This article details how to process a lump sum E payment and the different requirements between STP Phases 1 and 2. This article also considers businesses still exempt from STP reporting and who are therefore still publishing payment summaries.

Please note: functionality and instructions explained in this article pertain only to pay runs with a pay date of 1 July 2021 and onwards. STP Phase 2 functionality mentioned in this article will be available from 1 March 2022.

What is a lump sum E payment?

Lump sum E represents the amount for back payment of remuneration that accrued, or was payable, more than 12 months before the date of actual payment and is greater than or equal to $1200 (this being the lump sum E threshold amount). This means that an oversight or delay led to the payment not being paid in an earlier financial year/s (underpayment) and is only now being paid in the current financial year. To be clear, any underpayments/back payments that accrued and were paid in the current financial year are not to be classified as lump sum E.

STP Phase 1 vs STP Phase 2

For any lump sum E payments reported through STP Phase 1 and/or published via payment summaries, the employer is also required to issue the employee with a letter specifying the financial years over which the amount accrued and the gross amount that accrued each financial year.

A new reporting requirement of STP Phase 2 is to include the financial year the lump sum E payment relates to, thereby removing the need to provide lump sum E letters to your employees. Rather, the lump sum E amount and financial period(s) it relates to will be reported directly to the ATO once the pay event is submitted.

Any employer that is not reporting through STP Phase 2 by the end of the 2021/2022 financial year or is still generating payment summaries will still be required to issue employees with a lump sum E letter.

Creating a lump sum E pay category

It is essential that users differentiate between a standard back payment and a lump sum E back payment by creating a specific pay category just for lump sum E payments. The reason for doing this is to ensure payments made to an employee are classified correctly when being reported to the ATO and thereby does not impact the tax payable by an employee.

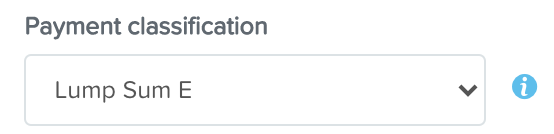

Instructions on setting up a pay category can be accessed here. When configuring the "Payment classification" for this pay category, ensure you select the 'Lump Sum E' option:

Also, take note, that when configuring the "Unit" setting for this pay category the nature of the back payment will determine whether the Unit should be set to 'Fixed' or 'Hourly'. If the underpayment relates to the employee not been paid for hours worked, then the pay category unit should be set to hourly. Whether leave should be accrued depends on whether the earnings are deemed OTE. If the underpayment is required to top up the rate the employee was already paid for hours worked then the pay category unit should be set to Fixed. This is because the hours worked by the employee have already been recorded previously.

Processing a lump sum E payment in the pay run

The method of adding a lump sum E payment in the pay run will vary slightly depending on whether your business is still reporting through STP Phase 1 or whether STP Phase 2 reporting has been switched on. We have provided separate instructions based on your reporting method.

STP phase 1 reporting

The steps for processing a lump sum E payment whilst still reporting with STP Phase 1 are as follows:

- Click on "Actions" (within the employee's pay) and then click on "Add lump sum payment";

- The earnings line will appear where you then select the applicable pay category classified as lump sum E;

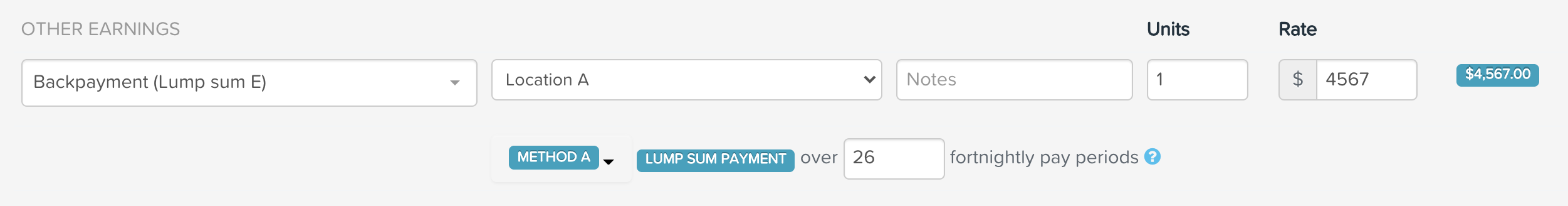

- If the back payment only relates to one prior financial year then enter the payment amount owing to the employee and select 'Method A' as the tax calculation method and enter the number of pay periods in a 12 month period. This means a weekly pay would be 52 pay periods, a fortnightly pay would be 26 pay periods and a monthly pay would be 12 pay periods. Then, click "Save". As an example, an employee is owed a back payment amount of $4567 that was incurred in the 2020/2021 financial year. The pay run frequency is fortnightly and so the payment would be entered as follows:

