This article provides guidelines about when to use the different work types and tags that are included as part of the pre-built Retail award packages. For further information about the general retail industry award, refer Restaurant Industry Award.

Key Updates to Award

Last Updated: August 2023

Key_Updates

Installing and Configuring the Pre-Built Award Package

For details on how to install and configure this Pre-built Award Template, please review the detailed help article here.

While every effort is made to provide a high-quality service, YourPayroll does not accept responsibility for, guarantee or warrant the accuracy, completeness or up-to-date nature of the service. Before relying on the information, users should carefully evaluate its accuracy, currency, completeness and relevance for their purposes, and should obtain any appropriate professional advice relevant to their particular circumstances.

Work Types

2+ hrs OT worked (no prior notice to employee)

An employee that was required to work more than 2 hours of overtime without being notified the previous day or earlier and is not provided with a meal should add 1 unit of this allowance to their shift. Refer section 20.1(a) of the Restaurant Industry Award.

Tool Allowance

Choose this work type for shifts where a cook or apprentice cook is required to use their own tools. Refer to section 24.3(a) of the Restaurant Industry Award.

No Break

Normally, meal breaks are automatically added for shifts over 5h30m. Use this work type to indicate that no meal break was taken during the shift

Public Holiday not Worked

Choose this work type where employees are not required to work on a gazetted public holiday.

Public Holiday Rostered Day Off - AL accrual

Choose this work type where a full time employee's rostered day off falls on a public holiday and the employee chooses to accrue annual leave in accordance with clause 38.2(c) of the Restaurant Industry award.

Public Holiday Rostered Day Off - Pay Extra Day

Choose this work type where a full time employee's rostered day off falls on a public holiday and the employee chooses to be paid an extra day's pay in accordance with clause 38.2(a) of the Restaurant Industry award.

COVID-19 Not Worked

Use this work type when an employee's ordinary hours have been reduced during the coronavirus outbreak and they are not working.

Annual Leave

Choose this work type when annual leave was taken

Carer’s leave

Choose this work type when carer’s leave was taken

Compassionate Leave

Choose this work type when compassionate leave was taken

Long Service Leave

Choose this work type when long service leave was taken

Sick leave

Choose this work type when sick leave was taken

Time in Lieu of Overtime

Choose this work type if the employee elects to accrue time in lieu rather than be paid for any overtime for this shift.

Time in Lieu taken

Choose this work type when time in lieu was taken

Unpaid Leave

Choose this work type when unpaid leave was taken

Rostered Day Off Worked

Choose this work type where a permanent employee is required to work on their rostered day off. Refer to clause 33.2(d) of the Restaurant Industry Award.

Shift Conditions

2+ hrs OT worked (no prior notice to employee)

An employee that was required to work more than 2 hours of overtime without being notified the previous day or earlier and is not provided with a meal should add 1 unit of this allowance to their shift. Refer section 20.1(a) of the Restaurant Industry Award.

Tags

The following tags are available for application to employees under the Restaurant Industry Award.

TIL of OT

Assign this tag if the employee elects to always accrue time in lieu rather than be paid overtime.

Substitute Allowance

Assign this tag to an employee’s profile where an agreement has been made to pay a Substitute Allowance per Clause R.5 of the Award.

Tool Allowance

Assign this tag to any cook or apprentice cook required to use their own tools. Refer to section 24.3(a) of the Restaurant Industry Award. This will then automate the payment of the tool allowance without the need to use a work type.

Key Updates

August 2023

14th

The ruleset Annualised Wage Arrangement has been updated to ensure that the work type Public Holiday Not Worked does not trigger penalty calculations.

1st

From 1 August, all employees are entitled to 10 days of paid family and domestic violence leave each year. The (Unpaid) Family and Domestic Violence Leave configuration settings under awards have been updated - the leave category is disabled from award leave allowance templates, and the work type is not enabled automatically for all employees. Please ensure that employees no longer use the unpaid leave category or work type.

July 2023

7th

We have updated the pay condition Permanent Restaurant (excluding shift workers) to ensure that the split shift allowance will apply correctly as per clause 21.3(b).

5th

We have corrected the Casual - Sunday rates for Introductory level, and levels 1 and 2.

