Effective from 9 August 2021

Some employees have study or training support loans (STSL) that need to be repaid when the employee's earnings (or "repayment income") exceeds the minimum repayment threshold. The minimum repayment threshold is normally reviewed every financial year. Current data on the threshold amount can be accessed here.

Information on the different type of loans that fall into the STSL category can be found here. From 1 July 2019, all study and training loans were consolidated into one set of thresholds and rates. In addition, the hierarchy in which compulsory repayments are applied to study and training loans (relevant to employees who have more than one type of loan) was changed to the following:

- Higher Education Loan Program (HELP);

- VET Student Loans (VSL);

- Student Financial Supplement Scheme (SFSS);

- Student Start-up Loan (SSL);

- ABSTUDY Student Start-up Loan (ABSTUDY SSL);

- Trade Support Loan (TSL).

Employees can choose to have their STSL amount calculated using one of 2 options:

- Calculated on taxable earnings; or

- Calculated on repayment income.

What is taxable earnings?

Taxable earnings are all gross earnings paid to an employee, minus the following:

- Salary sacrifice arrangements; and

- Earnings that are tax exempt.

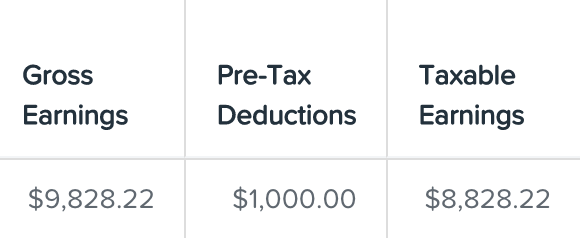

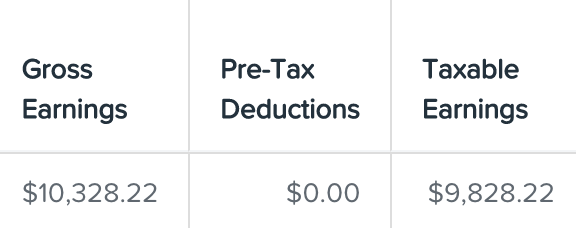

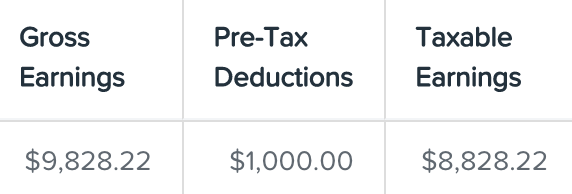

In the pay run, you will note that there are 2 columns - 'Gross Earnings' and 'Taxable Earnings'. If there is some form of salary sacrifice arrangement between an employer and employee, this will appear in the 'Pre-Tax Deductions' column and will reduce the employee's taxable earnings, as follows:

Where the employee has chosen to have their STSL amount calculated on taxable earnings, and using the example above, STSL will be calculated on the $8,828.22 amount. This is identical to how PAYG is calculated.

Alternatively, an employee's taxable earnings may vary from their gross earnings because of a tax-free payment added to their earnings. This amount will be included in their gross earnings but not form part of their taxable earnings, as follows:

Again, where the employee has chosen to have their STSL amount calculated on taxable earnings, and using the example above, STSL will be calculated on the $9,828.22 amount.

Effective from 9 August 2021, all new employees with an STSL debt will default to to using the taxable earnings calculation method. This can be changed to the repayment income calculation method directly from the employee's Tax File Declaration screen. Further information on the changes made from 9 August 2021 can be found in this support article.

What is the repayment income?

The repayment income is the employee's pay run earnings that determines the amount of STSL payable/deducted for that employee. The components that make up an employee's repayment income are:

- Taxable earnings (this is different to gross earnings);

- Reportable fringe benefits (regardless of the exempt status of your employer);

- Total net investment loss (which includes net rental losses);

- Reportable super contributions, including salary sacrifice super and employer contributions over the legislated 10% that the individual employee has influenced (eg negotiated a higher rate of super in their employment contract);

- Exempt foreign employment income amounts.

N.B. Reportable fringe benefits and total net investment loss are managed outside of payroll. Employees should be aware of their obligations around these components and possibly consider withholding extra tax from their pay to cover any potential STSL debt incurred. Salary packaging providers often have a calculator that will show an employee how much extra tax they'll owe at the end of the year if they have STSL.

You can set up recurring additional tax deductions for an employee using our pay run inclusions feature.

Examples of STSL calculations based on taxable earnings, reportable super contributions and exempt foreign income amounts are detailed further below.