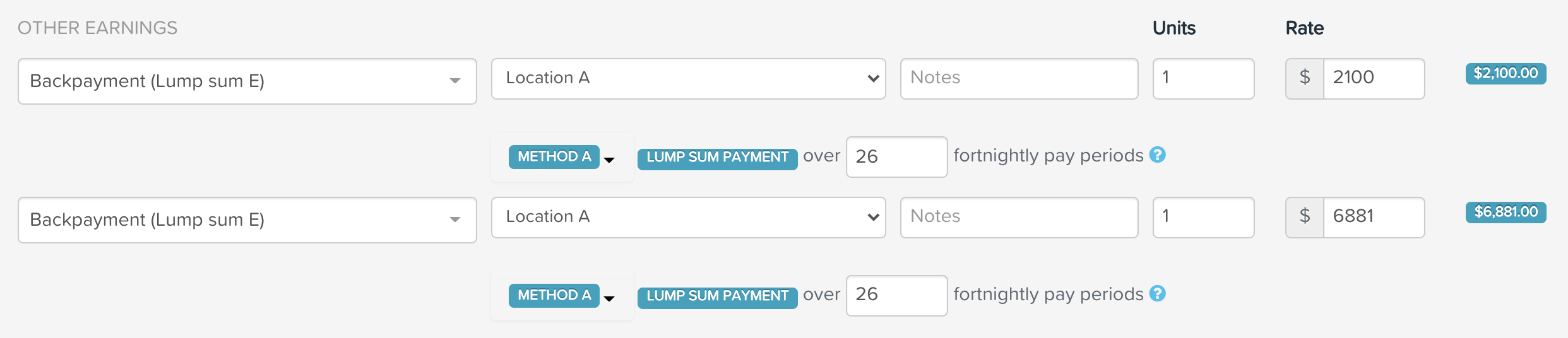

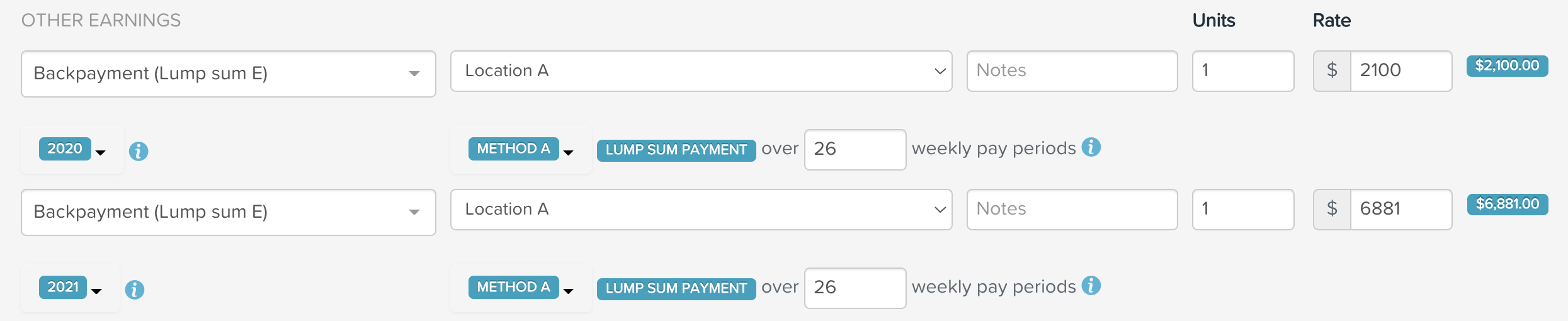

- If the back payment has accrued over more than one prior financial year, you must first determine the amounts owing for each financial year and then enter a separate earnings line for the affected financial years. Although reporting the financial year is not available in the pay run for STP Phase 1 businesses, it will put you in good stead later when your business transitions to STP Phase 2 and the lump sum E payments will need a year reported against them. For each earnings line created, select 'Method A' as the tax calculation method and enter the number of pay periods in a 12 month period. This means a weekly pay would be 52 pay periods, a fortnightly pay would be 26 pay periods and a monthly pay would be 12 pay periods. Then, click "Save". As an example, an employee is owed a back payment amount of $8981 that was incurred over 2 prior financial years. $2100 was incurred in the 2019/2020 financial year and the remaining amount incurred in the 2020/2021 financial year. The pay run frequency is fortnightly and so the payment would be entered as follows:

STP phase 2 reporting

This section relates to businesses who have transitioned over to STP Phase 2 reporting and also includes businesses who are still lodging payment summaries for employees instead of reporting via STP. The steps for processing a lump sum E payment for these businesses are as follows:

- Click on "Actions" (within the employee's pay) and then click on "Add lump sum payment";

- The earnings line will appear where you then select the applicable pay category classified as lump sum E;

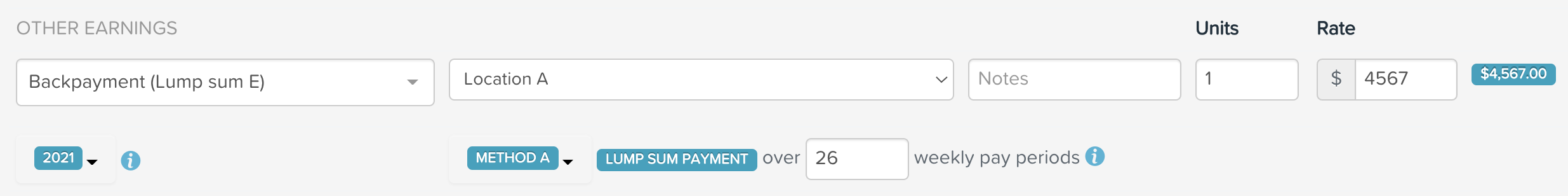

- If the back payment only relates to one prior financial year then enter the payment amount owing to the employee and select 'Method A' as the tax calculation method and enter the number of pay periods in a 12 month period. This means a weekly pay would be 52 pay periods, a fortnightly pay would be 26 pay periods and a monthly pay would be 12 pay periods. Select the financial year the back payment was incurred from the drop down list of years available. For eg, if the back payment was incurred during the period 1 July 2019 to 30 June 2020, select the 2020 financial year. Then, click "Save". As an example, an employee is owed a back payment amount of $4567 that was incurred in the period 1 July 2020 to 30 June 2021. The pay run frequency is fortnightly and so the payment would be entered as follows:

- If the back payment has accrued over more than one prior financial year, you must first determine the amounts owing for each financial year and then enter a separate earnings line for the affected financial years. This must be done so that each relevant financial year is recorded against the back payment amount incurred in that financial year. For each earnings line created, select 'Method A' as the tax calculation method and enter the number of pay periods in a 12 month period. This means a weekly pay would be 52 pay periods, a fortnightly pay would be 26 pay periods and a monthly pay would be 12 pay periods. Select the financial year the back payment was incurred for each earnings line from the drop down list of years available. For eg, if the back payment was incurred during the period 1 July 2019 to 30 June 2020, select the 2020 financial year. Then, click "Save". As an example, an employee is owed a back payment amount of $8981 that was incurred over 2 prior financial years. $2100 was incurred during the period 1 July 2019 to 30 June 2020 and the remaining amount was incurred during the period 1 July 2020 to 30 June 2021. The pay run frequency is fortnightly and so the payment would be entered as follows:

Transitioning to STP Phase 2

As stated above, there is no requirement to record the financial year a lump sum E payment relates to whilst reporting via STP Phase 1. In fact, the ability to do this was not provided when STP was first introduced, hence the need to still provide lump sum E letters to affected employees. Once a business does transition to STP Phase 2, it will become mandatory to record the financial year in the pay run. As such, this section deals with lump sum E payments that have been processed in a pay run for the 2021/2022 financial year whilst in STP Phase 1 mode and how the user can subsequently record the lump sum E financial year against those payments.

