This article discusses Type S and Type P employment termination payments, what they are, how to process them in a pay run or in opening balances, and how to report them to the ATO via STP or payment summary.

ETPs – what type?

Employment termination payments (ETPs) are a lump sumpayment made on termination of employment. Not every terminated employee receives an ETP – it depends on what the termination pay is made up of and whether any of those payment types fall into the ETP classification. A list of what is defined as an ETP can be accessed here.

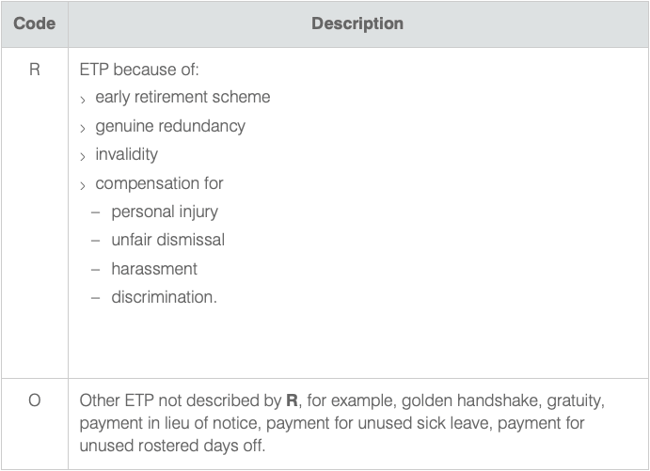

ETPs are broken down into 'codes' which are taxed differently according to Schedule 11. The two basic codes are Type R and Type O:

ETPs are generally made at the time the employee is terminated or by instalments in the same financial year. However, users may need to make multiple payments in different financial years for the same termination. In this situation, where an ETP was made in a previous financial year and another ETP is made in the current financial year relating to the same termination, these later payments are coded for ATO reporting as Type S and Type P and correspond to Type R or Type O payments respectively.

Processing Type S and Type P payments

The platform allows users to process Type S and Type P payments where:

- the employee has been terminated;

- the termination date on file is in a previous financial year; and

- the employee was paid an ETP – Type R, Type O or Type O unused leave – at that time.

The process is similar to ETPs Type R and Type O, essentially:

- Add terminated employee to pay run

- Terminate the employee

- Create an ETP by ticking the ‘Redundancy/ETP’ checkbox

- Add a Type S lump sum payment

- Add any Type P lump sum payments

- If leave is set up to pay out on ETP, then it will be automatically added to the pay run once and ETP is created.

- ETPs in opening balances

- Reporting ETPs

The specific steps will be detailed in the sections below.

1. Getting started

1.1 Add employee

Because Type S and Type P payments are paid to already terminated employees you do not need to reactivate the employee to add them to the pay run and make the payment.

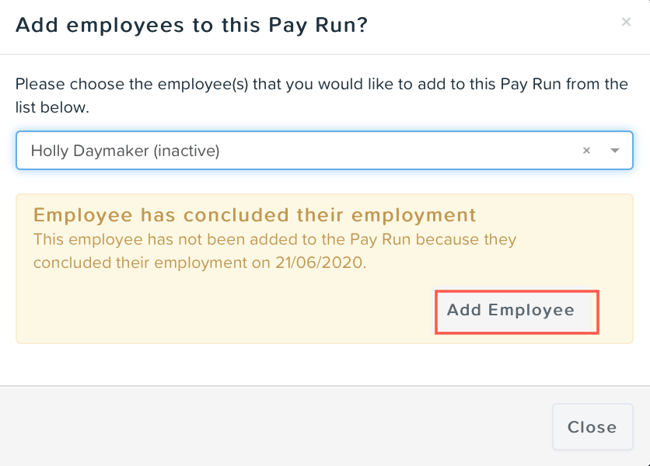

The employee will not be automatically included in the pay run so you will need to manually add the employee to the pay run in which they wish to make the payments. See this article for more information.

