You are notified of pay run warnings in 2 areas. The first being the 'Pay run' tab on the business dashboard, and you can view this article for more information on that. This article will focus on pay run warnings that appear, if applicable, during a pay run.

Warnings could appear as soon as the pay run is created or during the pay run (depending on what actions are performed in the pay run).

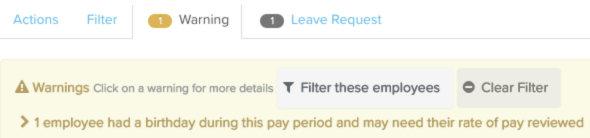

In order to see the specific details of the warning:

- Click on the word "Warning";

- This will redirect to that tab and expand on the data to show you each warning;

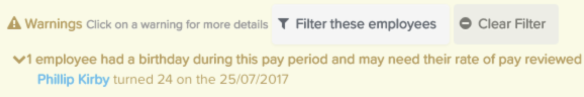

- If you click on the specific warning, this will also expand to show you details.

Click on the warning so that it expands to provide more information:

The following warnings will be displayed in a pay run:

- ABA details missing - this will be displayed when no bank account details have been provided for a pay run and therefore no ABA file can be generated.

- BPAY details missing - this will be displayed when no business BPAY file has been provided but employees have BPAY accounts set up and to be processed in the pay run. No BPAY file can be generated until such details have been added.

- Employee with negative earnings amount - this will be displayed when the net payment amount for an employee is less than 0.

- Employee with unpaid earnings - this will be displayed when an employee has an earnings line with hours applied, but the total value of the earnings line is 0. This usually indicates there's an error with the employee's rate of pay.

- Employee with birthday - this is displayed when an employee has a birthday during the pay run period and therefore may need to have their rate of pay reviewed.

- Employee with work anniversary - this is displayed when the anniversary of the employees start date occurs during the pay run period and therefore may need to have their rate of pay reviewed.

- Employee taking more leave than is accrued - this is displayed when an employee is attempting to take more leave than they have accrued.

- Previously terminated employee - this is displayed when an inactive employee who has previously been terminated appears in the pay run.

- Terminated employee with outstanding recurring expenses - this is displayed when a previously terminated employee, who is still owed an expense reimbursement amount from their expense pay run inclusion, appears in the pay run.

- Employee with expired qualification - this is displayed when an employee's qualified has expired within the pay run period.

- Employee with duplicate earnings lines - this is displayed when there is more than one earnings line associated with the same timesheet line that contains the same units, pay rate, total earnings and note.

- Employee expense without a tax code selected - this is displayed when an expense has been applied in a pay run and does not contain a tax code. This is only applicable where a business is connected to on online journal service and has synced their tax codes against the expense categories.

- Employee has reached their leave cap - this will displayed for any employee whose leave entitlement has reached the maximum accrual for the year. For example, say an employee is entitled to 'Special Leave' and the maximum accrual entitlement for this leave is 10 hours per year. When the employee reaches the accrual and now has a balance of 10 hours for the leave year, this warning will appear.

- Pending leave requests - this is displayed when an employee has submitted a leave request pertaining to any dates within that pay period, that is yet to be approved. Pending leave requests cannot be applied in the pay run unless approved. Additionally, for automated pay runs, pending leave requests will not be automatically applied in the pay run.

- Leave request extends past pay run dates - this is displayed when an employee's leave request spans multiple pay periods. This warning is important as it highlights only a portion of the leave request should be applied in the pay run.

- Leave request ends before pay run dates - this is displayed when an employee's leave request dates back in the past and is therefore relevant to previous pay periods.

- Incomplete pay run tasks - this is displayed when tasks have been created for the pay run in question are are not completed.

- Pending Expense Requests - this is displayed when an employee has submitted an expense request pertaining to that pay period that is yet to be approved. Pending expense requests will not be processed in the pay run unless approved. Additionally, for automated pay runs, pending expense requests will not be automatically processed in the pay run.

- Pro rata earnings within period for new or terminated employees - this is displayed when an employee, set up with default standard hours, has either commenced employment or terminated employment mid-pay period and so pro-rata hours have been calculated. This warning acts as a reminder to check the employee's pro-rata hours have been calculated correctly.

- Employee scheduled pay rate change auto applied within pay period - this is displayed when an employee has a scheduled pay rate change within the pay run period and indicates that the system has applied the new rate automatically.

- Employee scheduled pay rate change requires manual update in pay period - this is displayed when an employee has a new pay rate scheduled within the pay run period and requires a manual update to the employees pay rate.

- More than 28 days have passed without a TFN quoted - This warning indicates that the employees tax is being automatically updated due to the 28 day period passing in which their TFN has not been added.

- Scheduled updates have been applied - this is displayed when any scheduled updates have been applied within the pay run period.

Additionally, once a pay run has been finalised and no ABA file or BPAY file is set up, you will see the following warning against the "Download Payment File" button:

If you have any questions or feedback, please let us know via support@yourpayroll.com.au.