th June in the appropriate financial year and lodge that - this is because "something" has to be lodged under the new ABN before you can finalise the financial year STP reporting

- use the option 'Manually add employees' in the create pay run dialogue box

- add one employee who you've been lodging via STP through the year

- add an earnings line for 1c (add a note at the bottom of the employee's pay run record to leave an audit trail that this is an adjustment pay run created to correct an STP lodgement issue only)

- finalise then lodge this pay run

- once the pay event in Step 3 or 4 has been successfully lodged

- create and lodge your STP Finalisation Event using the EOFY wizard

- you should see one YTD earnings line for each employee in the event you create and when you lodge it an income statement will be created and made Tax Ready for each employee under the correct ABN - this will be the only income statement each employee sees

If you have already successfully lodged a Finalisation Event for the financial year:

- create and lodge an Earnings Reset Event for all employees - using an Earnings Reset event will clear incorrectly lodged information so far in the financial year at the ATO (this does not impact on the data in Employment Hero Payroll, it simply "clears the decks" at the ATO)

- change the ABN and/or branch code and any other details as required on the Details page, under the business settings heading on the payroll settings tab of your payroll account

- create a new pay schedule (call it 'EOFY Fix' or something similar) - Pay Schedules Set Up. The reason for this is if a pay schedule has been finalised and you try to create a new pay run on that schedule it will be blank in the pay event.

- create an ad hoc pay run using the new pay schedule with a pay period and paid date in the relevant financial year, use the option 'Manually add employees' in the create pay run dialogue box

- add one employee who you've been lodging via STP through the year

- add an earnings line for 1c (add a note at the bottom of the employee's pay run record to leave an audit trail that this is an adjustment pay run created to correct an STP lodgement issue only)

- finalise then lodge this pay run

- once that's successfully lodged you will be able to proceed with creating your STP Finalisation Event using the EOFY wizard for the new pay schedule, into which you will add all affected employees

- you should see one YTD earnings line for each employee in the event you create and when you lodge it an income statement will be created and made Tax Ready for each employee under the correct ABN - this will be the only income statement each employee sees

As always, please contact us at support@yourpayroll.com.au if you have questions.