STP: Preparing for the new Phase 2 reporting requirements

Most employers would now be experts in reporting Single Touch Payroll (STP), which is great news! With the second phase (Phase 2) commencing from 1 January 2022, we have prepared this article to inform users of the changes being introduced in what will be reported to the ATO. Additionally, we will provide details of the new settings in the platform that users may need to configure and/or existing settings that may need to be updated, depending on the scenario of the business and its employees. This will assist users when transitioning to Phase 2 reporting before 1 January.

N.B: This article will be updated regularly until the commencement of Phase 2, so ensure you keep your eye out for any updates. Additionally, new businesses setting up STP for the first time should also refer to our STP guide.

What isn't changing?

Before we go into the detail of the additional information that will need to be reported through Phase 2, let's clarify what isn't changing from 1 January:

- the way you lodge events, regardless of whether you are lodging as employer, intermediary or a registered tax agent;

- the due date for lodging events;

- the types of payments that are needed;

- tax and super obligations;

- end of year finalisation requirements.

What is changing?

The biggest change brought about with the introduction of Phase 2 is the additional reporting requirements of employee and earnings data. The ATO's intent with capturing more information is to streamline employer and employee interactions with other government agencies and reduce the administrative tasks associated with the hiring and termination of employees. The key reporting changes are:

- Disaggregation of gross

- Employment and taxation conditions

- Child support garnishees/deductions

- Income types and country codes

- Lump sum E payments

Lastly, once all the above has been updated accordingly in the platform and prior to lodging your first pay event using Phase 2 reporting, the ATO strongly suggests that an update event is lodged first. This will allow the ATO to easily assess whether YTD earnings, which will now be reported as disaggregated earnings, have transitioned across correctly. It is also a good opportunity to check that no validation warnings are triggered, as a result of incorrect transitioning to phase 2. If any validation warnings do appear, thereby preventing you from lodging the event, refer to this article that provides an explanation of each warning.

Disaggregation of gross

Whilst the priority in Phase 1 was to digitise the annual payment summary reporting process and so required employers to report an aggregated total of YTD gross income amounts, the main purpose of Phase 2 is to extend the use of the data to the social services agencies such as Department of Social Services, Services Australia (Child Support and Centrelink) and Department of Veterans’ Affairs.

The move to a disaggregation of gross model in Phase 2 is due to the different assessment of income required for the above agencies to administer their programmes. Not all the payments that were included in Phase 1's aggregated gross are treated the same way for welfare benefits. Therefore, the disaggregation of gross will provide the granularity to support the accurate application of employment income across the relevant welfare payments and services it is responsible for administering. Additionally, unlike the period of time for which the ATO use the data (ie, for annual income tax returns), social services agencies have specific fortnightly instalment periods whereby their customers must declare their income and upon which periodic welfare payments are made. As such, this change in reporting should improve the accuracy of payments and ensure individuals receive the right payment at the right time.

The components of gross earnings that will be disaggregated (itemised separately) include:

- allowances;

- bonuses and commissions;

- directors' fees;

- overtime;

- paid leave; and

- salary sacrifice.

In Phase 1, salary sacrifice amounts were not required to be reported. Rather, an employee's gross amount was reduced by any salary sacrificed amounts and it was the post-sacrificed gross amount that was then reported through STP. Reporting salary sacrifice is a new requirement being introduced in Phase 2, which means the gross amount reported will be the pre-sacrificed amount.

Preparation for users

The preparation required to ensure gross amounts are reported correctly as per new Phase 2 requirements can be broken down into 3 separate activities:

- Review pay category payment classification mappings

- Review leave category payment setup

- Assign new classifications to salary sacrifice deduction categories

Review pay category payment classification mappings

In order to ensure gross earnings are itemised and thereby reported in accordance with Phase 2 specifications, we will be adding a number of new payment classification options to the pay category settings. A list and description of each new payment classification (and existing classifications) can be accessed here. As part of releasing these new payment classifications, we also mapped the following pay categories (that we provide by default when creating a business) to the appropriate payment classification:

- Annual Leave Taken -> mapped to Leave - other paid leave;

- Bonus -> mapped to Bonuses and commissions;

- Casual - Overtime x 125% -> mapped to Overtime;

- Casual - Overtime x 75% -> mapped to Overtime;

- Community Service Leave Taken > mapped to Leave - ancillary and defence leave;

- Compassionate Leave Taken -> mapped to Leave - other paid leave;

- Long Service Leave Taken -> mapped to Leave - other paid leave;

- Permanent - Overtime x 100% -> mapped to Overtime;

- Permanent - Overtime x 50% -> mapped to Overtime;

- Personal/Carer's Leave Taken -> mapped to Leave - other paid leave.

