This article details how to rectify earnings already lodged via STP that have incorrectly reported one or more of the following details against an employee:

- Incorrect employing entity (ie employee was assigned to the incorrect employing entity at the time of lodging STP events);

- Incorrect ABN (ie the incorrect ABN was set up in the Details/ATO Settings screen or Employing Entities screen);

- Incorrect entity branch number (ie the incorrect branch number or no branch number was set up in the ATO Settings screen or Employing Entities screen);

- Incorrect BMS ID (ie the incorrect BMS ID was set up in the ATO Settings screen (Electronic Lodgement & STP tab) or Employing Entities screen when transferring over to this payroll system); and/or

- Incorrect employee STP Payroll ID (ie the incorrect STP payroll Id was assigned to an employee in the employee’s Opening Balances screen (STP tab) when transferring over to this payroll system).

Put simply, the purpose of the earnings reset event is to allow businesses to lodge a $0 earnings event via STP for all employees who have been reported with incorrect business/employee details. This allows you to effectively “reset” what has been reported to the ATO for the employees back to $0 without affecting any actual pay run data. Once the earnings reset event has been successfully lodged, you then just need to correct the business/employee details and start reporting again as normal.

We will detail further below how to correct each scenario provided above but will first explain how to lodge an earnings reset event.

Lodging an earnings reset event

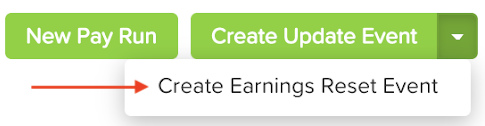

Navigate to the Reports > Single Touch Payroll screen. From this screen, click on the down arrow of the ‘Create Update Event” button and click on “Create Earnings Reset Event”:

N.B. If you click on the “Create Update Event” split button dropdown but cannot click on the “Create Earnings Reset Event” option, this means you haven’t lodged any successful events for that financial year and so should not and cannot create an earnings reset event.

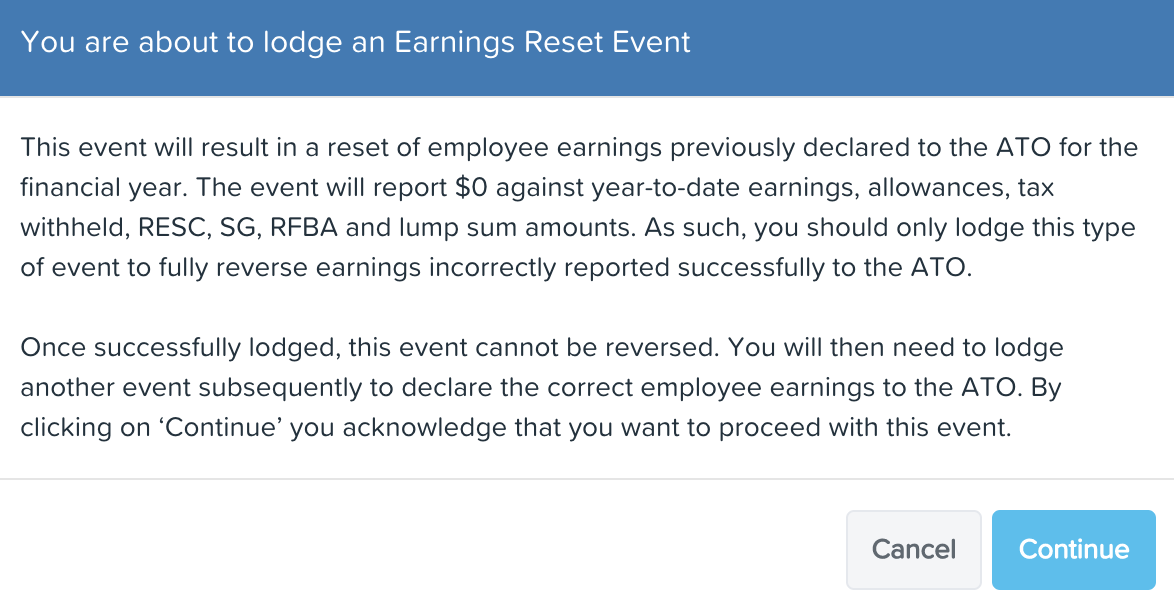

A modal will appear explaining exactly what the purpose of this event is:

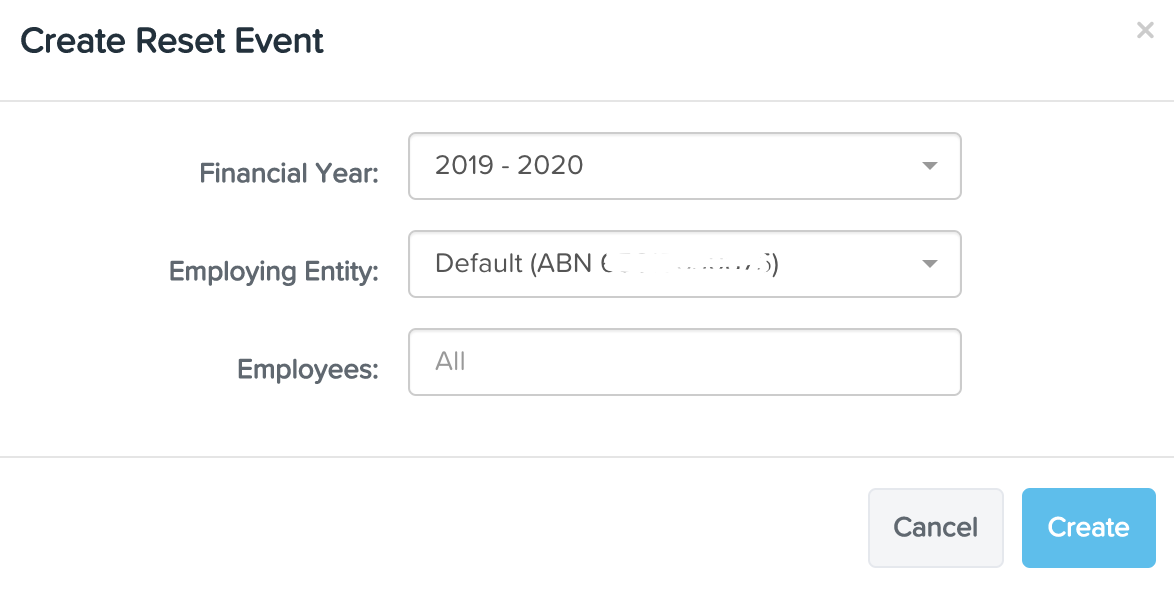

Click on “Continue” as confirmation you acknowledge the consequences of lodging an earnings reset event to proceed or alternatively click on “Cancel” to be taken to back to the Single Touch Reporting screen. If you click on “Continue”, the following modal will appear:

You can filter modal settings as follows:

- Financial Year: This will default to the current FY. Only financial years where successful STP events have been lodged will appear in the dropdown list;

- Employing Entity: This filter will only appear if you have more than one employing entity set up in the business. If you do, the default employing entity will appear, ie the entity set up in the business’ Details screen. You can select a different employing entity or select ‘All’ (ie all employing entities) by clicking on the dropdown list. Please note that only employing entities that have been reported in the chosen financial year will appear in the dropdown;

- Employees: You can select specific employees by clicking on the dropdown list and searching for the employees. Otherwise, leaving the field as is (ie ‘All’) will bring up ALL employees of the chosen employing entity or, if there are no employing entities set up in the business, ALL employees in the business. ALL = active employees who have been previously reported in events for that financial year. If you need to include an employee who is terminated, you will need to re-activate them first.

N.B. We have not included a pay schedule filter in the above modal because more often than not, the changes required aren’t pay schedule specific.

