This article explains how to use our JobKeeper Payment functionality in the pay run. This process will ensure you are using the correctly named pay categories without having to create the pay categories yourself. The ATO have prescribed specific naming conventions to identify JobKeeper payments being reported through STP and it is essential to honour these conventions, otherwise reimbursement by the ATO can be heavily delayed or not paid at all.

Due to the different requirements for JobKeeper 2.0, this article is broken into the following sections:

- JobKeeper 2.0 (JobKeeper extension)

- Adding multiple JobKeeper options

- Reporting JobKeeper Payments via STP

- Creation of Pay Categories

- JobKeeper 1.0 (legacy data)

JobKeeper 2.0

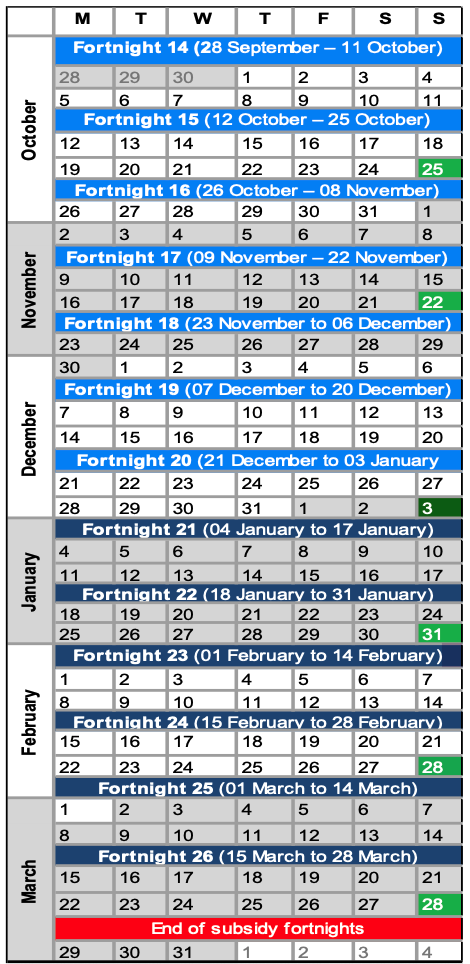

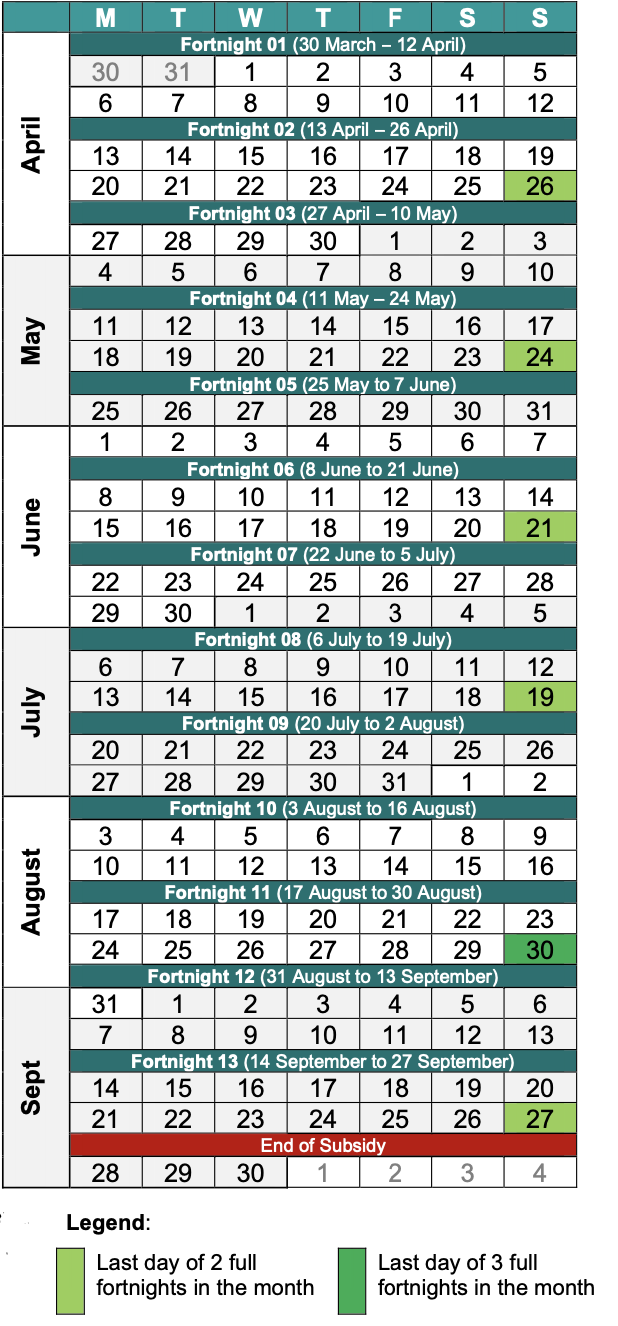

To be clear, references to 'fortnight' in this section of the article relate to ATO defined fortnights with fixed start/finish dates. Regardless of a business' pay run frequency, or the pay period start and end dates, the JobKeeper payment rate per fortnight applies to the pay dates within the following defined fortnights and from which fixed fortnight the payment applies:

JobKeeper subsidy duration

JobKeeper 2.0 will continue until 28 March 2021. The extension of the scheme applies over 2 quarters and introduces both lower payment rates per quarter than the JobKeeper 1.0 payment rate (which was $1500 per fortnight). Additionally, a tiered-rate approach will now apply to eligible employees and is based upon the average hours worked per week in a reference period, rather than a flat rate for all eligible employees.

The first quarter of this extension period runs from 28 September 2020 to 3 January 2021, comprising 7 fortnights of:

- Tier 1: $1,200 per fortnight for those working 80 hours or more in any reference period; and

- Tier 2: $750 per fortnight for those working fewer than 80 hours in any reference period.

