Social, Community, Home Care and Disability Services Industry Award 2010 (MA000100)

This article provides guidelines about when to use the different work types and tags that are included as part of the pre-built Social, Community, Home Care and Disabled Services Industry (abbreviated to SACS) award packages. For further information about the SACS award, refer to Social Community, Home Care and Disability Services Industry Award.

Key Updates to Award

Last Updated: August 2023

Key_Updates

**NOTE - Pay rates for social and community service employees and crisis accommodation employees are gradually increasing under the Equal Remuneration Order made by the Fair Work Commission. The increase will apply in full by 2020. This Award contains pay rates for these employees who would otherwise not have have been covered or subject to the following pre-reform Awards:

- Charitable Sector, Aged and Disability Care Services (State) Award 2003 [AN120117]

- Charitable, Aged and Disability Care Services (State) Award [AN120118]

- Social and Community Services Employees (State) Award [AN120505]

- Disability Support Workers Award - State [AN140093]

- Disabilities Services Award [AN150046]

- Social and Community Services Award [AN150140]

- Aged and Disabled Persons Hostels Award [AN160007]

- Community Services Award [AN170020]

- Crisis Assistance Supported Housing (Queensland) Award 1999 [AP777903]

- Residential and Support Services (Victoria) Award 1999 [AP795711]

- Social and Community Services - Victoria - Award 2000 [AP796561]

- Social and Community Services (ACT) Award 2001 [AP808334]

- Social and Community Services (Queensland) Award 2001 [AP808848]

- Social and Community Services - Western Australia Award 2002 [AP815319]

- Community and Aged Care Services (ACT) Award 2002 [AP817098]

- Social and Community Services Industry - Community Services Workers - Northern Territory Award 2002 [AP817216]

If you were or would have been subject to any of the above awards, the pay rates for social and community service employees and crisis accommodation employees may be different. Please check with Fair Work to determine the correct rates of pay for these employees.

Installing and Configuring the Pre-Built Award Package

For details on how to install and configure this Pre-built Award Template, please review the detailed help article here.

While every effort is made to provide a high-quality service, YourPayroll does not accept responsibility for, guarantee or warrant the accuracy, completeness or up-to-date nature of the service. Before relying on the information, users should carefully evaluate its accuracy, currency, completeness and relevance for their purposes, and should obtain any appropriate professional advice relevant to their particular circumstances.

Work Types

Work types are a description of the kind of shift you are working, and are selected when you record a timesheet. The following is a list of work types employees can select on their timesheet, and the meaning of each item.

10 hr shift by agreement

Choose this work type when, by agreement between an employer and a full time employee, the employee is rostered for up to 10 hours (rather than the usual 8 hours).

24 hour care shift

Choose this work type for the portion/s of a 24-hour care shift where the employee is providing care.

24 hour care shift - Inactive Time

Choose this work type for the portion/s of a 24-hour care shift where the employee is not providing care.

Agreed 8 hour break between shifts

Choose this work type when an employee has agreed to work with less than a 10 hour break in between shifts.

Annual Leave

Choose this work type when annual leave was taken.

Broken Shift (1 unpaid break)

This is a hidden work type and is automatically assigned to broken shifts with 1 unpaid break. No action is required to be taken to assign this work type to broken shifts with 1 unpaid break.

Broken Shift (2 unpaid breaks)

Choose this work type when an employee works a broken shift with 2 unpaid breaks. The work type can be applied to any or all of the individual broken shift segments.

Ceremonial Leave

Choose this work type when ceremonial leave was taken.

Compassionate Leave

Choose this work type when compassionate leave was taken.

Excursion

Choose this work type when an employee is required by the employer and agrees to supervise clients in excursion activities involving overnight stays from home.

Kilometre Allowance

Choose this when an employee is required and authorised by an employer to use their own motor vehicle in the performance of their duties, this work type should be used. The number of kilometres should be entered in the units field.

Launder clothing other than uniforms

Choose this work type when the clothing of an employee (other than a uniform) is soiled in the course of the performance of their duties.

Long Service Leave

Choose this work type when long service leave was taken.

No Meal Break

Choose this work type to indicate that no meal break was taken during the shift.Normally, meal breaks are automatically added for shifts over 5h30m.

On Call

Choose this work type where an employee is required to be on call (i.e. available for recall to duty) during any 24 hour period or part thereof.

Overtime Meal Allowance (1+ OT hrs worked)

Choose this work type where an employee is required to work more than one hour after their usual finishing time or, in the case of shiftworkers, when the overtime work on any shift exceeds one hour. If an employee has been supplied a meal then this workt ype does not need to be selected.

Overtime Meal Allowance (4+ OT hrs worked)

Where an employee is required to work more than 4 hours of overtime, choose this work type instead of the "Overtime Meal Allowance (1+ OT hrs worked)" work type.

