This article will provide guidance and direction in how to correct JobKeeper errors made either in the pay run or the pay category setting configuration. Before we get into the nitty gritty, be aware of the following:

- The ATO have allowed for transition rules for the month of April and thereby allow corrections to be made and reported via STP no later than 30 April. This means you must action all corrections for April pay runs before 1 May to be assured you will receive reimbursements by the ATO.

- If you have more than 1 error type to fix, we strongly suggest you correct all errors first and only then lodge an update/pay event. Much easier to keep track of what's happening this way. For any April corrections, ensure your events are lodged by 30 April.

- Make sure to lodge a pay/update event where needed to also report the fixes via STP. If you don't do this, you will be in risk of not getting reimbursed by the ATO. Additionally, if you have lodged an event but it has failed you MUST address the reason and lodge again. For any April corrections, ensure your events are successfully lodged by 30 April.

A breakdown of errors and solutions is as follows:

JobKeeper related pay categories are named incorrectly

The ATO are very strict about the naming conventions for JobKeeper pay categories. There cannot be any creative freedom here. Basically, if you decide to go outside the parameters provided by the ATO either (a) your reimbursements will be extremely delayed or (b) you won't receive any reimbursements at all.

So, DO NOT:

- add spaces

- add dashes or other characters

- add random words

- misspell the words..

I can keep going, but I won't. What you need to remember is that there is only 1 option available when naming the JobKeeper pay categories. The pay category naming requirements are as follows:

- For topping up to $1500 per fortnight, the pay category name MUST ONLY BE JOBKEEPER-TOPUP;

- For notifying the ATO of the eligible employee's fortnight start, the pay category name MUST ONLY BE JOBKEEPER-START-FNxx, where 'xx' = the fortnight period, ie 01, 02, 03, etc, up to 13. As at the end of April there should only be 2 fortnights reported - 01 (being the fortnight period 30 March to 12 April) and 02 (being the fortnight period 13 April to 26 April). So, if the employee's JobKeeper payments started on the 2nd of April, the pay category name used in the pay run would be JOBKEEPER-START-FN01.

- For notifying the ATO of the eligible employee's fortnight finish, the pay category name MUST ONLY BE JOBKEEPER-FINISH-FNxx, where 'xx' = the fortnight period, ie 01, 02, 03, etc, up to 13. As at the end of April there should only be 2 fortnights reported - 01 (being the fortnight period 30 March to 12 April) and 02 (being the fortnight period 13 April to 26 April). So, if the employee's JobKeeper payments ceased on the 20th of April, the pay category name used in the pay run would be JOBKEEPER-FINISH-FN02.

How can you check that you have named the pay categories correctly? We suggest generating a pay categories report for the period of 30 March to last pay in April. This will list all pay categories used in the pay run.

To fix the pay category names, you simply just need to edit the pay category itself and not do anything in the pay runs themselves. To do this, go to Payroll Settings > Pay Categories. Click on the name of the incorrect pay category so that the details of the pay category expand. Override the existing name with the correct name and then click on "Save".

Once you have done this for all incorrectly named pay categories, lodge an update event so that the updated correct pay categories are reported to the ATO.

