This article explains how to process lump sum payments directly from the pay run. Processing lump sum payments such as commission, bonus and back payments can be done so by aggregating the tax across a number of pay periods, depending on the method selected.

For paying "leave in advance" please refer further down this article for instructions on how to do this. Additionally, if you are processing a bonus and don't need to aggregate the tax please scroll down further and read the 'Processing a Bonus' section.

For a short video on processing lump sums, bonuses or leave in advance click here.

Processing lump sump payments using Method A or Method B(ii)

NOTE: Withholding amounts on lump sum payments are calculated using either the ATO's Method A or Method B(ii) calculation, as detailed in this ATO article.

You can choose the method selected based on the purpose of the payment:

- Method A is used when processing any additional payments regardless of the financial year the additional payment applies to. This includes all back payments, commissions, bonuses or similar payments. Further information on using this method can be found here.

- Method B(ii) is used when either processing back payments relating to a prior financial year and/or when processing any additional payments (including commissions, bonuses or similar payments) that don’t relate to a single pay period regardless of the financial year the additional payment applies to. Further information on using this method can be found here.

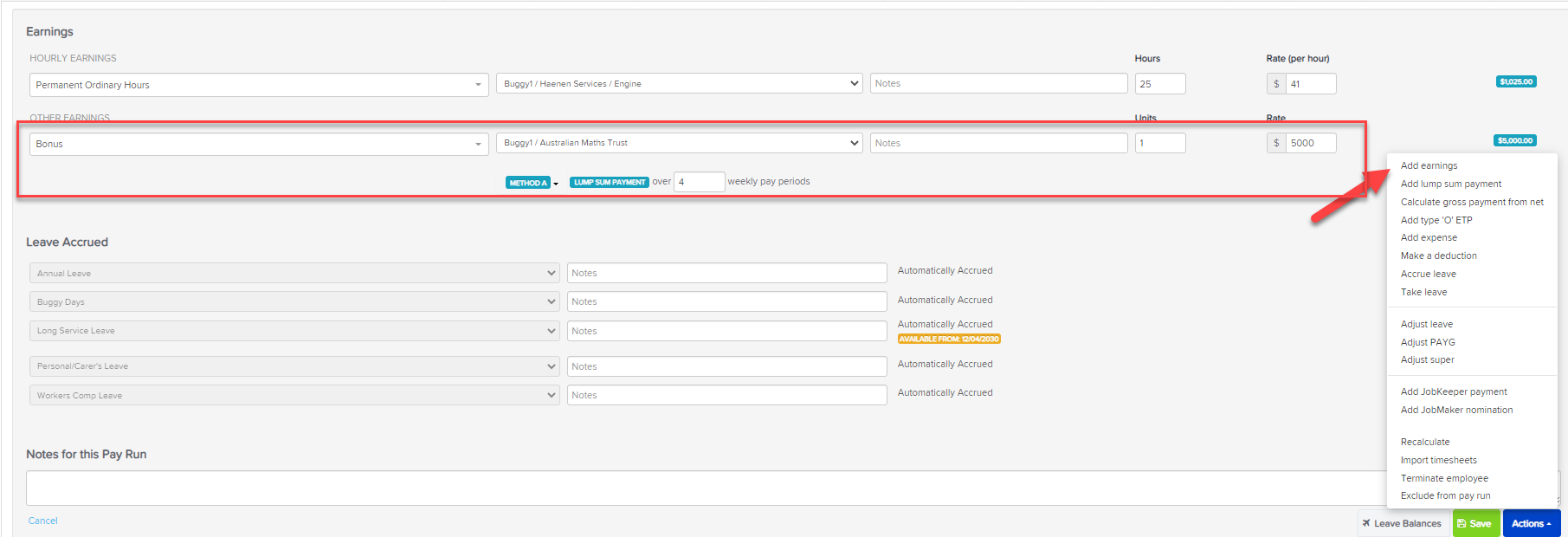

- Select the 'Actions' button in the bottom right hand corner of the employee's earning details.

- Select 'Add lump sum payment' from the pop up menu. An 'Other earnings' line will be added and you then need to select the pay category you are wanting to pay the lump sum against.

- Select the preferred method - Method A or Method B(ii).

- You need to fill in how many pay periods the tax will be aggregated, then enter the amount of the payment and select 'Save'.

- The pay will now include the lump sum payment and with the right PAYG calculated according to the method selected.

Paying leave "in advance" using lump sum payments

Use this if you are wanting to pay leave in advance but not "slug" your employee with extra tax. For example, say you want to pay your employee for last week's wages but they've taken this week and next week off on annual leave, and want to be paid up front, ie. you'll be paying them for 3 weeks - last week (when they worked) and this and next week's leave. Follow these steps:

- Pay the "ordinary" earnings as usual;

- Use the 'Add Lump Sum Payment' option via the 'Actions' button within the employee record in the pay run, select the 'Leave Taken' pay category and add the total leave hours to be paid.

- The method to select for this scenario will be Method A. Then, enter the appropriate number of pay periods (using the above example, enter 2).

- Paying leave this way does NOT reduce the employee's leave balance so you'll need to use the 'Adjust Leave' option from the Actions button within the employee record. Select the leave category and enter a negative adjustment to reduce the leave balance by the number of hours being taken (be careful NOT to apply any earnings rules).

- Paying leave this way does NOT accrue leave on the leave hours taken so you'll also have to adjust the leave accrual rate in the pay run. To do this, click on the pencil icon next to the accrual figure and override the existing leave accrual amount showing with the correct amount that should accrue.

Please note, the tax calculation will use the other earnings in the pay run to average out the tax so if:

- there are no "ordinary" earnings in this pay run; or

- you don't think the tax calculation is correct,

perform your own calculations and adjust the tax yourself, using the 'Adjust PAYG' option from the 'Actions' button - enter a negative adjustment to decrease the amount of tax calculated, or a positive one to increase it.

Processing a bonus that does not require tax aggregation

If you are wanting to pay a bonus without needing to aggregate the tax over a number of pay periods, simply use the 'Add Earnings' option on the 'Actions' button within the employee record in the pay run and select the 'Bonus' pay category to pay it.

If you have any questions or feedback, please let us know via support@yourpayroll.com.au.