In STP Phase 1, the gross amount you reported contained different types of amounts depending on the particular income type. This approach has changed in STP Phase 2 and all payment types are now reported consistently for each income type.

For a video overview on the disaggregation of gross click here.

Instead of reporting a single gross amount, you will now separately report:

- gross

- paid leave

- allowances

- overtime

- bonuses and commissions

- directors’ fees

- lump sum W (return to work)

- salary sacrifice.

This article will discuss how to correctly classify pay categories and deduction categories, in line with the new Phase 2 requirements.

Classifying pay categories

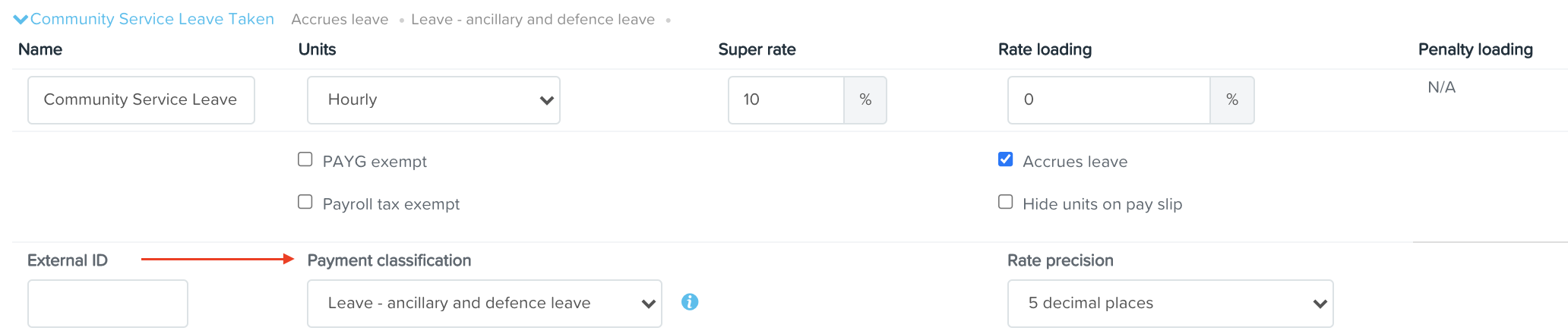

In order to ensure pay categories are classified correctly, they need to be mapped to a specific payment classification. Each payment classification is defined by the ATO and described below in detail. To assign a payment classification to a pay category, go to Payroll settings > Pay categories > click on the name of the pay category to view the settings. You will then see the 'Payment classification' setting with a dropdown list of pre-populated options:

A reference list to assist with selecting payment classifications for various payment types can be found in this article.

Payment classification descriptions

A list of the pre-defined payment classification options are as follows:

- Default: Assign this classification if the pay category does not fall into any other definition provided below.

- Allowance - award transport payments: This is a deductible expense allowance for the total rate specified in an industrial instrument to cover the cost of transport (excluding travel or cents per kilometre reported as other separately itemised allowances) for business purposes, as defined in Income Tax Assessment Act 1997.

- Allowance - cents per km: This is a deductible expense allowance that defines a set rate for each kilometre travelled for business purposes that represents the vehicle running costs, including registration, fuel, servicing, insurance and depreciation into account. This should not include any cents per kilometre allowances that are paid for travel between an employee's home and place of work unless it is a home-based business and the trip was for business purposes.

- Allowance - laundry: This is a deductible expense allowance for washing, drying and/or ironing uniforms required for business purposes. This allowance is typically paid as a regular rate for each week of work or services performed and cannot include dry cleaning expenses or reimbursements. Uniforms refers to the approved categories of clothing defined by the ATO.

- Allowance - other: This is any expense allowance not specifically addressed in any other allowance category (such as a car allowance - other than cents per kilometre - and uniform allowance) and/or for those expenses relating to private use (such as cents per kilometre for travel between home and work and laundry allowance for conventional clothing). When creating a pay category for "Allowance (Other)", you are also required to enter an allowance description as shown in this article. Pay categories pertaining to JobKeeper and JobMaker should also remain classified as this allowance type.

- Allowance - overtime meal: This is a deductible expense allowance defined in an industrial instrument that is in excess of the ATO reasonable amount, paid to compensate the employee for meals consumed during meal breaks connected with overtime worked.