Paid Meal Break

Choose this work type when an employee is required by the employer to have a meal with a client or clients as part of the normal work routine or client program.

Personal/Carer's Leave

Choose this work type when sick leave was taken.

Public Holiday not Worked

An employee should choose this work type if their rostered day off falls on a public holiday.

Remote Work - On Call

Choose this work type when an employee performs remote work while on call.

Remote Work - Not on Call

Choose this work type when an employee performs remote work where the employee is not on call.

Remote Work - Meetings/Training

Choose this work type when an employee performs remote work that involves participating in staff meetings or staff training remotely.

Sleepover

Choose this work type when an employer requires an employee to sleep overnight at premises where the client for whom the employee is responsible is located.

Time in Lieu Taken

Choose this work type when time in lieu was taken.

Time off in Lieu of Overtime*

Choose this work type when the employee elects to receive time off in lieu rather than be paid for any overtime they are entitled to for this shift.

Unpaid Leave

Choose this work type when unpaid leave was taken.

Work during Sleepover

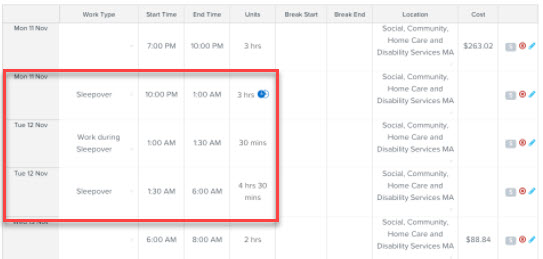

Choose this work type where an employee is required to undertake work during a sleepover shift. All time worked during a sleepover shift is paid at overtime rates within a minimum 1 hour of payment. If the employee is entering timesheets, and also the 'sleepover' work type, they will need to ensure that these do not overlap. E.g. if the employee was clocking on and off using WorkZone, he or she would have to go back in and edit their timesheet if they had to wake up during the sleepover, adding a new line for each period of 'sleepover' and 'work during sleepover'.

If they’re entering timesheets at the end of the day i.e. not clocking on / off, then they would create the timesheet like so - see the span of hours across Monday through to Tuesday:

Shift Conditions

Shift Conditions are further detail you can add to a shift where perhaps more than one work condition applies to your shift. Create a new shift each time a shift condition changes. Shift conditions are selected when you edit a timesheet record, or when clocking on using the ClockMeIn Time and Attendance app. The following is a list of Shift Conditions employees can select on their timesheet and a reference guide for each item.

10 hr shift by agreement

Select this work type when, by agreement between an employer and a full time employee, the employee is rostered for up to 10 hours (rather than the usual 8 hours).

Agreed 8 hour break between shifts

Select this work type when an employee has agreed to work with less than a 10 hour break in between shifts.

Broken Shift (1 unpaid break)

This is a hidden work type and is automatically assigned to broken shifts with 1 unpaid break. No action is required to be taken to assign this work type to broken shifts with 1 unpaid break.

Broken Shift (2 unpaid breaks)

Choose this work type when an employee works a broken shift with 2 unpaid breaks. The work type can be applied to any or all of the individual broken shift segments.

Launder clothing other than uniforms

Choose this work type when the clothing of an employee (other than a uniform) is soiled in the course of the performance of their duties.

Paid Meal Break

Select this work type when an employee is required by the employer to have a meal with a client or clients as part of the normal work routine or client program.

Tags

Employee Tags are specific conditions typically related to the employee’s agreement. These are often conditions negotiated and agreed between the employer and the employee, or unique characteristics of the employee’s role which are recurring and ongoing.

7-day shift worker

No longer applicable

Crisis Accommodation Services

Assign this tag if the employee is to be treated as a Crisis Accommodation Services employee for the purposes of overtime calculation.

Day Care Services

Assign this tag if the employee is to be treated as a Family Day Care Services employee for the purposes of overtime calculation.

Disability Services

Assign this tag if the employee is to be treated as a Disability Services employee for the purposes of overtime calculation.

First Aid

Assign this tag if the employee is allocated as a first aid officer for all shifts worked.

Home Care Services

Assign this tag if the employee is to be treated as a Home Care Services employee for the purposes of overtime calculation.

Laundry Allowance

Assign this tag if the employee is required to launder any special clothing or articles of clothing.

Social & Community Services

Assign this tag if the employee is to be treated as a Social and Community Services employee for the purposes of overtime calculation.

TIL of OT*

Assign this tag if the employee elects to always accrue time in lieu rather than be paid overtime.

Uniform Allowance

Assign this tag if the employee is to be paid a uniform allowance rather than be provided with uniforms.

