Disclaimer: On 13 August 2020, the High Court handed down a decision regarding the method of accruing personal/carer’s leave under the National Employment Standards. The High Court has found that the entitlement to 10 days of personal/carer’s leave is calculated based on an employee’s hours of work, not days, and should be calculated as 1/26th of an employee's ordinary hours of work in a year.

The High Court’s decision overturns the previous decision made by the Full Federal Court in August 2019. In light of this, employers who have been accruing personal/carer's leave in days should look at migrating to an hourly accrual method as per the instructions from this article.

This article explains how a leave category, set up with a leave category type of "Personal/Carer's Leave", accrues in a pay run. Furthermore, it will detail each component of the context panel that you can access within the pay run for each affected employee.

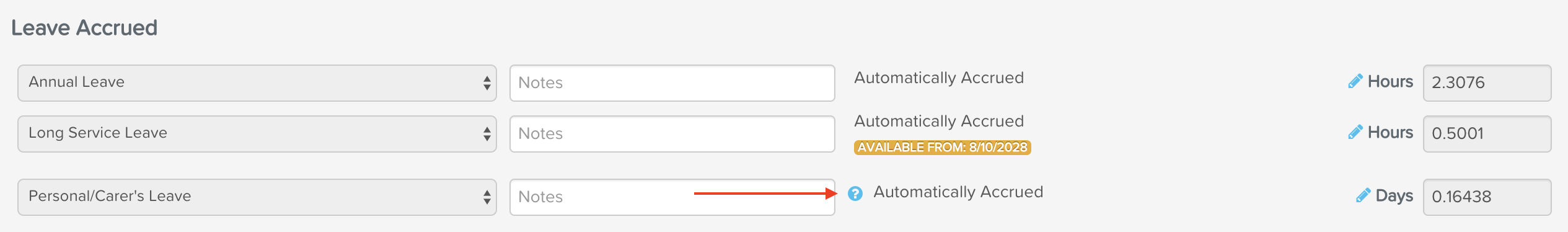

You can access the context panel by clicking on the "?" icon, positioned to the right of the Notes field for that leave category:

Context panel explained

The context panel displayed below shows example results and we will use this to explain each component of the panel:

- Pay Period: The dates displayed here will be the first and last day of the applicable pay period. The only exception to this rule is when an employee ends their employment during the pay period and a termination has been processed. For example, if an employee ceased employment on the 20th of March and the termination was recorded in the pay run the employee's pay period will be displayed as 01/03/2020 to 20/03/2020. The significance of showing the pay period date as such is to then clarify that the accrual of leave is only up to the last date shown in the pay period.

IMPORTANT NOTE (A): If an employee commenced employment prior to the start date of the first pay run being processed for them, the pay run will not "back pay" their accumulated leave. The reason this is the case is because this leave type does not accrue based on hours worked but rather on calendar days within the employee's service of employment. As such, you will need to calculate the days accrued and manually add it to the employee's accrued leave balance in the pay run. - Number of calendar days in pay period: The figure displayed here will be the number of ALL days within the pay period, including weekends and public holidays or days not normally worked by employees. If an employee commenced or ended employment within the pay period, the number of calendar days will be reduced accordingly. For example, in the image displayed above, the number of calendar days = 31. If, however, the employee started their employment on 10/03/2020, the figure would be 22 days.

IMPORTANT NOTE: If an employee has no earnings in a pay run, this leave category will still accrue the full entitlement for that pay period. The reason being that (a) accrual is based on calendar days in pay period as opposed to hours worked in a pay period and (b) the accrual will only stop/reduce for days not counted as service (refer to the next component). - Number of calendar days not counted as service: Days not counted as service will be calculated based on:

- any unpaid leave taken and recorded in the pay run. To clarify, if you do not record unpaid leave, the system will not magically know that an employee took unpaid leave so will not correctly calculate the number of days not counted as service. What does this mean? It means that employees will still be accruing leave on calendar days that they shouldn't be - this is a favourable outcome for the employee but probably something an employer may want to review their processes on. Refer to the section "Calculating calendar days not counted as service" below for further detailed explanations on how this figure is calculated.