1st

We have updated the award to reflect the Fair Work Commission’s National Minimum Wage increase detailed in the Annual Wage Review 2022-23 decision and also includes updates to expense-related allowances. You can find information on the Determinations here and here. These changes come into effect from the first full pay period on or after the 1st July 2023. Please install these updates after you have finalised your last pay run before the first full pay period beginning on or after the 1st July 2023.

We have also updated the Community Service Leave category to ensure it pays at base rate.

Pay Rate Templates, Employment Agreements and Pay Categories related to Schedule R has been disabled as this schedule ended operating on 10 August 2022.

January 2023

31st

We have updated the award to reflect changes made as part of the Fair Work Decision regarding Paid Family and Domestic Violence Leave. Further information on what changes have been applied to the platform and what you should be aware of can be found within this article.

We have created the following new categories:

- New Leave Category: Paid Family and Domestic Violence Leave.

- New Pay Category: Paid Family and Domestic Violence Leave.

- New Work Type: Paid Family and Domestic Violence Leave taken.

We have updated the Leave Allowance Templates to disable the existing unpaid Family and Domestic Violence and we have enabled the new Paid Family and Domestic Violence Leave. We also updated any impacted rule conditions.

As part of Fair Work's ruling, an employee must be paid their full pay rate; this includes their base rate plus any incentive-based payments and bonuses, loadings, monetary allowances, overtime or penalty rates, and any other separately identifiable amount.

December 2022

We have updated the award to correct the rate used within the Permanent - Public Holiday Overtime pay category.

28 October 2022

The ruleset Annualised Wage Arrangement has been updated to calculate 38 hours of Annualised Wage per week if an employee is attached to any (Weekly, Fortnightly or Four Weekly) ruleset period.

The pay category Permanent - No break overtime has been updated to calculate the correct rate. Additionally, the Permanent Restaurant (excluding shift workers) ruleset has also been updated to ensure the No Break Taken - OT rules apply the correct pay categories.

10 October 2022

The Award has been updated to correct the rates within the following pay rate templates, Casual L5 19yrs and Permanent L5 19yrs.

1 October 2022

The Award has been updated to reflect the Fair Work Commission’s National Minimum Wage increase of detailed in the Annual Wage Review 2021-22 decision. This also includes updates to expense-related allowances. Information on the Determinations can be found here and here. These changes come into effect from the first full pay period on or after 1 Oct 2022. Please install these updates AFTER you have finalised your last pay run prior to the first full pay period commencing on or after 1 Oct 2022.

23 September 2022

The below changes have been removed to correctly trigger Annualised Wage and Outer Limits Penalties.

The ruleset Annualised Wage Arrangement ordering has been updated to trigger Outer Limits Penalties above 18 hours and remove the duplicate Annualised Wage pay category.

19 September 2022

Annualised Wage Arrangements

The ruleset Annualised Wage Arrangement has been updated to include No Meal Break rules, these payments aren't covered by the annualised wage arrangement and are paid on top of the annualised wage.

The ruleset has also been updated to trigger outer limits payments for both Outer Limits Penalties above 18 hours and Outer Limits Overtime above 12 hours, these payments are exclusive of each other and must be paid once each outer limit has been reached.

Schedule R

Schedule R ceased operating on 10 August 2022, the rulesets Permanent Restaurant (excluding shift workers) & Casual Restaurant have been updated to remove the substitute allowance and Employment Agreements - exemption rate agreements within the platform have also been removed.

Additional Update

The ruleset Permanent Restaurant (excluding shift workers) has been updated to exclude the pay category OT Clearing from the following rules - 10.13(b) & 9. Exceeding period hours (over 1 week period), 10.13(b) & 9. Exceeding period hours (over 2 week period), 10.13(b) & 9. Exceeding period hours (over 3 week period) & 10.13(b) & 9. Exceeding period hours (over 4 week period). This will ensure period overtime for each respective period will be calculated correctly.

1 September 2022

Annualised Wage Arrangements

Significant changes have been made to the configuration of this award to accommodate for the changes made to Clause 20 - Annualised salary arrangements. Prior to this change made to the award, the Annualised salary arrangement could be paid in lieu of all entitlements listed in clause 20, as long as the employee was better off on this arrangement than on hourly pay at minimum wages. The new clause (now termed Annualised Wage Arrangements) requires employers to pay additional hours (termed Outer Limit hours) in addition to their standard salary for Penalty and Overtime hours exceeding a certain criteria. More information can be found here .

