Processing JobMaker nominations in the pay run

This article explains how to use our JobMaker nomination functionality in the pay run. This process will ensure you are using the correctly named pay categories without having to create the pay categories yourself. The ATO have prescribed specific naming conventions when processing JobMaker nominations and periods through STP and it is essential to honour these conventions, otherwise credits owed to employers may be delayed or not paid at all.

Prior to processing JobMaker nominations in the pay run, you should be aware of key dates where certain actions must be completed by the employer. Additionally, ensure you and your employees are eligible for the JobMaker Hiring Credit scheme.

Adding JobMaker nominations

Prior to explaining how to process JobMaker in the pay run, you should be fully aware of each JobMaker action - what they are used for, dos and don'ts, etc:

- jobmakernomination: Employers must use this action in the pay run to confirm with the ATO which employees are eligible for the JobMaker Hiring Credit scheme. Reporting of employees who have been nominated for the JobMaker Hiring Credit is expected to occur at the point of hiring during the JobMaker period dates, and prior to making a claim, noting it may take up to 72 hours for this information to be processed and made available for JobMaker Hiring Credit purposes. Employees are only required to be nominated once under the scheme - do not continue reporting this information per eligible employee in subsequent pay runs.

- JobMakerrenomination : Where a previously eligible and nominated employee ceased employment and is subsequently rehired and also meets the eligibility criteria for the JobMaker Hiring Credit, an employer can nominate the eligible employee again. This is when you would apply the JobMaker renomination action. You must not use this action if an employee was never nominated previously, ie the JobMaker nomination action was never previously processed for this employee in a pay run and therefore reported via STP. As the ATO would have been made aware of the employee's previous termination date, you must ensure the employee's new start date is entered in the "Start Date" field of the employee's file. N.B. The ATO do not support multiple rehires after one rehire via STP so should this occur the employer will need to contact the ATO directly to manage this situation.

- JobMaker period : Employers must inform the ATO when a nominated eligible employee has met the minimum hours test for a JobMaker period that they intend to claim for. Employers will need to report this quarterly that they met the eligibility criteria. Reporting of an employee meeting of the minimum hours test is expected to occur at the point where the employer has confirmed the employee has met the test for the period, and prior to making a claim for the period, noting it may take up to 72 hours for this information to be processed and made available for JobMaker Hiring Credit purposes. This is when you would apply the JobMaker period action. The JobMaker periods are as follows:

N.B. You only need to report the JobMaker period in the pay run once per JobMaker period - do not continue reporting the same period in subsequent pay runs. - Report incorrect JobMaker nomination : Where you have previously used the JobMaker nomination action for an employee and now need to cancel that nomination (to remove the original nomination and hence the employee from the JobMaker Hiring Credit scheme), you must use this action to cancel the original nomination. To be clear, this should only be used to indicate that the original nomination should not have been provided. It is not to be used to report the cessation of an employee during the JobMaker period. Instead, ensure the employee is terminated in the pay run so that their termination date is then reported via the STP pay event. You are only required to report an incorrect nomination once for an employee under the scheme - do not continue reporting in subsequent pay runs.

- JobMakerrenomination: Where you have previously used the JobMaker renomination action for an employee and now need to cancel that renomination (because it was incorrectly processed in the first place or because the employee was not eligible and so you need to remove the employee from the JobMaker Hiring Credit scheme), you must use this action to cancel the renomination. To be clear, this should only be used to indicate that the original renomination should not have been provided. It is not to be used to report the cessation of an employee during the JobMaker period. Instead, ensure the employee is terminated in the pay run so that their termination date is then reported via the STP pay event. Lastly, you are only required to report an incorrect renomination once for an employee under the scheme - do not continue reporting in subsequent pay runs.

