Racing Industry Ground Maintenance Award 2020 (MA000014)

This article provides guidelines about when to use the different work types and tags that are included as part of the pre-built Racing Industry Ground Maintenance Award 2020 [MA000014] package. For further information about the Racing Club Events Award 2020, refer to: Racing Industry Ground Maintenance Award

Key Updates to Award

Last Updated: August 2023

Key_Updates

Installing and Configuring the Pre-Built Award Package

For details on how to install and configure this Pre-built Award Template, please review the detailed help article here.

While every effort is made to provide a high-quality service, YourPayroll does not accept responsibility for, guarantee or warrant the accuracy, completeness or up-to-date nature of the service. Before relying on the information, users should carefully evaluate its accuracy, currency, completeness and relevance for their purposes, and should obtain any appropriate professional advice relevant to their particular circumstances.

Coverage

This industry award covers employers throughout Australia engaged in the maintenance of grounds at horse and greyhound racing venues. This could include as an example:

- thoroughbred racing clubs

- harness racing clubs

- trotting racing clubs

- greyhound racing clubs

See Section 4 of the Award for more information and exclusions.

Limitations

Clause 24.5(a) of the award requires the adoption of the equivalent rate for an employee while taking annual leave, instead of the base rate. While we can partially support this with the rule set, we cannot yet fully support this feature. We suggest checking any employees taking annual leave for what there equivalent wage would have been when reviewing the pay run.

Work Types

The following is a list of work types employees can select on their timesheet, and the meaning of each item.

Annual leave taken

Use this work type when annual leave is taken.

Compassionate leave taken

Use this work type when compassionate leave is taken.

Hours worked

Use this work type for any ordinary hours worked, unless another work type is more appropriate.

Hours worked - greyhound or harness racing public event

Use this for any hours you work at a greyhound or harness racing event that is open to the public.

Hours worked - greyhound or harness racing public event - track crossing attendant

Use this for any hours you work at a greyhound or harness racing event that is open to the public and you perform the role of a track crossing attendant.

Hours worked - night cleaning duties

Use this work type if your primary role is to perform night cleaning duties. If this is your permanent role and a tag has been used, you can alternatively simply select ‘hours worked’ (check with your payroll administrator).

Hours worked - other - track crossing attendant

Use this work type for any days not hosting a public event where you perform the role of a track crossing attendant

Hours worked - other public event

Use this work type for any days hosting a public event other than greyhound or harness racing.

Hours worked - other public event - track crossing attendant

Use this work type for any days hosting a public event other than greyhound or harness racing and you perform the role of a track crossing attendant

Hours worked with a delayed meal break

Use this work type for the part of the shift where you would have normally had a meal break, up to the time where you were able to take a break.

Leave without pay

Use this work type when leave without pay is taken.

Long service leave taken

Use this work type when long-service leave is taken.

Paid community service leave taken

Use this work type when paid community service leave is taken.

Personal / carer's leave taken

Use this work type when personal / carer’s leave is taken.

Public holiday (day off)

Use this work type when you have a paid day off due to the day being a public holiday. Only applicable to permanent employees.

Time in lieu taken

Use this work type when time in lieu is taken.

Tags

The following tags are available for application to employees under the Professional Employees Award 2010.

First aid

Select this tag if the employee is first aid qualified and performs first aid duties

In charge of tractor plant

Select this tag if the employee is in charge of tractor plant. This could be any of the following circumstances:

- when two or more employees are employed at the plant at the one time the employee who is invested with the superintendence and responsibility or who has to accept the superintendence and responsibility; or

- an employee who is invested with the superintendence and responsibility or who has to accept the superintendence and responsibility over one or more employees; or

- when an employee is the only person of their class employed on the plant, the employee who does the general repair work of the plant in addition to the work of operating, but not when the employee merely assists a fitter or engineer to do such work

In charge of less than 3 employees

Select this tag if the employee is typically in charge of less than 3 employees

In charge of 3-6 employees

Select this tag if the employee is typically in charge of 3-6 employees

In charge of 7 or more employees

Select this tag if the employee is typically in charge of 7 or more employees

Carpenter who provides own tools

Select this tag if the employee is a carpenter who is required to provide their own tools

Tradesperson (not carpenter) provides own tools

Select this tag if the employee is a tradesperson other than a carpenter who is required to provide their own tools

Water restrictions apply

Select this tag where the employer is subject to water restrictions. Water restrictions means restriction or rationing in the use of water in accordance with orders or regulations approved by the relevant authority.