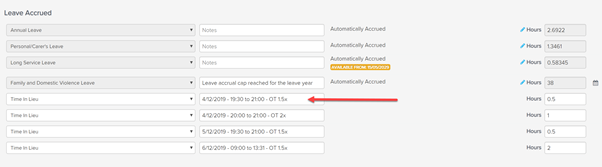

*Time off instead of payment for overtime leave is accrued at the same rate as the number of overtime hours worked. EXAMPLE: an employee who worked two (2) overtime hours is entitled to two (2) hours’ time off. If time off for overtime is not taken and the time off is to be paid out, it must be paid at the overtime rate applicable to the overtime when worked. This also applies when an employee is terminated and the time off is to be paid out. In order to be paid out correctly, the overtime rate will need to be recorded manually at the same time as the time in lieu accrual is processed. It is suggested that you record the overtime details in the “notes” section of the leave accrual line in the pay run.

If you are required to pay out the time off for overtime either before termination or during termination, you can run a Pay Run Audit Report for the pay runs for the employee when Time in Lieu was accrued to determine the applicable rates (which will detail your notes) and run an Employee Payment History Report to determine if any of the time off for overtime has been taken. You can then determine the correct balance based on the number of hours by taking the equivalent to the overtime payment that would have been made EXAMPLE: an employee who worked two (2) overtime hour at what would have been the rate of time and a half, is then entitled to three (3) hours of time off leave to be accrued. In our above example (the first accrual line of the screen shot) you would take 0.5 hours x 1.5 = 0.75 hours. Therefore, you will need to adjust the time in lieu balance by adding a further 0.25 hours (0.75 hours – 0.5 hours = 0.25 hours).

Key Updates

August 2023 11thWe have updated the Employment Agreements setting for home care employees—aged care to allow the employees assigned to the General Home care employment agreements to select the aged care roles as a higher classification.

Please note that this setting only applies to the General Home care employees. If the employee is primarily engaged to perform aged care work in a direct care capacity and performs some disability work on an ad-hoc basis, FWO advises that as a general rule, they would be looking at the primary purpose of engagement of the employee and in this instance, it would mean all hours may be remunerated at the aged care rate.

1st From 1 August, all employees are entitled to 10 days of paid family and domestic violence leave each year. The (Unpaid) Family and Domestic Violence Leave configuration settings under awards have been updated - the leave category is disabled from award leave allowance templates, and the work type is not enabled automatically for all employees. Please ensure that employees no longer use the unpaid leave category or work type. July 2023 1stThis includes Fair Work Commission recent change to increase minimum wages by 15% for some employees working in aged care.

In line with the change, new pay rate templates and employment agreements have been created. New “Home care employees—aged care” pay rate templates and employment agreements are for home care employees providing services to an aged person. Existing “Home Care” pay rate templates and employment agreements are for home care employees providing services to a person with a disability. You can find further information on what you should be aware of here.

May 2023

1st

We have updated the award to make sure that the Broken Shift rule will not override the Public Holiday not Worked and that the Maximum Daily Hours (10 hours by agreement) - Full Time will apply at any shift of the day.

31st

We have updated the Pay Category payment classification for Community Service Leave Taken in line with the ATO specification categories found here.

January 2023

23rd

We have updated the SCHCDS Permanent Day Worker ruleset to exclude On Call work type from the Broken Shift rule calculation.

31st

We have updated the award to reflect changes made as part of the Fair Work Decision regarding Paid Family and Domestic Violence Leave.

We have created the following new categories:

- New Leave Category: Paid Family and Domestic Violence Leave.

- New Pay Category: Paid Family and Domestic Violence Leave.

- New Work Type: Paid Family and Domestic Violence Leave taken.

We have updated the Leave Allowance Templates to disable the existing unpaid Family and Domestic Violence and we have enabled the new Paid Family and Domestic Violence Leave. We also updated any impacted rule conditions.

As part of Fair Work's ruling, an employee must be paid their full pay rate; this includes their base rate plus any incentive-based payments and bonuses, loadings, monetary allowances, overtime or penalty rates, and any other separately identifiable amount.

December 2022

Unpaid Pandemic Leave has been disabled as this entitlement has now expired within this award. Additional information can be found on the Fairwork website.

October 2022

The SCHCDS Permanent Shift Worker, SCHCDS Permanent Day Worker, SCHCDS Casual Day Worker and SCHCDS Casual Shift Worker rulesets have been updated to exclude Remote Work - Training/Meetings, Remote Work - On Call & Remote Work - Not on call from the calculation of Broken Shift (more than 12 hours) rule.

September 2022

The SCHCDS Permanent Shift Worker, SCHCDS Permanent Day Worker, SCHCDS Casual Day Worker and SCHCDS Casual Shift Worker rulesets have been updated to exclude Sleepover and 24 Care Shift - Inactive Time from the calculation of First Aid Allowance (tag) & First Aid Allowance (work type) rules.

August 2022

The SCHCDS Permanent Shift Worker, SCHCDS Permanent Day Worker rulesets have been updated to correct First Aid Allowance weekly allowance as per the award.