- any overlapping dates in the pay run, where dates have been used in a previously finalised pay run. For eg, an employee is normally paid on a monthly pay schedule - from the start to the end of the month. The employee's normal pay was finalised and the employee accrued personal/carer's leave for each day of the calendar month. An additional pay run was subsequently processed to pay the employee's bonus and the same pay period was used. Because the employee has already accrued leave for the days in that month they will now be deemed as not counted as service in the additional pay run. The reason these overlapping days are not counted as service is to eliminate the double/multiple accrual of leave.

- Total calendar days in period counted as service: The sum of "Number of calendar days in pay period" minus "Number of calendar days not counted as service".

- Year of service period: This is a 12 month period that starts on the anniversary of the employee's start date and reflects the current 12 month period for the pay run's pay period. Using the example screenshot above, the employee was employed on 06/01/2019. The first year of service was 06/01/2019 to 05/01/2020. The pay period reflected in the example screenshot is for March 2020 and this falls within the employee's second year of service, being 06/01/2020 to 05/01/2021. The significance of showing the year of service period will make more sense when explaining the next component.

- Number of calendar days in current year of service: Based on the dates in the above component, the value will be either 365 or 366 days. The difference will be based on whether a leap year falls within the year of service period or not. This amount will then determine the accrual formula applied. If the number of calendar days is 366, the accrual rate will be 0.0273224 days per calendar year (that is, 10 days/366 days). If the number of calendar days is 365, the accrual rate will be 0.02739726 days per calendar year (that is, 10 days/365 days).

- Accrual rate: Based on the value above, and as explained above, the accrual rate will either be 0.0273224 days or 0.02739726 days. This rate is multiplied by the value specified in "Total calendar days in period counted as service". The result will provide you with the Leave accrued for pay period.

Can I change the leave accrued for pay period?

No part of the automated accrual calculations can be manually overridden. However, if you want to change the total leave accrued for the pay period, you can override this amount by clicking on the pencil icon for that leave category in the Leave Accrued section of the employee's pay:

Processing an employee's termination pay where the termination date is outside of the pay period

There may be instances where the payroll officer is notified of an employee's termination after the pay run has been processed. In this instance and as a result, the employee's leave accrual may be overstated. If a subsequent pay run is processed for an employee to finalise their pay and the pay period for that pay run is subsequent to the employee's termination date, the following will occur:

- The termination pay run for the employee will not have any personal/carer's leave accrued; and

- The "over accrued" personal/carer's leave from the previous pay run will need to be reversed manually. This is probably more significant in instances where the personal/carer's leave is paid out upon termination.

Calculating calendar days not counted as service

Unpaid leave is deemed calendar days not counted as service. This section will explain how the system determines how unpaid leave hours are converted to calendar days not counted as service based on different scenarios. To be clear, if unpaid leave is set up in day units, this section does not apply.

Scenario 1: When leave is manually taken in a pay run (ie no timesheet or leave request applied) and the employee has advanced work hours

Pay Run Defaults- works 6 hrs every Monday, Wednesday and Sunday;

- is paid on a weekly pay schedule that runs from Tuesday to Monday; and

- 10 hours of unpaid leave is manually taken.

Scenario 2: When leave is manually taken in a pay run (ie no timesheet or leave request applied) and the employee does NOT has advanced work hours

Pay Run Defaults- works 5 hrs per day; and

- 15 hours of unpaid leave is manually taken.

To convert the 15 hours to days, divide the unpaid leave hours by the number of hours per day, ie 15/5 = 3 days.

How are part days calculated when determining calendar days not counted as service?

The formula is as follows:

Hours of leave taken divided (/) by employee hours per day (as per the employee's Pay Run Defaults settings).

This formula applies to all employee types, ie salaried employees and timesheet employees.

Further reading regarding the legislated changes to personal/carer's leave can be found here.

If you have any feedback or questions, please send an email to support@yourpayroll.com.au.