Prior to these changes, Employment Hero Payroll did not cater for the setup of employees under clause 20. We have now introduced a new ruleset, pay categories, pay rate templates and employment agreements to accommodate employees paid under this clause.

Summary of New Configuration in Employment Hero Payroll

New Pay Rate Templates, Employment Agreements and Pay Categories

We have created new Employment Agreements and pay rate templates for employees on an annualised wage arrangement. The new Pay Rate Templates are named in the following format, Permanent Annualised Wage L1 20yrs & over. The base rate for the employee’s salary has been set at the award minimum (125% of the ordinary rate). If an employee is paid a salary higher than this amount, you may override the employees base rate using the instructions in this article .

The new Employment Agreements are named in the following format, Level 1 - Full Time - Annualised Wage.

We have also created the following pay categories:

- Annualised Wage

- Annualised Wage Outer Limit - Ordinary Hours

- Annualised Wage Outer Limit - Saturday

- Annualised Wage Outer Limit - Sunday

- Annualised Wage Outer Limit - Public Holiday

- Annualised Wage Outer Limit - Overtime x1.5

- Annualised Wage Outer Limit - Overtime x1.75

- Annualised Wage Outer Limit - Overtime x2

- Annualised Wage Outer Limit - Public Holiday OT

New Rule Set

We have created a new rule set called Annualised Wage Arrangements. This new ruleset will:

- Pay employees an annualised wage of 38 hours per week (unless an unpaid leave request has been made)

- In addition to their regular salary, the employee will also be paid for any additional Outer Limit Hours where the employee:

- Works more than an average of 18 ordinary hours which would attract a penalty rate under clause 24.2(a) of the award per week, excluding hours worked between 7.00pm to midnight

- Works more than an average of 12 overtime hours per week in excess of ordinary hours

- These additional Outer Limit hours will be paid at the relevant penalty or overtime rates, however, these rates are based on the minimum award base rate for their classification rather than their annualised wage rate.

This new ruleset will not do the following (unless customised under guidance from the support team):

- Pay employees an annualised wage of less than or greater than 38 hours per week

- Pay the additional hours based on custom outer limit agreements, e.g. if the employer has agreed to pay additional Outer Limit hours for overtime worked in excess of 10 hours a week rather than 12.

- Pay Split Shift Allowance listed in clause 21.3

Instructions to Configure Employees on the Annualised Wage Arrangement

Employees under this arrangement must be set up with following settings. Note that these employees must be paid via timesheets rather than by default in a pay run (i.e. auto-pay).

Tables can't be imported directly. Please insert an image of your table which can be found here.

Item

Selection

Employment Basis

Full Time

Award

Restaurant Industry Award 2020 [MA000119]

Employment Agreement

Agreements named in the following format, Level 1 - Full Time - Annualised Wage

Pay Rate Template

Pay Rate Templates named in the following format, Permanent Annualised Wage L1 20yrs & over (will auto-populate)

Timesheets

Use timesheets to submit all time worked

Override pay rate

Leave unticked to pay at the minimum annualised wage rate.

Tick “override” to pay at an above award annualised wage rate

Normally works

38 hours per week

Pay these earnings by default in a pay run

Must be unticked

Pay Condition Rule Set

Annualised Wage Arrangements (will auto-populate)

August 2022

Changes have been made to the Casual - No break Sunday rates within the Pay Rate Templates to reflect correct rates as per the award.

July 2022

The ruleset, Permanent Restaurant (excluding shift workers), has been updated to exclude work type Annual Leave Taken from penalty rates, to ensure Annual Leave hours are paid at ordinary hours rate of pay.

29 June 2022

The award has been updated to remove the $350 superannuation threshold, please install this update into your business prior to the first pay run in July. Information on this decision can be found here

Unpaid Pandemic Leave has been disabled as this entitlement has now expired within this award. Additional information can be found on the Fairwork website.

June 2022

The ruleset, Permanent Restaurant (excluding shift workers), has been updated to exclude work type Personal/Carer's Leave Taken from penalty rates, to ensure Personal/Carer's Leave hours are paid at ordinary hours rate of pay.