Payment Classification setting of JobKeeper related pay categories are incorrect

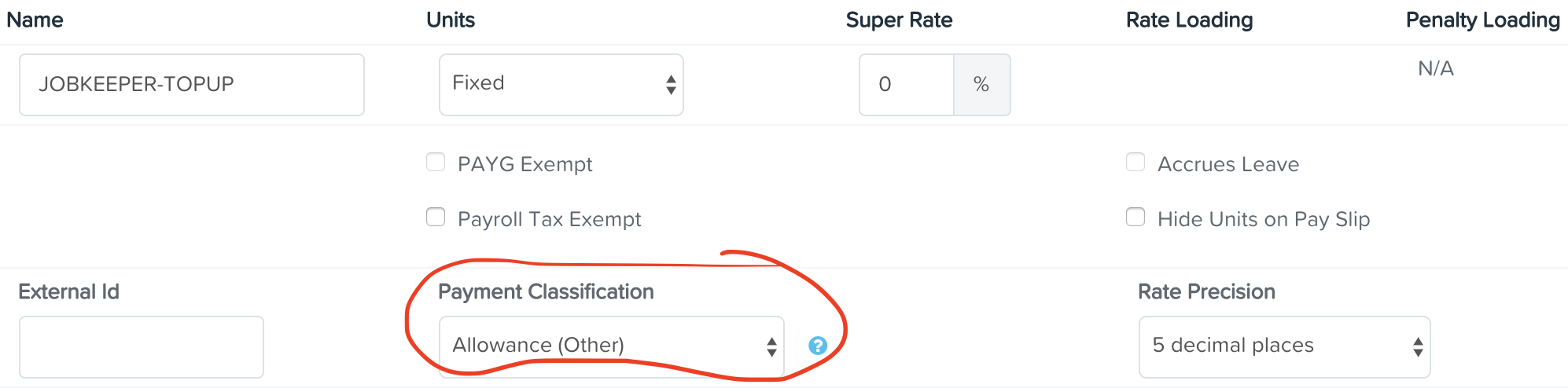

The ATO has made it very clear that JobKeeper related pay categories must be classified as an allowance. Specifically, they must be allocated the payment classification setting of "Allowance (Other)":

Because allowances are itemised in each STP transaction, this is how the ATO identify the JobKeeper payments. If the pay categories are incorrectly classified, the payments will not be itemised in the format required by the ATO and so may be completely missed. This means that either (a) your reimbursements will be extremely delayed or (b) you won't receive any reimbursements at all. So are the ATO strict about this requirement as well? Yes. There is no optional set up here. You must assign "Allowance (Other)" as the payment classification to all JobKeeper related pay categories or risk not being reimbursed by the ATO.

To fix the payment classification setting, you just need to edit the pay category itself and not do anything in the pay runs themselves. To do this, go to Payroll Settings > Pay Categories. Click on the name of the JobKeeper related pay category so that the details of the pay category expand. Select "Allowance (Other)" in the 'Payment Classification' dropdown field and then click on "Save".

Once you have done this for all incorrectly classified pay categories, lodge an update event so that the updated correct pay categories are reported to the ATO.

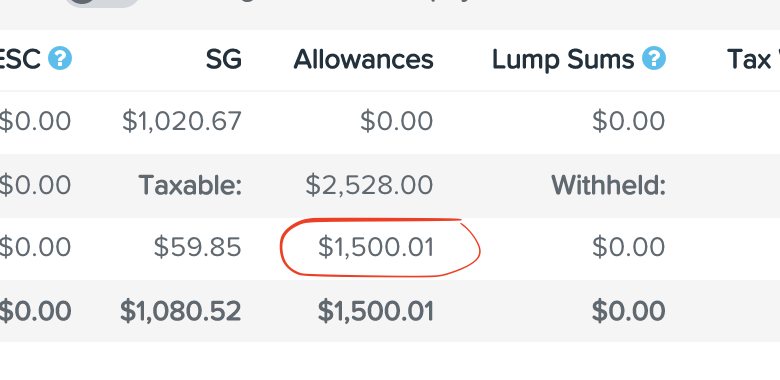

You will then see that all JobKeeper related payments are listed in the "Allowances" column of the pay/update event:

Incorrectly using "JOBKEEPER-START-FNxx" pay categories to report "top-up" amounts

Please stop doing this immediately! The one and only purpose of the JOBKEEPER-START-FNxx and JOBKEEPER-FINISH-FNxx pay categories is to notify the ATO when an eligible employee has started receiving JobKeeper payments or when an employee is no longer eligible and payments have ceased. That is it. They are not intended to be used to report top-up payments.

The only way to report top up payments is by using the pay category JOBKEEPER-TOPUP. If you decide to use any other creative means you will not get reimbursed by the ATO. This issue can only be rectified via a pay run. The specific steps to fix this are:

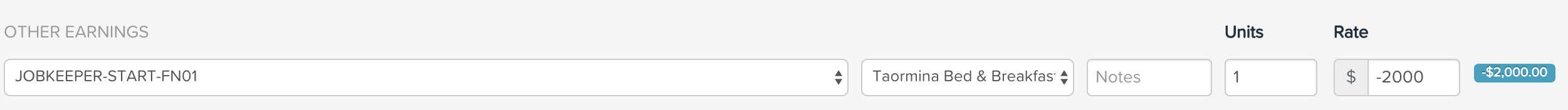

- Generate a pay categories report for the period of 30 March to the last pay period end in April. This will list the JOBKEEPER-START-FNxx pay categories and the earnings processed for each employee. Keep note of all these earnings.