The SCHCDS Permanent Shift Worker, SCHCDS Permanent Day Worker, SCHCDS Casual Day Worker and SCHCDS Casual Shift Worker rulesets have been updated to exclude Work during a sleepover from Ordinary hours for the purpose of overtime hours.

The SCHCDS Permanent Shift Worker, SCHCDS Permanent Day Worker, SCHCDS Casual Day Worker and SCHCDS Casual Shift Worker rulesets has been updated to ensure Broken Shift (1 unpaid break) work type and Paid Meal Break work types are applied correctly.

20 July 2022

The SCHCDS Permanent Shift Worker, SCHCDS Permanent Day Worker, SCHCDS Casual Day Worker and SCHCDS Casual Shift Worker rulesets have been updated to exclude Sleepover and Kilometre Allowance work types from the Assign Broken Shift (1 unpaid breaks) Work Type and Assign Broken Shift (2 unpaid breaks) Work Type rules to ensure correct calculation of Sleepover and Kilometre Allowances.

1 July 2022

There have been four updates to the award. These changes into effect from the first full pay period on or after 1 July 2022. Please install these updates AFTER you have finalised your last pay run prior to the first full pay period commencing on or after 1 July 2022.

1. Annual Wage Review 2021.22

The Award has been updated to reflect the Fair Work Commission’s National Minimum Wage increase of detailed in theAnnual Wage Review 2021-22 decision. This also includes updates to expense-related allowances. Information on the Determinations can be found here and here . These changes come into effect from the first full pay period on or after 1 July 2022.

2. Weekly Overtime Updates (System Improvement - Unrelated to Legislation Changes)

All rulesets have been updated to ensure that the correct overtime tiers are applied when an employee exceeds the standard hours per pay period. The tiers will now be applied once across all matching overtime shifts.

3. Removal of Unpaid Pandemic Leave

Unpaid Pandemic Leave has been disabled as this entitlement has now expired within this award. Additional information can be found on the Fairwork website .

4. Major Updates to the Award as Part of the 4 Yearly Review

**Important: Please read carefully**

Significant changes have been made to the configuration of the award to enact changes as part of the 4 yearly review of modern awards for the Social, Community, Home Care and Disability Services Industry Award. These changes come into effect from the first full pay period on or after 1 July 2022. More information is available here .

Actions You Must Take

In order to ensure you are using the system correctly to apply these changes we recommend that you do the following:

- Read the below section called “Summary of New Work Types and Shift Conditions to Assign to Timesheets” to understand the new work types and when they must be assigned to timesheets.

- Read the below section called “List of All System Changes” to understand what changes have been made within KeyPay and how this will impact pays processed after 1 July.

- Install the updates after you have finalised your last pay run prior to the first full pay period commencing on or after 1 July 2022.

Summary of New Work Types and Shift Conditions to Assign to Timesheets

The following are new work types that must be added to timesheets in the described scenarios. Please note, if you are using an external timesheet system, the below new work types will need to be configured in your external system.

Launder clothing other than uniforms

Choose this work type when the clothing of an employee (other than a uniform) is soiled in the course of the performance of their duties. This work type is also available as a shift condition.

Broken Shift (1 unpaid break)

This is a hidden work type and is automatically assigned to broken shifts with 1 unpaid break. No action is required to be taken to assign this work type to broken shifts with 1 unpaid break. This work type is also available as a shift condition.

Broken Shift (2 unpaid breaks)

Choose this work type when an employee works a broken shift with 2 unpaid breaks. The work type can be applied to any or all of the individual broken shift segments. This work type is also available as a shift condition.

Remote Work - On Call

Choose this work type when an employee performs remote work while on call.

Remote Work - Not on Call

Choose this work type when an employee performs remote work where the employee is not on call.

Remote Work - Meetings/Training

Choose this work type when an employee performs remote work that involves participating in staff meetings or staff training remotely.

24 hour care shift - Inactive Time

Choose this work type for the portion/s of a 24-hour care shift where the employee is not providing care.

List of All System Changes

Change to Award: New Minimum Engagement for Part Time Employees (Clause 10.5)

The SCHCDS Permanent Shift Worker and SCHCDS Permanent Day Worker rulesets have been updated to ensure that the new minimum engagement requirements for part time employees are applied. A 3 hour minimum engagement will be applied for part time social and community services employees (except when undertaking disability services work) and a 2 hour minimum engagement will be applied for all other employees.

Change to Award: Changes to Minimum Engagement for Casual Employees (Clause 10.5)

The SCHCDS Casual Shift Worker and SCHCDS Casual Day Worker rulesets have been updated to reflect changes to the minimum engagement requirements for casual employees. The one hour minimum engagement requirement for Home Care employees has been removed. The new minimum engagement requirements for casual employees are a 3 hour minimum engagement for social and community services employees (except when undertaking disability services work) and a 2 hour minimum engagement for all other employees.