When users manually add a terminated employee to the pay run, the following message will display, explaining why the employee was not originally included in the pay run. Click ‘Add employee’ to continue adding the terminated employee:

Once the employee is added, click 'Close' to close the pop-up.

1.2. Terminate employee

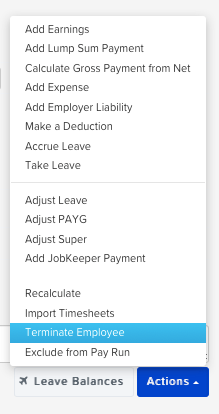

Once the employee has been added to the pay run, click on the employee within the pay run, then click the 'Actions' button and select 'Terminate employee'.

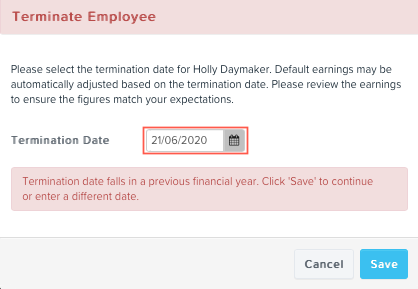

A pop-up will appear as follows:

The termination date defaults to the termination date on file and a warning message displays if the termination date is in an earlier financial year to the present pay run. If the date is correct and does not fall within the current financial year click 'Save' to continue.

N.B Because Type S and Type P payments are for a termination in a previous financial year for which an ETP (ie Type R or Type O) has already been paid, the termination date for both payments must be the same. If the termination date on the current pay run is changed the ETPs default to Type R and Type O.

The employee's record will turn pink as an indicator it is in termination mode and will display calculated earnings and any accrued leave to be paid out as part of the termination pay.

1.3. Create ETP

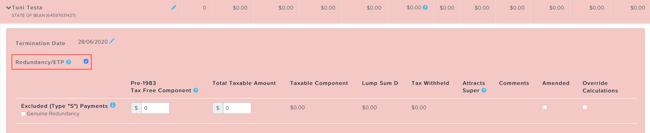

Once the ‘Terminate employee’ action has been selected, tick the ‘ETP/Redundancy’ checkbox:

This will allow you to enter Type S and Type P amounts, pay out unused Type P leave, and ensures that tax is correctly withheld.

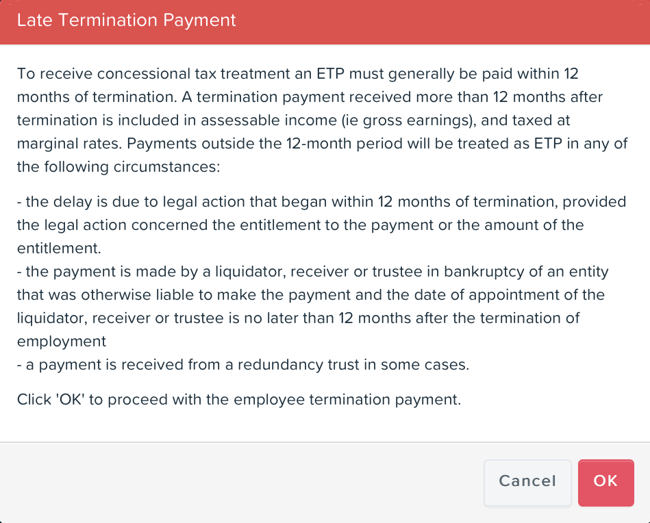

Late termination warning

If the current pay run paid date is more than 12 months after the termination date recorded on the employee file, when the 'Redundancy/ETP' checkbox is ticked a warning will display as follows:

Users can choose to continue by clicking 'OK'. Clicking 'Cancel' will revert to a non-ETP termination. In general, ETPs must be made no more than 12 months after the termination date. However, there are some exceptions which the ATO will accept. It is up to businesses to ensure they fall within the exceptions and have approval from the ATO. You can find out more here.

