Leave Adjustments

There may be occasions when leave will have to be adjusted, for example:

- If annual leave was paid but it should have been sick leave taken (example 1).

- An employee was credited with 8 Hours annual leave but this should have been sick Leave (example 2)

- An employee returns to work early but the (whole) leave request has already been applied to the pay run (example 3).

For a short video on adjusting leave click here.

Example 1:

If annual leave was paid but it should have been sick leave taken.

To adjust the leave error you will need to follow these steps

- Create a New Pay Run Creating a New Pay Run OR make your adjustment in the next scheduled pay run

- Open the employee's pay run record by clicking on their name

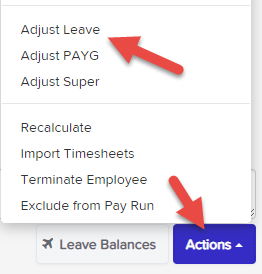

- Select the "Action" button at the bottom right hand corner of the screen (See image below) and then select "Adjust Leave"

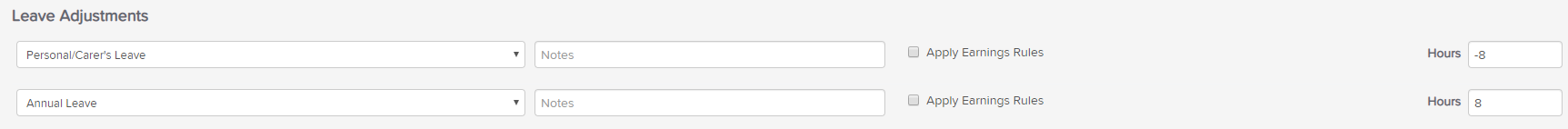

- Adjust the Leave accordingly but remember, this is a leave "adjustment" so a negative adjustment will "take" leave (meaning reduce the leave balance), a positive adjustment will add to the leave balance. In the example shown below the intention is to change the leave taken from annual leave to sick leave so there's a positive adjustment to increase the annual leave balance and a negative adjustment to reduce sick leave.

- Depending on the leave category settings, and if the Apply Earnings Rules box is ticked, the Leave Adjustment will create a line in the earnings of the employee indicating that annual leave has been adjusted. NB. ticking the box to apply 17.5% leave loading will also add an earnings line to pay the loading if leave is being taken (a negative adjustment) but will reverse/deduct the 17.5% loading if leave is being added/replaced (a positive adjustment).

- You can leave a note in the "Notes For This Pay run" section

- The pay run can now be finalised (see example/scenario below for further clarification)

Example 2:

An employee was credited with 8 Hours Annual Leave but this should have been Sick Leave. To correct this, under the "Leave Adjustments" section, a minus 8 Hours (-8) has to be entered under Sick Leave and a plus 8 Hours (8) entered under Annual Leave.

If the boxes to Apply Earnings Rules and Loading are ticked - and depending on how your leave category is set up - new earnings lines will be created under the "Earnings" section to minus 8 Hours (-8) annual leave and/or to reverse payment of the leave loading.

The minus 8 Hours (-8) for Sick Leave under Leave Adjustments will not be shown in the "Earnings" section as this will just reduce the Sick Leave balance with no monetary adjustment to be made.

Example 3:

An employee returns to work early but the (whole) leave request has already been applied to the pay run.

Just use the same steps outlined above but add a positive adjustment to the appropriate leave category in the leave adjustment line, this will replenish the leave balance for leave not taken - notate why you are putting the leave back in the notes field but again, be careful about applying earnings rules, ie. only apply them if the employee would not normally have been paid for that time or if leave loading was paid.

If you have any questions or feedback, please let us know via support@yourpayroll.com.au

![Pay Cat Logo New 2.png]](https://www.paycat.com.au/hs-fs/hubfs/Pay%20Cat%20Logo%20New%202.png?height=50&name=Pay%20Cat%20Logo%20New%202.png)