January 2022

The Unpaid Pandemic Leave pay category has been updated and counts as service for entitlements under awards and the National Employment Standards.

If any staff have used this category previously, please adjust their Annual, Personal and Long Service Leave balances for any period of unpaid pandemic leave previously taken.

To identify affected employees and enter the leave accrual see: Calculating Missing Leave Accrual for Unpaid Pandemic Leave Taken

January 2022

The ruleset, Permanent Restaurant (excluding shift workers), has been updated to ensure that when hours for Part Time employees are topped up to standard hours this is paid at their ordinary rate of pay.

December 2021

Changes have been made to the Casual Restaurant ruleset to ensure the correct pay categories apply when overtime is worked on a Saturday in cases where no meal break has been taken.

November 2021

The Award has been updated in line with the ATO's requirements for STP Phase 2 reporting. The reporting of gross earnings are now being disaggregated into distinguishable categories. The Pay Category payment classifications have been updated in line with the ATO specification categories found here. For further information please see our STP support article.

Pay rates templates for Juniors employees under Levels 3-6 have been updated as per the pay guide.

1 November 2021

The Award has been updated to reflect the Fair Work Commission’s National Minimum Wage increase of 2.5% detailed in the Annual Wage Review 2020-21 decision. This also includes updates to expense-related allowances. Information on the Determinations can be found here and here. These changes come into effect from the first full pay period on or after 1 November 2021.

Please install these updates AFTER you have finalised your last pay run prior to the first full pay period commencing on or after 1 November 2021.

In addition, penalty rates for no meal break taken on weekends have been amended on 9/11/2021.

September 2021

Changes have been made to the ruleset, Exemption Rate Agreement (Full Time Level 5 and 6), to ensure leave accruals are limited to a 38 hour week. A new pay category, Permanent - Ordinary Hours (Exemption Rate) - Above 38 hours, has been created as part of this update.

August 2021

The Award has been updated to reflect the addition of Schedule R to the Award. More information can be found here.

A new ruleset, Exemption Rate Agreement (Full Time Level 5 and 6), has been created for employees who are on an Exemption Rate Agreement per Clause R.3 in the Award. New Employment Agreements, Level 5 (Exemption Rate) – Full Time and Level 6 (Exemption Rate) – Full Time, have been created, along with corresponding Exemption Rate Pay Rate Templates. New Exemption Rate pay categories have also been created.

The rulesets, Permanent Restaurant (excluding shift workers) and Casual Restaurant have been updated to allow for the Substitute Allowance in Clause R.5 of the Award. Where the Substitute Allowance applies, the tag “Substitute Allowance” must be added to the employee’s profile. A new pay category, Substitute Allowance, has been added. All existing pay rate templates for both Casual and Permanent, Intro Level to Level 6 have been updated to include a rate for the Substitute Allowance.

Updates have been made to the Unpaid Pandemic Leave allowance Templates so that the balance is displayed in weeks instead of hours in line with the Fair Work Commission's guidelines.

Once the award update is installed, all employee’s Unpaid Pandemic leave balances will be displayed in weeks not hours. This will mean that an employee’s balance may now show as 76 weeks. In order to correct the balance please see How to Fix Unpaid Pandemic Leave Balance Data.

Updates have also been made to the Leave Category Family & Domestic Violence Leave, so that the balance is displayed in days instead of hours in line with the National Employment Standards.

Once the update is installed, all employee’s FDV leave balances will be displayed in days not hours. This will mean that an employee’s balance may now show as 38 days. In order to correct the balance please see How to Fix Family & Domestic Violence Leave Balance Data.