- Allowance - qualifications/certificates: This is a deductible expense allowance that is paid for maintaining a qualification that is evidenced by a certificate, licence or similar. For example, allowances to cover registration fees, insurance, licence fees, etc that are expected to be expended to maintain a requirement of the job. This is a new payment classification introduced for Phase 2 reporting.

- Allowance - tasks: This is a service allowance that is paid to an employee to compensate for specific tasks or activities performed that involve additional responsibilities, inconvenience or efforts above the base rate of pay. For example, higher duties allowance, confined spaces allowance, dirty work, height money, first aid, etc. This is a new payment classification introduced for Phase 2 reporting.

- Allowance - tool: This is a deductible expense allowance to compensate an employee who is required to provide their own tools or equipment to perform work or services for the employer. For example, chef’s knives, divers’ tanks, trade tools, phone allowances. This is a new payment classification introduced for Phase 2 reporting.

- Allowance - travel: This is a deductible expense allowance that is in excess of the ATO reasonable allowances amount (for domestic or overseas travel), undertaken for business purposes, which are intended to compensate employees who are required to sleep away from home. It is not a reimbursement of actual expenses, but a reasonable estimate to cover costs including meals, accommodation and incidental expenses.

- Bonuses and commissions: Bonuses and commissions are typically paid as lump sum payments rather than at each regular pay period. Bonuses are usually paid to an employee in recognition of performance or services and may not be related to a particular period of work performed. Commissions are usually paid to an employee in recognition of performance or services and may be calculated as a portion of the proceeds or volume of sales. If a bonus or commission is paid in respect of overtime, this should be classified as "Overtime". This is a new payment classification introduced for Phase 2 reporting.

-

Community Development Employment Projects (CDEP) payments: This relates to the wages of employees working under the CDEP scheme. The CDEP scheme has now ceased, but support arrangements are in place that require those remaining members of the scheme to be supported for the duration of its operation. There should not, however, be any earnings reported under this payment classification in Phase 2 and will result in a validation error, preventing the lodgement of an STP event.

- Directors’ fees: These are payments to the director of a company or to a person who performs the duties of a director of the company. Directors’ fees may include payment to cover travelling costs, costs associated with attending meetings and other expenses incurred in the position of a company director. This is a new payment classification introduced for Phase 2 reporting.

- ETP (Death benefit) - Code B: This is a multiple payment for a death benefit ETP code N for the same deceased person, where the later payment is paid in a subsequent financial year from the original code N payment.

- ETP (Death benefit) - Code D: This is a death benefit payment directly to a dependant of the deceased employee. A dependant may include a spouse of the deceased, a minor child, a person who had an interdependency relationship with the deceased or a person who was a dependant of the deceased just before the latter died.

- ETP (Death benefit) - Code N: This is a death benefit payment directly to a non-dependant of the deceased employee. A non-dependant is a person who is not a dependant of the deceased and not a trustee of the deceased estate.

- ETP (Death benefit) - Code T: This a death benefit payment directly to a trustee of the deceased estate. This person may be an executor or administrator who has been granted probate or letters of administration by a court.

- ETP (Life benefit) - Code O: This is a life benefit payment as a consequence of employment, paid for reasons other than those provided in "ETP (Life benefit) - Code R". Examples include an ex-gratia payment, gratuity or golden handshake, non-genuine redundancy payments, payments in lieu of notice and some types of unused leave, under specific circumstances. This is the non-excluded part of the ETP.

- ETP (Life benefit) - Code R: This is a life benefit payment as a consequence of employment, paid only for reasons of genuine redundancy (ie, where the employer decides the job no longer exists), invalidity (the employee sustained a permanent disability), early retirement scheme (an ATO-approved plan that offers employees incentives to retire early or resign when the employer is rationalising or reorganising their business operations) or compensation for personal injury, unfair dismissal, harassment or discrimination. This is the excluded part of the ETP.

- ETP (Multiple payments) - Code P: This is a multiple payment for life benefit ETP code O for the same termination of employment, where the later payment is paid in a subsequent financial year from the original code O payment. This is the non-excluded part of the ETP.

- ETP (Multiple payments) - Code S: This is a multiple payment for life benefit ETP code R for the same termination of employment, where the later payment is paid in a subsequent financial year from the original code R payment. This is the excluded part of the ETP.

- Exclude from payment summary (income statement): Assign this classification to any payments made to an employee that are not to reported to the ATO and therefore not displayed on an employee's income statement. Examples include award overtime meal allowances and domestic or overseas travel allowances up to the reasonable allowances amount.