- Report incorrect JobMaker period : Where you have previously used the JobMaker period action for an employee and now need to cancel that action (for eg, the employee may not have met the minimum hours test and therefore is not eligible for a specific period), you must use this action to cancel the original JobMaker period for a specific period. To be clear, this should only be used to indicate that the original period nominated should not have been provided. N.B. You only need to report an incorrect JobMaker period in the pay run once per JobMaker period - do not continue reporting the same period in subsequent pay runs.

The next section below provides details on what happens in the pay run when using the JobMaker function. To be clear, under the JobMaker Hiring Credit Scheme you do not pay the "incentives" to the employee in the pay run; rather you are letting the ATO know via the pay run (and hence STP) who the eligible employees are and of those who have passed the minimum hours test per period.

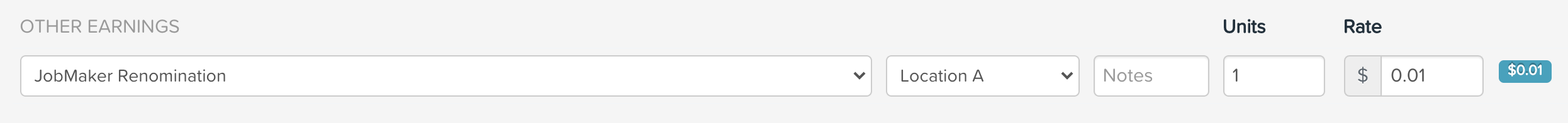

You will note that we automatically apply a rate of $0.01 to all JobMaker pay categories. This pay rate is needed so that the information is included within the STP event. Do not change this! If you change the rate to anything less than $0.01 it will not be captured in any STP events which means you have not undertaken the compulsory step of reporting JobMaker via STP.

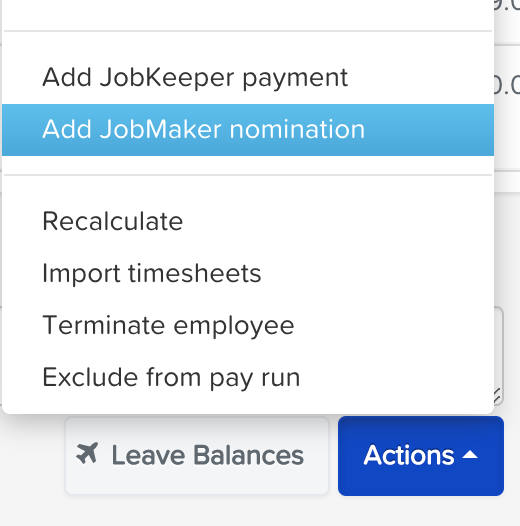

To access the JobMaker nomination functionality, you must be in a pay run. Click on the relevant employee's pay so that the "Actions" button is displayed. Click on "Actions" > "Add JobMaker nomination":

A context panel will then appear where you can complete one or more of the following 6 actions:

JobMaker nomination

Select the nomination option for an eligible employee as follows:

Click the 'Finished' button to be redirected to the employee's pay, where the nomination will be displayed as follows:

Click 'Save' in the pay run so that the earnings line save accordingly.

