Submitting a Claim for JobMaker Hiring Credit

Once you are registered for the scheme, you must meet ongoing reporting obligations to be eligible to make a claim and remain eligible. This includes both of the following:

- Reporting certain information through STP ;

- Completing a claim form for each JobMaker period you are eligible for.

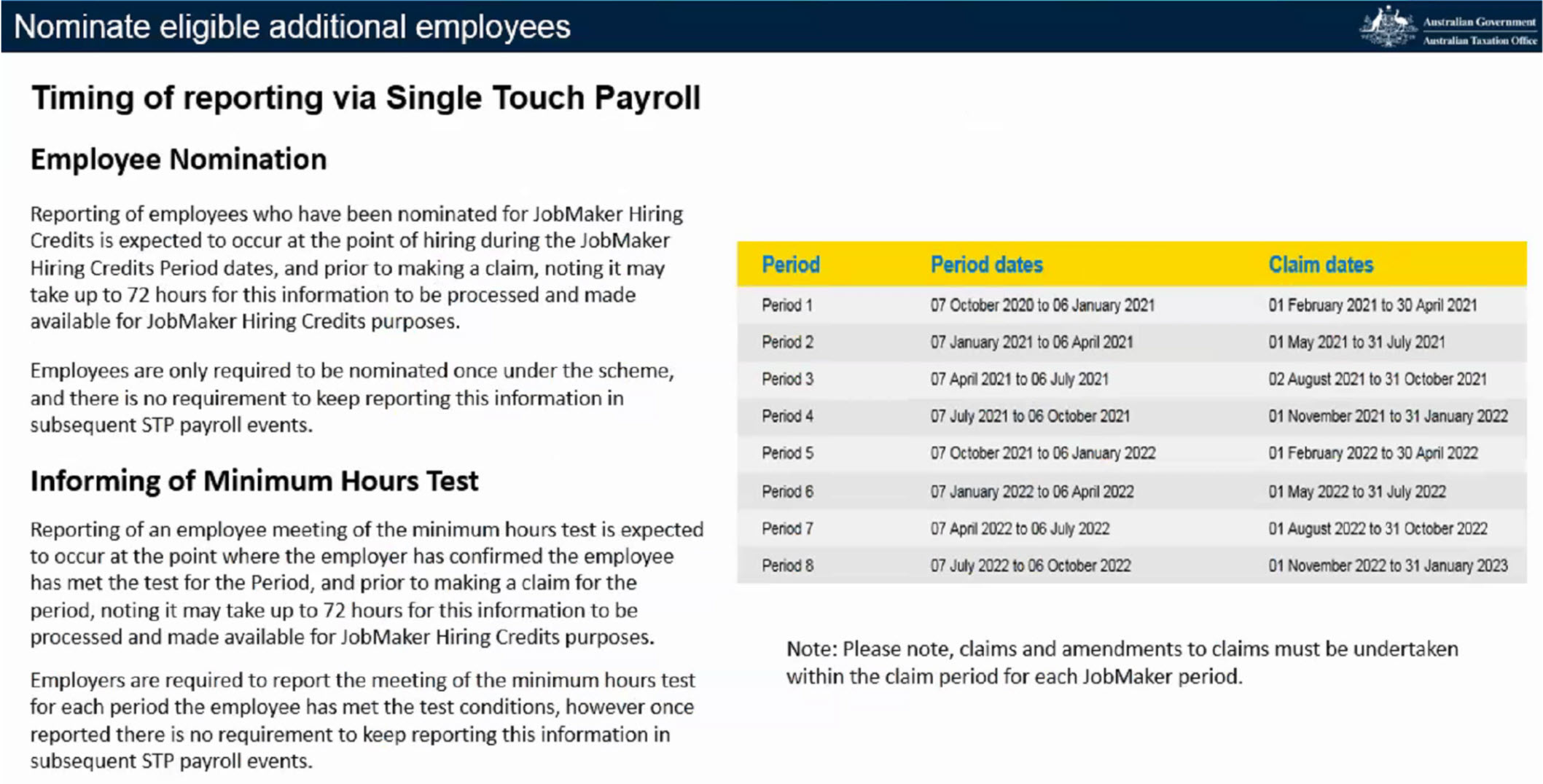

Reporting via STP

Your STP reporting is due three days before the end of the JobMaker claim period you make a claim for. For example, to make a claim for JobMaker period 1 (7 October 2020 to 6 January 2021), your STP reporting should be up to date by 27 April 2021, three days before the end of the claim period on 30 April 2021. This will enable the relevant information to be pre-filled in the claim form.

