- Knowledge Base AU

- Add Ons (AU)

- QuickBooks

-

Payroll

-

NoahFace

-

Your training

-

Reporting

-

Add Ons (AU)

-

Awards and Employment Agreements

-

Partners (AU)

-

Time and Attendance (AU)

-

Timesheets (AU)

-

Timesheets (MY)

-

Video Tutorials

-

Director Pays

-

Pay Runs (AU)

-

Business Settings

-

General (NZ)

-

General (AU)

-

Business Settings (SG)

-

Business Settings (NZ)

-

Getting Started (AU)

-

Rostering (AU)

-

Pay Conditions

-

Timesheets

-

Brand/Partners (NZ)

-

Business Settings (AU)

-

Product Release Notes

-

Timesheets (SG)

-

API (AU)

-

Swag

-

Partners (SG)

-

Timesheets (NZ)

-

Business Settings (MY)

-

Partners (UK)

-

Partners (MY)

-

ShiftCare

-

Employees

Understanding W1 and W2 tax codes in QBO

When exporting journals to QBO, the system has the ability to assign the W1 and W2 amounts so that they'll appear correctly in the BAS.

***Note - To ensure proper W1/W2 tax code reporting you need to ensure that your BAS codes are enabled

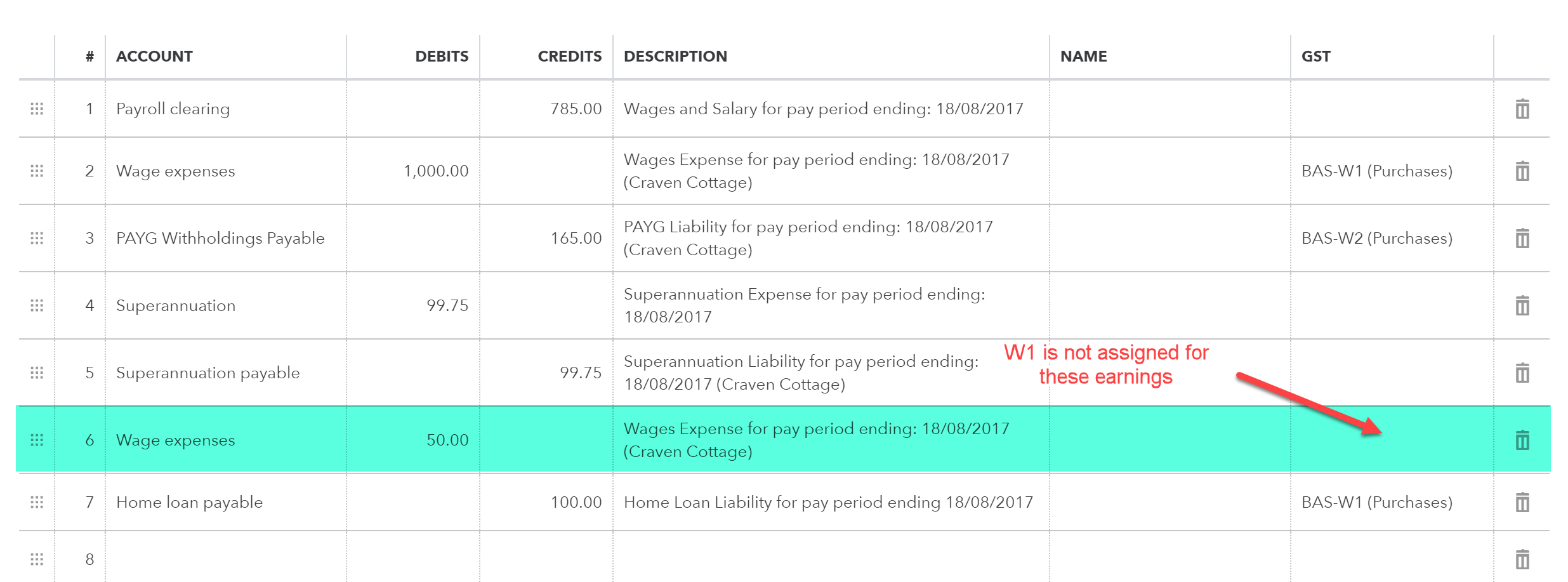

Once your BAS codes are enabled, you will see the BAS codes being allocated to your journal entries as per the image below:

BAS codes will be allocated to the following transaction types (as per the ATO guidelines):