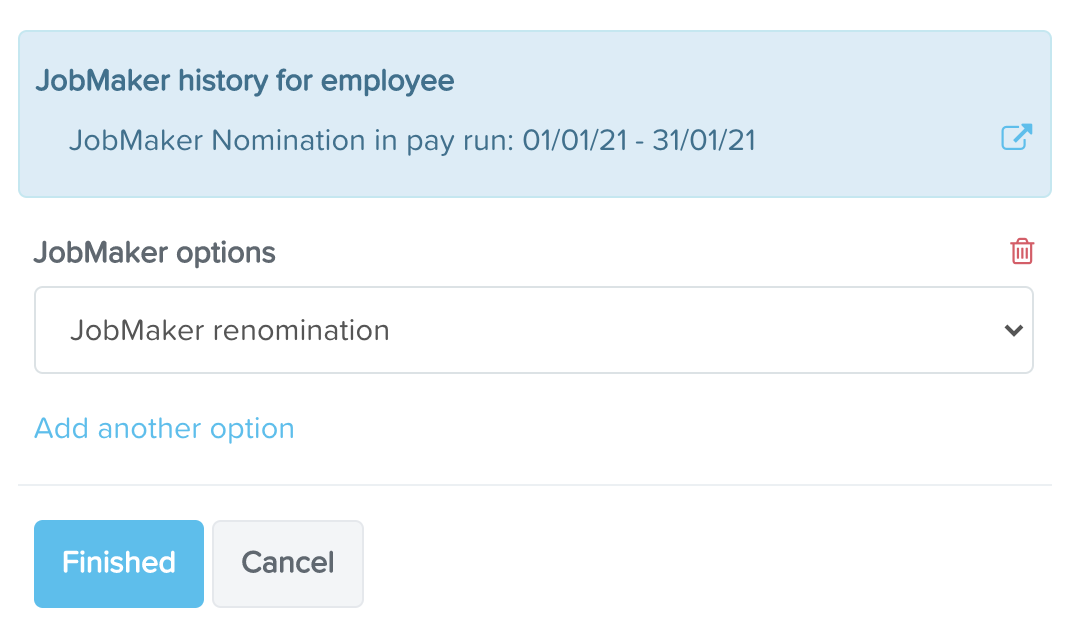

JobMaker renomination

Select the renomination option for an eligible employee as follows:

Take note of the JobMaker history that appears in the above context panel. This confirms that the employee has been nominated in a prior pay run and so using the renomination action is the correct action (on the proviso it's being used because the employee's employment ceased and they have since returned and are still eligible for the scheme). If there is no confirmation in the panel that a nomination has previously been reported, then you should not be using the renomination action.

Click the 'Finished' button to be redirected to the employee's pay, where the nomination will be displayed as follows:

Click 'Save' in the pay run so that the earnings line save accordingly.