July 2021

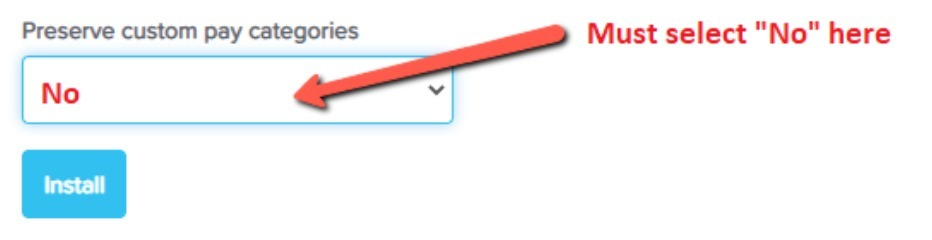

This update is to ensure that any new installs of this award conducted since 1 July are now captured with the SG increase from 9.5% to 10% for all pay categories. If you have installed this award between 1 July 2021 to 8 July 2021 for the first time, please ensure you select "NO" to preserve custom pay categories. If you were using this award prior to 1 July 2021, then you do not need to select "NO." Further information can be found in Incorrect SG rate used in pay runs article here.

May 2021

The clause numbers have been updated in each pay condition rule set to reflect the changes to clause numbers in this award as part of the 4 Year Modern Review.

April

Update to the pay condition rule set Permanent Restaurant (excluding shift workers) to ensure overtime is paid correctly on a public holiday.

March

Update to the pay condition rule sets Casual Restaurant and Permanent Restaurant (excluding shift workers) in line with Table 8 - Penalty Rates. The rules for Monday to Friday - 10pm to midnight and Monday to Friday - midnight to 6am penalty rate now allow for the full hour of the penalty payments to be processed when only part of an hour is worked. The rule now allows for rounding of units.

Two new pay categories "Casual - No break Sunday and Casual - No break Sunday overtime" have been created. The pay condition rule set Casual Restaurant has been updated to ensure the correct rate is applied when someone does not take a meal break on a Sunday.

February 2021

Rounding of $0.01 for some linked pay categories has been updated in line with the new pay rate changes effective as of 1 February 2021. If you have not updated the new pay rates yet, do not install this update until you have finalised your last pay run prior to the first full pay period commencing on or after 1 February 2021.

February 2021

The Award, as part of Group 3 Awards, has been updated to reflect the Fair Work Commission’s National Minimum Wage increase of 1.75% detailed in the Annual Wage Review 2019-20 decision. This also includes updates to expense-related allowances. Information on the Determinations can be found here and here. These changes come into effect from the first full pay period on or after 1 February 2021. Please install these updates AFTER you have finalised your last pay run prior to the first full pay period commencing on or after 1 February 2021.

August 2020

The award has been updated to reflect the High Court's decision on the accrual of personal/carer's leave which overturns the decision made by the Full Federal Court of Australia, with personal/carer's leave being calculated on working days not hours. Information on the decision can be found here. As such, we have removed the Personal/Carer's (10 days) Leave Allowance Templates and updated associated Employment Agreements. Please note, this update will not remove any of the above from a business where the award was already installed prior to 25 August 2020. However, any new award installs from 25 August 2020 will not display personal/carer's (10 days) leave details.

For further information on migrating from daily personal/carers leave accruals to hourly please refer here

April 2020

The award has been updated to reflect changes made as part of the Fair Work Decision around flexibility during coronavirus. The new schedule allows employees to take up to two (2) weeks unpaid pandemic leave. A new pay category (Unpaid Pandemic Leave Taken), leave category and work type (Unpaid Pandemic Leave) have been created. Also, the rule sets have been updated, where necessary, to include/exclude the work type and leave category to some pay conditions. Further, the Leave Allowance Templates have been updated to ensure this new leave category is enabled and is now accessible for employees to take this leave when required.

Further, under this new schedule employees can take up to twice as much annual leave at a proportionally reduced rate if their employer agrees. The employee's pay rate and leave balance will need to be manually adjusted to half in each pay run for the period of leave.

The award has been updated to reflect changes made as part of the Fair Work Decision around flexibility during coronavirus. The new schedule I allows employers to temporarily reduce permanent employees’ hours during this coronavirus period. A new work type has been created - COVID-19 Not Worked, which is to be used for ordinary hours not worked, enabling employees to still accumulate their leave entitlements at their ordinary hours, however, they will not be paid for those hours.

February 2020

Due to recent changes to the interpretation of personal/carer's leave accrual under the National Employment Standards, updates have been made to the setup of the Award. Further information can be found here.