This means that users will not have to manually update the classifications for the above pay categories as we will automatically do this on your behalf. Moving forward any new business, created from 9 November and onwards, will have the updated classifications assigned by default.

Additionally, shortly after 9 November 2021 being the release date of these new payment classifications, we will commence publishing updates to any pre-packaged Awards with pay categories that need their associated payment classifications updated. This means that, once users publish the relevant award update, no further manual intervention will be required by users to ensure Award associated pay categories are mapped correctly as per Phase 2 requirements.

Where businesses have created their own pay categories, a review of those pay categories will need to be undertaken to assess whether they need to be re-classified to meet the new Phase 2 requirements. Refer to our article for a definition on each payment classification to assist you in determining whether the payment classification of any pay categories need to updated.

N.B: You can commence updating pay category payment classifications prior to Phase 2 commencing as this will have no effect on Phase 1 reporting requirements.

Review leave category payment setup

- Basic;

- Don't pay for the leave taken;

- Report the earnings for the leave taken against another pay category; and

- Custom.

Further details on the payment setup settings of leave categories can be accessed here. However, for the purposes of ensuring correct Phase 2 reporting, we will provide more detail here and explain what preparation is required to update the payment setup option, where needed.

Basic option

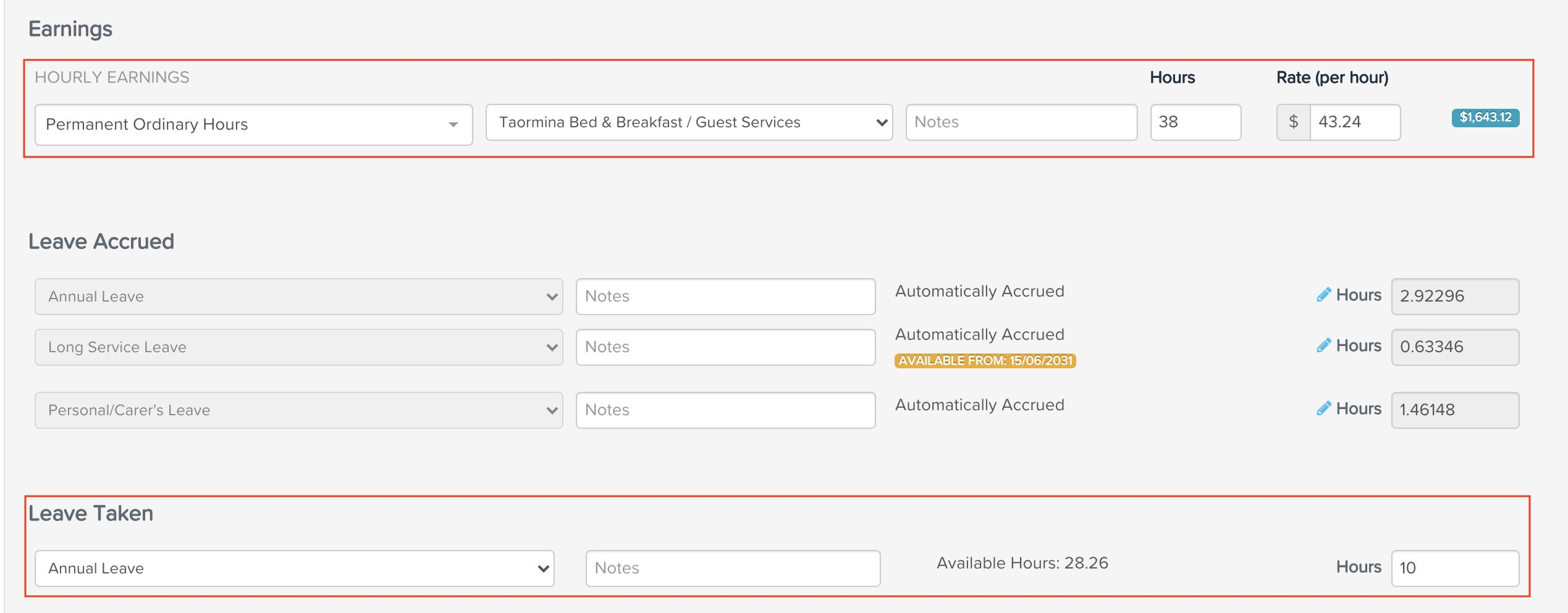

If the 'Basic' option has been applied, when an employee takes leave, the result in the pay run is that there is no itemised leave related pay category associated to the earnings for that paid leave. Rather, the employee is paid their default pay category for hours worked and leave hours taken. For eg, the 'Annual Leave' pay category has a 'Basic' payment setup configured. A weekly paid employee takes 10 hours of annual leave - this is displayed in the pay run as follows:

As you can see, the employee's pay has recorded 10 hours of annual leave taken, which will reduce their annual leave balance by 10 hours, however all earnings for the week are recorded against the pay category 'Permanent Ordinary Hours'. As a result, when reporting this employee's pay through STP, there will not be an itemisation of gross earnings relating to paid leave.

Phase 2 reporting requires all paid leave earnings be itemised against the specific leave related payment classifications, and so the 'Basic' option does not facilitate this. As such, it is essential that users change the payment setup configuration for any affected leave categories using this payment setup option to apply the 'Report the earnings for the leave taken against another pay category' payment setup option instead. Once this is done, and upon mapping the leave pay category to the relevant payment classification as detailed above, this will ensure that any earnings associated to any paid leave taken moving forward is reported in accordance with Phase 2 requirements when lodging STP events.

Custom option

This setting allows you to transfer leave hours to a specific pay category. Without wanting to assume that users have chosen to transfer leave hours to a specific leave pay category, we will just clarify here that that's exactly what should be done. By doing this, all you then need to do is ensure the leave pay category is mapped to the correct payment classification as per Phase 2 requirements.

Report the earnings for the leave taken against another pay category option

If you're already using this setup option, then we recommend reviewing that the associated pay category is one that fits within the itemised leave payment classifications. For eg, if you're reporting ALL leave against one leave related pay category, this will definitely need to be reviewed and updated accordingly. For example, if you have jury service leave and paid parental leave and annual leave reported against one 'all inclusive' pay category, this will need to change as all 3 leave types need to be reported against separate payment classifications.

Creating new leave pay categories

Based on what has been discussed above, you may need to create new pay categories that are specifically related to paid leave, unless the default leave pay categories already exist. Instructions on how to do this can be accessed here. Once you have created the new pay categories, or if the leave pay categories already exist, you can begin mapping them to the relevant payment classification setting, where needed.

N.B: To be clear, any leave category using the payment setup option of 'Don't pay for the leave taken' does not need to be reviewed, as Phase 2 reporting requirements only extend to itemising paid leave earnings.

A few things to note:

- For termination payouts, excluding death benefits and normal terminations, we have system pay categories that are automatically assigned in the pay run to the leave payout earnings - these will automatically be mapped to the correct payment classifications.

- For a while now, any new business created has a default set of leave categories that are automatically mapped to their associated leave pay categories. For new businesses created and any existing businesses that have retained these mappings, the associated leave pay categories will be automatically mapped to the correct payment classifications from 9 November.

Assign new classifications to salary sacrifice deduction categories

As Phase 2 reporting requires salary sacrifice amounts be itemised, we have added 2 new classification options to the deduction category settings to meet these requirements. The new options are as follows:

- Salary sacrifice (superannuation); and

- Salary sacrifice (other employee benefits)

A description of each new classification (and existing classifications) can be accessed here. As part of releasing these updates, we will automatically assign the 'Salary sacrifice (superannuation)' classification to any existing deduction category mapped to the deduction type 'Reportable employer super contribution (RESC)'. As such, no manual user intervention will be required here.

Users should review all other deduction categories pertaining to salary sacrifice arrangements other than superannuation as they will need to be manually mapped to the 'Salary sacrifice (other employee benefits)' classification.

Employment and taxation conditions

These conditions relate to the employment relationship between the employer and employee and the withholding rates applied to an employee. Specifically, this section requires the following information to be reported in Phase 2:

- Employee's commencement date: existing data already being reported since Phase 1

- Employee's cessation/termination date: existing data already being reported since Phase 1

- Employment basis: new mandatory requirement

- Cessation/termination reason: new mandatory requirement

- Tax treatment: new mandatory requirement

Employers already provide a lot of this information to the ATO and other government agencies in different ways and via different forms and so including this information in Phase 2 will streamline the delivery of this information. Specifically, upon commencing Phase 2 reporting, employers will no longer need to send TFN declarations to the ATO or provide employment separation certificates when an employee ceases employment. This is because the information will now be submitted through STP instead.