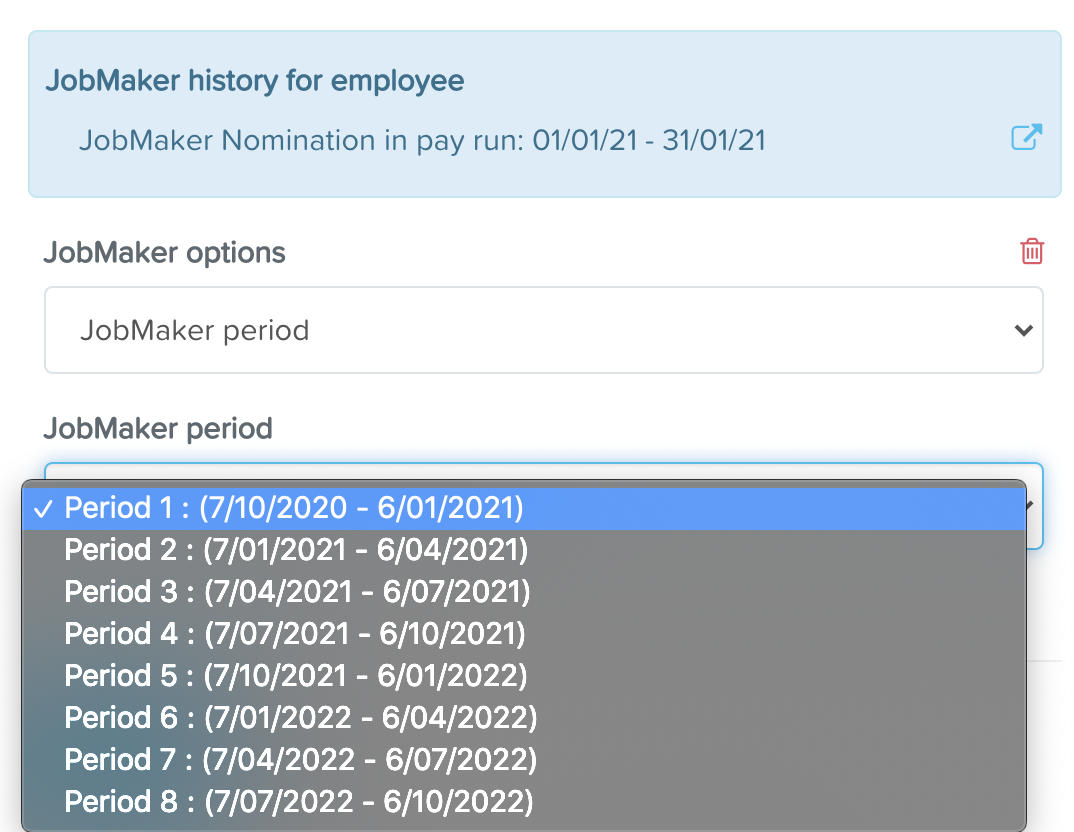

JobMaker period

Just a quick reminder that this action confirms the employee meets the minimum hours test for a specific period. It goes without saying you cannot report this action in advance of the period ending!

When selecting the period option for an eligible employee, you will then be required to select the actual period you want to report, as follows:

Take note of the JobMaker history that appears in the above context panel. This confirms that the employee has been nominated in a prior pay run and so using the period action is the correct action. If there is no confirmation in the panel that a nomination has previously been reported, you will need to also report a nomination action in that same pay run as this is the initial trigger for the ATO to know that the employee is eligible for the scheme.

Click the 'Finished' button to be redirected to the employee's pay, where the period will be displayed as follows:

Click 'Save' in the pay run so that the earnings line save accordingly.

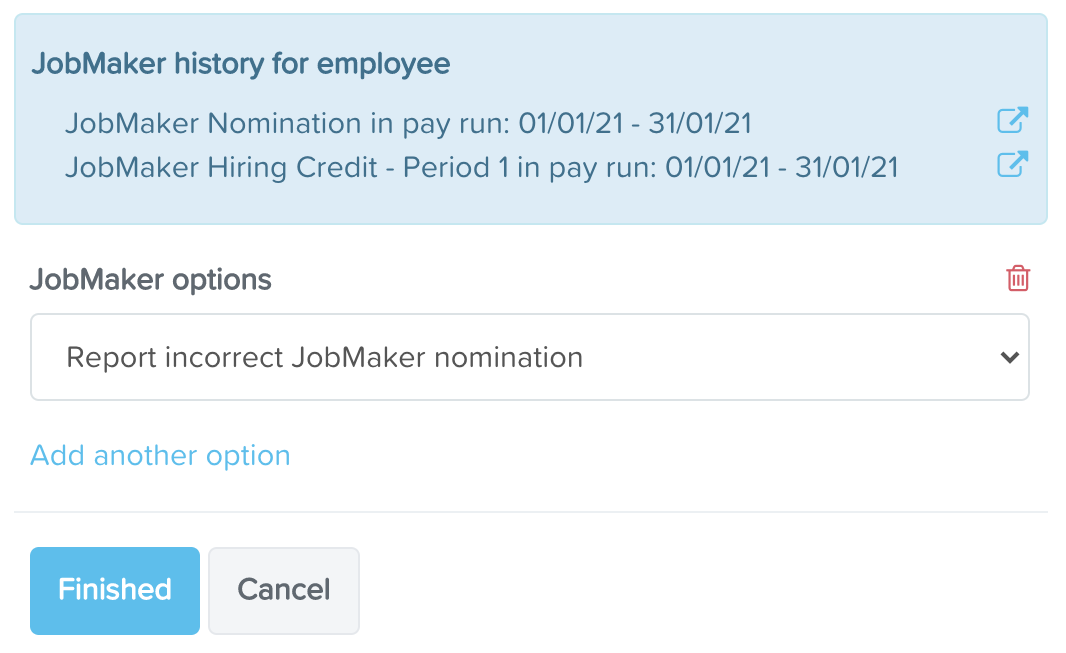

Report incorrect JobMaker nomination

Select the 'Report incorrect JobKeeper nomination' option from the dropdown as follows:

Take note of the JobMaker history that appears in the above context panel. This confirms that the employee has been nominated in a prior pay run and so using the report incorrect nomination action is the correct action (on the proviso you're only using this action to report to the ATO that the employee was incorrectly nominated and should have never been part of the scheme). If there is no confirmation in the panel that a nomination has previously been reported, then you should not be using the report incorrect nomination action as it would be safe to assume that the employee was never nominated in the first place.