The second quarter of this extension period runs from 4 January 2021 to 28 March 2021, comprising 6 fortnights of:

- Tier 1: $1,000 per fortnight for those working 80 hours or more in any reference period; and

- Tier 2: $650 per fortnight for those working fewer than 80 hours in any reference period.

How to classify employees against a tier

Each employee must be classified against a tier as it determines the amount of top-up payment required against each employee. The tier level is determined on hours worked per week in a reference period. The reference period is either the four weeks ending at the end of the most recent pay cycle before 1 March 2020 or before 1 July 2020.

Your employee only needs to satisfy the 80-hour threshold in one of the 28-day reference periods. If they satisfy it in one reference period, you do not need to determine if they satisfy it in other reference period. Employees will satisfy the 80-hour threshold if, in their 28-day reference period, the total of the following is 80 hours or more:

- actual hours worked, and/or

- hours they were on paid leave, and/or

- hours they were paid for absence on a public holiday.

If your eligible employee satisfies the 80-hour threshold, you can claim the tier 1 (higher) payment rate for them. If they do not meet the 80-hour threshold, you can only claim the tier 2 (lower) payment rate for them. The reference period is a historical period, so an employee’s tier will not change during the extension period unless it was incorrectly reported.

The ATO has also established alternative reference periods that can be used where the standard periods are not appropriate. More information on alternative reference periods can be found here.

Adding JobKeeper Payments

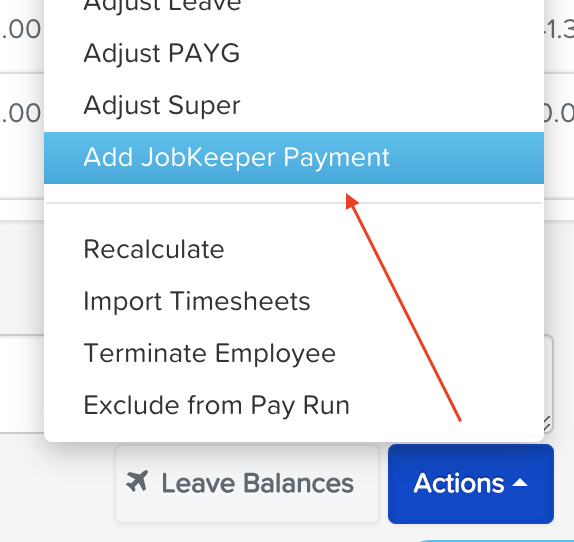

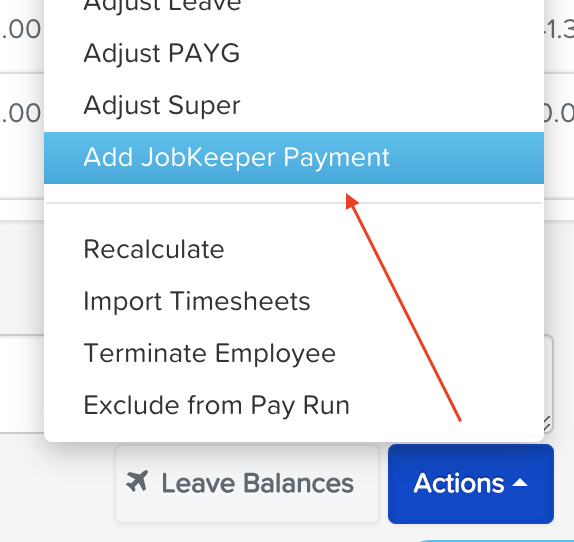

To access the JobKeeper Payment functionality in the pay run, click on the relevant employee's pay so that the "Actions" button is displayed. Click on "Actions" > "Add JobKeeper Payment":

A context panel will then appear where you can complete one or more of the following 5 actions:

- Top up an employee's pay (where their original earnings are less than the payment rate for the relevant tier).

- Record the 'start' fortnight the JobKeeper payment is commencing for each affected employee. This MUST be reported for each eligible employee and only needs to be reported once. You must ONLY report employee eligibility start fortnights only if their eligibility commences or re-commences in the extension period, ie from 28 September 2020 onwards. You are NOT required to re-report existing eligible employees whose start fortnight has already been reported and still applies.

- Record the 'finish' fortnight the JobKeeper payment is ceasing for each affected employee. This only needs to be reported if an employee ceases to be eligible for the JobKeeper payment from 28 September 2020 onwards. You are NOT required to re-report employees whose finish fortnight has already been reported and still applies. Nor are you required to report a finish fortnight for employees who were eligible for JobKeeper 1.0 payments but are not eligible for JobKeeper 2.0 and so received their last JobKeeper payment in the 13th fortnight. In this instance, simply stop reporting any JobKeeper top up.

- Assign JobKeeper tier for all eligible employees. This MUST be reported for ALL eligible employees (new and existing) and only needs to be reported once (unless a tier has been reported incorrectly). If this action is not completed, you will not be reimbursed by the ATO. If you are already enrolled in JobKeeper and eligible for the extension, you do this in your business monthly declaration in November.

- Report incorrect JobKeeper tier. This action is only required where an employee’s tier was initially reported incorrectly. If this action is performed in a pay run, you must then also complete the above action of assigning the (correct) JobKeeper tier for the affected employee.

Further details of each action are explained below.

JobKeeper Top Up

If an employee’s pay run earnings is the same amount or more than that of the relevant tier payment rate, continue to pay the employee all earnings as normal and include all entitlements to leave accrual and superannuation. There is no top up or change required to the employee's pay in this instance. Rather, the JobKeeper payment will be a supplement for the employer.