Please note:

- new employees will still need to complete a TFN declaration and the employer must retain this for their records. What the employer will not have to do moving forward is actually lodge/post/upload the declaration to the ATO.

- existing employees do not need to complete new TFN declarations to start reporting through Phase 2.

Preparation for users

The main preparation required for this section will be to:

Review termination details for any employee terminated in the 21/22 FY

Recording a termination reason when terminating an employee has only become mandatory in the platform from 19 October 2021, which means that there may be some terminated employees without a reason recorded. You must ensure a termination reason is recorded for any employee that has been terminated in the 21/22 FY. If a reason is not recorded, any STP event that includes a terminated employee (with no termination reason) will fail validation. This means you will not be able to lodge the event with the ATO until it is rectified.

To check and update any terminated employee without a recorded termination reason:

- export the employee file and select data type = 'Template with employee data (including terminated employees)';

- filter the data in the export so that only employees with a date of 1/7/21 or later in the ‘EndDate’ column display;

- further filter the data in the export so that only employees with no value in the 'TerminationReason' column display;

- if there are any employees displayed in the export this means they need a termination reason assigned. To do this, navigate to the 'TerminationReason' column and select a termination reason from the cell dropdown. Repeat this step for every affected terminated employee.

- Save the updates and re-import the file. Upon successfully importing, a termination reason will be recorded against the affected terminated employees' file.

Review employees' tax status

In order to ensure the correct tax status of each employee is being reported in accordance with Phase 2 specifications, we have added new settings to the employee's 'Tax File Declaration' screen. Detailed information on the new settings (and existing settings) that determine an employee's tax status, and thereby derive the tax treatment of the employee, can be accessed here. We strongly suggest users read the article to take note of any new settings that may be applicable to an employee. When these new settings are made available, users will be able to commence updating an employee's record, if required. Take note that updating an employee's record prior to Phase 2 commencing is more than okay as it will have no impact on Phase 1 reporting.

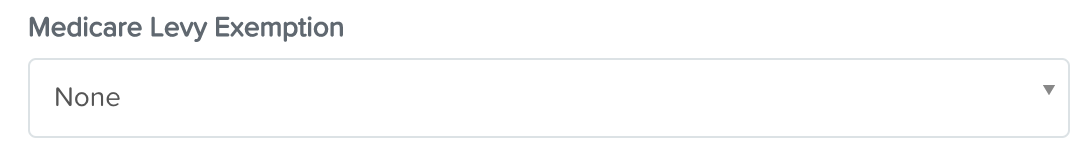

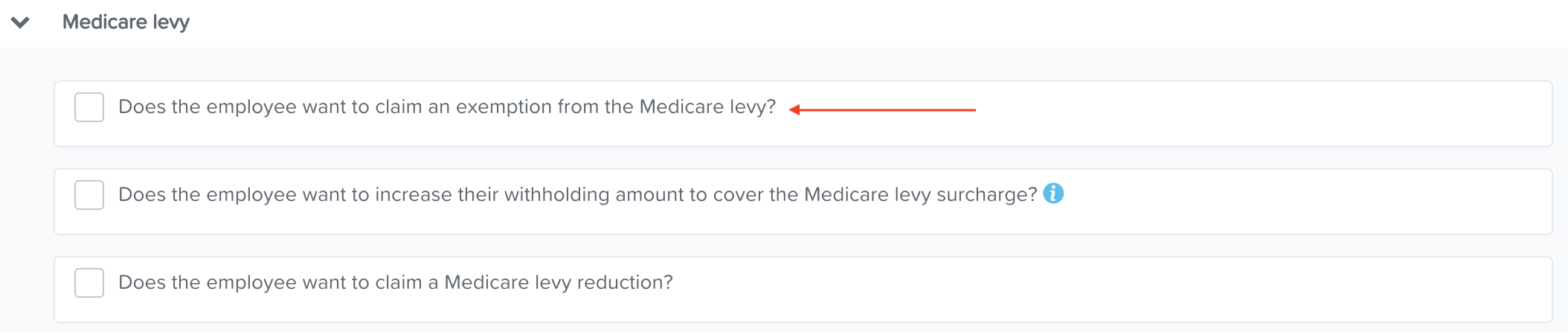

Lastly, take note that the new 'Medicare levy' section will include a setting already available in the platform, being the Medicare levy exemption setting, which is currently displayed as follows:

This existing setting will be repositioned so that it is consolidated with the other new Medicare levy settings, as follows:

If an employee already has an exemption (either half or full) applied in their record, this configuration will not be affected and the existing setting will be retained.