What is the relationship between PAYG and STSL?

In layman terms, STSL is an additional tax debt to PAYG. Regardless of whether the employee has an STSL debt or not, the employee's PAYG amount will be the same. Some payroll systems incorporate PAYG and STSL into one amount and so there is no clear separation between the 2 amounts. This payroll system separates the 2 amounts (in the pay run, pay slips and most payroll reports) to provide greater transparency to the employer and employee.

When reporting these amounts to the ATO however (through STP or payment summaries) they are consolidated into one combined amount, as per ATO guidelines. At the end of the financial year, the ATO will determine the actual PAYG and STSL owed based on the employee's payroll and non payroll income. If an insufficient amount of tax has been deducted through the payroll for the employee, the employee will be required to pay an extra amount directly to the ATO. If however, the amount of tax deducted is more than required, the ATO will refund the 'overpaid' amount back to the employee.

N.B. If an employee chooses to have additional/voluntary tax deducted, the additional amount will appear in the PAYG column.

Examples of STSL pay run calculations

The amount used when calculating the STSL amount in a pay run depends on the pay run's frequency. You can access the ATO STSL tax tables here based on the applicable pay frequency:

You can also refer to the ATO's component look up tool provided here to determine STSL calculations.

At any time, if you require confirmation of the STSL calculation method being used in the pay run for an employee with an STSL, click on the tooltip next to the amount displayed in the 'STSL' column for that employee and this will advise you:

The examples provided below are based on 'positive' earnings. However, take note that if earnings or any other components affecting STSL calculations apply in the pay run as a negative, the negative earnings will also be taken into account when calculating STSL (ie they will reduce the STSL debt). As per existing practice with PAYG calculations, we do not calculate negative STSL in the pay run. If your employee's earnings are negative (due to a reversal, for eg), you will then need to manually adjust the employee's PAYG and apply a negative PAYG/STSL amount.

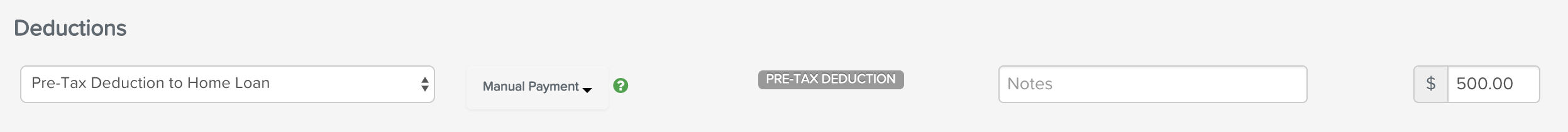

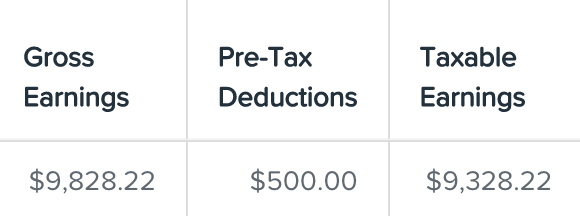

Example 1: Pre-tax deductions that are not salary sacrifice super

Any pre-tax deduction amount that is not paid to a super fund is not included as part of the employee's repayment income. The pre-tax deduction does however affect the employee's taxable income. For eg, we apply a $500 pre-tax deduction to the employee's pay:

This results in the employee's taxable earnings being $500 less than their gross earnings:

- Employee's STSL calculated on taxable earnings: STSL will be calculated on the taxable earnings amount, which is $9,328.

- Employee's STSL calculated on repayment income: As stated above, as a pre-tax deduction not paid to a super fund does not constitute repayment income, the employee's taxable earnings will be used in this instance to calculate the STSL amount as there is no reportable super contributions or exempt foreign employment income amounts for this pay.

Example 2: Salary sacrifice super deduction

Where an employee salary sacrifices a component of their earnings to super (ie reportable super contribution), this will reduce their taxable earnings but the deduction amount must still be included in their repayment income. For eg, we apply a $1000 salary sacrifice (pre-tax) deduction to the employee's pay:

This results in the employee's taxable earnings being $1000 less than their gross earnings:

- Employee's STSL calculated on taxable earnings: STSL will be calculated on the taxable earnings amount, which is $8,828.

