In addition to the information provided in our overview article, Phase 2 reporting will include a six-character tax treatment code for each employee. The tax treatment code is an abbreviated way of telling the ATO about the factors that can influence the amount withheld from payments to employees.

For an overview video on tax treatment in Phase 2 click here.

Reporting the tax treatment for each employee through STP means that when employees provide their TFN declaration (either online or hard copy), employers no longer need to send a copy of the declaration to the ATO. It will also allow the ATO to notify employees if they have provided their employer with incorrect information that may result in a higher tax bill for the employee at the end of the financial year.

The six-character tax treatment code is made up of a combination of:

- Tax scale category;

- Options within each category;

- Study and Training Support Loan (STSL) status; and

- Medicare Levy settings

From a user perspective, it is essential that each employee has the correct settings applied. The payroll platform will then automatically generate the code combination based on those settings and report that code through the STP event for each employee.

The ATO have specific rules around the possible combination of options, STSL & Medicare Levy applicable to each tax scale category. As such, inbuilt validations exist in the platform that will prevent users from applying a particular setting against an employee if that employee is already assigned another setting that is not then a valid combination. For eg, a foreign resident cannot claim any Medicare Levy settings - as such, if an employee does not have the 'Australian resident for tax purposes' checkbox ticked then the 'Does the employee want to claim an exemption from the Medicare levy?' checkbox cannot be ticked for that employee.

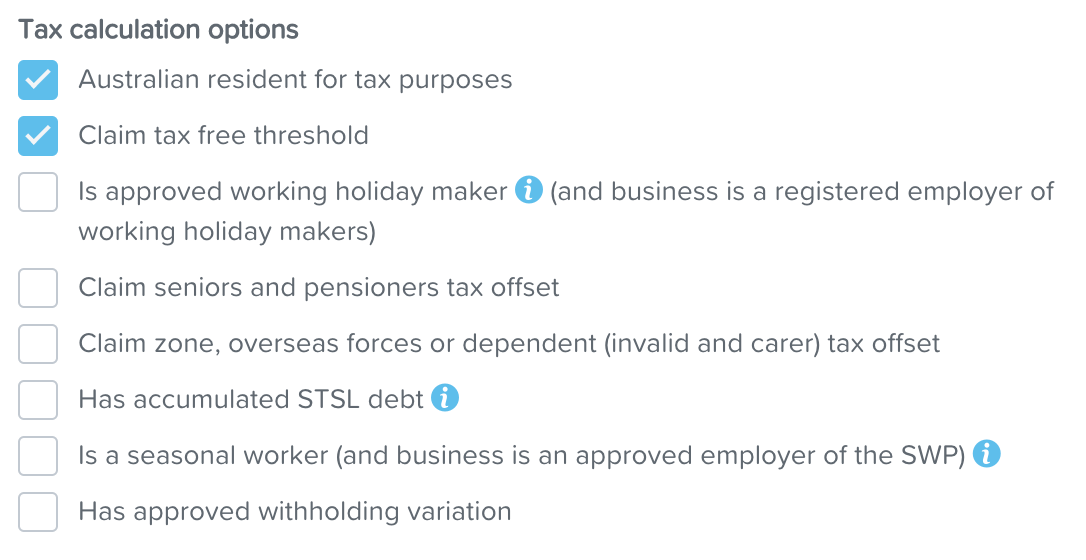

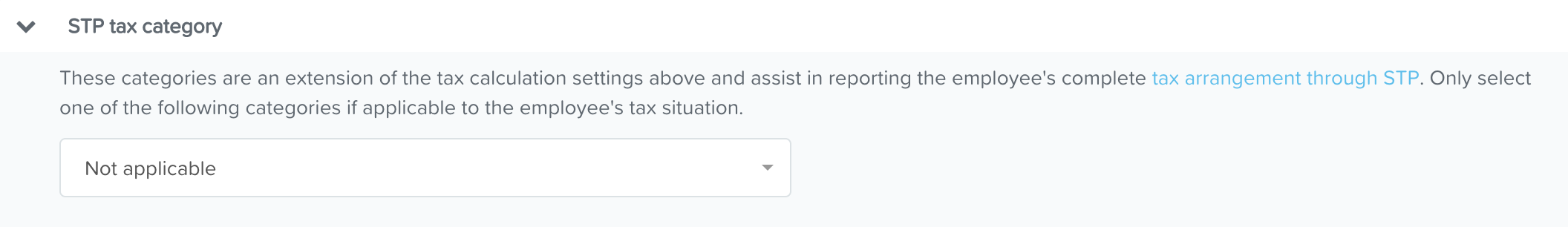

All the settings that determine an employee's tax treatment for STP purposes are located in the employee's Tax File Declaration screen. They will either be configured via the:

- 'Tax calculation options' section

- 'STP tax category' section (this is a new section that will be available to users in the coming weeks); and

- 'Medicare levy' section (this is a new section that will be available to users in the coming weeks)

Tax scale categories

Following is a description of each tax scale category and instructions on how to assign a category against an employee:

- Actors: Australian residents for tax purposes who have provided a valid TFN or TFN exemption reason and are actors, variety artists and other entertainers who receive payments for their performances. It includes employees performing promotional activities. Employees classified in this tax scale category have a specific tax table that is currently not catered for in the payroll platform. A recurring tax adjustment can be set up so that the withholding amount is automatically calculated in the pay run. To classify an employee under this category, select the 'Actor' option from the dropdown in the STP tax category section. You will then be required to select a sub-category option from the dropdown list that reflects the employee's scenario, as follows:

-

- With tax free threshold

- No tax free threshold

- 3 or less performances per week

- Promotional

-

- Horticulturists and Shearers: This category applies to employees working for a continuous period not exceeding six months in any horticultural process associated with the production, cultivation or harvest of a horticultural crop or in the shearing industry such as shearers, crutchers, wool classers, cooks, shed hands and pressers that have provided a valid TFN or TFN exemption reason. It includes foreign residents but excludes working holiday makers or seasonal worker programme employees. Employees classified in this tax scale category have a specific tax table that is currently not catered for in the payroll platform. A recurring tax adjustment can be set up so that the withholding amount is automatically calculated in the pay run. To classify an employee under this category, select the 'Horticulturist & shearer' option from the dropdown in the STP tax category section. You will then be required to select a sub-category option from the dropdown list that reflects the employee's scenario, as follows:

-

- With tax free threshold

- Foreign resident

-

- Seniors and Pensioners: This category applies to employees aged 66 years or older, or veterans receiving a service pension and/or war widows/widowers receiving an income support supplement from the Department of Veterans’ Affairs who are at least 60 years of age. Employees classified in this tax scale category have a specific tax table that is currently not catered for in the payroll platform. A recurring tax adjustment can be set up so that the withholding amount is automatically calculated in the pay run. To classify an employee under this category, select the 'Senior & pensioner' option from the dropdown in the STP tax category section. You will then be required to select a sub-category option from the dropdown list that reflects the employee's scenario, as follows:

-

- Single

- Married

- Couple separated due to illness

-

- Working Holiday Makers: Foreign residents for tax purposes who are working in Australia under a subclass 417 or subclass 462 visa or other bridging visa arrangement. Working holiday makers are identified as such when the 'Is approved working holiday maker (and business is a registered employer of working holiday makers)' checkbox within the 'Tax calculation options' section is selected. Further information on the working holiday maker setting can be found here.

- Seasonal Worker Programme: This category applies to non-residents of Australia for tax purposes engaged under the SWP administered by the Department of Foreign Affairs and Trade. This category also applies to payees within the Pacific Australia Labour Mobility scheme who have indicated on a TFN declaration that they are a non-resident. Seasonal workers are identified as such when the 'Is a seasonal worker (and business is an approved employer of the SWP)' checkbox within the 'Tax calculation options' section is selected. Refer to the ATO website for further information on this category of employees.

- Foreign Resident: Employees who answered “no” to the question “Are you an Australian resident for tax purposes?” on their tax file number declaration or withholding declaration. It excludes working holiday makers, employees otherwise classified as Horticulturists and Shearers and seasonal worker programme employees. Foreign residents are identified as such when the:

-

- 'Australian resident for tax purposes' checkbox within the 'Tax calculation options' section is NOT selected; and

- 'Is a seasonal worker (and business is an approved employer of the SWP)' checkbox within the 'Tax calculation options' section is NOT selected; and

- 'Is approved working holiday maker (and business is a registered employer of working holiday makers)' checkbox within the 'Tax calculation options' section is NOT selected; and

- No STP tax category options have been selected.

-

- No TFN: Employees who have not provided a tax file number declaration, or employees who have provided a tax file number declaration but have not supplied a tax file number, or employees who have provided a tax file number declaration but have supplied an incorrect/invalid tax file number and also not claimed an exemption from having to provide a tax file number. This excludes seasonal worker programme employees. Employees are classified under this category if their tax file number is entered as 000000000.