- Create a pay run (select the 'Create pay run with empty pays' options so that employee standard pays do not come through in the pay run). Also ensure if you're fixing April pays, that the period end and date paid is no later than 30 April.

- For each affected employee, you will need to reverse the top up earnings processed using the incorrect pay category. For eg, say you paid an employee a total of $2000 in top up pay for the month using the JOBKEEPER-START-FN01 pay category. Using the 'Add Earnings' action, you will need to assign the same pay category and enter the top up amount as a negative:

- For each affected employee, you will then need to add the top up earnings as a positive amount using the correct pay category. Using the 'Add JobKeeper Payments' action, select the 'JobKeeper top-up' option and then enter the total top up amount, ie '2000', click on 'Finished' and then 'Save'.

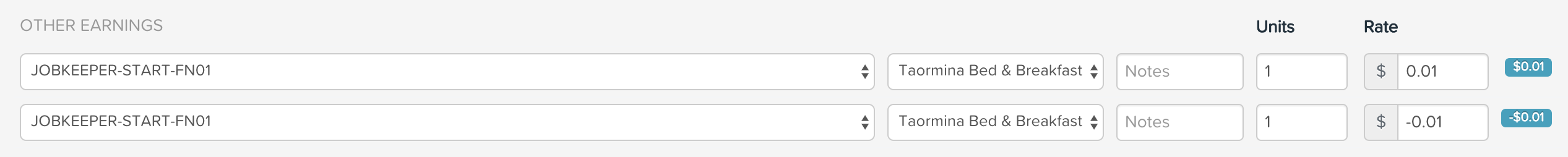

- The employee's earnings will then have 2 lines - one negative and the other positive - and gross earnings should be $0:

- Finalise the pay run. You don't need to publish the pay slips as this pay run is purely for adjustment purposes. You must lodge the pay event so that the corrections are reported to the ATO.

Reporting employee fortnight start and/or finish periods using the incorrect rate or number of units

So, by now, everyone must be aware that employers MUST notify the ATO:

- when eligible employees commence receiving JobKeeper payments; and

- when employees no longer become eligible and hence stop receiving JobKeeper payments.

The other requirement when reporting start/finish periods is that the rate associated to the earnings line must be a minimum of $0.01. Anything less than this will not transmit to the ATO, which means you have breached the requirement of notifying the ATO of when employee start/cease JobKeeper payments. It also means there has been no trigger to the ATO notifying them of any commencement of payment and therefore any reimbursements from the ATO will be very hard to come by!

So what do I mean specifically? Here are examples of what employers have been processing in the pay run which has basically resulted in the ATO not being notified of any start/finish payments:

- 1 unit of $0:

![]()

- 0 unit of $0:

![]()

- 0 unit of $0.01:

![]()

- 1 unit of $0.00001:

![]()

As you can see, all above scenarios end up with a total of $0.00 and because $0 allowances are not reported through STP, you're breaching the ATO rules around notification.

The last example I'll show you, and probably the sneakiest of all, is the following:

The end result is the same - the total YTD amount for that pay category is $0 and so will not be reported through STP.

This issue can only be rectified via a pay run. The specific steps to fix this are:

- Generate a pay categories report for the period of 30 March to the last pay period end in April. This will list the JOBKEEPER-START-FNxx and JOBKEEPER-FINISH-FNxx pay categories and the earnings processed for each employee. Keep note of all employees whose YTD earnings for these pay categories are $0.

- Create a pay run (select the 'Create pay run with empty pays' options so that employee standard pays do not come through in the pay run). Also ensure if you're fixing April pays, that the period end and date paid is no later than 30 April.

- For each affected employee, you will need to add the $0.01 earnings against the relevant start/finish fortnight period. N.B. You only need to record the finish fortnight IF the employee is no longer eligible and hence does not receive JobKeeper payments anymore. Using the 'Add JobKeeper Payments' action, select the 'JobKeeper start' option and then select the relevant fortnight period the payments commenced, click on 'Finished' and then 'Save'. If you need to correct the reporting of finish fortnight periods, using the 'Add JobKeeper Payments' action, select the 'JobKeeper finish' option and then select the relevant fortnight period the payments ceased, click on 'Finished' and then 'Save'. You are NOT to report start or finish periods in advance of the actual period, for eg if an employee will be commencing JobKeeper payments in the month of August, DO NOT record that in any pay runs prior to August. This also applies to finish fortnights.