Change to Award: New Allowance - Laundering of clothing other than uniforms (Clause 20.3)

All rulesets have been updated to incorporate the new laundry allowance payable when the clothing of an employee (other than a uniform) is spoiled in the course of the performance of their duties. To pay this allowance, the work type or shift condition Launder clothing other than uniforms must be assigned to the employee's timesheet.

Change to Award: New Allowances - Broken Shifts (Clause 20.12)

All rulesets have been updated to incorporate two new broken shift allowances for social and community services employees when undertaking disability services work and for home care employees. Two new pay categories have been created; Broken Shift Allowance (1 unpaid break) and Broken Shift Allowance (2 unpaid breaks). Two new work types have also been created; Broken Shift (1 unpaid break) and Broken Shift (2 unpaid breaks). These work types have also been added as shift conditions.

For broken shifts with 1 unpaid break, we have configured the rulesets to automatically apply the work type based on certain criteria. Therefore, you do not need to assign the Broken Shift (1 unpaid break) to any shifts. The automatic application of the work type enables the broken shift allowance for 1 unpaid break to be paid to the employee.

For broken shifts with 2 unpaid breaks, the Broken shift (2 unpaid breaks) work type must be manually assigned to any or all of the individual broken shift segments. The manual application of the work type enables the broken shift allowance for 2 unpaid breaks to be paid to the employee.

Change to Award: Change of Criteria for Night Shift on Broken Shifts (Clause 25.6e(ii))

The SCHCHS Permanent Shift Worker and SCHCHS Casual Shift Worker rulesets have been updated to ensure that when an employee works a broken shift, the night shift allowance is not paid for work performed on night shift that commences before 6:00am.

Change to Award: Changes to 24-hour Care Shift Payments (Clause 25.8)

All rulesets have been updated to action changes to the 24-hour care clause. An employee who works a 24-hour care shift is now entitled to payment for work exceeding 8 hours. The work exceeding 8 hours will now also be paid at the applicable overtime rate. In addition to the existing work type, 24 hour care shift, we have added a new work type called 24 hour care shift - Inactive Time. This is to distinguish between parts of the shift where the employee is and is not providing care.

Change to Award: New Clause for Remote Work (Clause 25.10)

All rulesets have been updated to accommodate the new Remote Work clause. Three work types have been created, Remote Work - On Call, Remote Work - Not on Call and Remote Work - Meetings/Training.

A minimum engagement of 15 minutes will now apply to an employee who is on call and performs remote work between 6:00am and 10:00pm. A minimum engagement of 30 minutes will now apply to an employee who is on call and performs remote work between 10:00pm and 6:00am. A minimum engagement of 1 hour will apply to an employee who is not on call and performs remote work at any time. A minimum engagement of 1 hour will also apply to an employee who performs work by participating in staff meetings or staff training remotely. All time worked exceeding the minimum engagement will be rounded to the nearest 15 minutes.

The rate paid for overtime work will differ depending on the time of day or day of week as detailed in section d of clause 25.10.

May 2022

The SCHCDS Casual Day Worker and the SCHCDS Casual Shift Worker rulesets have been updated to ensure that when a social and community services employee undertakes disability services work, a 2 hour minimum engagement applies.

February 2022

The rule set pay conditions for SCHCDS Permanent Day Worker, SCHCDS Casual Day Worker, SCHCDS Permanent Shift Worker and SCHCDS Casual Shift Worker have been updated to include shift conditions for 10 hour shift by agreement, Agreed 8 hour break between shifts, and Paid Meal Break. These shift conditions can now be used as options. The work types still exist as well.

Updates have made to the Minimum break between shifts rules to exclude that from being paid when the employees are on Sleepover, in Pay Condition Rule sets SCHCDS Permanent Day Worker and SCHCDS Permanent Shift Worker.

All rulesets have also been adjusted to ensure that when a shift fits both conditions of a no meal break penalty and overtime due to maximum daily hours, that the correct no meal break overtime pay categories are applied and the overtime tier does not reset.

January 2022

The Unpaid Pandemic Leave pay category has been updated and counts as service for entitlements under awards and the National Employment Standards.

If any staff have used this category previously, please adjust their Annual, Personal and Long Service Leave balances for any period of unpaid pandemic leave previously taken.

To identify affected employees and enter the leave accrual see: Calculating Missing Leave Accrual for Unpaid Pandemic Leave Taken

November 2021

The Award has been updated in line with the ATO's requirements for STP Phase 2 reporting. The reporting of gross earnings are now being disaggregated into distinguishable categories. The Pay Category payment classifications have been updated in line with the ATO specification categories found here. For further information please see our STP support article.

September 2021

The rule set pay conditions for SCHCDS Permanent Day Worker, SCHCDS Casual Day Worker, SCHCDS Permanent Shift Worker and SCHCDS Casual Shift Worker have been updated to include new rules for Excursions as part of clause 25.9. A new work type called Excursion has been created for when an employee is working on an excursion activity. This work type should be selected on a timesheet when an excursion applies.