- Employee's STSL calculated on repayment income: When calculating the employee's STSL debt using the repayment income method, we use their taxable earnings + reportable super contributions (ie salary sacrifice super) amount. So $8,828 + $1,000 = $9,828; this is the employee's repayment income amount. N.B. If a super salary sacrifice deduction is not set up to be paid to the employee's super fund (ie it's configured as a manual payment or paid to a bank account), it will not be deemed a reportable super contribution and therefore no STSL will be applied to the amount. As such, be careful when processing super salary sacrifice deductions and ensure they are being set up to be paid to the super fund!

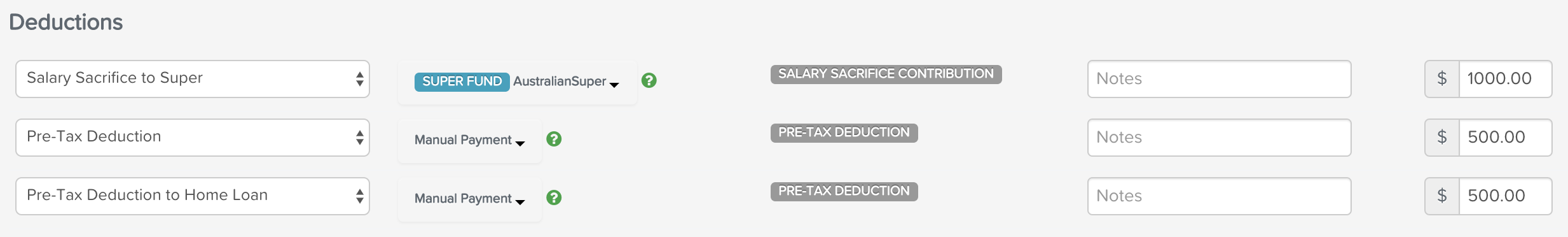

Example 3: Multiple pre-tax deductions

Where an employee's pay includes several pre-tax deductions, the system will only look at deductions paid to a super fund when determining the employee's repayment income amount. For eg, the following pre-tax deductions are applied to the employee's pay:

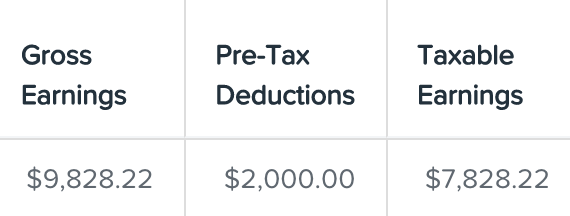

This results in the employee's taxable earnings being $2000 less than their gross earnings:

- Employee's STSL calculated on taxable earnings: STSL will be calculated on the taxable earnings amount, which is $7,828.

- Employee's STSL calculated on repayment income: When calculating the employee's STSL debt using the repayment income method, we use their taxable earnings + salary sacrifice super amount (ie reportable super contributions) only. So $7,828 + $1,000 = $8,828; this is the employee's repayment income amount.

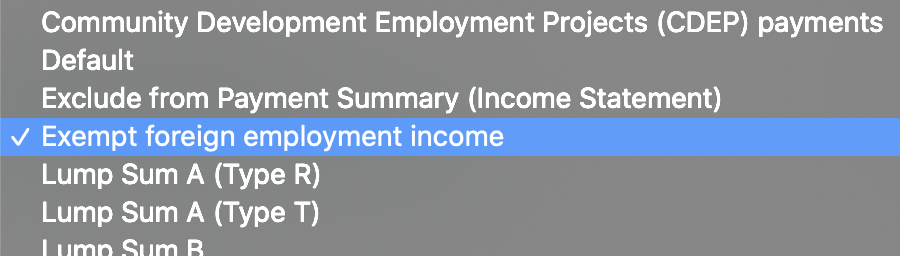

Example 4: Exempt foreign employment income

Any tax-free foreign employment income processed in an employee's pay is included as part of the employee's repayment income. The system recognises earnings as foreign employment income if the pay category's "Payment Classification" is configured to 'Exempt foreign employment income':

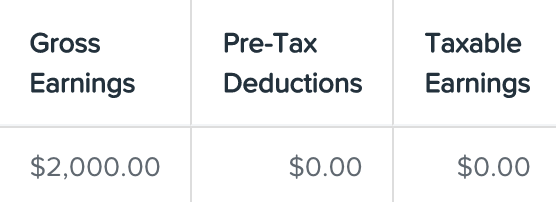

For eg, an employee's earnings are made up of $2000 worth of foreign employment income only:

This results in $0 taxable earnings:

- Employee's STSL calculated on taxable earnings: STSL will be calculated on the taxable earnings amount, which is $0. As such, no STSL will be deducted.

