This page is available to all businesses that have enabled STP and can be accessed via Reports > Single Touch Payroll (under the 'ATO Reporting' list)

From here you can view the details of all historical events as well as perform other actions like creating a new pay run, creating an update event and launching the finalisation wizard.

Historical Events

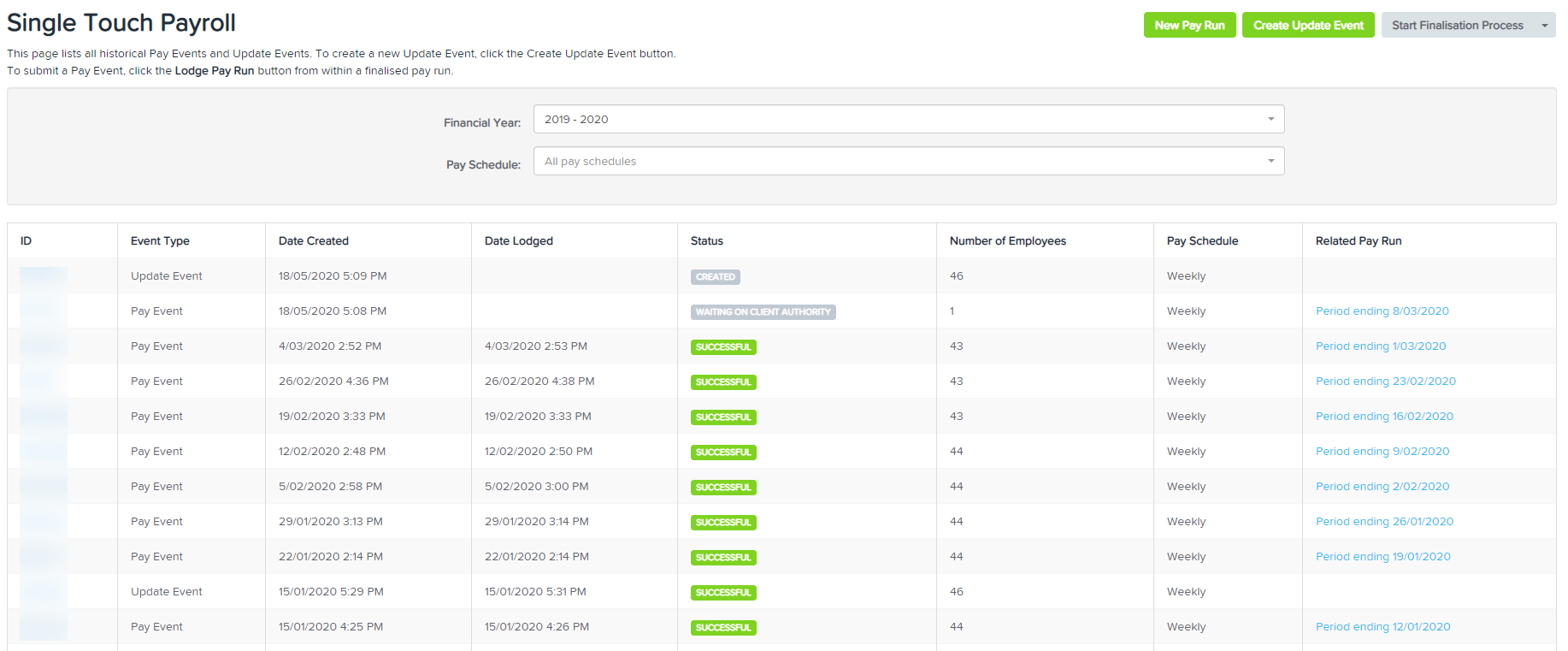

This screen will list all historical Pay Events, Update Events, Finalisation Event & Amended Finalisation Event for a specific financial year. You can further filter this page by choosing a specific pay schedule. Otherwise, the default view will include all pay schedule events. If you do filter by pay schedule or change the financial year, click on 'Search' thereafter to refresh the results displayed.

An example of the results displayed on this screen are as follows:

The following describes each component of this report:

- ID: Each pay event/update event has it's own unique ID (similar to a pay run). When you click on the ID, you will be directed to another screen that provides more detail of that event. This includes the wages/figures being reported to the ATO, lodgement details and errors (if applicable) as well as the ability to export the data to excel.