Night cleaner

Select this tag if the employee’s entire role is that of a night cleaner

TIL of OT*

Select this tag if the employee has agreed to receive time off in lieu of receiving overtime penalties.

*Time off instead of payment for overtime leave is accrued at the same rate as the number of overtime hours worked. EXAMPLE: an employee who worked two (2) overtime hours is entitled to two (2) hours’ time off. If time off for overtime is not taken and the time off is to be paid out, it must be paid at the overtime rate applicable to the overtime when worked. This also applies when an employee is terminated and the time off is to be paid out. In order to be paid out correctly, the overtime rate will need to be recorded manually at the same time as the time in lieu accrual is processed. It is suggested that you record the overtime details in the “notes” section of the leave accrual line in the pay run.

If you are required to pay out the time off for overtime either before termination or during termination, you can run a Pay Run Audit Report for the pay runs for the employee when Time in Lieu was accrued to determine the applicable rates (which will detail your notes) and run an Employee Payment History Report to determine if any of the time off for overtime has been taken. You can then determine the correct balance based on the number of hours by taking the equivalent to the overtime payment that would have been made EXAMPLE: an employee who worked two (2) overtime hour at what would have been the rate of time and a half, is then entitled to three (3) hours of time off leave to be accrued. In our above example (the first accrual line of the screen shot) you would take 0.5 hours x 1.5 = 0.75 hours. Therefore, you will need to adjust the time in lieu balance by adding a further 0.25 hours (0.75 hours – 0.5 hours = 0.25 hours).

Key Updates

August 2023

1st

From 1 August, all employees are entitled to 10 days of paid family and domestic violence leave each year. The (Unpaid) Family and Domestic Violence Leave configuration settings under awards have been updated - the leave category is disabled from award leave allowance templates, and the work type is not enabled automatically for all employees. Please ensure that employees no longer use the unpaid leave category or work type.

July 2023

1st

We have updated the award to reflect the Fair Work Commission’s National Minimum Wage increase detailed in the Annual Wage Review 2022-23 decision and also includes updates to expense-related allowances. You can find information on the Determinations here and here. These changes come into effect from the first full pay period on or after the 1st July 2023. Please install these updates after you have finalised your last pay run before the first full pay period beginning on or after the 1st July 2023.

January 2023

31st

We have updated the award to reflect changes made as part of the Fair Work Decision regarding Paid Family and Domestic Violence Leave. Further information on what changes have been applied to the platform and what you should be aware of can be found within this article.

We have created the following new categories:

- New Leave Category: Paid Family and Domestic Violence Leave.

- New Pay Category: Paid Family and Domestic Violence Leave.

- New Work Type: Paid Family and Domestic Violence Leave taken.

We have updated the Leave Allowance Templates to disable the existing unpaid Family and Domestic Violence and we have enabled the new Paid Family and Domestic Violence Leave. We also updated any impacted rule conditions.

As part of Fair Work's ruling, an employee must be paid their full pay rate; this includes their base rate plus any incentive-based payments and bonuses, loadings, monetary allowances, overtime or penalty rates, and any other separately identifiable amount.

July 2022

The Award has been updated to reflect the Fair Work Commission’s National Minimum Wage increase of detailed in the Annual Wage Review 2021-22 decision. This also includes updates to expense-related allowances. Information on the Determinations can be found here and here. These changes come into effect from the first full pay period on or after 1 July 2022. Please install these updates AFTER you have finalised your last pay run prior to the first full pay period commencing on or after 1 July 2022.

Unpaid Pandemic Leave has been disabled as this entitlement has now expired within this award. Additional information can be found on the Fairwork website.

January 2022

The Unpaid Pandemic Leave pay category has been updated and counts as service for entitlements under awards and the National Employment Standards.

If any staff have used this category previously, please adjust their Annual, Personal and Long Service Leave balances for any period of unpaid pandemic leave previously taken.

To identify affected employees and enter the leave accrual see: Calculating Missing Leave Accrual for Unpaid Pandemic Leave Taken

November 2021

The Award has been updated in line with the ATO's requirements for STP Phase 2 reporting. The reporting of gross earnings are now being disaggregated into distinguishable categories. The Pay Category payment classifications have been updated in line with the ATO specification categories found here. For further information please see our STP support article.

1 November 2021

The Award has been updated to reflect the Fair Work Commission’s National Minimum Wage increase of 2.5% detailed in the Annual Wage Review 2020-21 decision. This also includes updates to expense-related allowances. Information on the Determinations can be found here and here. These changes come into effect from the first full pay period on or after 1 November 2021.