- Employee's STSL calculated on repayment income: When calculating the employee's STSL debt using the repayment income method, we use their taxable earnings + foreign employment income. So $0 + $2,000 = $2,000; this is the employee's repayment income amount.

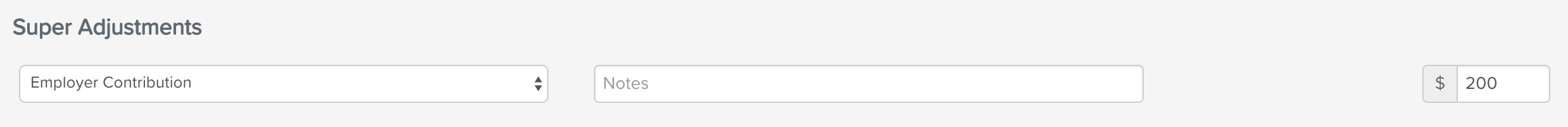

Example 5: Employer Contributions

Reportable employer super contributions include super contributions paid by the employer that are above the legislated super guarantee and are a result of the employee's 'influence' (eg negotiated a higher rate of super in their employment contract). They do NOT include amounts over the legislated super guarantee where the requirements exists in line with a registered agreement or if it is company policy to pay additional super, as the individual employee has not influenced this.Any reportable employer contributions must be processed in the pay run using the 'Employer Contribution' category within the Super Adjustments section. This can also be set up a recurring pay run inclusion.So, in this example, the employer processes a $200 contribution for the employee, as follows:

This does not affect an employee taxable earnings at all. Rather the amount is displayed in the 'EC' column under 'Super Contributions':

- Employee's STSL calculated on taxable earnings: STSL will be calculated on the taxable earnings amount, which is $2,485. Employer contributions do not affect taxable earnings and, as such, are disregarded when calculating STSL using the taxable earnings method.

- Employee's STSL calculated on repayment income: When calculating the employee's STSL debt using the repayment income method, we use their taxable earnings + employer contribution amount. So $2485 + $200 = $2685; this is the employee's repayment income amount.

Example 6: lump sum payments

Lump sum payments are treated as "annual" payments regardless of why/how they are in the pay run:

- the Add lump sum payment option from the Actions button within the pay run record was used, or

- annual leave is being paid out on termination

...so the lump sum amount will be divided by the pay frequency for STSL threshold calculations, ie.

-

-

- divided by 12 if the pay schedule frequency is monthly

- divided by 26 if the pay schedule frequency is fortnightly

- divided by 52 if the pay schedule frequency is weekly

-

Then, the actual calculation to estimate annual repayment income is as follows:

- Monthly pay schedule: Ordinary Hours* + (Lump Sum / 12) = $$$$ per month x 12

- Fortnightly pay schedule: Ordinary Hours* + (Lump Sum / 26) = $$$$ per fortnight x 26

- Weekly pay schedule: Ordinary Hours* + (Lump Sum / 52) = $$$$ per week x 52

* We do not "pro-rata" ordinary earnings figures if an employee is terminated mid way through the pay period of a termination pay run. If you want to make this adjustment then you will need to do your own calculations to see if the affected employee's estimated annual income will breach the threshold for STSL and if it does, use the appropriate tax rate % (as per the table on the ATO website) to work out the tax on the earnings and then add a PAYG adjustment (another option from the Actions button within the pay run record).

Remember, it doesn't matter that a PAYG adjustment won't show up as STSL in the pay run because all of the tax goes to the ATO in one hit anyway - they sort out how much tax should have been paid on the earnings and allocate anything leftover to the STSL debt when the employee finalises their tax arrangements at EOFY.

Why are the withheld amounts different in the pay run?

The ATO prescribes that payroll software use specific formulas to derive the PAYG and STSL amounts. The specific details of these formulas can be accessed, as follows:

As a result, there may be some minimal instances where the withheld amounts in the pay run vary to what is displayed in the tax tables published by the ATO. For eg, the ATO tax tables may show that an employee's PAYG amount is $532 and STSL amount is $108, totalling an amount of $640 to be withheld for the employee. The pay run amounts however are displaying as $534 PAYG and $106 STSL. This also totals $640.

Don't forget that the amounts withheld are sent to the ATO as a consolidated figure so if there is a small variance, there is no need to be concerned if the consolidated amounts are the same.

If you have any queries or comments please contact us via support@paycat.com.au.