- Exempt foreign employment income: These are earnings paid to an Australian resident, for tax purposes, who work in another country for 91 days or more for a continuous period and the income is subject to tax in that country. The foreign income may be exempt from tax if the foreign service is attributable to any one of the following:

- Non-government agency workers delivering Australian Official development assistance;

- Operating a public fund declared by the Minister to be a developing country relief fund;

- Operating a public fund established and maintained to provide monetary relief to people in a developed foreign country impacted by a disaster (a public disaster relief fund);

- Prescribed charitable or religious institution exempt from Australian income tax because it’s located outside Australia, or the institution is pursuing objectives outside Australia;

- Deployment outside Australia by an Australian government (or authority) as a member of a disciplined force.

- Leave - ancillary and defence leave: Paid leave for absences such as for Australian Defence Force, emergency leave, eligible community service and jury service. This is a new payment classification introduced for Phase 2 reporting.

- Leave - cash out of leave in service: Leave entitlement earnings that have been paid out in lieu of the employee taking the absence from work. This option represents Fair Work entitlements as defined in an award, enterprise agreement or contract of employment (for award and agreement free employees). When leave is cashed out, it reduces the balance of the entitlement, as occurs if the absence was taken, but on the date of payment rather than over the duration of the absence. This is a new payment classification introduced for Phase 2 reporting.

- Leave - other paid leave: All other paid absences not otherwise covered in the other leave payment classifications and regardless of rate of pay (full, half, reduced rate) must be reported under this payment classification. Examples include, but are not limited to: annual leave, leave loading, long service leave, personal leave, RDOs. This is a new payment classification introduced for Phase 2 reporting.

- Leave - paid parental leave: Some employers offer paid parental leave and the Government Paid Parental Leave (GPPL) Scheme offers eligible employees, who are the primary carer of a newborn or adopted child, up to 18 weeks’ leave, paid at the national minimum wage. Generally, GPPL is paid by Services Australia to the employer to pay the employee, but both types of paid parental leave may be paid at the same time. This is a new payment classification introduced for Phase 2 reporting.

- Leave - unused leave on termination: Any leave balances paid out on termination that are otherwise not deemed an ETP or lump sum payment. This is a new payment classification introduced for Phase 2 reporting.

- Leave - worker's compensation: Any workers’ compensation payments received by an injured employee for the hours not worked, or not attending work as required, or if the employment has been terminated. This is a new payment classification introduced for Phase 2 reporting.

- Lump Sum A (Type R): All unused annual leave or annual leave loading, and that component of long service leave that accrued from 16/08/1978, that is paid out on termination only for genuine redundancy, invalidity or early retirement scheme reasons.

- Lump Sum A (Type T): Unused annual leave or annual leave loading that accrued before 17/08/1993, and long service leave accrued between 16/08/1978 and 17/08/1993, that is paid out on termination for normal termination (that is, other than for a genuine redundancy, invalidity or early retirement scheme reason).

- Lump Sum B: Long service leave that accrued prior to 16/08/1978 that is paid out on termination, regardless of the reason for such termination.

- Lump Sum D: This represents the tax-free amount of a genuine redundancy payment or early retirement scheme payment, up to the limit, based on the employee's years of service.

- Lump Sum E: This represents the amount for back payment of remuneration that accrued, or was payable, more than 12 months before the date of payment and is greater than the lump sum E threshold amount, being $1,200.

- Overtime: This represents a payment made to an employee that works extra time. It can include work done beyond their ordinary hours of work, outside the agreed number of hours or outside the spread of ordinary hours (the times of the day ordinary hours can be worked). This is a new payment classification introduced for Phase 2 reporting.

- Return to work payment: This represents an amount paid to induce an employee to resume work, such as to end industrial action or to leave another employer. It does not matter how the payments are described or paid, or by whom they are paid. This is a new payment classification introduced for Phase 2 reporting.

Classifying deduction categories

In order to ensure deduction categories are classified and reported correctly, they need to be mapped to a specific classification. To assign a classification to a deduction category, go to Payroll settings > Deduction categories > click on the name of the deduction category to view the settings. You will then see the 'Classification' setting with a dropdown list of pre-populated options:

The description of each classification can be accessed in this article.

If you have any questions or feedback, please let us know via support@yourpayroll.com.au.