There may be instances where a pay event is deemed partially successful. The reason for this would be that one or more employee records failed. N.B. To clarify, all other employees whose records do not fail are successfully lodged with the ATO.

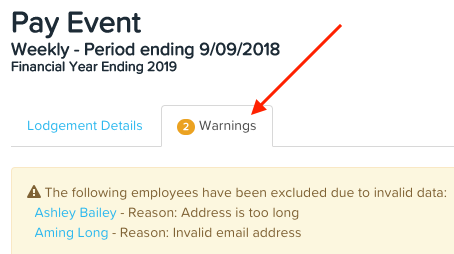

Once an event is created, if you see a "Warnings" tab on the screen, ensure you go through and correct all the validation warnings as this will significantly reduce the instances of a failed or partially successful lodgement.

Partially Successful Lodgements

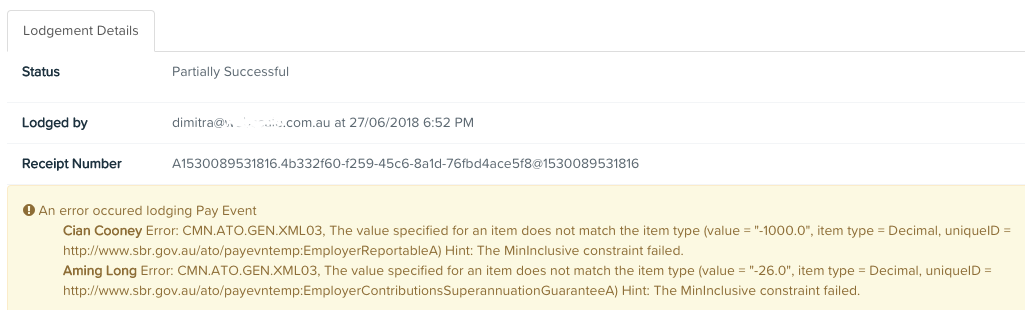

Below is an example of a partially successful lodgement:

There are 2 employees in this lodgement containing errors. The first employee, Cian, had a negative YTD salary sacrifice deduction. The second employee, Aming, had a negative YTD super contribution amount.

N.B: YTD values of gross salary or wages, allowances, deductions and PAYG withholding for each employee may be less than a previous lodgement (due to recovery of an overpayment, for example) however the YTD amounts cannot be negative.

These 2 employees have, in effect, been removed from the lodgement with the ATO. That is, no YTD data for these 2 employees has been sent to the ATO for that specific event.

How to deal with this partially successful lodgement depends on whether the lodgement pertains to the most recent pay run for a specific pay schedule or to a previous/older pay run (that is, a subsequent pay run exists for this pay schedule).

We would also like to point out here that the ATO states the following in terms of when the employer needs to report a fix to employee data:

- An employer must report a fix within 14 days from when the issue is detected.

- An employer may choose to report a fix in the next pay event for an employee where this is later than 14 days from when the error is detected. Additional time will be allowed to the next regular pay cycle for the employee. For example, monthly pay cycle.

- An employer may report a fix in an update event.

This article will provide assistance on how to re-lodge a pay event and/or create an update event to fix employee data.

Partially Successful lodgement pertaining to the most recent pay run (where the ABA file has NOT been sent to the bank)

Using the above example, the employee errors relating to this pay event are payroll related, that is they can only be rectified by making adjustments in a pay run. As such, we recommend here that you unlock the pay run and make any amendments. You can relodge the pay run in two ways:

- Select the ‘Create pay event immediately’ option in the pay run finalisation dialog

- Select ‘Relodge’ from the dropdown on the pay run page

NB: If you have already sent the ABA file to the bank we recommend that you do not unlock the pay run and relodge. See our article on managing failed or partially successful pay events for more information.

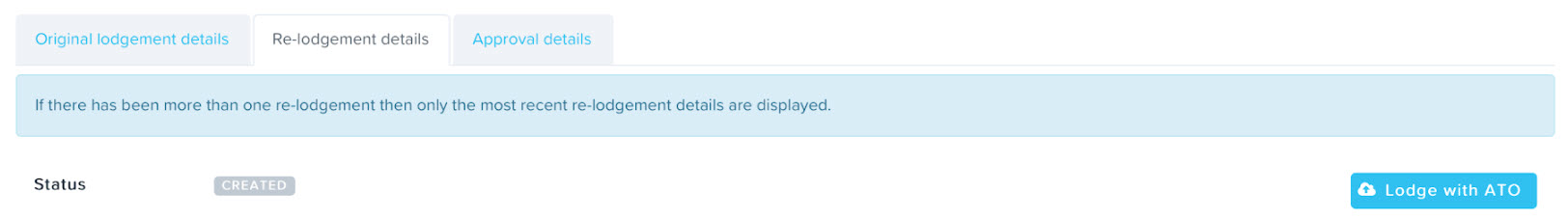

The pay event screen will open as usual but you will notice that there is now an additional ‘Re-lodgement details’ tab. The ‘Lodgement details’ tab will continue to display the details of original lodgement while the ‘Re-lodgement details’ tab will contain the details of the most recent re-lodgement. That means, if you re-lodge multiple times, the most recent re-lodgement will override any earlier re-lodgements:

The same fields will be present:

- Status

- Authorised by user at date/time

- Lodged by user at date/time

- Receipt number and lodgement message Id

- Upload error

The year-to-date table will show the figures for the most recent pay run i.e. it will include any amendments made when you unlocked and re-finalised the pay run.