- ATO-Defined: This category applies when the ATO issues a written notice to an employer to vary the PAYG withholding downwards (for gross income or specific payments only) of an employee, or where the payee is a death beneficiary (who is not also an employee), or where the employee is not covered by any other tax table such as for a non-employee for superannuation guarantee purposes only. To classify an employee under this category, select the 'ATO defined' option from the dropdown in the STP tax category section. You will then be required to select a sub-category option from the dropdown list that reflects the employee's scenario, as follows:

-

- Death beneficiary

- Downward variation

- Non-employee

-

- Daily casuals: This category applies to employees whose work patterns are irregular and have no job certainty such as casuals who may only rely on daily income, regardless of the frequency of payday. It excludes working holiday makers, seasonal worker programme employees and foreign residents. Employees classified in this tax scale category have a specific tax table that is currently not catered for in the payroll platform. A recurring tax adjustment can be set up so that the withholding amount is automatically calculated in the pay run. To classify an employee under this category, select the 'Daily casual' option from the dropdown in the STP tax category section.

- Regular: All employees not otherwise covered by the above categories including directors, office holders, religious practitioners, labour hire workers and Pacific Labour Scheme workers. There is no specific setting that users need to configure for this tax scale category - rather, the system will recognise and report this category automatically. If your employee does not fall into the specific categories listed above, then select the 'Not applicable' setting within the employee's STP tax category setting.

- Voluntary Agreement: A contractor under a voluntary agreement to withhold under section 12-55 of Schedule 1, Part 2-5 of the TAA 1953, including those who have informed the payer of their CIR, that they don’t have a CIR and if the payment includes an amount for GST. This category will not be supported in this payroll platform.

Study and Training Support Loan (STSL)

An employee would indicate they have an STSL debt by answering "yes" to the question "Do you have a Higher Education Loan Program (HELP), VET Student Loan (VSL), Financial Supplement (FS), Student Start-up Loan (SSL) or Trade Support Loan (TSL) debt?" on their tax file number declaration. This results in an obligation for the employee to repay a higher rate of withholding when income thresholds are reached. Further information on how STSL is calculated can be found here.

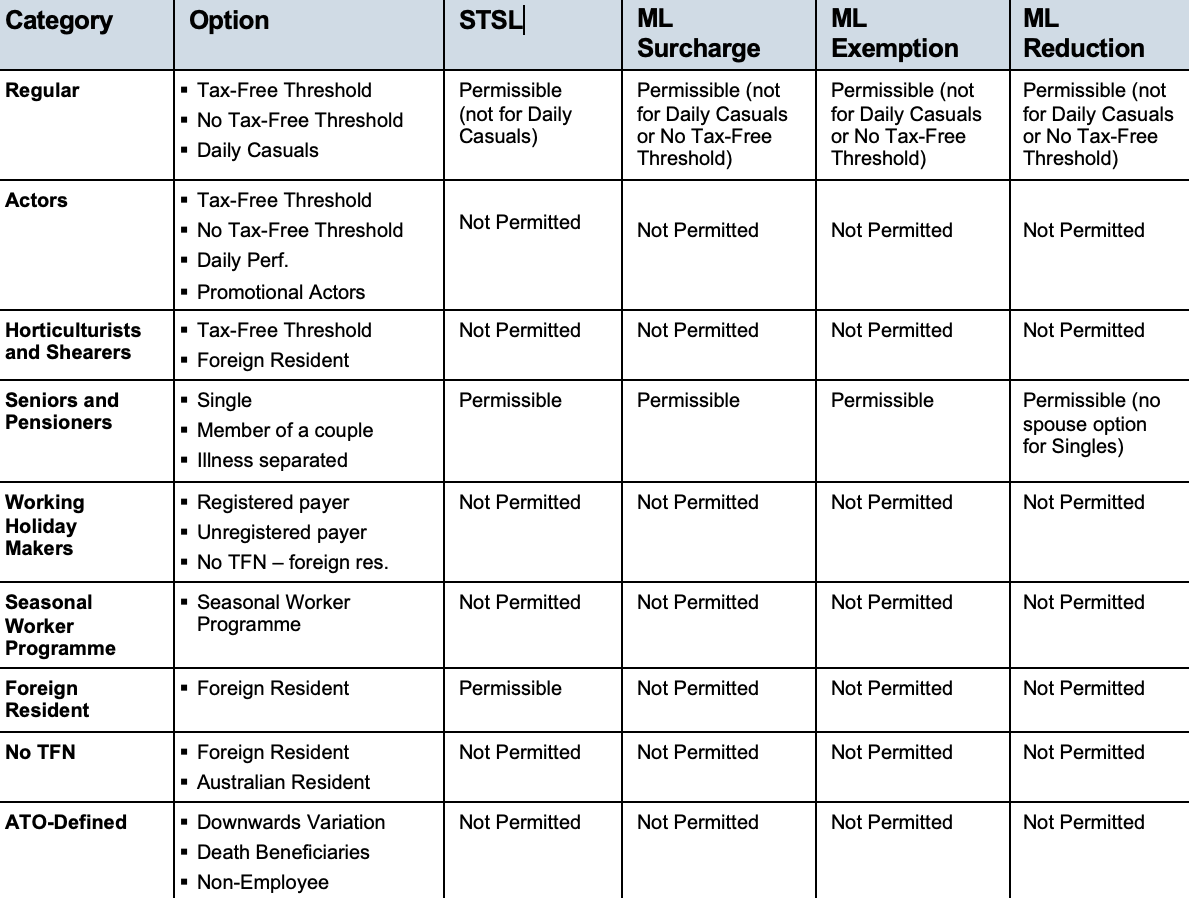

STSL is not permissible for all tax scale categories. An overview of permissions is available below.