- The employee's pay will have 1 earnings line with 1 unit of $0.01 pre-populated. Do not change this!

- Finalise the pay run. You don't need to publish the pay slips as this pay run is purely for adjustment purposes. You must lodge the pay event so that the corrections are reported to the ATO.

Claiming JobKeeper payments for eligible employees but not paying/topping up eligible employees to a minimum of $1500 per fortnight

You cannot pay your employees less than $1,500 per fortnight and keep the difference. You will not be eligible for the JobKeeper payment if you pay your nominated eligible employees less than $1,500 (before tax) per fortnight. If you usually pay your employees monthly, the payment can be allocated between fortnights in a reasonable manner but your employees must have received at least $3,000 for every four-week period.

You will need to reconcile what you have paid your eligible employees for each relevant fortnight period you are claiming JobKeeper for each employee to ensure it is at least $1500 per fortnight. If it less than $1500 per fortnight, you will need to create a pay run and pay the difference as a top up amount. The specific steps to rectify this are as follows:

- Create a pay run (select the 'Create pay run with empty pays' options so that employee standard pays do not come through in the pay run). Also ensure if you're fixing April pays, that the period end and date paid is no later than 30 April.

- For each affected employee, you will need to add top up earnings to ensure you comply with the $1500 fortnight minimum. Using the 'Add JobKeeper Payments' action, select the 'JobKeeper top-up' option, enter the top up amount, click on 'Finished' and then 'Save'.

- Finalise the pay run. Seeing as you are adding earnings to an employee's pay, you must ensure you send the pays to the bank and publish the pay slips. You must also lodge the pay event immediately so that the corrections are reported to the ATO.

General corrections to incorrect reporting of JobKeeper fortnight start periods

- If you have incorrectly reported a fortnight start period for an employee who is actually not eligible, you would correct this by reporting the equivalent fortnight finish period. For eg, if the ineligible employee was reported using the pay category JOBKEEPER-START-FN01, you must then use the JOBKEEPER-FINISH-FN01 pay category to cancel out the incorrect entry.

- If you have incorrectly reported a later fortnight start period for an eligible employee, you would correct this by subsequently reporting the correct fortnight start period. The ATO will assume the earlier fortnight start period is the correct one, assuming no equivalent fortnight finish period has been reported.

- If you have incorrectly reported an earlier fortnight start period for an eligible employee, you would correct this by reporting the equivalent fortnight finish period. For eg, if the employee was reported using the pay category JOBKEEPER-START-FN04, you must then use the JOBKEEPER-FINISH-FN04 pay category to cancel out the incorrect entry. You would then have to record the correct fortnight start period.

General corrections to incorrect reporting of JobKeeper fortnight finish periods

- If you have incorrectly reported a fortnight finish period (to confirm ineligibility) for an employee who is actually still eligible, you would correct this by reporting the equivalent fortnight start period. For eg, if the incorrect employee was reported using the pay category JOBKEEPER-FINISH-FN06, you must then use the JOBKEEPER-START-FN06 pay category to cancel out the incorrect entry.

- If you have incorrectly reported a later fortnight finish period for an employee, you would correct this by subsequently reporting the correct (earlier) fortnight finish period. The ATO will assume the earlier fortnight finish period is the correct one where no unmatched fortnight start period has been reported.

- If you have incorrectly reported an earlier fortnight finish period for an employee, you would correct this by reporting the equivalent fortnight start period. For eg, if the employee was reported using the pay category JOBKEEPER-FINISH-FN04, you must then use the JOBKEEPER-START-FN04 pay category to cancel out the incorrect entry. If the fortnight period that the employee actually did finish has already passed, you would then have to record the correct fortnight finish period.

Incorrectly using normal earnings pay categories to report "top-up" amounts

If you started topping up employee pays before the ATO published specific instructions on how to report JobKeeper payments, you may have used the employee's default pay category to do this. You will need to make adjustments here and ensure the top-up payments are processed in the pay run using only the JOBKEEPER-TOPUP pay category.

Follow the instructions provided in the scenario "Incorrectly using "JOBKEEPER-START-FNxx" pay categories to report "top-up" amounts to rectify this issue. Secondly, ensure you have reported the fortnight start periods for each eligible employee.

Should you have any questions, feel free to email us at support@paycat.com.au.