You must report the following information in STP for each employee you intend to claim for:

- Tax file number (TFN);

- Date of birth;

- Full name;

- Start date of employee (if occurring in the JobMaker period);

- End date of employee (if occurring in the JobMaker period);

- Whether your employee met the hours requirement

See this article for instructions on processing JobMaker nominations in the pay run

Reporting through ATO online services or the Business Portal

For each claim period, you must also complete your claim through ATO online services or the Business Portal. You need to report:

- Your baseline payroll amount – this amount may be different to the amount provided in the registration form if the number of days in the period is different. If so, you will need to submit an updated baseline payroll amount;

- Your total payroll amount for the JobMaker period;

- Your headcount at the end of the JobMaker period.

Information about the employees you intend to claim for will be populated from your STP report.

You will need to confirm that the information in the claim form is true and correct.

You must make a claim within the claim period after each JobMaker period ends. If you do not claim within this time, any payment you may have been entitled to will expire. You will not be able to make another claim for these amounts.

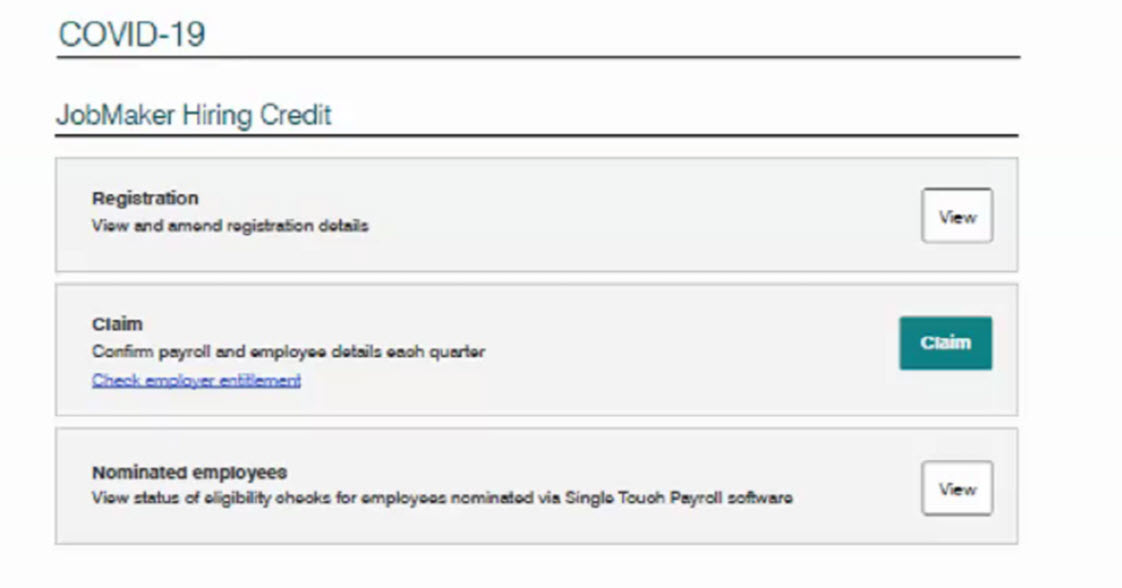

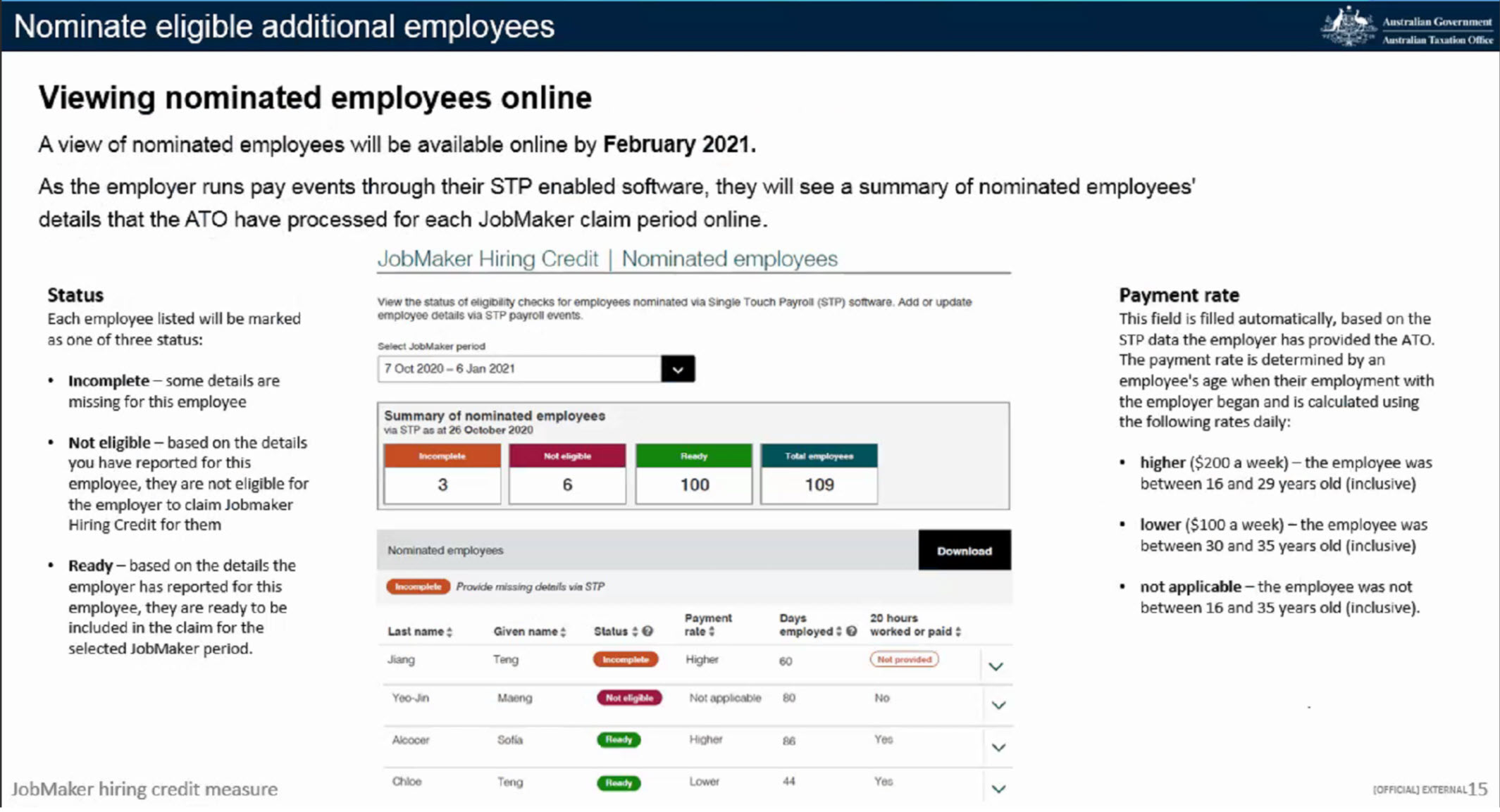

The following screenshots illustrate the JobMaker process of registering, claiming and nominating employees from the ATO side:

The homepage allows you to do 3 things:

- Registration: View and amend registration details

- Claim: Each quarter you'll need to submit your JobMaker claim

- Nominated employees: You'll be able to view the eligibility of employees within your business. A reminder that the eligibility report that you can run via the payroll system do not take into account all eligibility criteria, and as such the final decision is up to the user.

JobMaker registration:

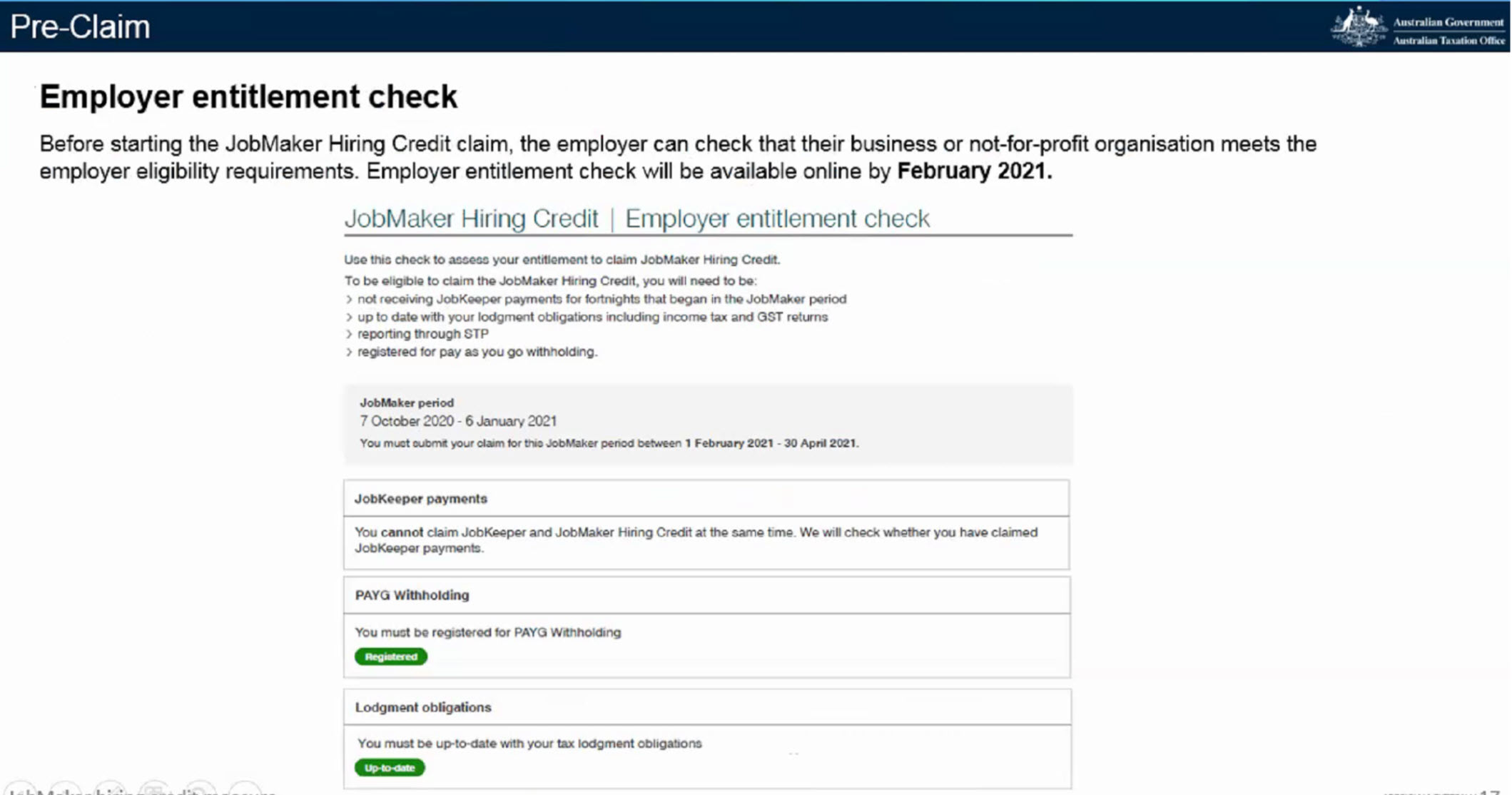

Claiming JobMaker:

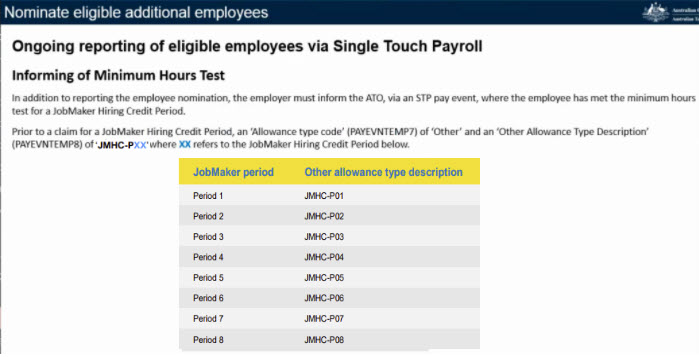

JobMaker nominations:

Please see the following articles for more information on processes relating to JobMaker:

Processing JobMaker nominations via the pay run

Managing the JobMaker Hiring Credit Scheme

Should you have any questions, feel free to email us at support@yourpayroll.com.au.

![Pay Cat Logo New 2.png]](https://www.paycat.com.au/hs-fs/hubfs/Pay%20Cat%20Logo%20New%202.png?height=50&name=Pay%20Cat%20Logo%20New%202.png)