Child support garnishees/deductions

Phase 2 reporting has introduced the ability to report on child support garnishees and deductions through STP. Reporting though STP will remove the need for employers to provide separate remittance advices to the Child Support Registrar. However, you must still pay the required amounts directly to them by the date specified in your notice.

Please note that reporting on child support through STP is voluntary. If you choose to not report through STP then there is no preparation required to be Phase 2 ready in this area. To be clear though, employers will still need to report directly to the Child Support Registrar on an ongoing basis.

If you do choose to report child support deductions and garnishees through STP, you will need to assign the applicable child support classification against the relevant child support deduction category, as explained in this article.

N.B: You can commence updating the child support deduction category classifications prior to Phase 2 commencing as this will have no effect on Phase 1 reporting requirements.

Income types and country codes

Another new requirement being introduced in Phase 2 is reporting an income type for each payment made to an employee and, in some cases, a country code alongside that income type. The 3 main drivers of reporting income types and country codes are as follows:

-

To identify amounts with specific tax consequences and/or mapping to a specific part of an individual's income tax return.

-

To easily identify any payers choosing to claim an STP reporting concession, such as a reporting concession for closely held payees, which thereby avoids the ATO unnecessarily contacting the payer to follow up with them.

-

Clarifies the employer's reporting obligations with respect to foreign tax and whether there are any applicable tax treaties in place with a foreign country.

Preparation for users

The main preparation required for this section will be to:

- Review income type definitions to know what to assign to employee, if required

- Obtain visa country of existing working holiday makers

- Review locations assigned to foreign employment employees

Review income type definitions

In order to ensure the correct income type for each employee is being reported in accordance with Phase 2 specifications, we have added new settings to the employee's 'Pay Run Defaults' screen. Detailed information on the new settings (and existing settings) that determine an employee's income type and country code, if required, can be accessed here. We strongly suggest users read the article to take note of any new settings that may be applicable to an employee. When these new settings are made available, users will be able to commence updating an employee's record, as required. Updating an employee's details prior to the commencement of Phase 2 is more than okay as it will have no impact on Phase 1 reporting.

Take note: existing employees already classified as closely held in the platform will not be required to be reconfigured. The closely held setting has been consolidated with other income type settings in the employee 'Pay Run Defaults' screen and existing employee configuration will be retained when the new settings are made available.

Obtain visa country of existing working holiday makers

When reporting working holiday makers through STP Phase 2, the visa country of the working holiday maker will also need to be reported, as explained here. It would be worth making note of the visa country for each working holiday maker so that when the new country code setting is made available, users will be able to commence updating this information immediately without any impact to Phase 1 reporting.

Review locations assigned to foreign employment employees

Employees classified with an income type of foreign employment will also be required to report on the host country where the employee is working, as explained here. This will be configured through locations to cater for potential multi-country work. This will allow us to report the earnings paid to employees against the country of the location such earnings have been allocated to. As such, and only for businesses with foreign employment income type employees, we strongly suggest reviewing the location set up in the business and make sure that:

- separate locations are set up for each non-AU country where employees work;

- non-AU locations are separated by country, for eg if there is an employee working in Greece and another employee working in Italy, a location per country (as a minimum) should be set up;

- foreign employment income type employees are assigned a primary location that is specific to the country they work in and, if such employees are required to submit timesheets, they are submitting timesheets for locations specific to the country of work.

The above rules will ensure that, when reporting earnings for foreign employment income type employees, the country code will be reported as per Phase 2 requirements.

Lump sum E payments

STP Phase 1 did not support recording the financial year to which the lump sum payment related to. This meant that employers were still required to issue lump sum E letters to their employees specifying the financial year(s) the amount accrued. Phase 2 does support the reporting of the financial year and this will be recorded in the pay run at the time of processing the lump sum payment fo the employee.

Preparation for users

If employers have already processed a lump sum E payment in the pay run they will be required to go back to that pay run and enter the financial year(s) pertaining to the lump sum amount. This can be done once STP Phase 2 is switched on and the lump sum E pay run functionality is made available.

Further information on lump sum E payments in general, how to utilise the new functionality and how to record a financial year for a pay run already processed can be accessed through this support article.

If you have any questions or feedback, please contact us on support@yourpayroll.com.au.

![Pay Cat Logo New 2.png]](https://www.paycat.com.au/hs-fs/hubfs/Pay%20Cat%20Logo%20New%202.png?height=50&name=Pay%20Cat%20Logo%20New%202.png)