August 2021

Updates have been made to the Unpaid Pandemic Leave allowance Templates so that the balance is displayed in weeks instead of hours in line with the Fair Work Commission's guidelines.

Once the award update is installed, all employee’s Unpaid Pandemic leave balances will be displayed in weeks not hours. This will mean that an employee’s balance may now show as 76 weeks. In order to correct the balance please see How to Fix Unpaid Pandemic Leave Balance Data.

July 1 2021

The Award has been updated to reflect the Fair Work Commission’s National Minimum Wage increase of 2.5% detailed in the Annual Wage Review 2020-21 decision. This also includes updates to expense-related

allowances. Information on the Determinations can be found here and here.

These changes come into effect from the first full pay period on or after 1 July 2021. Please install these updates AFTER you have finalised your last pay run prior to the first full pay period commencing on or after 1 July 2021.

Updates have also been made to the Leave Category Family & Domestic Violence Leave, so that the balance is displayed in days instead of hours in line with the National Employment Standards.

Once the update is installed, all employee’s FDV leave balances will be displayed in days not hours. This will mean that an employee’s balance may now show as 38 days. In order to correct the balance please see How to Fix Family & Domestic Violence Leave Balance Data.

An update was made to the Laundry allowance to exclude that from being paid when the employees are on On-Call for the SCHCDS Permanent Day Worker, and SCHCDS Permanent Shift Worker pay condition rule sets, to ensure as part of clause 20.2(c).

An Update was made to the Broken Shift (more than 12 hours) pay condition rule sets to exclude that from being paid when the employees are on Sleepover, to comply with clause 25.6(a).

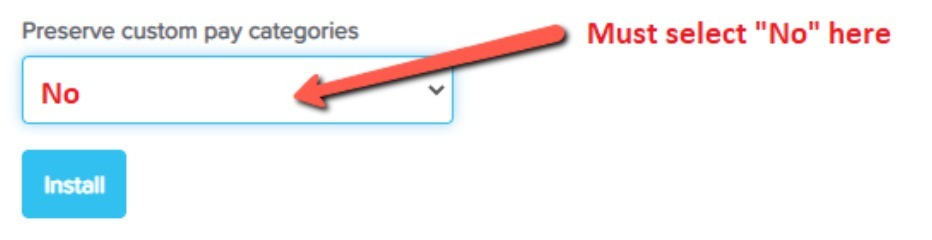

This update is to ensure that any new installs of this award conducted since 1 July are now captured with the SG increase from 9.5% to 10% for all pay categories. If you have installed this award between 1 July 2021 to 8 July 2021 for the first time, please ensure you select "NO" to preserve custom pay categories. If you were using this award prior to 1 July 2021, then you do not need to select "NO." Further information can be found in Incorrect SG rate used in pay runs article here.

June 2021

A new work type has been created Agreed 8 hour break between shifts. Pay condition rule sets SCHCDS Permanent Day Worker and SCHCDS Permanent Shift Worker have been updated to ensure when this work type is selected the less than 10 hour minimum break penalties are not applied.

April 2021

The pay condition rule set for SCHCDS Casual Shift Worker has been updated to map the pay category for no meal break public holiday overtime to the casual.

1 December 2020

The pay rates for Social and Community Services and Crisis Accommodation employees have been updated to reflect the Fair Work Commission's Equal Remuneration Order.

The new pay rates take effect from the first full pay period on or after 1 December 2020. Please install this update AFTER you have finalised your last pay run prior to the first full pay period commencing on or after 1 December 2020.

August 2020

The award has been updated to reflect the High Court's decision on the accrual of personal/carer's leave which overturns the decision made by the Full Federal Court of Australia, with personal/carer's leave being calculated on working days not hours. Information on the decision can be found here. As such, we have removed the Personal/Carer's (10 days) Leave Allowance Templates and updated associated Employment Agreements. Please note, this update will not remove any of the above from a business where the award was already installed prior to 25 August 2020. However, any new award installs from 25 August 2020 will not display personal/carer's (10 days) leave details.

For further information on migrating from daily personal/carers leave accruals to hourly please refer here

July 2020

The casual penalty loading for overtime pay categories have been updated to reflect changes made as part of the Fair Work Decision 4 year review of modern awards. The determination can be found here.

The Award, as part of Group 1 Awards, has been updated to reflect the Fair Work Commission’s National Minimum Wage increase of 1.75% detailed in the Annual Wage Review 2019-20 decision. This also includes updates to expense-related allowances. Information on the Determinations can be found here and here.

Included in the updates is also increases to the penalty rates for casual employees working on Saturday or Sunday as part of Fair Work's 4 yearly modern award reviews. The determination can be found here.

