- Knowledge Base AU

- Reporting

- STP Reporting

-

Payroll

-

NoahFace

-

Your training

-

Reporting

-

Add Ons (AU)

-

Awards and Employment Agreements

-

Partners (AU)

-

Time and Attendance (AU)

-

Timesheets (AU)

-

Timesheets (MY)

-

Video Tutorials

-

Director Pays

-

Pay Runs (AU)

-

Business Settings

-

General (NZ)

-

General (AU)

-

Business Settings (SG)

-

Business Settings (NZ)

-

Getting Started (AU)

-

Rostering (AU)

-

Pay Conditions

-

Timesheets

-

Brand/Partners (NZ)

-

Business Settings (AU)

-

Product Release Notes

-

Timesheets (SG)

-

API (AU)

-

Swag

-

Partners (SG)

-

Timesheets (NZ)

-

Business Settings (MY)

-

Partners (UK)

-

Partners (MY)

-

ShiftCare

-

Employees

Tax File Declaration Reporting

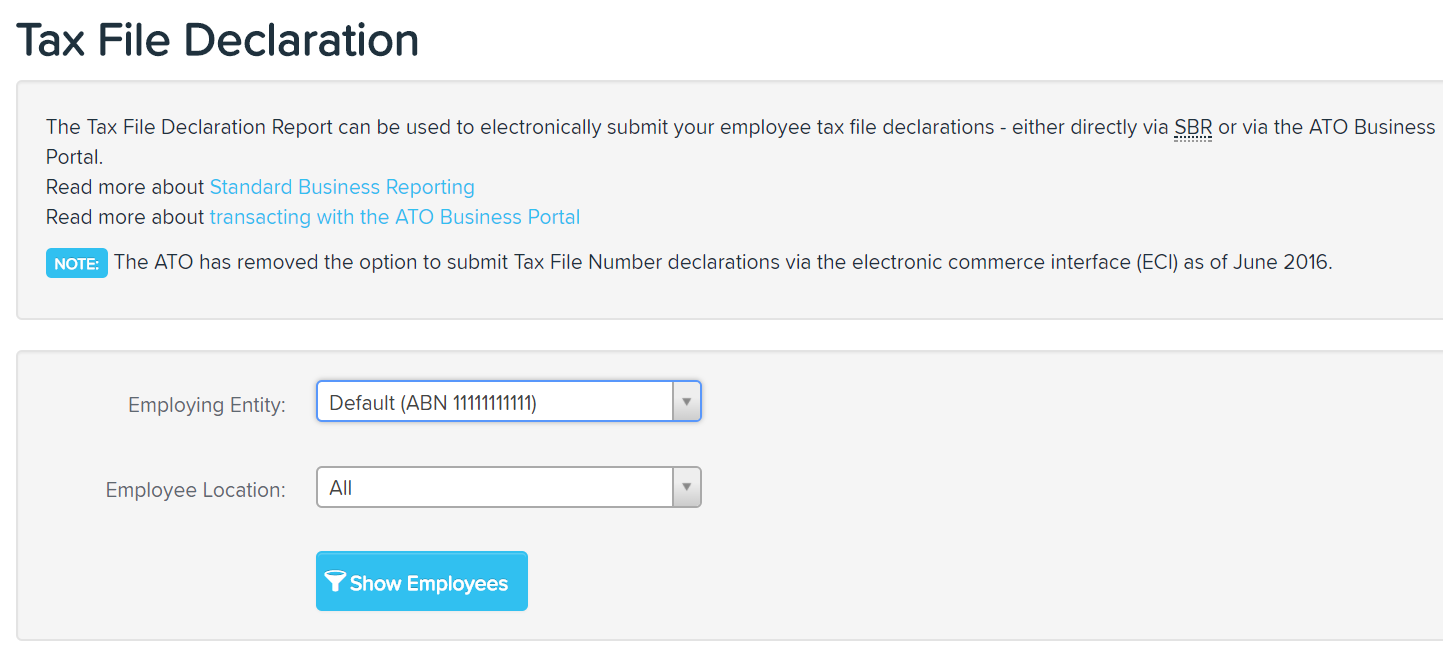

Tax file declaration reporting generates a tax file generation report for new starters that can be submitted to the ATO.

Lodging the Tax File Declaration Report

The tax file declaration report is lodged electronically to the ATO via the ATO Business Portal. The paper based Tax File Declaration form may also be lodged physically via mail but electronic reporting can reduce your paperwork (there is no need to send forms to the ATO if you electronically lodge them).

- Please refer to this article on Lodging tax file number (TFN) declaration data online

Producing the Tax File Declaration Report Tax file declaration reporting is available from the 'Reports' home page under the 'ATO Reports' section.

You are able to filter the report based on:

- Employing Entity (if applicable)

- Employee Location:

Once you 'Click to show Employees', and select the required one/s you have the option to

- Generate - will generate a .tfd file to be submitted via the ATO portal

- Generate and mark as reported - You are required to set the reporting period that should be applied. Will be exported into a .tfd file and will mark each employee as lodged via ECI

- Mark as Reported - Will not create the .tfd file but will mark the employees as lodged

- Lodge Electronically - will lodge directly to the ATO using Standard Business Reporting (SBR)

Note: Upon the commencement of STP Phase 2, pay events will report the taxation information of every included employee. As a result, employers will no longer be required to lodge TFN declarations with the ATO. We will be switching off the electronic lodgement capability on this screen once the transition to Phase 2 reporting is complete.

Businesses not reporting through STP, due to an exemption or deferral, are still required to lodge TFN declarations with the ATO by following the above instructions.

If you have any questions or feedback, please let us know via support@yourpayroll.com.au