A new Leave Category called Personal/Carer's (10 days) Leave has been created. Also, new Leave Allowance Templates (LATs) have been created specific to 10 days accrual per year for each state and the LATs have been attached to the current Employment Agreements for selection options for an employee's LAT in their Employee Default Pay Run screen. Any rules impacted by Personal/Carer's Leave have also been updated with the new leave category.

Instructions on converting the accruals to the 10 day method can be found here.

The Award has been updated to reflect changes made as part of the Fair Work Decision 4 year review of modern awards. The determination can be found here. The changes come into effect from the first full pay period on or after 23 January 2020. Further information can be found at Fair Work.

Clause 14.12 & 20.2 Apprentice Wages - the Pay Rate Templates and Employment Agreements have been updated to include all apprentice classifications and wages under the new clauses, which also includes competency based progression. If the apprentice moves to a higher stage of progression faster than the maximum time requirement, then you may change their anniversary date in their employee details screen to match the stage the employee has reached to ensure the correct pay rate is applied.

Clause 24.3(a) Tool Allowance - the Pay Category name has been changed to Tool Allowance and the Work Type has been changed to Tool Allowance, removing the word "Apprentice" as this allowance now applies to both Cooks and Apprentice Cooks when they use their own Tools.

December 2019

Update to the rule set pay conditions for Permanent Restaurant (excluding shift workers) and Casual Restaurant to ensure that when the maximum hours have been worked in a period if the employee has not had a meal break that the appropriate overtime rate applies.

July 2019

Rounding update for Casual Pay Rate Templates.

30 June 2019

The Award has been updated to reflect the Fair Work Commission’s National Minimum Wage increase of 3% from its Annual Wage Review 2018-19 decision. This also includes updates to expense-related allowances. Information on the Determinations can be found here and here.

These changes come into effect from the first full pay period on or after 1 July 2019. Please install these updates AFTER you have finalised your last pay run prior to the first full pay period commencing on or after 1 July 2019.

May 2019

Update to the rule set pay conditions for Permanent Restaurant (excluding shift workers) to the Apply Overtime rules for Overtime worked on a Public Holiday. The Current rule 33.2 Apply Overtime Penalties rule now excludes the Public Holiday and a separate rule 33.2 Apply Overtime Penalties PH pays the Public Holiday rate.

May 2019

Update to the rule set pay conditions for Casual Restaurant, Permanent Restaurant (excluding shift workers) to the Apply Overtime rules for Overtime worked on a Public Holiday. The Current rule 33.2 Apply Overtime Penalties rule now pays the Public Holiday rate for the whole shift, no overtime rate applies.

December 2018

The setup of the Payroll Tax Exempt field in Payroll Settings>Pay Categories was replicating the PAYG Exempt field rather than creating a unique identity; when installed into the business settings. An audit has been carried out across the system and the issue has now been resolved with this update.

October 2018

The following changes are a result of a general award overview,

The "no meal break" rule in pay conditions Casual Restaurant and Permanent Restaurant (excluding shift workers) has been updated to rule 32.3 the rate multiplier has been removed and instead pay category with linked rate has been applied.

The maximum daily engagement rule 31.2 has been updated and is now processing as 1 line to top up and to not pay OT on the top up of standard hours.

September 2018

Creation of new Employment Agreements for Part-Time Adult Apprentice and Apprentice Cooks.

1 August 2018

The award has been updated to reflect changes made as part of the Fair Work Decision 4 year review of modern awards. The determination for the new clause in the modern award allowing employees to take unpaid leave to deal with family and domestic violence can be found here. Family and Domestic Violence leave applies from the first full pay period on or after 1 August 2018. Further information can be found at Fair Work.

Employees, including part-time and casual employees are entitled to 5 days unpaid family and domestic violence leave each year of their employment. The 5 days renews each 12 months of their employment but does not accumulate if the leave is not used.

A new leave category has been created - “Family and Domestic Violence Leave” and a new Work Type - “Family and Domestic Violence Leave taken”. The Leave Allowance Templates and any impacted rule conditions have also been updated.

29 June 2018

The Award has been updated to reflect the Fair Work Commission’s national minimum wage increase of 3.5% from its Annual Wage Review 2017-18 decision. This also includes updates to expense-related allowances.

These changes come into effect from the first full pay period on or after 1 July 2018. Please install these updates AFTER you have finalised your last pay run prior to the first full pay period commencing on or after 1 July 2018.