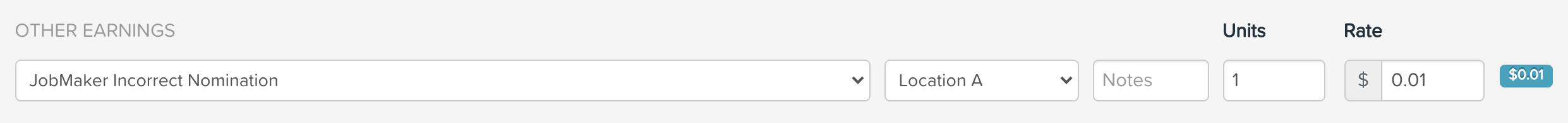

Click the 'Finished' button to be redirected to the employee's pay, where the period will be displayed as follows:

Click 'Save' in the pay run so that the earnings line save accordingly.

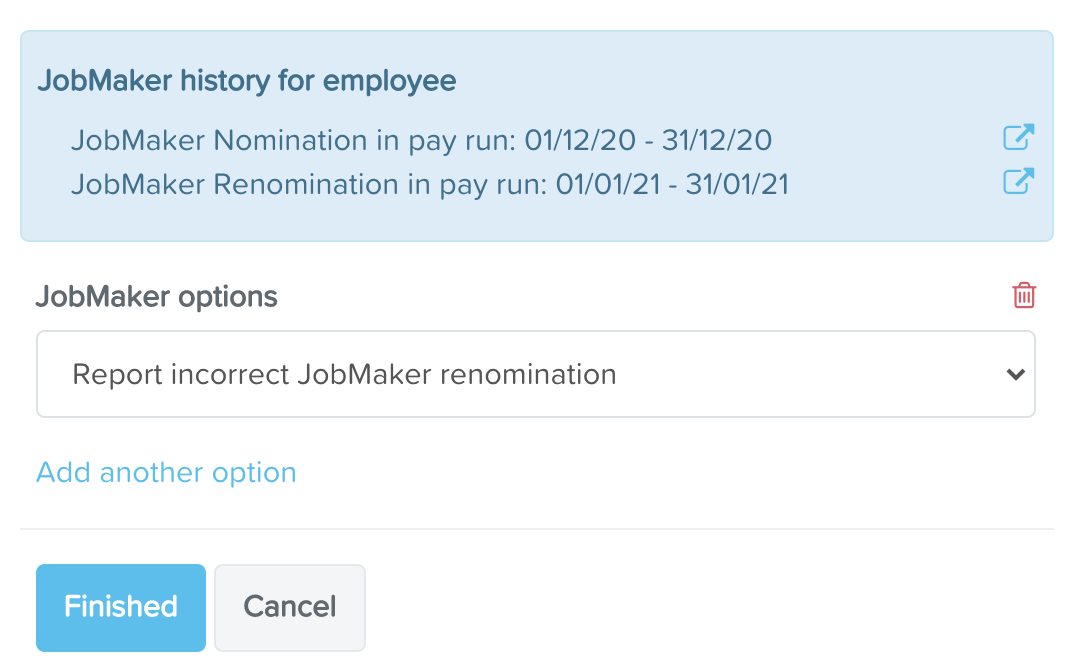

Report incorrect JobMaker renomination

Select the 'Report incorrect JobKeeper renomination' option from the dropdown as follows:

Take note of the JobMaker history that appears in the above context panel. This confirms that the employee has been renominated in a prior pay run and so using the report incorrect renomination action is correct (on the proviso you're only using this action to cancel the original renomination reported to the ATO). If there is no confirmation in the panel that a renomination has previously been reported, then you should not be using the report incorrect renomination action as it would be safe to assume that the employee was never renominated in the first place.