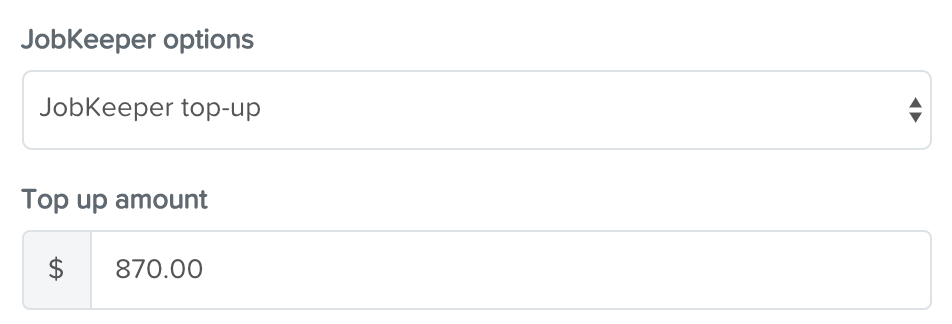

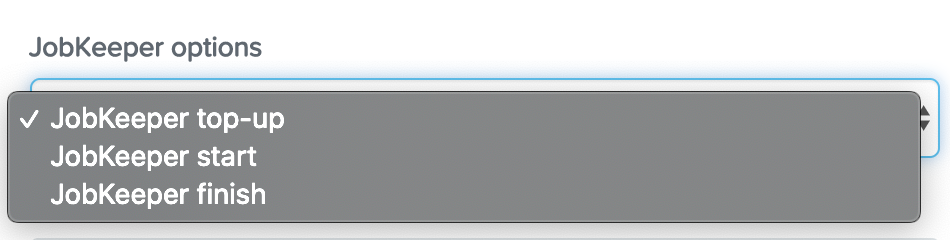

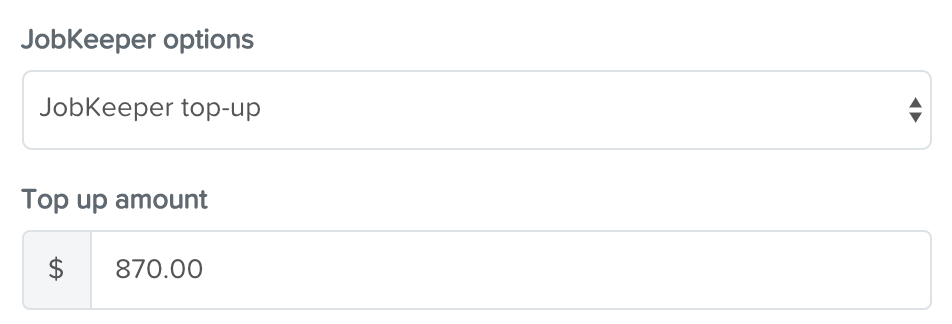

You only need to top up an eligible employee's pay if they earn less than the relevant tier payment rate per fortnight. In this instance, you would pay the employee all earnings and include all entitlements to leave accrual and superannuation as you normally would. Then, you will need to top up an amount being the difference between what the employee was paid and the relevant tier payment rate. For eg, an employee is classified as tier 1 and has been paid a gross earnings amount of $330 in the first quarter of the extension period. The employer would then be required to top up the employee's pay by $870 (being $1200 - $330). To do this, go to the employee's pay and click on "Actions" > "Add JobKeeper Payment" > select "JobKeeper top-up" from the options dropdown list > enter 870 in the "Top up amount" field > click on "Add" > click on "Finished".

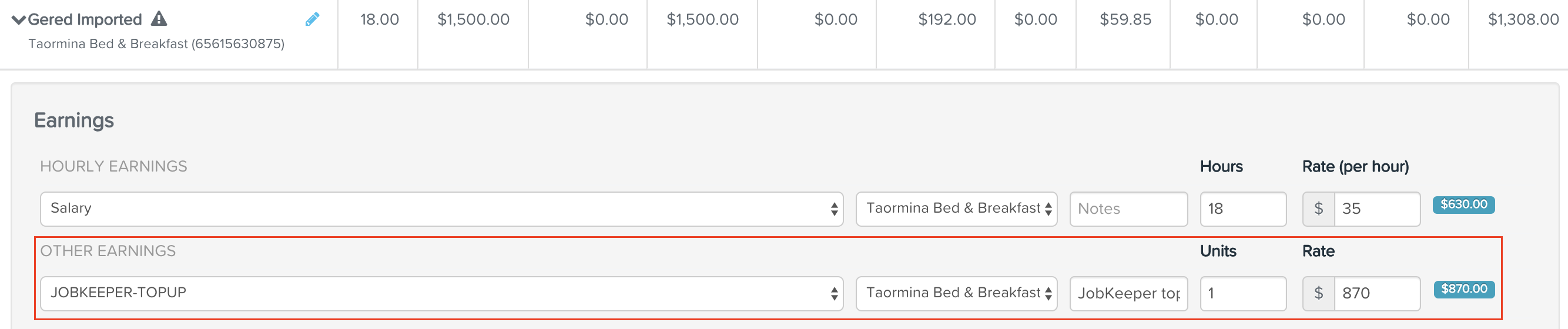

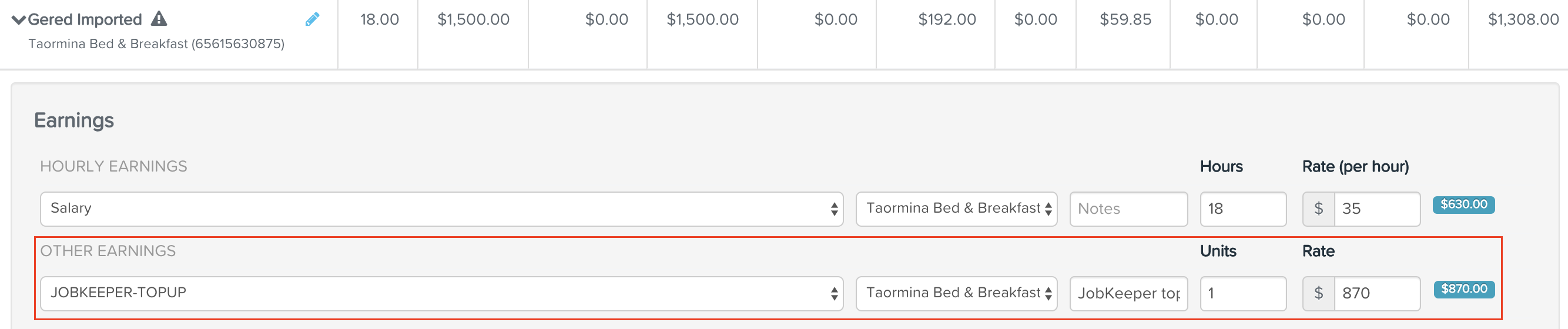

The top up amount will then appear in the eligible employee's pay using a system generated pay category that reflects the ATO's requirements:

Click "Save" in the pay run so that the earnings line save accordingly.