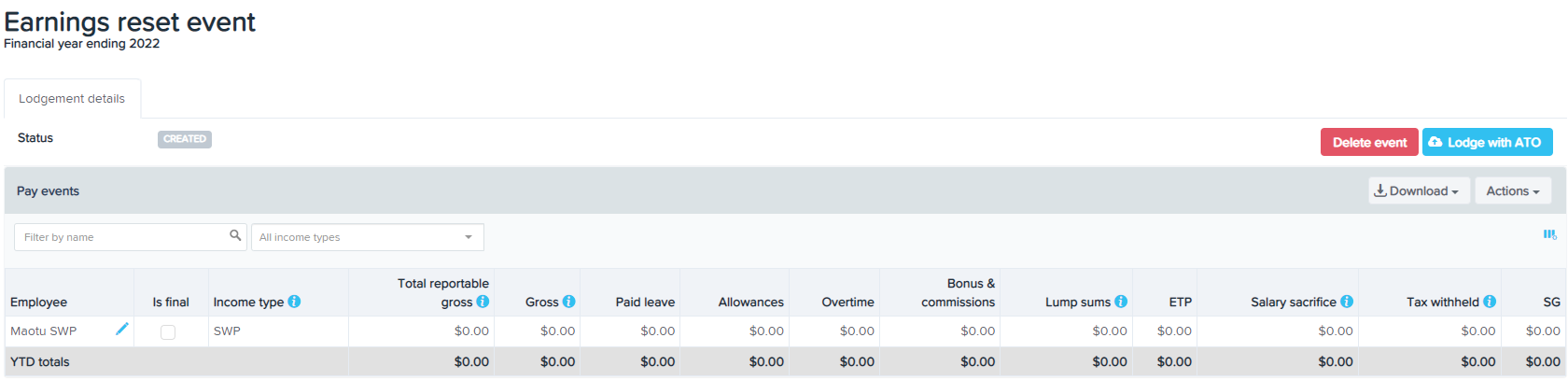

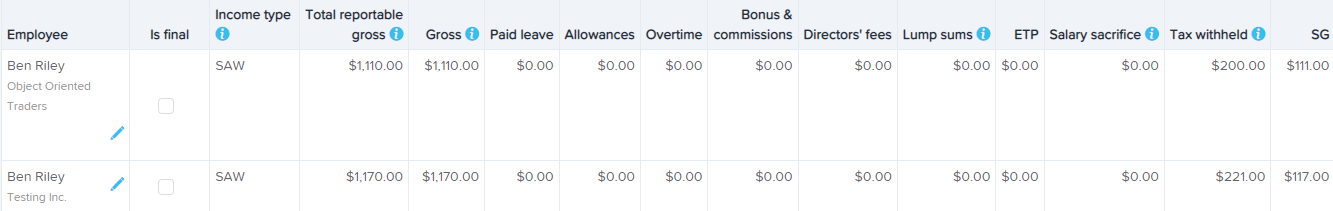

Once you click on “Create”, the event will appear as follows (example only):

As you can see, all earnings are set to $0. This is what will be reported to the ATO once lodged. A few things to note:

- Unlike other event types, there is no ability to edit the RFBA column. This is intentional as all earnings, including previously reported RFBA, need to be “wiped out”.

- Where an earnings reset event is created post lodgement of a finalisation event or amended finalisation event and the employee was included in either event, the employee will automatically be marked as ‘Is Final’.

- Where an employee has been terminated in a pay run and the associated pay event was lodged, a subsequent earnings reset event including that employee will automatically mark the employee as ‘Is Final’.

- The “Actions” button includes the following actions:

- Mark all as is final - this allows you to bulk mark all employees as is final;

- Mark all as not final - this will appear if all employees are marked as is final and allows you bulk mark all employees as not final;

- Add Employee - use this function if you want to add additional employees to the earnings reset event;

- Request Client Authority - this will appear if the business is using a registered tax/BAS agent to lodge events. As with any event type, you will need to obtain authorisation from your client before proceeding with lodging this event. You can assign one or more STP event approvers to the list and then add a note to indicate the purpose of this earnings reset event. The users added to the list will be notified via email that there is an event waiting to be actioned.