These changes come into effect from the first full pay period on or after 1 July 2020. Please install these updates AFTER you have finalised your last pay run prior to the first full pay period commencing on or after 1 July 2020.

April 2020

The award has been updated to reflect changes made as part of the Fair Work Decision around flexibility during coronavirus. The new schedule allows employees to take up to two (2) weeks unpaid pandemic leave. A new pay category (Unpaid Pandemic Leave Taken), leave category and work type (Unpaid Pandemic Leave) have been created. Also, the rule sets have been updated, where necessary, to include/exclude the work type and leave category to some pay conditions. Further, the Leave Allowance Templates have been updated to ensure this new leave category is enabled and is now accessible for employees to take this leave when required.

Further, under this new schedule employees can take up to twice as much annual leave at a proportionally reduced rate if their employer agrees. The employee's pay rate and leave balance will need to be manually adjusted to half in each pay run for the period of leave.

The work types Paid Meal Break and Sleepover have been excluded from the no meal break rules in the SCHCDS Permanent Day Worker, SCHCDS Casual Day Worker, SCHCDS Permanent Shift Worker, and SCHCDS Casual Shift Worker pay condition rule sets, to ensure as part of clause 27.1(c), an employee having a meal with a client is considered a qualified meal break and when on a sleepover, the employee is not required to take a meal break.

March 2020

Updates have been made to the rule set pay conditions for SCHCDS Permanent Day Worker, SCHCDS Casual Day Worker, SCHCDS Permanent Shift Worker and SCHCDS Casual Shift Worker:

- Exceeding hours rules for part-timers to exclude OT Clearing pay category

- All exceeding hours rules now apply to pay category OT Clearing if conditions are satisfied

- Included work type is not Paid Meal Break to the Automatic Meal Break rule

- Paid Meal Break work type is mapped to the Employee's Primary Pay Category

- New rules have been included for clause 27.1(b); payment of overtime when meal break is not given

- Clause 28.3; less than 10 hour break between shifts now applies double time if conditions are satisfied

New pay categories for No Meal Break for all pay conditions have been created for both permanent and casual employees and new pay categories for Minimum Break Between Shifts for all pay conditions for permanent employees have been created.

February 2020

Due to recent changes to the interpretation of personal/carer's leave accrual under the National Employment Standards, updates have been made to the setup of the Award. Further information can be found here.

A new Leave Category called Personal/Carer's (10 days) Leave has been created. Also, new Leave Allowance Templates (LATs) have been created specific to 10 days accrual per year for each state and the LATs have been attached to the current Employment Agreements for selection options for an employee's LAT in their Employee Default Pay Run screen. Any rules impacted by Personal/Carer's Leave have also been updated with the new leave category.

Instructions on converting the accruals to the 10 day method can be found here.

1 December 2019

The pay rates for Social and Community Services and Crisis Accommodation employees have been updated to reflect the Fair Work Commission's Equal Remuneration Order.

The new pay rates take effect from the first full pay period on or after 1 December 2019. Please install this update AFTER you have finalised your last pay run prior to the first full pay period commencing on or after 1 December 2019.

September 2019

Update to the rule set pay conditions for SCHCDS Permanent Day Worker, SCHCDS Casual Day Worker, SCHCDS Permanent Shift Worker and SCHCDS Casual Shift Worker to the First aid allowance for Part Time and Casual rules to ensure if the day has multiple shifts it is paid across all shifts and not limited to the first shift, the maximum units per week still applies.

Update to the employment agreement for Social & Community Services Level 3 (Shift Worker) - Casual to amend the Pay Rate Template to reflect Casual Social & Community Services Level 3 Paypoint 4 when the employees anniversary date has reached three years.

August 2019

Update to the rule set pay conditions for SCHCDS Permanent Day Worker, SCHCDS Casual Day Worker, SCHCDS Permanent Shift Worker and SCHCDS Casual Shift Worker to the exceeding hours rule to include weekly (38hrs), fortnightly (76hrs) and 4 weekly (152hrs) rule set periods. An audit was completed on the Permanent Pay Rate Templates to update any rounding.

Rounding update for Casual Pay Rate Templates.

July 2019

Update to the rule set pay conditions for SCHCDS Permanent Day Worker, and SCHCDS Permanent Shift Worker to Minimum Break between Shifts clause and the Broken Shift (more than 12 hours) clause to exclude leave taken.

Rounding update for Casual Pay Rate Templates.

30 June 2019

The Award has been updated to reflect the Fair Work Commission’s National Minimum Wage increase of 3% from its Annual Wage Review 2018-19 decision. This also includes updates to expense-related allowances. Information on the Determinations can be found here and here.

These changes come into effect from the first full pay period on or after 1 July 2019. Please install these updates AFTER you have finalised your last pay run prior to the first full pay period commencing on or after 1 July 2019.