Important takeaways:

- Super is not calculated on any "top-up" earnings. It will be up to the employer if they want to pay superannuation on the "top-up" component of the JobKeeper payment.

- This payment is subject to PAYG.

- All state/territory authorities have confirmed that top up payments are not liable for payroll tax. As such, all system JobKeeper related pay categories have the "Payroll Tax Exempt" checkbox ticked by default.

- As stated above, the top up pay category is system generated and set up in accordance with ATO requirements. Do not change the pay category name or payment classification! If you do, you will be breaching the ATO's requirements which may result in payment delays by the ATO or no reimbursement at all. The ATO are very strict about the way JobKeeper payments are to be reported so please don't get creative with this - it will only hurt you in the end!

JobKeeper Start

During the JobKeeper extension period, the ATO requires that the employer reports the JobKeeper payment commencement fortnight only for eligible employees commencing or re-commencing JobKeeper payments on after 28 September 2020. To be clear, if an existing eligible employee has already been reported with a fortnight start of 1 to 13 (ie as part of JobKeeper 1.0) and has continued receiving JobKeeper payments, then the employer is not required to report a fortnight start again for such employee. All that will be required for existing eligible employees is to report the relevant tier each eligible employee is classified against.

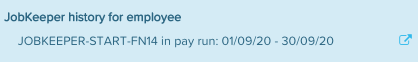

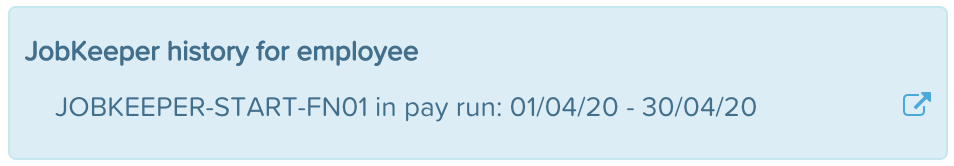

In all other cases, ie where an employee commenced being eligible or has become eligible once again on or after 28 September 2020, the fortnight start must be reported in the pay run. In this instance, notifying the ATO of the JobKeeper fortnight start is compulsory, as this is what will trigger payment by the ATO for each new eligible employee. This only needs to be reported once (only exception to this rule is detailed below in the important takeaways section) and should be done within the fortnight period the payment commences. If a fortnight start and/or fortnight finish has been recorded in a pay run, the following notification will display in the employee's JobKeeper Payment context panel in subsequent pay runs to act as a reminder of what has already been reported to the ATO:

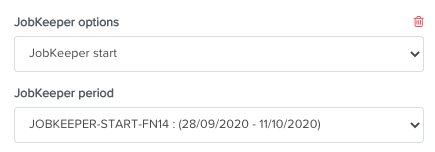

To determine what fortnight you commenced paying an employee the JobKeeper payment, refer to the ATO's JobKeeper fortnight calendar displayed at the start of this article. Cross check the dates allocated to each fortnight with the date you paid the employee. For example, if you paid an employee the JobKeeper payment for the first time on the 30 September (ie pay date was 30/9/20), this means the payment was made in FN14. To record this in the pay run (so it is then reported via STP), go to the employee's pay and click on "Actions" > "Add JobKeeper Payment" > select "JobKeeper start" from the options dropdown list > select "JOBKEEPER-START-FN14" from the "JobKeeper period" dropdown list > click on "Finished".

The fortnight start will then appear in the eligible employee's pay using a system generated pay category that reflects the ATO's requirements:

Click "Save" in the pay run so that the earnings line save accordingly.

Important takeaways:

- We automatically apply a rate of $0.01 to the fortnight start pay categories. DO NOT CHANGE THIS! This pay rate is needed so that the fortnight start information is included in the pay/update event to the ATO. If you change the rate to anything less than $0.01 it will not report via STP which means you have not undertaken the compulsory step of notifying the ATO of the eligible employee's JobKeeper's fortnight start.

- The fortnight start pay categories are system generated and set up in accordance with ATO requirements. Do not change the pay category name or payment classification! If you do, you will be breaching the ATO's requirements which may result in payment delays by the ATO or no reimbursement at all.

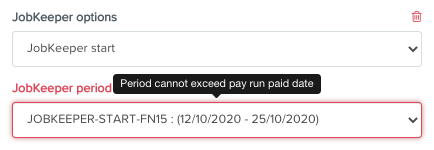

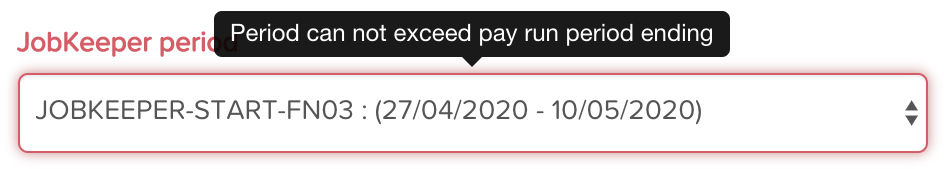

- You cannot forward date the fortnight start entries in the pay run, but you can add it to a subsequent pay run, if you've already started paying your eligible employees JobKeeper. For eg, if your pay run's pay date is 30 September you cannot, in that pay run, apply a fortnight start of "FN15" to indicate an employee will commence receiving payments in the fortnight period 12 to 25 October. If you select a fortnight start that is after the period end date of the pay run you are processing you will the see the following warning and will not be allowed to save the record:

- The following scenarios are valid circumstances where the fortnight start can be reported more than once:

- If you incorrectly report a fortnight start to be later than what it actually was, you will need to report the correct fortnight again in the next pay run. To do this follow the normal instructions of adding the JobKeeper start.