- Please note, we have not included the Excel reports within Download for this event type as there are no earnings to report/reconcile against;

- This event type will still undergo a validation process. If there are any validation issues, you will see a “Warnings” tab on the event screen. As with any event type, you will need to rectify these issues before you are able to lodge the event. A list of all validation warnings and fixes can be found here.

Once everything is ready to be lodged and you have received the appropriate authorisation (if you are lodging as a registered agent), you can commence the process of lodging the event to the ATO. The lodgement process is the same as per every other event type. If you are unsure of the process refer to the “Lodging a Pay Event” section of this article.

Once the event is successfully lodged, you will be in a position to rectify the business/employee issues and re-lodge the actual employee earnings with the ATO.

Detailed workflow on how to rectify incorrect lodgements

This section will detail the exact steps per scenario that must be followed to, in effect, reverse incorrect lodgements and then re-lodge using the correct details.

N.B. For all scenarios detailed below, you must:

- Ensure that you do not correct the issues until AFTER the reset event is successfully lodged.

- Create and lodge the update event immediately after you have corrected the issues.

Scenario 1: Events lodged where employee was attached to incorrect employing entity

Step 1: Create an earnings reset event and add the affected employees to the event.

Step 2: Lodge the earnings reset event and ensure it is successful. If your lodgement fails refer to our troubleshooting guide to assist in rectifying the issue.

Step 3: For each affected employee, navigate to the employee’s Tax File Declaration screen where you will see the “Employing Entity” field. Click on the “Change” button and select the employing entity the employee should be assigned to. You must then ensure you select the correct effective date that the employing entity is to apply from. It will either be effective from the employee’s start date or a custom date. If you select as of today, this will not ‘backdate’ the employing entity change. You can bulk update employee employing entities via the Employing Entities screen (Reassign Employing Entities tab) by following these instructions. N.B. Do not bulk update employee employing entities using the employee file import as this will only make the updated employing entity effective from the date you import the file and this will not fix the issue!

Step 4: Create and lodge an update event for the correct employing entity (or an amended finalisation event if you have already completed a finalisation event for that employing entity). This event should contain the affected employee’s actual YTD earnings and will now be reported against the correct employing entity. If an employee’s employing entity has changed mid financial year (and so they were employed by different entities during the course of the year) there will be a line displayed per entity in the event for that employee. Specifically, the YTD earnings associated against each employing entity will be separated accordingly, as follows:

Once the event is lodged successfully, you’re done!

Scenario 2: Events lodged where the incorrect ABN was applied to the employee’s employing entity

Step 1: Create an earnings reset event and add the affected employees to the event.

Step 2: Lodge the earnings reset event and ensure it is successful. If your lodgement fails refer to our troubleshooting guide to assist in rectifying the issue.

Step 3: To apply the correct ABN, navigate to the Details screen, enter the correct business number in the “ABN” field and then click on “Save”. If you need to fix an ABN against an employing entity then navigate to the Employing Entities screen, click on the affected employing entity name to expand the details, enter the correct business number in the “ABN” field and click on “Save”.

Step 4: Ensure the new ABN you have applied is integrated with the ATO for STP reporting, otherwise all subsequent lodgements will fail. Instructions on enabling integration can be accessed here.

Step 5: Create and lodge an update event for all affected employees (or an amended finalisation event if you have already completed a finalisation event for that employing entity). This event should contain the affected employee’s actual YTD earnings and will now be reported against the correct employing entity. Once the event is lodged successfully, you’re done!

If the update event is blank or you receive an error message from the ATO: "Your submission was not processed. We were unable to process your submission because you have not reported using Single Touch Payroll for that financial year", it means that no prior pay events have been lodged under that ABN before, which means that you can't skip straight to lodging an update event. You'll need to do a little more work to transfer the YTD data across.