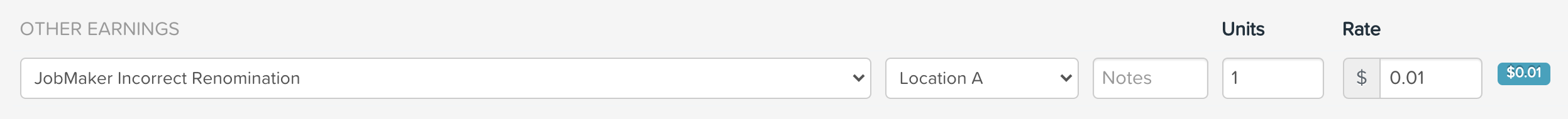

Click the 'Finished' button to be redirected to the employee's pay, where the period will be displayed as follows:

Click 'Save' in the pay run so that the earnings line save accordingly.

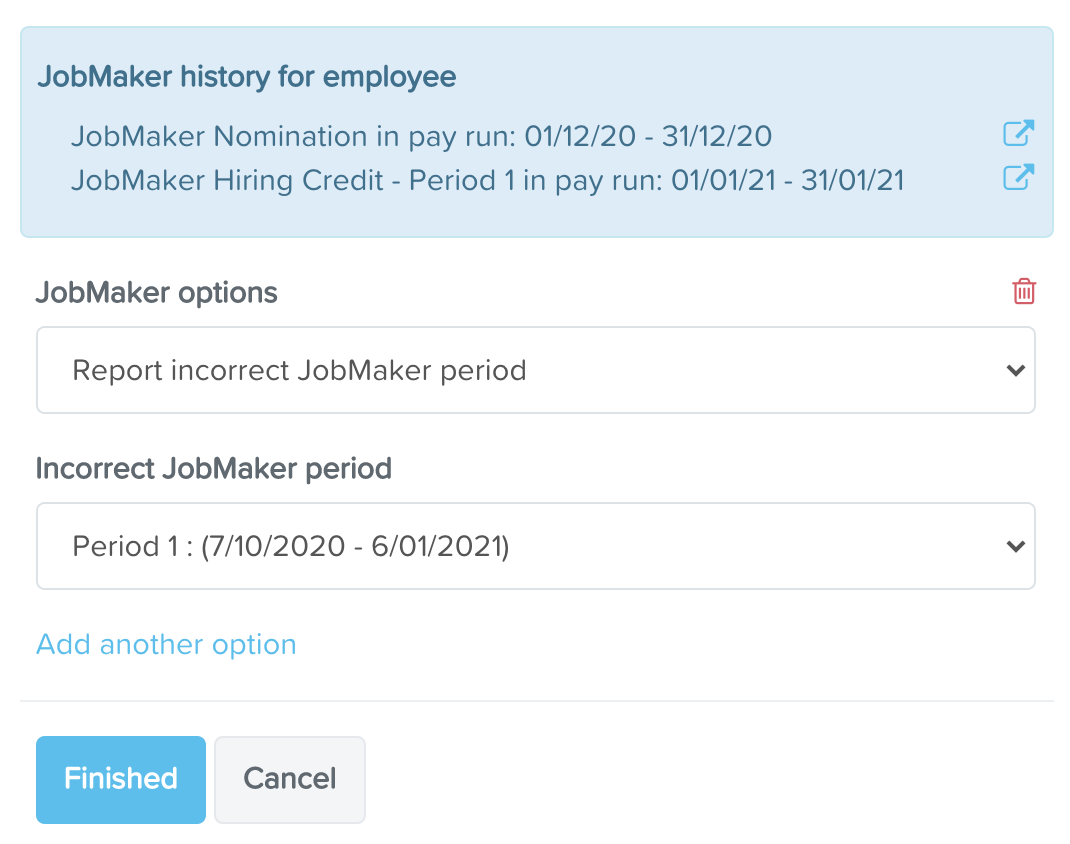

Report incorrect JobMaker period

When selecting the 'Report incorrect JobKeeper period' option from the dropdown, you will then be required to select the actual period you want to report, as follows:

Take note of the JobMaker history that appears in the above context panel. This confirms that the employer had reported a period in a prior pay run and so using the report incorrect period action is correct (on the proviso you're only using this action to cancel the original period reported to the ATO as the employee had not met the minimum hours test for that period). If there is no confirmation in the panel that a specific period has previously been reported, then you should not be using the report incorrect period action. Also, you should only report a specific incorrect period for a period you had already reported, for eg if you reported Period 2 and Period 3, do not report an incorrect period for Period 1. Lastly, you do not need to report incorrect periods if you're cancelling an original nomination or renomination for an employee - you simply just need to report the incorrect nomination or incorrect renomination and that action will suffice in letting the ATO know the employee was incorrectly nominated or renominated for the scheme.

Click the 'Finished' button to be redirected to the employee's pay, where the period will be displayed as follows:

Click 'Save' in the pay run so that the earnings line save accordingly.

Lastly, you must lodge each pay run with the ATO using STP. If you do not, the ATO will not be aware of any employee nominations and so no incentives will be afforded to the employer or there will be significant delays in receiving the scheme's incentives.

JobMaker Pay Categories

As part of using the JobMaker function in the pay run, you do not need to create your own JobMaker pay categories. This is because the system will auto generate the pay categories based on the JobMaker actions you have performed in pay runs. We strongly recommend against users creating their own pay categories because of the specific requirements imposed by the ATO on how these pay categories should be configured. And why do something yourself when we can do it for you!

For complete transparency, the ATO require that pay categories:

- be set up as an allowance and assigned the 'Allowance (Other)' classification

- have a unique and defined allowance code for each JobMaker action. The allowance codes are as follows:

- JobMaker nomination = JMHC-NOM

- JobMaker renomination = JMHC-RENOM

- JobMaker period = JMHC-PXX, where XX is the period, ie 01, 02, 03, etc

- JobMaker incorrect nomination = JMHC-NOMX

- JobMaker incorrect renomination = JMHC-RENOMX

- JobMaker incorrect period = JMHC-PXXX, where XX is the incorrect period, ie 01, 02, 03, etc

Any variance to the above will impact on the business receiving their scheme incentives so it is essential the rules are followed to a tee.

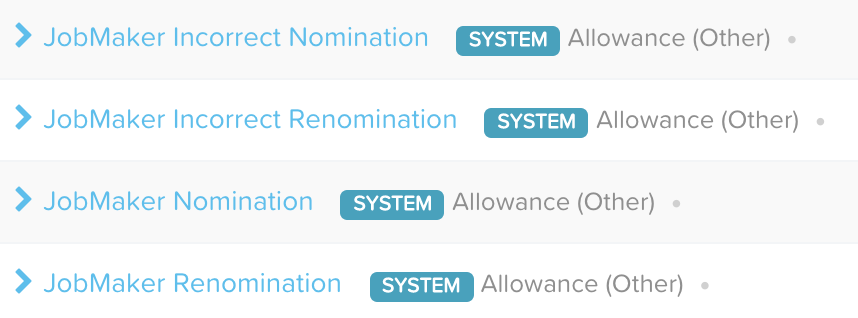

From the Payroll Settings > Pay Categories screen, you will see a list of JobMaker pay categories only if the applicable actions have been applied in a pay run. An example of such pay categories are as follows:

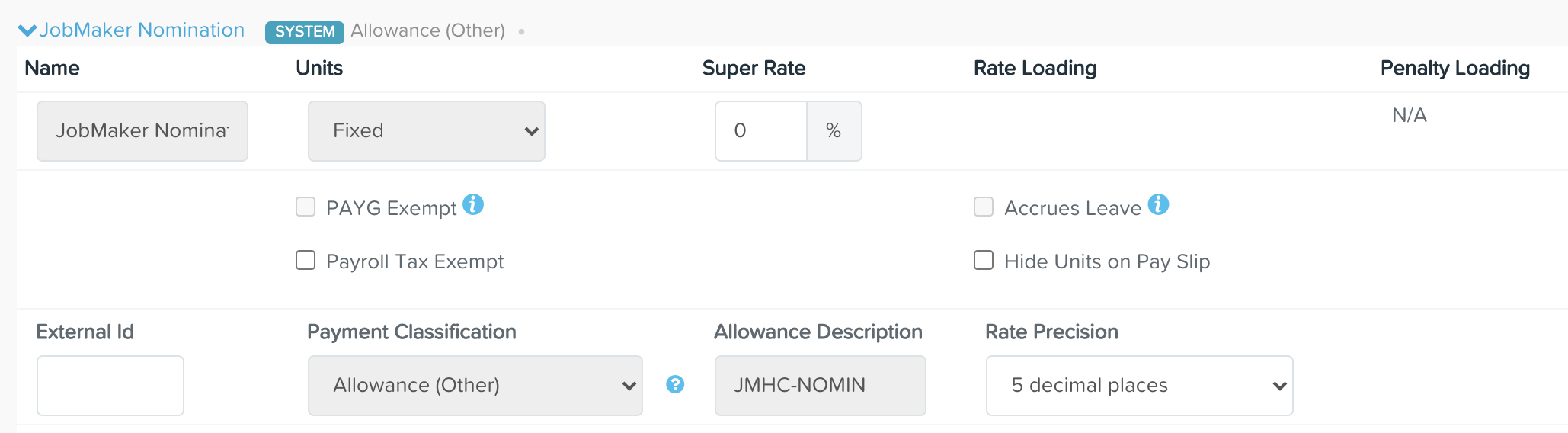

When you expand on one of the JobMaker system pay categories, take note of the following:

- The name of the pay category is locked meaning you cannot override this setting. This has been done so that the system can continue using the same pay category when this JobMaker action is processed in the pay run

- The unit, payment classification and allowance description of the pay category is locked meaning you cannot override this setting. This has been done to ensure the ATO requirements are not manually changed by users, thereby potentially impeding on businesses receiving their incentives

- The payroll tax exempt, super rate and hide units from pay slip settings can be configured as per user requirements

- The PAYG exempt setting by default is unticked and cannot be overridden

Minimum Hours Test

To be an eligible employee for the JobMaker Hiring Credit payment, an employee must work a minimum average of 20 hours per week across each JobMaker period from the time they are employed. To easily determine this, you can generate the JobMaker Eligibility Report at the end of each JobMaker period to get a breakdown of average hours worked by the employee. If the employee has met the minimum hours test for the applicable JobMaker period, you can then report the JobMaker period in the relevant pay run.

JobMaker Hiring Credit cessation

If a nominated employee ceases employment within 12 months of being hired the employer must inform the ATO of this via an STP payroll event. To do this, you simply need to terminate the employee in the applicable pay run and then lodge that pay run via STP. The employee's termination date will then be transmitted to the ATO via the pay event.

If a previously nominated employee ceases employment and is therefore marked as 'is final' in their last pay event, once they are rehired and a pay processed in a pay run they will no longer be marked as 'is final' so manual user intervention will be required to reactivate the employee in an STP event.

Should you have any questions, feel free to email us at support@yourpayroll.com.au.

![Pay Cat Logo New 2.png]](https://www.paycat.com.au/hs-fs/hubfs/Pay%20Cat%20Logo%20New%202.png?height=50&name=Pay%20Cat%20Logo%20New%202.png)