- If you incorrectly report a fortnight start to be earlier than what it actually was, you will need to report a fortnight finish (applying the same FN as the incorrect fortnight start) and then report the correct fortnight start in the next pay run. To do this follow the normal instructions of adding the JobKeeper start and JobKeeper finish.

- Where an employee's JobKeeper payment ceased due to ineligibility, for eg they were on a worker's compensation absence, paid parental leave, etc) the fortnight finish should have been recorded in the relevant pay run. If the employee returns/becomes eligible again and so the JobKeeper payment recommences for this employee, the employer will need to notify of the new fortnight start in the relevant pay run. To do this follow the normal instructions of adding the JobKeeper start.

JobKeeper Finish

Similarly with the JobKeeper start fortnight, the ATO must be made aware when JobKeeper payments cease for any employee, as they may no longer be eligible. The ineligibility may be due to:

- Workers’ compensation absence;

- Paid parental leave;

- Cessation of employment; or

- Change of citizenship, visa, personal circumstances.

The ATO only need to be notified where eligibility ceases during the JobKeeper 2.0 extension period. This means that if you have already reported finish fortnights during JobKeeper 1.0, do NOT report this again. Additionally, if the employer is not eligible for JobKeeper 2.0, there is no requirement to report finish fortnights for the employees who were receiving JobKeeper payments. Rather, the employer just simply needs to stop reporting JobKeeper in the pay run.

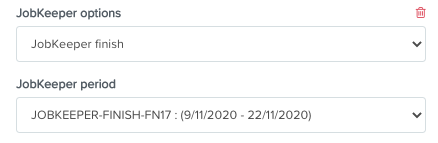

To determine what fortnight you ceased paying an employee the JobKeeper payment, refer to the ATO's JobKeeper fortnight calendar displayed at the start of this article. Cross check the dates allocated to each fortnight with the date you stopped making the payment to the employee. Then select the fortnight period after to be the fortnight finish period. For example, if you last paid the employee the JobKeeper payment on the 30th of October (ie pay date was 30/10/20), this means the last payment was made in FN16. However, the employee is technically no longer eligible from the FN17 period. To record this in the pay run (so it is then reported via STP), go to the employee's pay and click on "Actions" > "Add JobKeeper Payment" > select "JobKeeper finish" from the options dropdown list > select "JOBKEEPER-FINISH-FN17" from the "JobKeeper period" dropdown list > click on "Finished".

The fortnight finish will then appear in the eligible employee's pay using a system generated pay category that reflects the ATO's requirements:

Click "Save" in the pay run so that the earnings line save accordingly. You can record this in the same pay run that the employee is receiving their last JobKeeper payment.

Important takeaways:

- We automatically apply a rate of $0.01 to the fortnight finish pay categories. DO NOT CHANGE THIS! This pay rate is needed so that the fortnight finish information is included in the pay/update event to the ATO. If you change the rate to anything less than $0.01 it will not report via STP which means you have not undertaken the compulsory step of notifying the ATO of the employee's cessation of JobKeeper payments.

- The fortnight finish pay categories are system generated and set up in accordance with ATO requirements. Do not change the pay category name or payment classification! If you do, you will be breaching the ATO's requirements which may result in 'not very pleasant' conversations with the ATO.

Assign JobKeeper tier

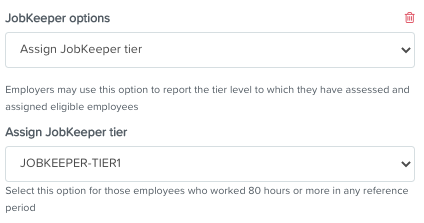

This action is mandatory for all new and existing eligible employees. If the eligible employee's tier is not reported, the ATO will not reimburse you for that employee. Once each employee has been assessed and tier determined, record this in the pay run (so it is then reported via STP) by accessing the employee's pay and clicking on "Actions" > "Add JobKeeper Payment" > select "Assign JobKeeper tier" from the options dropdown list > select "JOBKEEPER-TIER1" or "JOBKEEPER-TIER2" from the "Assign JobKeeper tier" dropdown list > click on "Finished".

The tier level will then appear in the eligible employee's pay using a system generated pay category that reflects the ATO's requirements:

Click "Save" in the pay run so that the earnings line save accordingly.

Important takeaways:

- An employee's tier cannot be changed during JobKeeper 2.0. The only exception here is if the tier was reported incorrectly in the first place. In this instance you must correct the tier as per the below instructions.

- We automatically apply a rate of $0.01 to the JobKeeper tier pay categories. DO NOT CHANGE THIS! This pay rate is needed so that the tier classification is included in the pay/update event to the ATO. If you change the rate to anything less than $0.01 it will not report via STP which means you have not undertaken the compulsory step of notifying the ATO of the employee's tier level.

- The JobKeeper tier pay categories are system generated and set up in accordance with ATO requirements. Do not change the pay category name or payment classification! If you do, you will be breaching the ATO's requirements which may result in a delay of reimbursements.

Report incorrect JobKeeper tier

This action is only required when the employer has reported the incorrect tier level for an employee. Why is it important to ensure the correct tier is reported? This is because each tier level has a different payment rate and the ATO will only reimburse you based on what tier you classify your employee.

To reverse a previously reported incorrect tier allocation, access the employee's pay in the pay run and click on "Actions" > "Add JobKeeper Payment" > select "Report incorrect JobKeeper tier" from the options dropdown list > select "JOBKEEPER-TIER1X" or "JOBKEEPER-TIER2X" from the "Report incorrect JobKeeper tier" dropdown list > click on "Finished".

If you incorrectly reported an employee's tier as 1 and they should be on tier 2, you would select "JOBKEEPER-TIER1X" from the dropdown list.

