PAYG Withholding Report

The PAYG Withholding Report shows a breakdown of the PAYG withheld per month for a specified date range or pay run. The report is available via the 'Reports' tab on the payroll dashboard.

The data can be filtered as follows:

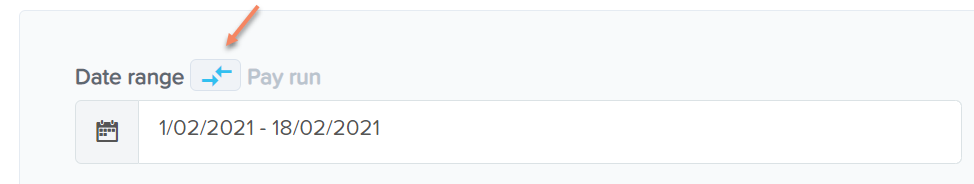

- Date Range: There are multiple frequencies to choose from as well as a 'custom range'. Remember that report results are based on DATE PAID. Additionally, if you want to select a specific pay run instead of a date range, you can change to that filter by clicking the toggle button:

- Employing Entity: This option will only appear if the business has more than one employing entity set up. The default selection here is 'All'.

- Group By: Here you can select either 'Earnings Location' or 'Employee Default Location'. If 'Employee Default Location' is chosen the data will be assigned to the employee's primary location, regardless of which location the employee worked.

- Earnings Location/Employee Default Location: The filter type displayed here depends on the Group By selection you made above.

Once you have entered the required details, clicking on 'Run Report' will generate a web view of the report.

The report contains more than just PAYG amounts for the selected period. Extra information has been provided here to easier assist reconciling this report with other payroll reports. An explanation of each header is as follows:

- Month: Even if you have selected a quarterly, annual or other custom date range, the figures will be displayed on a per month basis.

- Reporting Location: The data is reported per location based and may vary depending on whether you have chosen to report by earnings location or employee default location.

- Gross Earnings: These are all pay earnings and include taxable earnings, tax exempt earnings and pre-tax deduction amounts.

- Tax Exempt Earnings: These are earnings that are not subject to PAYG, for example, kilometre allowances up the ATO prescribed limit.

- Pre-Tax Deductions: Deduction amounts that basically reduce the employee's taxable earnings as they are applied to an employee's gross earnings prior to the calculation of PAYG. An example of such a deduction includes salary sacrifice super.

- Taxable Earnings: Gross earnings minus tax exempt earnings minus pre-tax deductions.

- PAYG Withheld: The PAYG deducted from the employees' taxable earnings for the date range/pay run period selected.

You can choose to export this report into CSV, Excel or PDF format.

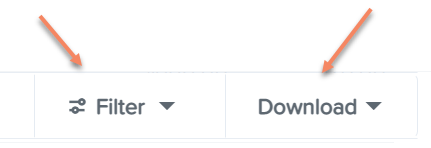

You can easily access the report filter and download button whilst scrolling through the report via a sticky filter, without having to scroll back to the top of the page. The sticky filter buttons will appear on the top right-hand side of the report when you scroll down the report:

Using this sticky filter, you can choose to change the filter parameters by clicking on the 'Filter' button and making the changes then clicking the 'Update' button. You also have the option to clear the filter completely to default by clicking the 'Clear filters' option at the bottom right-hand side of the sticky filter.

If you have any questions or feedback, please let us know via support@yourpayroll.com.au.

![Pay Cat Logo New 2.png]](https://www.paycat.com.au/hs-fs/hubfs/Pay%20Cat%20Logo%20New%202.png?height=50&name=Pay%20Cat%20Logo%20New%202.png)