2. Adding payments

2.1 Type S

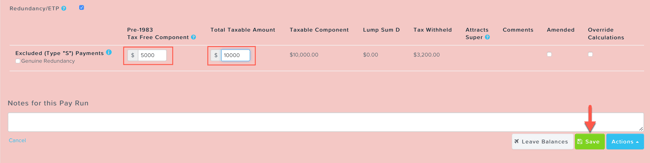

After ticking the 'Redundancy/ETP' checkbox a Type S pay run line will display. Enter any tax free component (see here for more information on working out the tax free component) and the total taxable amount and click ‘Save’.

The system will then calculate the tax to withhold on the taxable amount in accordance with the Schedule 11 tax tables and display this under 'Tax withheld'.

If the payment is for a genuine redundancy, the system will calculate the tax free amount to be reported as Lump Sum D on the employee's EOFY income statement. For more information on genuine redundancy, see the ATO guide.

2.2 Type P

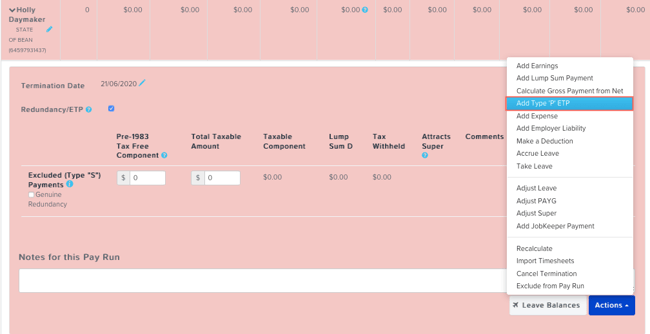

Once the ‘Terminate employee’ action has been selected and ‘ETP/Redundancy’ option is selected, lump sum Type P payments can be added to the pay run. To add unused leave Type P payments see below. To add a lump sum Type P payment, click on ‘Actions’ in the employee’s pay run and select ‘Add ‘Type P’ ETP’:

This will generate a new pay run line. Enter any tax-free component and the total taxable amount and click ‘Save’.

The system will then calculate the tax to withhold on the taxable amount in accordance with the Schedule 11 tax tables and display this under 'Tax withheld'.

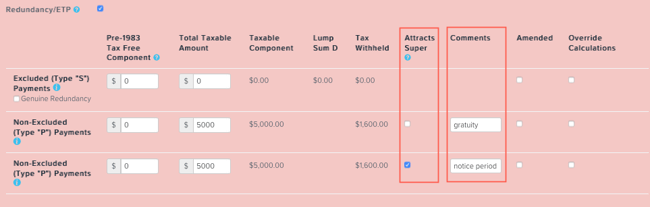

Additional Type P lines can be added in the same way. Users can enter a description in the ‘Comments’ box to differentiate the payments. Any comments entered in each row will appear in the employee's pay slip if the ‘Show line notes’ setting is ticked in ‘Payroll settings’ > ‘Business settings’ > ‘Pay slips’ screen.

Superable Type P payments

Ticking the ‘Attracts super’ checkbox will calculate the superannuation guarantee (SG) on the amount entered in this row. If you have multiple Type P payments where some are superable (eg payment in lieu of notice) and others are not, you will need to create multiple Type P lines to separate these payments:

2.3 Override calculations

If users need to override ETP values, they can tick the ‘Override calculations’ checkbox. For more information on overriding ETP amounts, see this article.

2.4 Amended payments

When a payment summary has already been lodged with the ATO but there has been an error in the calculations, users are able to correct the error in the pay run and tick the ‘Amended’ checkbox which will mark the payment summary as amended once the pay run is finalised.

3. Paying out Type P unused leave

Annual leave and long service leave are required to be paid out on termination of employment, and are taxed differently and reported separately from ETPs. Businesses may choose to pay out other types of leave (eg personal carer’s leave or rostered days off) on termination. If so, these other leave types should be set up to pay out as an ETP to ensure they are taxed and reported accurately. For more information about setting up leave categories, see this article.

N.B. If unused leave (but not annual leave or long service leave) is only being paid out as part of a redundancy and is not otherwise paid out when employment is terminated, then it will form part of a genuine redundancy payment and should be entered as part of a Type S (or Type R if it is made at the time of termination) lump sum payment.