| Transaction Type | Tax Code | Net effect |

| Wage Expense | BAS-W1 | Credit |

| PAYG Liability | BAS-W2 | Credit |

| Pre-tax deduction liability | BAS-W1 | Debit |

| Pre-tax deduction payment to bank account | BAS-W1 | Debit |

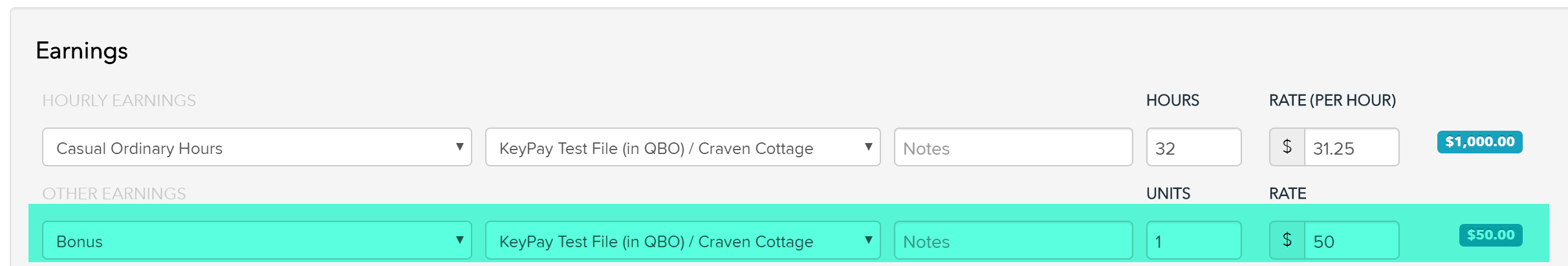

Excluding earnings from being included in W1

Under certain circumstances, you may wish to exclude earnings from being reported as W1 on your BAS. You can exclude these payments by following these steps:

- Go to payroll settings > pay categories and click on the pay category you don't want reported at W1 on your BAS

- Under the pay category settings, ensure the "Exclude from W1 in journals" option is ticked

- Now when you pay an employee under these earnings, they won't be reported as W1 on the journal

W1 reporting and Salary Sacrifice

The ATO guidelines are very clear that amounts subject to salary sacrifice arrangements should not be reported as W1 on your BAS.

To handle this, the system will assign the W1 tax code to all pre-tax deduction liability amounts. This has the net effect of reducing the W1 amount reported on the BAS.

This is demonstrated in the example below:

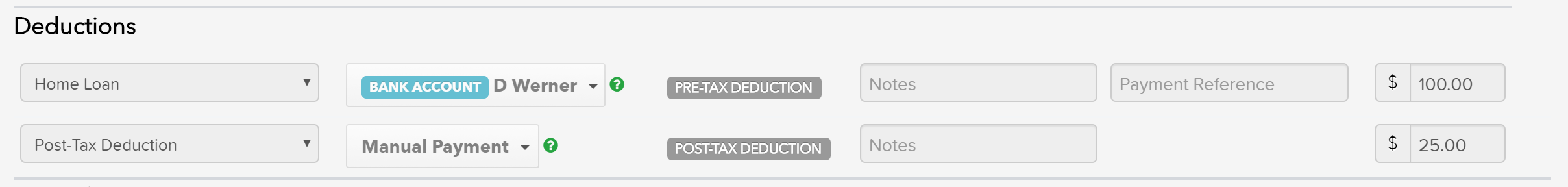

In my pay run, I have the following deductions:

- A pre-tax deduction of $100 for a home loan repayment

- A post-tax deduction of $25

The total earnings for this pay run is $1000.

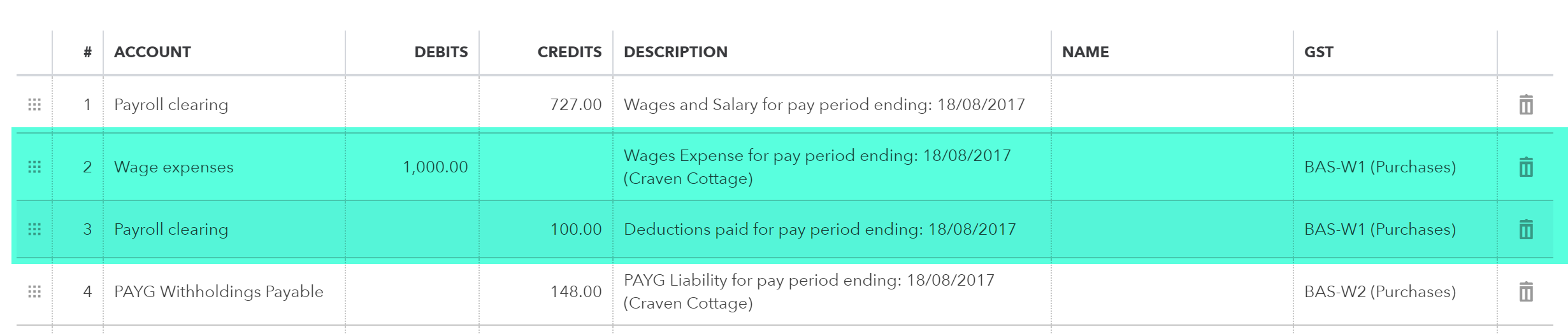

When I finalise this pay run I get a journal with the following transactions:

The key transactions here are lines 2 and 3.

On line 2 you can see there's a debit from the wages expense account for $1000 which will be credited as W1 on the BAS.

One line 3 you can see there's a credit from the wages expense account for $100 which will be debited from W1 on the BAS.

The net effect here is that there will be $900 reportable at W1 onthe BAS, thus satisfying the requirement for the salary sacrifice arrangements to be excluded from being reported at W1.

This behaviour applies to all pre-tax deductions regardless of if they're paid to a bank account, super fund or manually paid.

***Note there is no change in the tax code of W1 for the post tax deduction as this is included in the gross wages amount and is therefore not exempt from being reported as W1 on the BAS