- Event Type: The options here may include - Pay Event, Update Event, Finalisation Event and Amended Finalisation Event.

- Date Created: This is the date and time the event was created.

- Date Lodged: This is the date and time the event was lodged with the ATO. This information reflects the lodgement date & time from the Lodgement Details tab within the actual event.

- Status: The options here are:

- Created: The pay event has been created upon finalising the pay run or an update event has been created. The client authorisation is yet to be requested (where lodging as Tax/BAS Agent) or lodgement has not yet been processed.

- Waiting on client authority: Client authorisation has been requested and either (a) awaiting client action or (b) client has rejected lodgement and so another client request needs to be sent. If a client has rejected a lodgement, full access users will receive an email notification. A notification will also appear on your payroll dashboard.

- Client authorised: Client authorisation has been requested and client has approved lodgement. When a client authority is approved, full access users will receive an email notification. A notification will also appear on your payroll dashboard.

- Awaiting ATO processing: The event has been lodged with the ATO and is awaiting final ATO confirmation of success or failure.

- Partially Successful: The event has been lodged with the ATO and there are one or more employees with errors. Any employees containing errors will not have been lodged as part of this event. Refer further below on how to address partially successful lodgements.

- Successful: The event has been lodged with the ATO and no errors have occurred.

- Failed: The event has been lodged with the ATO and the whole submission has failed. If this occurs, you will be advised as to the reason for the error. This type of scenario usually relates to an error in the setup of business/tax agent/intermediary details or ATO connection and so we suggest here fixing the error as detailed and lodging an update event.

- Number of Employees: The number of employees included in the event.

- Pay Schedule: You will note here that update events are associated to a pay schedule, despite the fact there is no pay run attached. This is because the data being submitted to the ATO needs to be filtered by pay schedule, similar to a pay event.

- Related Pay Run: This only applies to pay events as pay events are attached to a pay run. When you click on the pay run, you will be directed to the pay run screen of that related pay run.

New Pay Run

Clicking on the New Pay Run option here will give you the pop-up modal where you can enter the details of the new pay run you would like to create. This will work in the same was it would if you were to select the new pay run option from the payroll dashboard.

See here for further details - Creating a New Pay Run

Creating an Update Event

Clicking on the Update Event option here will give you the pop-up modal where you can enter the details of the update event you would like to create.

See here for further details on how to create an Update Event - Creating & Lodging an Update Event

What is the difference between a Pay Event & an Update Event?

Pay Event

Whenever an employer makes a payment (that is, creates a pay run) to an employee that is subject to withholding, they are required to lodge a pay event with the ATO on or before the date the payment is made. This includes where the amount of withholding is $0 (for example where an employee's gross income is below the tax free threshold) or where the employee has no net pay (for example where the employee is repaying an advance or overpayment to the employer, voluntarily foregoing their net pay).

A pay event reports employee YTD gross payments, tax withheld, allowances, deductions and superannuation liability information for each individual employee reported. As employee amounts are YTD, once an amount has been reported it should continue to be reported even if it has not changed (for example ETPs should continue to be reported in each pay event after they are first reported if the employee is included in any subsequent pay events).

Basically, once a pay run is finalised, a pay event should be lodged with the ATO.

Update Event

An update event is used to report changes to employee YTD amounts previously reported to the ATO. Update events are not associated to any pay runs and thus can only be created when an employee payment has not been made. Other examples of why an update event would be created include:

-

Upon transferring YTD payroll data from one payroll system to another to align the latest employer BMS data with the last employee data reported to the ATO;

-

To assist with EOFY processes, including finalisation and amendments to STP. After 30 June, any changes made to reported employee data for the prior financial year must only be submitted through an update event.

Start Finalisation Process

Clicking on the Start Finalisation Process option will launch the finalisation process wizard. This should only be done at the end of the financial year when no further payments will be made to your employees for the financial year.

See here for further details on how to process your end of year using the finalisation wizard - STP: Processing Finalisation Events using the EOFY Wizard

NOTE: once a finalisation process has been processed you will then be given the option to process an Amended Finalisation if you require. This option will appear from a drop-down arrow within the Start Finalisation Process option.

See here for further details on how to process an amended finalisation event - Creating and Lodging an Amended Finalisation Event

Our complete STP Guide can be found here.

If you have any questions or feedback, please let us know via support@yourpayroll.com.au