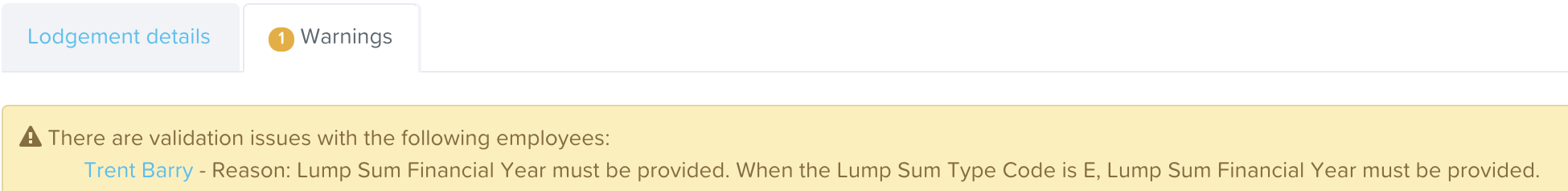

When a business attempts to lodge an event (whether it is a pay event, update event or finalisation event) in STP Phase 2 mode, they may see the following validation warning that prevents them from lodging the event:

This warning indicates that the affected employee has been paid earnings against a pay category with the payment classification of 'Lump Sum E' and that there has been no financial year recorded against those earnings in the pay run. This can only be rectified in a pay run but the fix varies depending on the specific scenario. Each option is explained below.

Scenario 1: Pay run cannot be unlocked due to automated super payments

In this scenario, you will need to get in contact with your payroll system administrator who will be able to unlock the pay run on your behalf. Once the pay run is unlocked, you can follow the instructions provided in the remaining scenarios, depending on whether the payment relates to one or multiple financial years.

Scenario 2: Lump sum E payment pertains to one financial year only and pay run can be unlocked

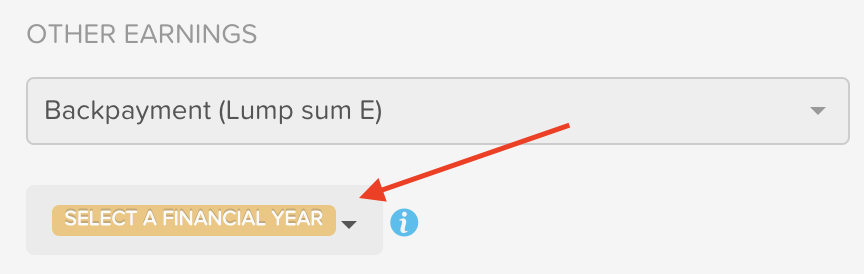

When you navigate to the affected pay run and then the affected employee(s) within that pay run, you will notice that the lump sum E payment now displays the "select a financial year" option, but in read-only mode:

You must unlock the pay run, which will then allow you to select the financial year the payment relates to. Repeat this step for any other affected employee in that pay run. Once you finalise the pay run you can then refresh the data in the STP event which will remove the validation warning from the event. You will then be in a position to the lodge the STP event.

Scenario 3: Lump sum E payment pertains to more than one financial year and pay run can be unlocked

As per scenario 2, you must first unlock the affected pay run to activate the "select a financial year" dropdown. If the payment owing per financial year was reported separately, ie there is a lump sum earnings line per financial year and payment amounts are broken down into each financial year, then it's just a matter of assigning the correct financial year to each payment line.

If, however, only one lump sum earnings line was processed in the pay run, this will need to be broken down into payment lines per financial year and then the relevant financial year assigned to each lump sum line. Extreme caution must be applied here as the original pay run data for this employee, such as total gross and net earnings, PAYG and SG must not be altered as a result of separating the lump sum earnings. In order to ensure this does not occur, generate the Pay Run Audit Report so that you capture both the employee payroll data as well as the total pay run data (as recorded in the finalised pay run) to then compare and ensure both employee and pay run figures are identical - the comparison would be done once the lump sum payment earnings lines have been manually separated. The other thing to note is that when separating the lump sum payment earnings lines, a different PAYG amount may be calculated as a result of how the lump sum calculation was processed initially versus a different method this time. You must ensure that the employee's PAYG amount does not differ to the original PAYG amount processed for them in the affected pay run. As such, you may be required to manually adjust the employee's PAYG once the lump sum payment earnings lines have been manually separated.

When all affected employee(s) lump sum payments have been separated and the financial years allocated to the earnings lines accordingly, you must finalise the pay run. Once this is done, refresh the data in the STP event so that the validation warning is removed from the event. You will then be in a position to the lodge the STP event.

If you have any questions or feedback, please let us know via support@yourpayroll.com.au.