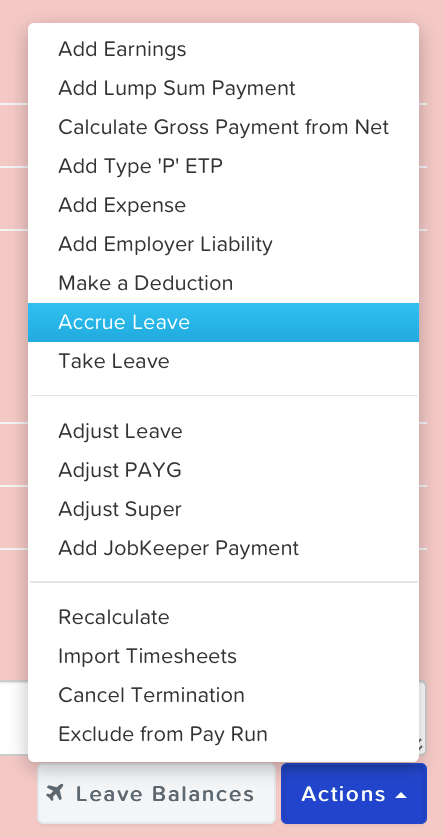

If unused leave (other than annual leave or long service leave) was not paid in the initial ETP, it can be paid as a subsequent ETP. The process is a little different to Type O unpaid leave. In the terminated employee’s record in the pay run, click on ‘Actions’ and select ‘Accrue leave’:

The user should select the type of leave and add the units to be paid out:

The applicable balance can be obtained by running a leave balances report as at the initial date of termination – see this article for more information.

This will add a pay run line under ‘Other earnings’, with the leave then being classified as a Type P Unused Leave payment (provided the selected leave has been set up to pay out as an ETP in leave category settings):

ETPs in opening balances

If an employee was terminated and received an ETP in a previous financial year but the business only has pay run data for the current financial year, you can still process ETP Type S and Type P in a pay run. First, you need to ensure the following:

- Employee’s opening balances has Type R and/or Type O payment figures recorded;

- Opening balances are for a previous financial year;

- The payment date for those payments is in a previous financial year; and

- Employee’s termination date is entered on the employee file.

N.B Because Type S and Type P payments relate to a termination in a previous year where an ETP was made, users will need to check that the termination date they have entered on the file is correct.

More information about setting opening balances for ETPs can be found here.

Once these initial steps have been taken, users can then process Type S and Type P payments as per the steps above.

Tax reporting for ETPs

STP reporting

When a pay run containing an ETP is finalised, the corresponding STP pay event will specify:

- the total taxable components;

- any tax free component

- total tax withheld

- ETP code

and report to the ATO once lodged. If there are multiple Type P payments and Type P unused leave paid out, these will be reported as one amount.

The employee is automatically marked as 'is final' within the STP pay event.

Employment termination payment summaries

Businesses which are exempt from STP reporting – ie WPN holders – must provide the employee with a 'PAYG payment summary – employment termination payment’ (ETP payment summary) within 14 days of making the payment.

Once the pay run has been finalised an ETP payment summary is generated. A separate payment summary is created for each ETP type, although multiple Type P payments are reported together. The payment summary will display:

- the total taxable component;

- any tax free component

- total tax withheld

- ETP code

ETP payment summaries are available on the employee portal under ‘Documents’ > ‘Payment summaries’. Businesses can send a notification to the employee from the employee file under ‘Employee management’ > ‘Payment summaries’ or from Reports > ATO reporting > Payment summaries under the ‘Employment termination payment’ tab.

Opening balances

Users can also generate a payment summary for Type S or Type P amounts entered in opening balances. Under the 'Employment termination payment' tab in the employees opening balances, change the 'Generate ETP Payment Summary' field to 'Yes'. The employee's ETP payment summary will automatically publish and they will be able to access this via their employee portal.

Users should take care to ensure the payment date entered falls within the financial year assigned for opening balances.

If you have any questions or feedback, please let us know via support@yourpayroll.com.au.