If you incorrectly reported an employee's tier as 2 and they should be on tier 1, you would select "JOBKEEPER-TIER2X" from the dropdown list.

You must then ensure that you report the correct JobKeeper tier for the affected as per the above instructions.

Important takeaways:

- The ATO does not support multiple corrections so extreme caution should be taken to ensure accuracy of originally reported JobKeeper extension data.

- We automatically apply a rate of $0.01 to the JobKeeper tier pay categories. DO NOT CHANGE THIS! This pay rate is needed so that the tier classification is included in the pay/update event to the ATO. If you change the rate to anything less than $0.01 it will not report via STP which means you have not undertaken the compulsory step of notifying the ATO of the employee's tier level.

- The JobKeeper tier pay categories are system generated and set up in accordance with ATO requirements. Do not change the pay category name or payment classification! If you do, you will be breaching the ATO's requirements which may result in a delay of reimbursements.

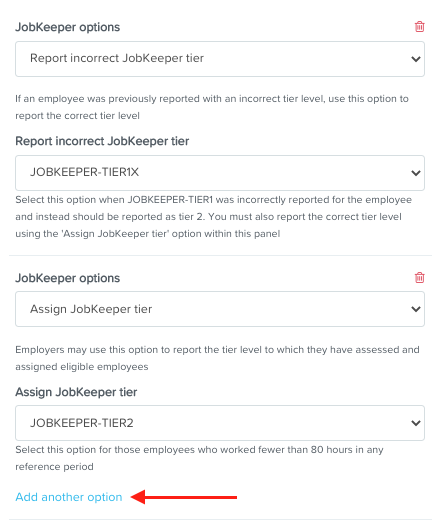

Adding multiple JobKeeper options

There may be instances where you need to report more than one JobKeeper component in an employee's pay, for eg:

- an employee needs a top up and the ATO needs to be notified of the employee's tier level;

- an employee's tier level was incorrectly reported so a reversal of the incorrect tier is required as well as reporting the correct tier.

You can add more than one option via the JobKeeper Payment context panel for an employee by clicking on "Add another option". This will display an additional entry where the employer can then add a different JobKeeper option.

Reporting JobKeeper Payments via STP

Once the pay run has been finalised, you must lodge the pay event to ensure the data has been transmitted to the ATO. There are no new steps required when reporting JobKeeper payments - just follow the usual steps required to lodge pay events and/or update events.

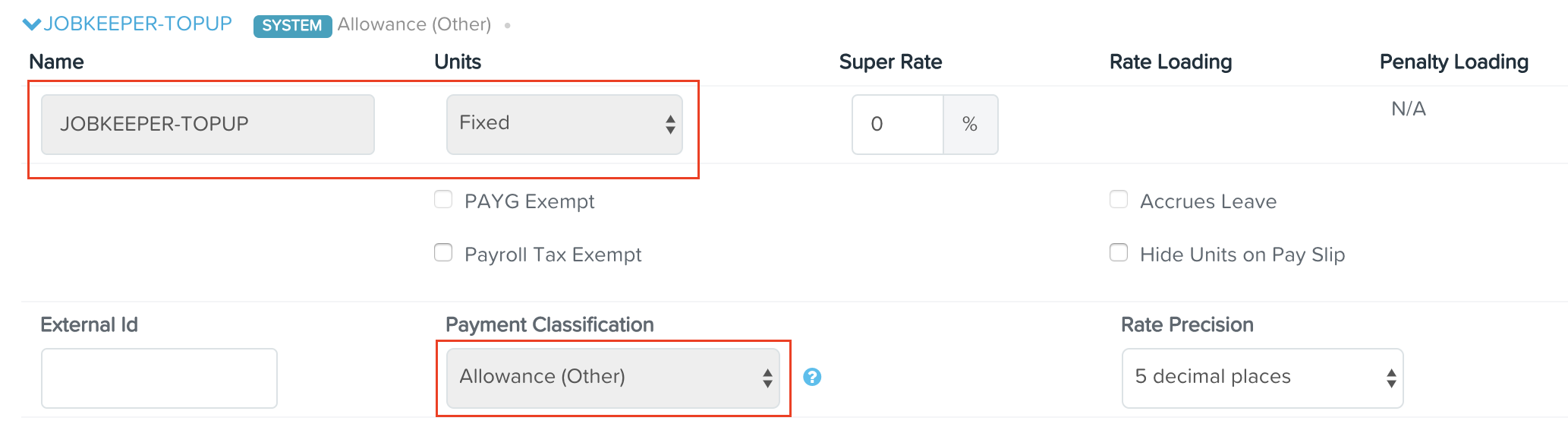

Creation of Pay Categories

Once any of the above 5 JobKeeper options are used in the pay run, the system will automatically create a pay category for that action, for eg if you topped up an employee's pay, a system based pay category named "JOBKEEPER-TOPUP" will be added to your pay category list. Take note of the following with these system created pay categories:

- System created pay categories will NOT automatically be created if the business already has the applicable JobKeeper pay category set up AND that pay category is set up correctly. In this instance, the system will continue to use the pay category already set up;

- The "Name", "Units" and "Payment Classification" fields of the pay category are locked and cannot be edited. This is intentional - the ATO are very specific about how JobKeeper must be identified in STP reporting and so we do not allow any of the crucial settings to be changed;

- By default the "Super Rate" field is set at 0% which is allowed by the ATO. If a business wants to pay super on the top-up payments, they can change the rate from 0 to 9.5;

- All other fields in the pay category settings can be edited to suit the business' needs.

JobKeeper 1.0

Prior to paying any JobKeeper payments to your employees, you should be aware of key dates where certain actions must be completed by the employer. Additionally, ensure you and your employees are eligible for the JobKeeper payment scheme.