- If you've not lodged EVERY pay run/event in the account it's a simple fix:

- just lodge any unlodged pay event, it doesn't matter what pay period it's for, as long as it's in the relevant financial year

- once that's done you should lodge an update event, to be sure the YTD totals are current or proceed with your Finalisation process for the FY (NB. a finalisation or amended finalisation event will pick up each employee's current YTD totals so if you are finalising/re-finalising there's no need to lodge an Update event after lodging an out of sequence pay run)

- If every pay run/event in the account has already been lodged then you will have to:

- create an ad hoc pay run with a pay period and paid date in the relevant financial year, use the option Manually add employees to the pay run option -How do I process an Ad Hoc pay run

- add one employee who you've been lodging via STP through the year

- add an earnings line for 1c (add a note at the bottom of the employee's pay run record to leave an audit trail that this is an adjustment pay run created to correct an STP lodgement issue only)

- finalise then lodge this pay run

- once that's successfully lodged you will be able to proceed with your Finalisation process for the FY

Scenario 3: Events lodged where the incorrect branch number or no branch number was assigned to the employee’s employing entity

Not all business entities have branch numbers by default, but only in circumstances where it suits the structural, management and accounting arrangements of the organisation. The ATO provides businesses with branch numbers and you can find your branch number via the ATO Portal. For eg, if the value in your Number field is '11111111111/003', the branch number is 003. The number before the “/” is your ABN. Alternatively, you can contact the ATO directly and ask them what branch number you should use.

N.B. If the value after your ABN is '/001', this effectively means the entity has not been designated a branch number. Therefore you can just leave the “Branch Number” fields in your entity settings blank. If you have already entered 001, there is no need to remove it.

Step 1: Create an earnings reset event and add the affected employees to the event.

Step 2: Lodge the earnings reset event and ensure it is successful. If your lodgement fails refer to our troubleshooting guide to assist in rectifying the issue.

Step 3: To apply the correct branch number to your default business/ABN, navigate to the ATO Settings screen and scroll to the “Branch Number” field in the Business Details section. Enter the correct 3 digit number and then click on “Save”. If you need to fix a branch number against an employing entity then navigate to the Employing Entities screen, click on the affected employing entity name to expand the details, enter the correct 3 digit number in the “Branch Number” field and click on “Save”.

Step 4: Create and lodge an update event for the affected employing entity (or an amended finalisation event if you have already completed a finalisation event for that employing entity). This event should contain the affected employee’s actual YTD earnings and will now be reported against the correct employing entity branch number. Once the event is lodged successfully, you’re done!

Scenario 4: Events lodged where the incorrect BMS ID was used for an employing entity

This scenario should only pose a problem to businesses transferring over from a previous payroll system during the financial year. There are a number of transition options available when moving payroll systems when it comes to the continuation of STP reporting. An incorrect BMS ID has most likely caused duplicate records or overstated earnings being reported to the ATO (and therefore in the employee’s myGov account).

If a business wants to migrate YTD figures and use the previous system’s BMS ID to report STP going forward, both the BMS ID and employee STP Payroll Id need to change. If this is what has occurred and needs to be rectified, ensure you also complete Step 3 of Scenario 5 when completing Step 3 of this scenario, ie fix both the BMS ID and STP Payroll Id before you proceed to Step 4.

Step 1: Create an earnings reset event and add the affected employees to the event.

Step 2: Lodge the earnings reset event and ensure it is successful. If your lodgement fails refer to our troubleshooting guide to assist in rectifying the issue.

Step 3: The BMS ID setting for the default employing entity is located in the ATO Settings screen (Electronic Lodgement & STP tab). For any other employing entities set up in the business, navigate to the Employing Entities screen, click on the affected employing entity name to expand the details and you will see the BMS ID field. Follow these instructions to change the BMS ID. As stated above, if the original issue related to both an incorrect BMS ID and STP Payroll ID, then you should at this stage also refer to Step 3 of Scenario 5 and fix this as per the instructions provided before proceeding to the next step.

