This article applies to any business with 19 or less employees that pay closely held payees and who are obligated to commence reporting STP events for closely held employees from 1 July 2021.

Information pertaining to closely held employees prior to 1 July 2021 can be accessed here.

A short video on managing closely held employees can be found here.

What is a closely held employee?

A closely held employee (payee) is one who is not "at arm’s length". This means they are directly related to the entity from which they receive payments. Examples include:

- family members of a family business;

- directors or shareholders of a company;

- beneficiaries of a trust.

If you are unsure of whether any employee in your business is deemed a closely held employee, you should obtain advice from the ATO.

What are the STP reporting options for closely held employees?

Firstly, to clarify, businesses that have a combination of closely held employees and non-closely held employees (ie arm's length employees) must report their arm's length employees on or before each pay day. This requirement has been in place since 1 July 2020. This article will specifically discuss how to manage closely held employees only.

Employers can choose to report amounts paid to closely held employees through STP in any of the following ways:

- Report actual payments on or before the date of payment (Option 1) – whenever you process a pay for a closely held employee, report the information on or before each pay day. This is the exact same process for reporting arm's length employees.

- Report actual payments quarterly (Option 2) – report your actual payments to closely held employees on a quarterly basis, at the time when the business' activity statement is due.

- Report a reasonable estimate quarterly (Option 3) – report amounts equal to or greater than a percentage of gross payments and tax withheld from the latest year, across each quarter.

You can choose the reporting option you want to use. Not all reporting methods will suit your business circumstances. Here are some examples of business scenarios and choice of reporting:

Example 1:

Example 2:

What must be reported for a closely held employee?

Like all STP reporting for arm's length employees, STP reporting for your closely held employees must include:

- year-to-date amounts for each closely held employee who received a payment subject to withholding that is required to be reported via STP;

- ordinary times earnings (OTE) or your superannuation liability for the employee;

- total gross wages for payments being reported – same as the W1 label on your activity statement;

- total PAYG withholding payments being reported – same as the W2 label on your activity statement.

You must not report on:

- reimbursements where the amount is expected to be expended in full;

- dividends;

- trust distributions; or

- loans.

Option 1: Report payments on or before the date of payment

If you choose to report amounts you pay to your closely held employees on or before pay day, the general STP reporting rules will apply. As such, instructions on how to report STP in this scenario can be accessed:

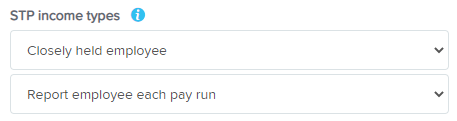

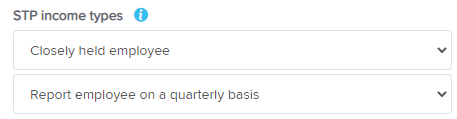

If a closely held employee is to be reported on or before each pay day, navigate to the employee's STP income types (located in the employee's Pay Run Defaults screen) and then select "Closely held employee" and "Report employee each pay run" as the reporting method, as follows:

As you would for your arm's length employees, you must still:

- include any pay as you go (PAYG) withholding amounts on your activity statement and pay the amount you owe to the ATO by the due date

- make super guarantee (SG) contributions for your closely held employees before the quarterly due date.

Closely held employees reported each pay run will also be included in any update or finalisation events for the applicable pay schedule.

Option 2: Report actual payments quarterly

If you choose to report actual payments on a quarterly basis, your quarterly STP report is due on or before the due date for your quarterly activity statements. This includes concessions that may apply to your circumstances. If you report your PAYG withholding on monthly activity statements, your quarterly STP report is due on the same day as your activity statement for the final month of the quarter.

The amounts reported to the ATO for this option will be the total (ie YTD) of all amounts processed in finalised pay runs, up to the last date paid for the applicable quarter being reported. For example, if you are reporting an STP event for the July - September quarter, the amounts that will be reported for the closely held employee includes reportable amounts included in all finalised pay runs with a date paid from 1 July up to 30 September for that financial year. Then, when reporting an STP event for the October - December quarter, the amounts that will be reported for the closely held employee includes reportable amounts included in all finalised pay runs with a date paid from 1 July up to 31 December for that financial year.

Choosing to report STP on a quarterly basis does not change the due date for:

- reporting and paying your PAYG withholding on your activity statement

- making SG contributions for your closely held payees.

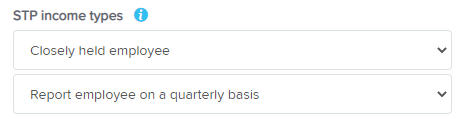

To set up your closely held employees on a quarterly reporting frequency, navigate to the employee's STP income types (located in the employee's Pay Run Defaults screen) and then select "Closely held employee" and "Report employee on a quarterly basis" as the reporting method, as follows:

Existing employees as at 20 August 2021, who had the "closely held employee" checkbox ticked will automatically be updated to this setting.

To be clear, selecting this option excludes the employee from appearing in standard pay events, update events and finalisation events. Rather, these closely held employees will be reported completely separate from at arm's length employees. Instructions for reporting closely held employees on a quarterly basis can be found here.

Option 3: Report a reasonable estimate quarterly

If you choose to report using this method, you need to:

- make a reasonable estimate of the amounts you have paid to closely held employees during the quarter;

- enter these estimates into a pay run and ensure the pay run is finalised and has a date paid no later than the last day of the quarter; and then

- report that estimate through STP.

As the estimate is based on payments you have made to your closely held employees, you should also:

- report and pay your PAYG withholding on your activity statement based on your estimate

- make SG contributions for your closely held payees based on your estimate.

The amounts reported to the ATO for this option will be the total (ie YTD) of all estimated amounts processed in finalised pay runs, up to the last date paid for the applicable quarter being reported. For example, if you are reporting an STP event for the July - September quarter, the estimated amounts reported for the closely held employee will include reportable amounts included in all finalised pay runs with a date paid from 1 July up to 30 September for that financial year. Then, when reporting an STP event for the October - December quarter, the estimated amounts reported for the closely held employee will include reportable amounts included in all finalised pay runs with a date paid from 1 July up to 31 December for that financial year.

Advice on how to determine a reasonable estimate and make corrections to estimates can be found on the ATO website.

Choosing to report STP on a quarterly basis does not change the due date for:

- reporting and paying your PAYG withholding on your activity statement

- making SG contributions for your closely held payees.

To set up your closely held employees on a quarterly reporting frequency, navigate to the employee's STP income types (located in the employee's Pay Run Defaults screen) and then select "Closely held employee" and "Report employee on a quarterly basis" as the reporting method, as follows:

To be clear, selecting this option excludes the employee from appearing in standard pay events, update events and finalisation events. Rather, these closely held employees will be reported completely separate from at arm's length employees. Instructions for reporting closely held employees on a quarterly basis can be found here.

If you have any questions or feedback, please let us know via support@yourpayroll.com.au.