To be clear, references to 'fortnight' in this article and JobKeeper in general relate to ATO defined fortnights with fixed start/finish dates. Regardless of a business' pay run frequency, or the pay period start and end dates, the $1500 per fortnight applies to the pay dates within the following defined fortnights and from which fixed fortnight the payment applies:

Also, this article will make regular references to '$1500 per fortnight'. For employers that use pay frequencies other than fortnightly, the $1500 reference is broken down as follows:

- Weekly pay frequencies: $1500 across the pay dates within each JobKeeper fortnight period. For eg, if a weekly pay run has a date paid on Wednesday then there are 2 pay days (1/4 and 8/4) within Fortnight 01. As such, the total pay per eligible employee must be at least $1500 for those 2 pays. It may be evenly split per week, ie $750 per pay, or the second week's pay must make up at least the total $1500, for eg if the employe was paid $400 i the first week, then they must be paid a minimum $1100 in the second week.

- Monthly pay frequencies: $1500 for each full JobKeeper fortnight within the month. This will be $3000 for each month except August, which includes 3 JobKeeper fortnights. The employer may choose to apply $3250 each month as an average or alternatively apply $3000 per month except for August which would be $4500. N.B. The ATO will reimburse based upon complete fortnights per month, ie a maximum $3000 per month except for August which would be reimbursed at a maximum $4500 per eligible employee.

Adding JobKeeper Payments

This section should be read in conjunction with "How do I record JobKeeper Payments?" contained in this article.

To access the JobKeeper Payment functionality, you must be in a pay run. Click on the relevant employee's pay so that the "Actions" button is displayed. Click on "Actions" > "Add JobKeeper Payment":

A context panel will then appear where you can complete one or more of the following 3 actions:

- Top up an employee's pay (where their original earnings are less than $1500 per fortnight). Further details are provided below.

- Record the 'start' fortnight the JobKeeper payment is commencing for each affected employee. This MUST be reported for each eligible employee and only needs to be reported once. Further details are provided below.

- Record the 'finish' fortnight the JobKeeper payment is ceasing for each affected employee. This only needs to be reported if an employee ceases to be eligible for the JobKeeper payment prior to the 27th of September. Further details are provided below.

JobKeeper Top Up

If an employee’s earnings in the pay run you are processing are $1500 or more per fortnight, continue to pay the employee all earnings as normal and include all entitlements to leave accrual and superannuation. There is no top up or change required to the employee's pay in this instance. Rather, the JobKeeper payment will be a supplement for the employer.

You only need to top up an eligible employee's pay if they earn less than $1500 gross per fortnight. In this instance, continue to pay the employee all earning and include all entitlements to leave accrual and superannuation as you usually would. Additionally, you will need to top up an amount that totals the difference between $1500 per fortnight and the employee’s gross earnings. For eg, an employee's normal gross earnings for the fortnight is $630. The employer would then be required to top up the employe's pay by $870 ($1500 - $630). To do this, go to the employee's pay and click on "Actions" > "Add JobKeeper Payment" > select "JobKeeper top-up" from the options dropdown list > enter 870 in the "Top up amount" field > click on "Add" > click on "Finished".

The top up amount will then appear in the eligible employee's pay using a system generated pay category that reflects the ATO's requirements:

Click "Save" in the pay run so that the earnings line save accordingly.

Important takeaways:

- For the transition into the JobKeeper payment, employers can retrospectively apply this payment for pay runs on or after 30 March by 8 May. Basically, you need to ensure the first 2 fortnight's of $1500 per fortnight is paid to the employee by 8 Mayl 2020, otherwise the ATO will not reimburse. If you backpay a JobKeeper payment amount to an employee in May for JobKeeper fortnights 1 and/or 2, you will not be reimbursed by the ATO for this amount.

- Super is not calculated on any "top-up" earnings. It will be up to the employer if they want to pay superannuation on the "top-up" component of the Jobkeeper payment.

- This payment is taxable, however, the state authorities are yet to provide clear direction on whether the payment is liable for payroll tax.

- As stated above, the top up pay category is system generated and set up in accordance with ATO requirements. Do not change the pay category name or payment classification! If you do, you will be breaching the ATO's requirements which may result in payment delays by the ATO or no reimbursement at all. The ATO are very strict about the way JobKeeper payments are to be reported so please don't get creative with this - it will only hurt you in the end!

JobKeeper Start

The ATO requires that the employer indicate via STP when the JobKeeper payment commenced for each eligible employee. Each business' payroll arrangements may be different, and employees may enter or exit pay periods at different times. Some workers may be on workers’ compensation absences and only return to work sometime after the start of the JobKeeper payment. As such, the ATO do not assume that every eligible employee will commence receiving JobKeeper payments from the first JobKeeper fortnight.

Notifying the ATO of the JobKeeper fortnight start is compulsory! This is what will trigger payment by the ATO for each eligible employee. Put simply, if you do not complete this step for each eligible employee you will not be reimbursed by the ATO. This only needs to be reported once (only exception to this rule is detailed below in the important takeaways section) and should be done within the fortnight period the payment commences. If a fortnight start and/or fortnight finish has been recorded in a pay run, the following notification will display in the employee's JobKeeper Payment context panel in subsequent pay runs to act as a reminder of what has already been reported to the ATO:

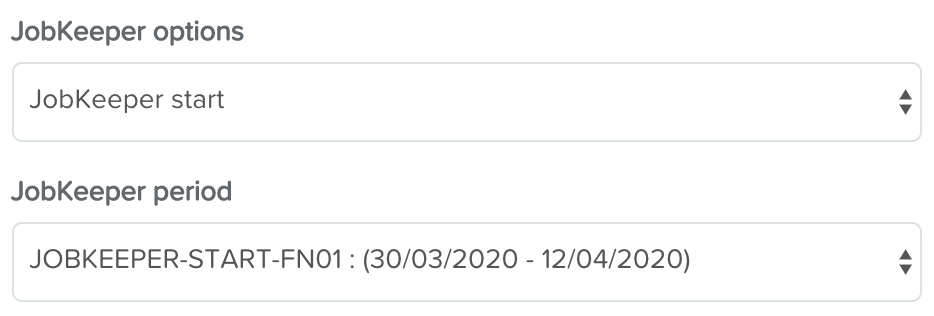

To determine what fortnight you commenced paying an employee the JobKeeper payment, refer to the ATO's JobKeeper fortnight calendar displayed at the start of this article. Cross check the dates allocated to each fortnight with the date you paid the employee. For example, if you paid an employee the JobKeeper payment for the first time on the 2nd of April (ie pay date was 2/4/20), this means the payment was made in FN01. To record this in the pay run (so it is then reported via STP), go to the employee's pay and click on "Actions" > "Add JobKeeper Payment" > select "JobKeeper start" from the options dropdown list > select "JOBKEEPER-START-FN01" from the "JobKeeper period" dropdown list > click on "Finished".