Please install these updates AFTER you have finalised your last pay run prior to the first full pay period commencing on or after 1 November 2021.

August 2021

The award name has been updated to "Racing Industry Ground Maintenance Award 2020 (MA000014)" to reflect changes made as part of the Fair Work Decision 4 year review of modern awards.

Updates have been made to the Unpaid Pandemic Leave allowance Templates so that the balance is displayed in weeks instead of hours in line with the Fair Work Commission's guidelines.

Once the award update is installed, all employee’s Unpaid Pandemic leave balances will be displayed in weeks not hours. This will mean that an employee’s balance may now show as 76 weeks. In order to correct the balance please see How to Fix Unpaid Pandemic Leave Balance Data.

Updates have also been made to the Leave Category Family & Domestic Violence Leave, so that the balance is displayed in days instead of hours in line with the National Employment Standards.

Once the update is installed, all employee’s FDV leave balances will be displayed in days not hours. This will mean that an employee’s balance may now show as 38 days. In order to correct the balance please see How to Fix Family & Domestic Violence Leave Balance Data.

July 2021

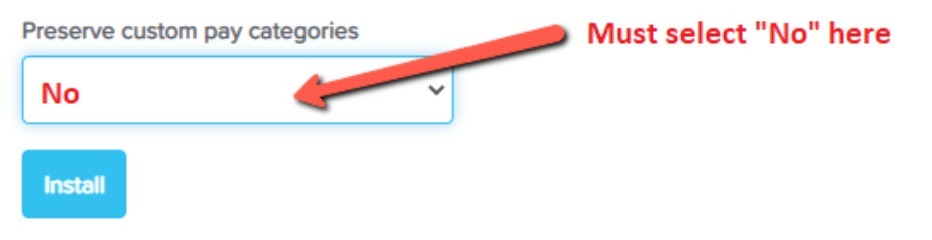

This update is to ensure that any new installs of this award conducted since 1 July are now captured with the SG increase from 9.5% to 10% for all pay categories. If you have installed this award between 1 July 2021 to 8 July 2021 for the first time, please ensure you select "NO" to preserve custom pay categories. If you were using this award prior to 1 July 2021, then you do not need to select "NO." Further information can be found in Incorrect SG rate used in pay runs article here.

1 February 2021

The Award, as part of Group 3 Awards, has been updated to reflect the Fair Work Commission’s National Minimum Wage increase of 1.75% detailed in the Annual Wage Review 2019-20 decision. This also includes updates to expense-related allowances. Information on the Determinations can be found here and here. These changes come into effect from the first full pay period on or after 1 February 2021. Please install these updates AFTER you have finalised your last pay run prior to the first full pay period commencing on or after 1 February 2021.

August 2020

The award has been updated to reflect the High Court's decision on the accrual of personal/carer's leave which overturns the decision made by the Full Federal Court of Australia, with personal/carer's leave being calculated on working days not hours. Information on the decision can be found here. As such, we have removed the Personal/Carer's (10 days) Leave Allowance Templates and updated associated Employment Agreements. Please note, this update will not remove any of the above from a business where the award was already installed prior to 25 August 2020. However, any new award installs from 25 August 2020 will not display personal/carer's (10 days) leave details.

For further information on migrating from daily personal/carers leave accruals to hourly please refer here

April 2020

The award has been updated to reflect changes made as part of the Fair Work Decision around flexibility during coronavirus. The new schedule allows employees to take up to two (2) weeks unpaid pandemic leave. A new pay category (Unpaid Pandemic Leave Taken), leave category and work type (Unpaid Pandemic Leave) have been created. Also, the rule sets have been updated, where necessary, to include/exclude the work type and leave category to some pay conditions. Further, the Leave Allowance Templates have been updated to ensure this new leave category is enabled and is now accessible for employees to take this leave when required.

Further, under this new schedule employees can take up to twice as much annual leave at a proportionally reduced rate if their employer agrees. The employee's pay rate and leave balance will need to be manually adjusted to half in each pay run for the period of leave.

February 2020

Due to recent changes to the interpretation of personal/carer's leave accrual under the National Employment Standards, updates have been made to the setup of the Award. Further information can be found here.

A new Leave Category called Personal/Carer's (10 days) Leave has been created. Also, new Leave Allowance Templates (LATs) have been created specific to 10 days accrual per year for each state and the LATs have been attached to the current Employment Agreements for selection options for an employee's LAT in their Employee Default Pay Run screen. Any rules impacted by Personal/Carer's Leave have also been updated with the new leave category.