At first you will notice the status is ‘Created’. Once the pay event is lodged with the ATO, the status will update with the usual status labels.

Items of note:

- If the original status is ‘Failed’ then the re-lodgement tab will not activate. The re-lodgement tab will only trigger where the original lodgement was successful or partially successful.

- There is no delete button on the re-lodgement tab. This is because once there has been a successful lodgement, even if it was the original lodgement, the pay event cannot be deleted.

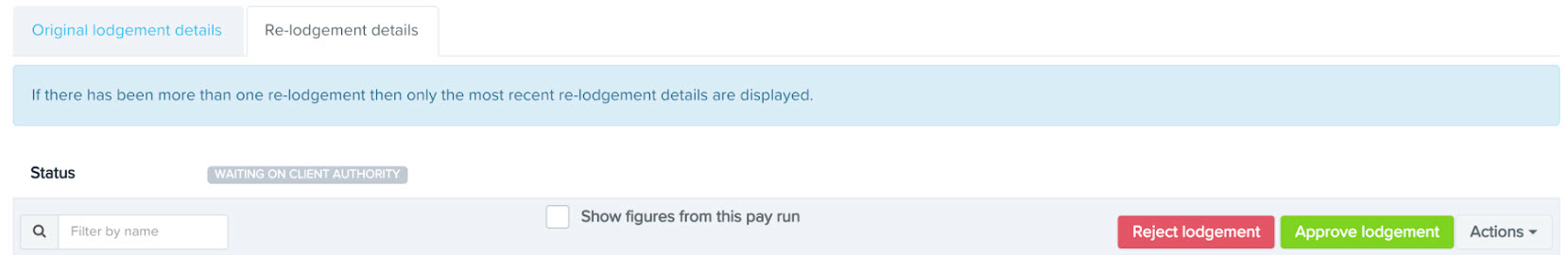

What happens if there is an STP pay event approver?

If there is an STP pay event approval process configured, the STP approver will see both tabs when they log in and can reject or approve as per normal:

Other points of note in relation to STP pay approvers are:

- The 'Authorised by [authority email] at date/time' details will display for the original lodgement and re-lodgement on their respective tabs, as per existing behaviour;

- The Approvals tab will contain the authorisation details and approval status for the original lodgement and the most recent re-lodgement;

- The original lodgement authorisation will display at the top and the re-lodgement authorisation underneath that.

Partially Successful lodgement pertaining to the most recent pay run (where the ABA file HAS been sent to the bank)

Using the same example above, if the ABA file has been submitted to the bank, we highly recommend you DO NOT unlock the pay run to fix the employee errors. The reason for this is that employee net figures sent to the bank may end up being different in the pay run and therefore payroll reports will not match actual figures.

Rather, in this instance, we suggest creating a new pay run for the sole purpose of fixing the employee issues. You can then choose to either:

(a) create a pay event for that pay run; or

(b) create an update event.

Partially Successful lodgement pertaining to an older pay run

When a partially successful lodgement for a pay event:

- pertains to a pay run that is NOT the most recent pay run for that pay schedule; and

- and a more recent pay event has successfully been lodged for that pay schedule

You need to re-lodge the event. This is because we include the pay run pay date in the event so the ATO knows when the payment was actually made.

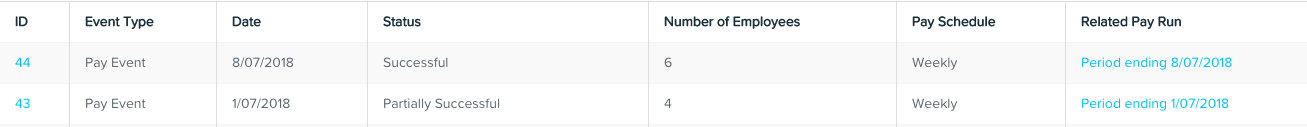

So, looking at the example below, you will note the pay event for pay run PE 1/7/18 is partially successful. However, the pay event for pay run PE 8/7/18 (a more recent pay run) has been lodged successfully. You will still need to re-lodge the PE 1/7/18 so that it is fully successful.

Failed Lodgements

A pay/update event will completely fail because of business validation errors. You will need to rectify the issues first so that the event does not fail again. Once this is done you will need to re-lodge the pay/update event. Refer here for our troubleshooting guide on how to fix business errors.

Instructions on how to create and lodge an update event can be found here.

If you have any questions or feedback please let us know via support@yourpayroll.com.au