May 2019

An update has been made to the Superannuation Contributions Guarantee (SG) for the On Call Allowance (Weekday) and On Call Allowance (Weekend & PH) pay categories to a zero percentage, in line with the ATO Allowance Guide.

May 2019

Update to the rule set pay conditions for SCHCDS Permanent Day Worker, SCHCDS Casual Day Worker, SCHCDS Permanent Shift Worker and SCHCDS Casual Shift Worker to the apply overtime rules for overtime worked on a Public Holiday. New rules were created for the 28.1 Apply Overtime pay conditions which now exclude the Public Holiday Overtime. A new rule was created - 34.2 Public Holiday Overtime to ensure double time and a half is paid for all overtime hours worked on a Public Holiday.

April 2019

Update to the rule set pay conditions for SCHCDS Permanent Day Worker, SCHCDS Casual Day Worker, SCHCDS Permanent Shift Worker and SCHCDS Casual Shift Worker to the "on call" allowance so that the allowance only pays once on a weekend Public Holiday.

February 2019

Update to the rule set pay conditions for SCHCDS Permanent Day Worker, SCHCDS Casual Day Worker, SCHCDS Permanent Shift Worker and SCHCDS Casual Shift Worker in line with clause 27.5(e), where any work performed by an employee during a sleepover will be paid for a minimum time of one hour. Rule has been corrected and is now applying accurately for all time worked less than one hour.

December 2018

The setup of the Payroll Tax Exempt field in Payroll Settings>Pay Categories was replicating the PAYG Exempt field rather than creating a unique identity; when installed into the business settings. An audit has been carried out across the system and the issue has now been resolved with this update.

1 December 2018

Pay Rates for social and community service employees and crisis accommodation employees have been updated.

The new pay rates take effect from the first full pay period on or after 1 December 2018. The increase is in accordance with the Equal Remuneration Order. Further information can be found here.

November 2018

Rounding update of Home care employee - Casual for the following classifications

Level 1 - Pay point 1

Level 2 - Pay point 1

Level 2 - Pay point 2

Level 3 - Pay point 1

Level 5 - Pay point 1

Level 5 - Pay point 2

October 2018

Update to the Casual - 24 Hour Care pay category rate inline with Clause 25.8(c) with the rate being 155% of the employee's appropriate rate plus the 25% casual loading.

1 August 2018

The award has been updated to reflect changes made as part of the Fair Work Decision 4 year review of modern awards. The determination for the new clause in the modern award allowing employees to take unpaid leave to deal with family and domestic violence can be found here. Family and Domestic Violence leave applies from the first full pay period on or after 1 August 2018. Further information can be found at Fair Work.

Employees, including part-time and casual employees are entitled to 5 days unpaid family and domestic violence leave each year of their employment. The 5 days renews each 12 months of their employment but does not accumulate if the leave is not used.

A new leave category has been created - “Family and Domestic Violence Leave” and a new Work Type - “Family and Domestic Violence Leave taken”. The Leave Allowance Templates and any impacted rule conditions have also been updated.

July 2018

First aid allowance rule set multiplier was updated to reflect maximum weekly allowance of $16.03. Allowance effective from 1 July 2018.

June 2018

The Award has been updated to reflect the Fair Work Commission’s national minimum wage increase of 3.5% from its Annual Wage Review 2017-18 decision. This also includes updates to expense-related allowances.

These changes come into effect from the first full pay period on or after 1 July 2018. Please install these updates AFTER you have finalised your last pay run prior to the first full pay period commencing on or after 1 July 2018.

Additionally, the following change have been made as part of this update:

- The Payment Classification settings for Allowance based pay categories have been updated as per Single Touch Payroll (STP) requirements.

March 2018

- Fix any auto meal break rules so that they don't apply to leave requests

- Updated allowance pay categories configuration. e.g. changed payment classifications.

- Created Kilometre allowance pay categories - above and below ATO limits

1 January 2018

The award has been updated to reflect changes made as part of the Fair Work Decision 4 year review of modern awards. The following is a summary of the changes to the award made:

-

Part-time rosters no longer need to have the same amount of hours in each week. Employees and employers may agree to have a different amount of hours in each week over a roster cycle.

-

Roster variations can be for short term or permanent changes to the roster.

Upon review, our existing rule sets do not provide overtime to part time employees where they work in excess of their standard hours. As a result, there was no requirement to change the existing rule set. We consider the results of the award review to mainly impact rostering but not result in any changes to the application of overtime.

30 November 2017

Pay rates have been updated and take effect on the first full pay period on or after 1 December 2017. This is in accordance with clause 5.5(f) of the Equal Remuneration Order.

If you have any feedback or questions please contact us via support@yourpayroll.com.au

![Pay Cat Logo New 2.png]](https://www.paycat.com.au/hs-fs/hubfs/Pay%20Cat%20Logo%20New%202.png?height=50&name=Pay%20Cat%20Logo%20New%202.png)