Rounding is a necessary evil in payroll for a number of reasons:

- you can only actually "pay" an employee 2 decimal points (you won't see any more than 2 decimal places on the list of transactions in your bank account)

- an employee's hourly rate might be calculated from an annual salary figure

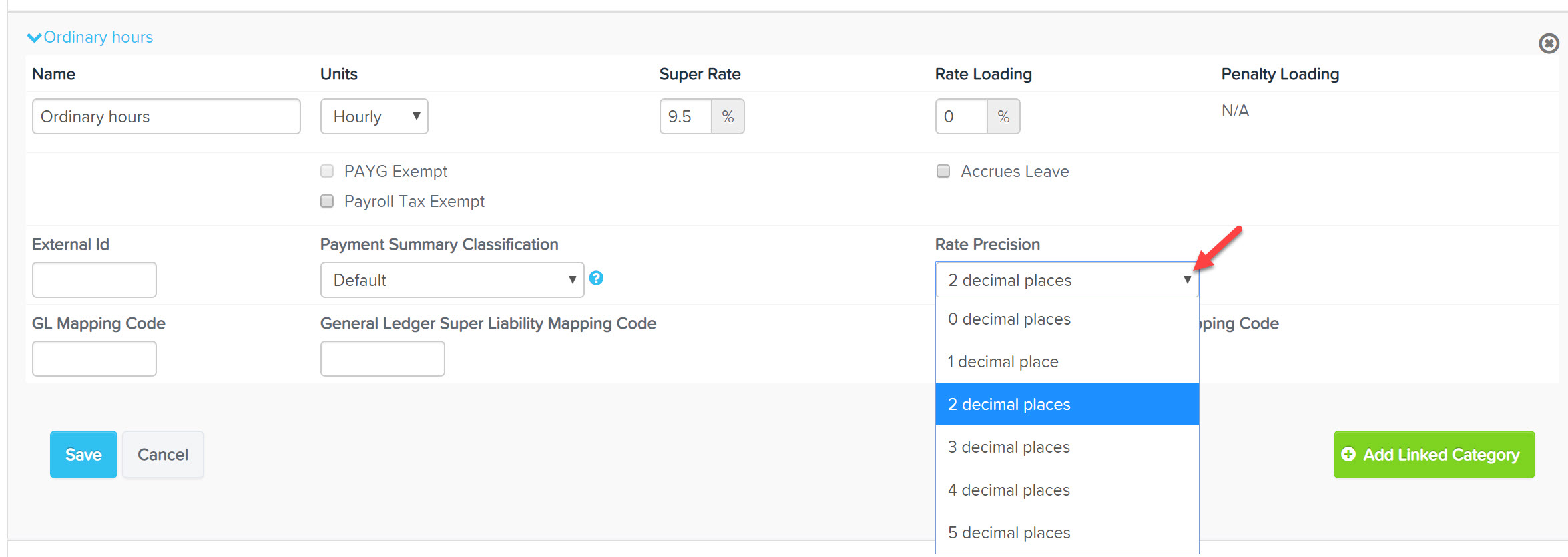

- a pay category can be set to have a rate precision of up to 5 decimal places

So, how/when is rounding done in the system?

In the pay run

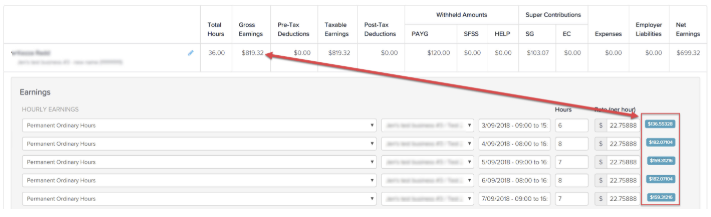

The rounding in the pay run happens when the gross earnings total is calculated. Meaning, all of the employee's earnings lines are totalled and then that figure is rounded to two decimal points.

Note in this example, the sum of the earnings lines is RM5,000.00055, so this is rounded to RM5,000.00.

This rounding is necessary because we give users the option to set a pay category to use up to 5 decimal places when calculating employee earnings in the pay run (the rate precision field is in the pay category settings, click here for more information on pay category settings).

If you're calculating earnings to 5 decimal places in the pay run then at some point you need to round the earnings down to 2 decimal points (so you can pay your employee net earnings with 2 decimal places).

In the Pay Run Journal

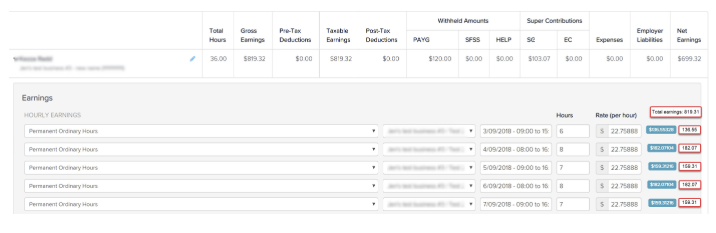

The rounding for pay run journals happens on each line...

... but as you can see in this example, the total earnings figure in the journal will vary (by 1sen) from the gross earnings figure in the pay run so when that happens, the system will add a 1sen balancing entry (because the journal has to balance).

By default, the earnings line that we choose to put the 1sen balancing entry on in the journal is an earnings line using the employee's Primary Pay Category (as set on the Pay Run Defaults page). If there are no earnings lines using the Primary Pay Category we'll put the 1sen against the pay category/earnings line with the highest earnings total. If there are multiple earnings lines using different pay categories with the equal highest total, one is chosen at random.

Year to date (YTD) figures

On the pay slip YTD figures displayed on the pay slip are rounded once only, at the end of the most recent pay period. Meaning, the YTD figure you see on the pay slip is calculated by totalling up all unrounded earnings lines from all pay runs for the basis period to date for that employee, and then rounding that total to 2 decimal points. So, the rounding on the last pay slip (at the end of the basis period) is the total of all earnings lines for the whole basis period. This is why you'll occasionally see a small variation between the total earnings figure for the basis period on the reports when compared to the YTD figure on the pay slip.

Rounding in reports

Not all reports round the same way:

The Detailed Activity Report (DAR), Pay Categories Report round each earnings line individually - as per the pay run journal method. So these reports will show the total of all of the (already rounded) earnings figures from each pay run.

The Gross to Net report (G2N) report totals up all unrounded earnings for the filtered period, and then rounds the total. It does this to try to match the Pay Slip (which sums the unrounded earnings lines for the basis period to date and displays it as a 2 decimal points total).

If you have any questions or feedback, please let us know via support@yourpayroll.io