Instructions on converting the accruals to the 10 day method can be found here.

July 2019

Rounding update for Casual Pay Rate Templates.

30 June 2019

The Award has been updated to reflect the Fair Work Commission’s National Minimum Wage increase of 3% from its Annual Wage Review 2018-19 decision. This also includes updates to expense-related allowances. Information on the Determinations can be found here and here.

These changes come into effect from the first full pay period on or after 1 July 2019. Please install these updates AFTER you have finalised your last pay run prior to the first full pay period commencing on or after 1 July 2019.

December 2018

The setup of the Payroll Tax Exempt field in Payroll Settings>Pay Categories was replicating the PAYG Exempt field rather than creating a unique identity; when installed into the business settings. An audit has been carried out across the system and the issue has now been resolved with this update.

1 August 2018

The award has been updated to reflect changes made as part of the Fair Work Decision 4 year review of modern awards. The determination for the new clause in the modern award allowing employees to take unpaid leave to deal with family and domestic violence can be found here. Family and Domestic Violence leave applies from the first full pay period on or after 1 August 2018. Further information can be found at Fair Work.

Employees, including part-time and casual employees are entitled to 5 days unpaid family and domestic violence leave each year of their employment. The 5 days renews each 12 months of their employment but does not accumulate if the leave is not used.

A new leave category has been created - “Family and Domestic Violence Leave” and a new Work Type - “Family and Domestic Violence Leave taken”. The Leave Allowance Templates and any impacted rule conditions have also been updated.

June 2018

The Award has been updated to reflect the Fair Work Commission’s national minimum wage increase of 3.5% from its Annual Wage Review 2017-18 decision. This also includes updates to expense-related allowances.

These changes come into effect from the first full pay period on or after 1 July 2018. Please install these updates AFTER you have finalised your last pay run prior to the first full pay period commencing on or after 1 July 2018.

Additionally, the following changes have been made as part of this update:

- The Payment Summary Classification settings for Allowance based pay categories have been updated as per Single Touch Payroll (STP) requirements.

- We have created a new rule - 10.2(c) Apply Overtime - Over Advanced Standard Hours - Part-Time. This rule reflects the following provisions of clause 10.2(c):

- the hours worked each day;

- which days of the week the employee will work;

- the actual starting and finishing times of each day.

Previously we could only assess the number of hours worked per week for overtime purposes using the existing Apply Overtime - Over Standard Hours - Part Time rule. Now, however, we can assess the Advanced Standard Work Hours as set up within the employee's Pay Run Defaults screen.

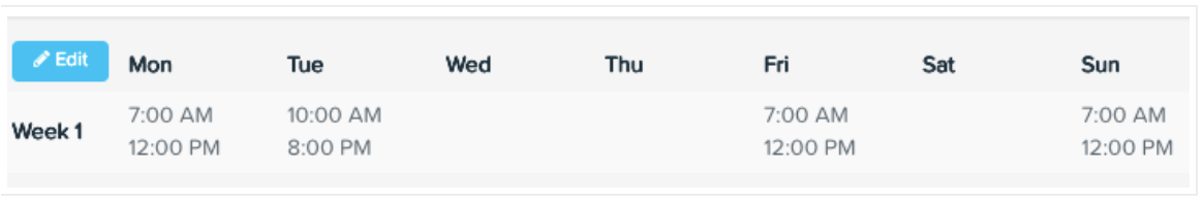

For example, if an employee's Advanced Standard Work Hours were as follows:

The rule will assess hours as follows:

- Any time worked on Wednesday, Thursday and Saturday will be deemed overtime;

- Any time worked before the start times on Monday, Tuesday, Friday and Sunday will be deemed overtime; and

- Any time worked after the end times on Monday, Tuesday, Friday and Sunday will be deemed overtime.

N.B:

(a) This rule only works where Advanced Standard Work Hours have been set up using start and finish times, NOT hours only;

(b) If no Advanced Standard Work Hours have been set up for a part time employee, then all hours will be deemed overtime.

If you have any feedback or questions please contact us via support@yourpayroll.com.au

Article is closed for comments.

Search for a feature, function or article…![Pay Cat Logo New 2.png]](https://www.paycat.com.au/hs-fs/hubfs/Pay%20Cat%20Logo%20New%202.png?height=50&name=Pay%20Cat%20Logo%20New%202.png)