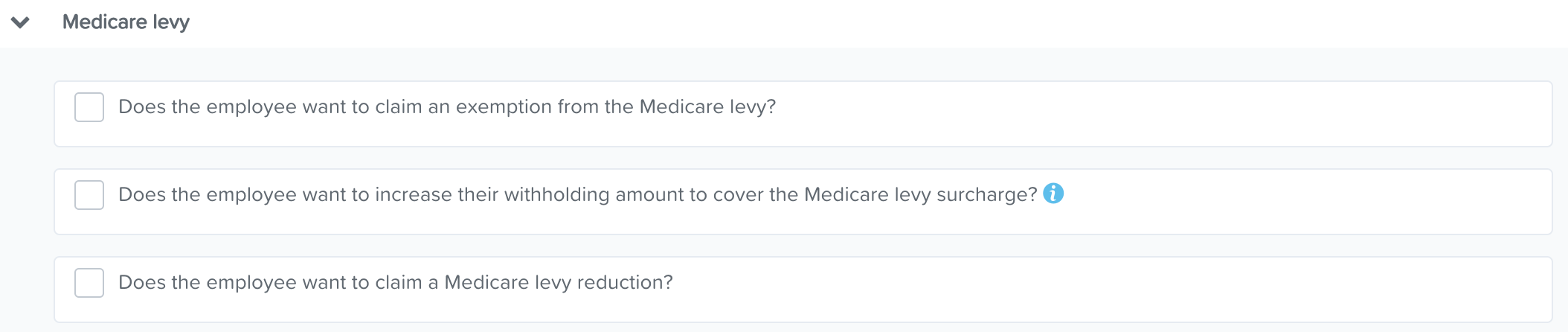

Medicare Levy

The Medicare levy helps fund some of the costs of Australia's public health system known as Medicare. The Medicare levy is 2% of an employee's taxable income and is in addition to the tax paid on taxable income. The Medicare levy is automatically calculated as part of PAYG amount withheld in the pay run. An employee's actual Medicare levy is calculated upon lodging their income tax return.

An employee may be eligible for a reduction or exemption from paying the Medicare levy, depending on the circumstances of the individual and their spouse. Determining eligibility for a reduction or exemption is the responsibility of the employee.

An employee should communicate any Medicare circumstances by completing a Medicare levy variation declaration form and providing this form to their employer. Only then should any of these settings be configured for an employee. The 3 settings are as follows:

- Medicare Levy Surcharge : This represents any additional rates of Medicare Levy imposed on those who do not have an appropriate level of private patient hospital cover and earn above a certain income. The rates are dependent upon domestic circumstances (single/family) and combined family income thresholds. Applying any one of the tier settings in the platform will not result in additional PAYG automatically being withheld from the employee in the pay run. Rather, a recurring tax adjustment can be set up - using the 'percentage of taxable earnings' option, with the percentage amount reflecting the option chosen by the employee in the Medicare levy variation declaration form - so that the additional withholding amount requested is automatically calculated and applied in the pay run.

- Medicare Levy Exemption : Selecting either a full or half exemption from the Medicare Levy for those who meet eligibility requirements will result in an automatic reduction of PAYG withheld in the pay run for that employee, ie the exemption will be automatically calculated in the pay run.

- Medicare Levy Reduction : This represents a reduction in the rate of Medicare Levy based on family taxable income below a certain threshold and consideration of the number of dependants, if any. Claiming this variation may also absolve the employee from repaying any STSL debt that would otherwise be payable, for the period of reduction. This would be made clear from the employee's completed Medicare levy variation declaration form. Selecting the Medicare Levy reduction option will result in an automatic reduction of PAYG withheld in the pay run for that employee, ie the reduction will be automatically calculated and applied in the pay run (the automatic deduction to PAYG will be available to users from 9 December).

Only employees with a tax scale category of 'Regular' (excluding daily casuals and those not claiming the tax free threshold) and 'Seniors & Pensioners' are eligible to select one of the Medicare Levy options. Additionally, if an employee is claiming a full Medicare Levy exemption they cannot also claim a reduction.

Overview of tax treatment permissions

The table below summarises the withholding options permissible for each tax category:

The table below summarises the income types permissible for each tax category:

If you have any questions or feedback, please contact us on support@yourpayroll.com.au.