- Knowledge Base AU

- Add Ons (AU)

- QuickBooks

-

Payroll

-

NoahFace

-

Your training

-

Reporting

-

Add Ons (AU)

-

Awards and Employment Agreements

-

Partners (AU)

-

Time and Attendance (AU)

-

Timesheets (AU)

-

Timesheets (MY)

-

Video Tutorials

-

Director Pays

-

Pay Runs (AU)

-

Business Settings

-

General (NZ)

-

General (AU)

-

Business Settings (SG)

-

Business Settings (NZ)

-

Getting Started (AU)

-

Rostering (AU)

-

Pay Conditions

-

Timesheets

-

Brand/Partners (NZ)

-

Business Settings (AU)

-

Product Release Notes

-

Timesheets (SG)

-

API (AU)

-

Swag

-

Partners (SG)

-

Timesheets (NZ)

-

Business Settings (MY)

-

Partners (UK)

-

Partners (MY)

-

ShiftCare

-

Employees

Why aren't my BAS Figures Reporting W1 and W2 Amounts Correctly?

The most common reason for the W1 and W2 amounts not being reported correctly on the QBO BAS reporting is because the W1 and W2 tax codes have not been applied correctly to the payroll journals.

You can correct these by following these steps:

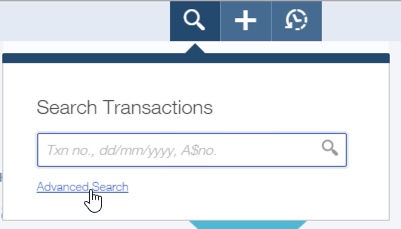

- Log into QBO and click on the "Search" button at the top of the screen and then click "Advanced Search"

- From the advanced search screen select the following criteria:

"Journal Entries"

"Memo" - "Contains" - "Pay Run"

- From the list of journal entries that appears, check each journal entry to ensure that the W1 and W2 Tax codes have been applied.

If they haven't been applied, assign the appropriate tax code to each transaction line in the journal.

Alternatively, you can unlock and re-finalise the pay run from the pay runs screen and the tax codes will be automatically created for you.

If you have any feedback or questions please contact us via support@yourpayroll.com.au