The fortnight start will then appear in the eligible employee's pay using a system generated pay category that reflects the ATO's requirements:

Click "Save" in the pay run so that the earnings line save accordingly.

Important takeaways:

- For the transition into the JobKeeper payment, employers can retrospectively report the start fortnight for pay runs on or after 30 March by 8 May.

- We automatically apply a rate of $0.01 to the fortnight start pay categories. DO NOT CHANGE THIS! This pay rate is needed so that the fortnight start information is included in the pay/update event to the ATO. If you change the rate to anything less than $0.01 it will not report via STP which means you have not undertaken the compulsory step of notifying the ATO of the eligible employee's JobKeeper's fortnight start.

- The fortnight start pay categories are system generated and set up in accordance with ATO requirements. Do not change the pay category name or payment classification! If you do, you will be breaching the ATO's requirements which may result in payment delays by the ATO or no reimbursement at all.

- You cannot forward date the fortnight start entries in the pay run, but you can add it to a subsequent pay run, if you've already started paying your eligible employees JobKeeper. For eg, if your pay run's pay date is 16 April you cannot, in that pay run, apply a fortnight start of "FN03" to indicate an employee will commence receiving payments in the fortnight period 27 April to 10 May. If you select a fortnight start that is after the period end date of the pay run you are processing you will the see the following warning and will not be allowed to save the record:

- The following scenarios are valid circumstances where the fortnight start can be reported more than once:

- If you incorrectly report a fortnight start to be later than what it actually was, you will need to report the correct fortnight again in the next pay run. To do this follow the normal instructions of adding the JobKeeper start.

- If you incorrectly report a fortnight start to be earlier than what it actually was, you will need to report a fortnight finish (applying the same FN as the incorrect fortnight start) and then report the correct fortnight start in the next pay run. To do this follow the normal instructions of adding the JobKeeper start and JobKeeper finish.

- Where an employee's JobKeeper payment ceased due to ineligibility, for eg they were on a worker's compensation absence, paid parental leave, etc) the fortnight finish should have been recorded in the relevant pay run. If the employee returns/becomes eligible again and so the JobKeeper payment recommences for this employee, the employer will need to notify of the new fortnight start in the relevant pay run. To do this follow the normal instructions of adding the JobKeeper start.

JobKeeper Finish

Similarly with the JobKeeper start fortnight, the ATO must be made aware when JobKeeper payments cease for any employee, as they may no longer be eligible. The ineligibility may be due to:

- Workers’ compensation absence;

- Paid parental leave;

- Cessation of employment; or

- Change of citizenship, visa, personal circumstances.

The ATO only need to be notified if the payments cease before the 27th of September (being the date the JobKeeper payments subsidy ceases).

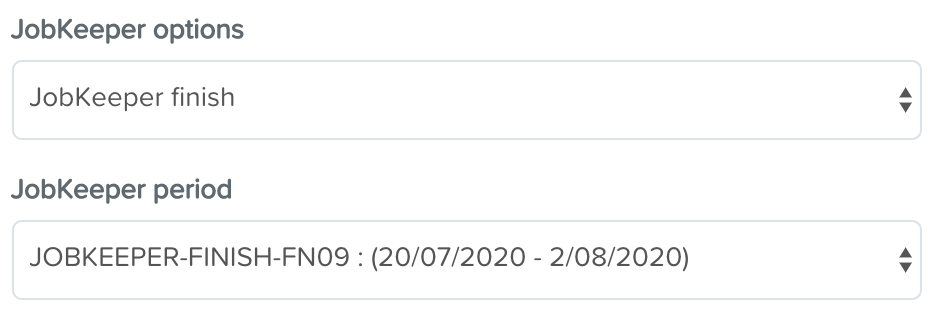

To determine what fortnight you ceased paying an employee the JobKeeper payment, refer to the ATO's JobKeeper fortnight calendar displayed at the start of this article. Cross check the dates allocated to each fortnight with the date you stopped making the payment to the employee. Then select the fortnight period after to be the fortnight finish period. For example, if you last paid the employee the JobKeeper payment on the 8th of July (ie pay date was 8/7/20), this means the last payment was made in FN08. However, the employee is technically no longer eligible from the FN09 period. To record this in the pay run (so it is then reported via STP), go to the employee's pay and click on "Actions" > "Add JobKeeper Payment" > select "JobKeeper finish" from the options dropdown list > select "JOBKEEPER-FINISH-FN09" from the "JobKeeper period" dropdown list > click on "Finished".

The fortnight finish will then appear in the eligible employee's pay using a system generated pay category that reflects the ATO's requirements:

Click "Save" in the pay run so that the earnings line save accordingly. You can record this in the same pay run that the employee is receiving their last JobKeeper payment.

Important takeaways:

- We automatically apply a rate of $0.01 to the fortnight finish pay categories. DO NOT CHANGE THIS! This pay rate is needed so that the fortnight finish information is included in the pay/update event to the ATO. If you change the rate to anything less than $0.01 it will not report via STP which means you have not undertaken the compulsory step of notifying the ATO of the employee's cessation of JobKeeper payments.

- The fortnight finish pay categories are system generated and set up in accordance with ATO requirements. Do not change the pay category name or payment classification! If you do, you will be breaching the ATO's requirements which may result in 'not very pleasant' conversations with the ATO.

Should you have any questions, feel free to email us at support@yourpayroll.com.au.