End of Year Reconciliation - Payment Summaries

A crucial part of wrapping up EOFY is reconciling the data you are about to send the ATO with a payroll report, such as the Detailed Activity Report (DAR), to ensure the figures match.

From the Payment Summaries screen, ie Reports > Payment Summaries (listed under ATO Reporting), select the applicable financial year and then click on "Show Payment Summaries". This will display all payment summary and ETP information for your employees. A row of action buttons will also be displayed.

Click on "Download" > "Excel" to generate a payment summary report - this is the report containing the payment summary earnings that you will use to reconcile with the DAR.

It is important to advise you at this stage that businesses with a combination of closely held employees and non-closely held employees, that only closely held employees will appear in this report as non-closely held employees must be reported via STP.

Once you have downloaded the excel payment summary report, you can then download the DAR. Make sure to use the following filters when downloading the report:

- Date range = financial year (if generating on or before 30 June - if generating the report post this date, select 'last financial year');

- Pay schedule = All;

- Group by = employee default location.

You now have your two reports to compare. N.B. If the business has both closely held employees and non-closely held employees, you will need to remove the non-closely held employees from the DAR so that you're comparing apples with apples.

From the payment summary excel report, you will notice 2 tabs:

- Payment summaries:

- ETP payment summaries.

There will only be data in the 'ETP payment summaries' worksheet if you have terminated an employee and there is an ETP associated to that payment. Otherwise, this worksheet will have no data.

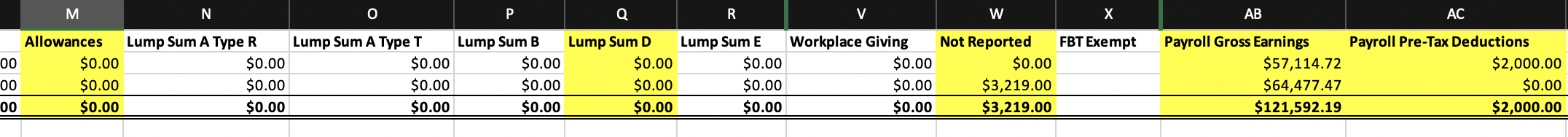

In the payment summary excel report, calculate the following:

- total 'Payroll Gross Earnings' (Column AB), minus

- total 'Not Reported' (Column W), minus

- total 'Payroll Pre-Tax Deductions' (Column AC), minus

- total 'Lump Sum D' (Column Q), minus

- total tax-free allowances (Column M), plus

- total taxable component component of ETP (Column G in the 'ETP payment summaries' worksheet).

Column M contains both taxable and tax-free allowances, so make sure to seperate these amounts.

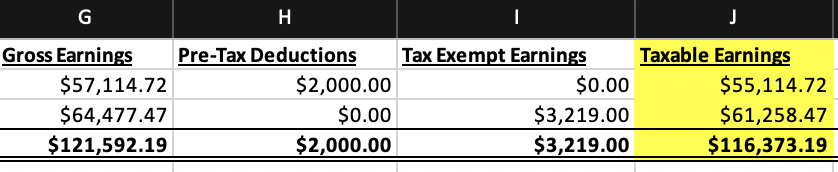

Then, from the DAR, review the 'Taxable Earnings' column:

If the total figures between the two reports are identical then you're good to commence the process of publishing payment summaries.

If the total figures between the two reports do not match, we recommend auditing each employees' earnings lines between both reports to drill down exactly where the variance lies.

If you have any questions or feedback, please let us know via support@yourpayroll.com.au.

![Pay Cat Logo New 2.png]](https://www.paycat.com.au/hs-fs/hubfs/Pay%20Cat%20Logo%20New%202.png?height=50&name=Pay%20Cat%20Logo%20New%202.png)