Step 4: Create and lodge an update event for the correct employing entity (or an amended finalisation event if you have already completed a finalisation event for that employing entity). This event should contain the affected employee’s actual YTD earnings and will be consolidated with the existing data reported via your previous payroll system into one employee record once the event is successfully lodged.

Scenario 5: Events lodged where the incorrect STP Payroll ID was used for an employee

This scenario should only pose a problem to businesses transferring over from a previous payroll system during the financial year. There are a number of transition options available when moving payroll systems when it comes to the continuation of STP reporting. An incorrect STP Payroll ID has most likely caused duplicate records or overstated earnings being reported to the ATO (and therefore in the employee’s myGov account). By default, this payroll system uses the employee’s Employee Id (as displayed on the employee’s Details screen) however this can be changed for transferring businesses, but only after the BMS ID has been changed.

Step 1: Create an earnings reset event and add the affected employees to the event.

Step 2: Lodge the earnings reset event and ensure it is successful. If the lodgement fails refer to our troubleshooting guide to assist in rectifying the issue.

Step 3: The STP Payroll ID setting for each employee is located in the employee’s Opening Balances screen (STP tab). To correct the Id, simply click on the “Change” button, enter the valid Id and then click on “Update”. You can bulk update employee STP Payroll Id’s using the employee file import functionality and updating the “PayrollId” column. If the original issue related to both an incorrect BMS ID and STP Payroll ID, then you should at this stage also refer to Step 3 of Scenario 4 and fix this as per the instructions provided before proceeding to the next step.

Step 4: Create and lodge an update event for the correct employing entity (or an amended finalisation event if you have already completed a finalisation event for that employing entity). This event should contain the affected employee’s actual YTD earnings and will be consolidated with the existing data reported via your previous payroll system into one employee record once the event is successfully lodged.

Scenario 6: Events lodged incorrectly after employee's employing entity was retrospectively changed during the financial year

Refer to the "Process of rectifying incorrect STP reporting following a retrospective employing entity change for an employee" section of this article for detailed instructions in fixing this scenario.

What do I do if the update event is blank or I receive an error message from the ATO?

You may find the update event is blank or you receive an error message from the ATO: "Your submission was not processed. We were unable to process your submission because you have not reported using Single Touch Payroll for that financial year", this is because no prior pay events have been lodged under that ABN/branch code before, which means that you can't skip straight to lodging an update event. You'll need to do a little more work to transfer the YTD data across.

- If you've not lodged EVERY pay run/event in the account it's a simple fix:

- just lodge any unlodged pay event, it doesn't matter what pay period it's for, as long as it's in the relevant financial year

- once that's done you will be free to proceed with your Finalisation process for the FY (the finalisation event will pick up each employee's current YTD totals so it replaces the need to lodge an Update event after lodging an out of sequence pay run)

- If every pay run/event in the account has already been lodged then you will have to:

- create a new pay schedule (call it 'EOFY Fix' or something similar). The reason for this is if a pay schedule has been finalised and you try to create a new pay run on that schedule it will be blank in the pay event.

- create an ad hoc pay run using the new pay schedule with a pay period and paid date in the relevant financial year, use the option 'Manually add employees' to the pay run option -How do I process an Ad Hoc pay run

- add one employee who you've been lodging via STP through the year

- add an earnings line for 1c (add a note at the bottom of the employee's pay run record to leave an audit trail that this is an adjustment pay run created to correct an STP lodgement issue only)

- finalise then lodge this pay run

- once that's successfully lodged you will be able to proceed with your Finalisation process for the FY

How do I reverse an earnings reset event that I lodged in error with the ATO?

To reverse what has been reported to the ATO, you simply need to lodge an update event for the pay schedule the employee is attached to. This will report the employee’s actual earnings processed via pay runs and/or from opening balances (where applicable).

Please contact us at support@yourpayroll.com.au if you have questions.