Additionally, the Payment Classification settings for Allowance based pay categories have been updated as per STP requirements.

5 February 2018

The following changes are a result of a general award overview and incorporate new enhancements made to pay conditions rules:

- The automated meal break rule now is automatically excluded from timesheets created from a leave request. Additionally, the rule will search any manual break recorded before automatically applying a meal break;

- Leave categories are mapped to leave work types so that leave pay categories are automatically applied in the pay run;

- Created a shift condition for overtime meal allowance, as detailed further below;

- Overtime Meal Allowance has been amended so that it is set to be excluded from an income statement;

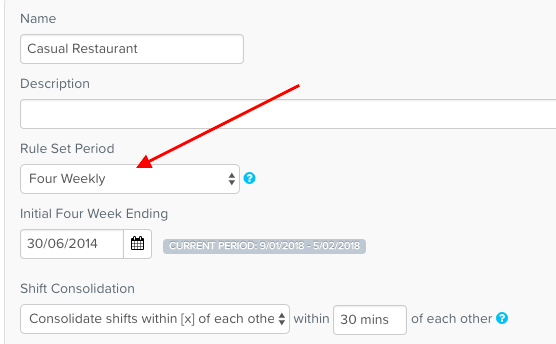

- Users can choose to have the 38 hour week averaged over a 1, 2, 3 or 4 week period. This setting can be adjusted via the Rule Set Period setting:

- Created a tag for Tool Allowance, as detailed further below;

- Amended the setup of the work type Apprentice Tool Allowance so that it does not need to be added on a separate timesheet line. Rather, the work type can be assigned on the same timesheet line detailing the employee start and finish time;

- Automatically enabled the work types Time in Lieu of Overtime and Time in Lieu Taken for casual employees;

- Activated the leave type Time in Lieu Taken for casual leave allowance templates;

- The Permanent Restaurant (excluding shift workers) rule set has been amended so that TIL of Overtime was accruing against the leave category Time in Lieu rather than Annual Leave;

- Maximum daily engagement of 11.5 hours has also been applied to part time employees, in accordance with clause 12.8(b) of the Award;

- Tags descriptions have been added.

1 January 2018

The award has been updated to reflect changes made as part of the Fair Work Decision 4 year review of modern awards.

Casual employees

The changes are a replacement of Clause 13 - Casuals and Clause 33 - Overtime to include overtime paid for casuals. This now provides for casual staff to be paid overtime in excess of the following:

- For a maximum of 38 hours per week or, where the casual employee works in accordance with a roster, an average of 38 hours per week over the roster cycle (which may not exceed 4 weeks)

- 12 hours in one day

NB: We have applied the rule using 152 hours worked over a four week period to remain consistent with the rule set for permanent staff.

Implicitly, this also means overtime can be converted to TIL by using the 'TIL of OT' employee tag, and this has also been reflected in the rules.

These changes are reflected in the "Casual Restaurant" rule set. We've also automatically enabled the work types relating to meal allowances for casual staff. To be paid a meal allowance, the '2+ hrs OT worked (no prior notice to employee)' work type needs to be selected on a separate line of the timesheet and a unit of 1 recorded.

These changes have also meant a set of new pay categories for casual overtime and the pay rate templates for casual employees have been updated.

Part time employees

Clause 12 has been updated for part time employees, and mandates the idea of 'guaranteed hours' reflected as the employee standard hours in the system, and the 'employees availability'. We have interpreted the employees availability as only affecting the hours available to roster the part time employee (use 'unavailability' in rostering to achieve this), so no changes are reflected in the pay condition rule set.

The new changes do mean that an employee can work hours in excess of their guaranteed hours and not attract overtime, until they've worked in excess of 38 hours or an average of 38 hours per roster cycle.

This means we've removed the 'overtime in excess of standard hours' and replaced this with 'overtime in excess of 152 hours per 4 weeks'.

These changes have been reflected in the 'Permanent Restaurant (excluding shift workers)' rule set.

Please note that the changes come into effect on the first full pay period on or after 1 January 2018. This means that you should only install these updates once you've completed the last pay period that pays shifts worked during December 2017.

If you have any feedback or questions please contact us via support@yourpayroll.com.au