This article provides guidelines about when to use the different work types and tags that are included as part of the pre-built Hospitality Industry award package. For further information about the hospitality industry award, refer Hospitality Industry (General) Award

Key Updates to Award

Last Updated: August 2023

Installing and Configuring the Pre-Built Award Package

For details on how to install and configure this Pre-built Award Template, please review the detailed help article here.

While every effort is made to provide a high-quality service, YourPayroll does not accept responsibility for, guarantee or warrant the accuracy, completeness or up-to-date nature of the service. Before relying on the information, users should carefully evaluate its accuracy, currency, completeness and relevance for their purposes, and should obtain any appropriate professional advice relevant to their particular circumstances.

Work Types

8 hr break between shifts

Choose this work type in the case where there is a changeover of rosters and there was only 8 hours break between shifts. Refer section 30.1(b) of the Hospitality Industry award.

Accrued Day Off Taken

Choose this work type when an accrued day off was taken

COVID-19 Not Worked

Use this work type when an employee's ordinary hours have been reduced during the coronavirus outbreak and they are not working.

First Aid Officer

Choose this work type if the employee is the holder of a current recognised first aid qualification and is appointed by the employer to perform first aid duty.

Overnight Stay

When requested to stay on the employer’s premises for the purpose of providing prompt assistance to guests outside of ordinary business operating hours, choose this work type and enter a unit amount of 1.

Work during overnight stay

Choose this work type when required to perform work in excess of 1 hour during an overnight stay period. Refer to clause 21.3(b)(iii) of the Award.

Overtime Meal Allowance

When required to work overtime for more than 2 hours without being notified on the previous day or earlier, choose this work type and enter a unit amount of 1.

Public Holiday not worked

Choose this work type where employees are not required to work on a gazetted public holiday.

Rostered Day Off Worked

Choose this work type when an employee is required to work on their rostered day off. Refer section 33.3(a)(iii) of the Hospitality Industry Award.

Tool allowance

Where required to use their own tools, a cook should choose this work type and enter a unit amount of 1.

Vehicle Allowance

Managerial staff who are required to use their own vehicle should choose this work type and enter the kilometres travelled in the 'units' field.

Annual Leave

Choose this work type when annual leave was taken

Carer’s leave

Choose this work type when carer’s leave was taken

Compassionate Leave

Choose this work type when compassionate leave was taken

Long Service Leave

Choose this work type when long service leave was taken

Sick leave

Choose this work type when sick leave was taken

Unpaid Leave

Choose this work type when unpaid leave was taken

Uniform Allowance Employees in the catering and motel industry should use this work type to enter the number of uniforms required to be laundered. N.B. full time catering employees are not required to use this work type.Shift Conditions

RDO/ADO Taken on a Public Holiday (accrue AL)

Select this shift condition when an employee is taking a Rostered Day Off or an Accrued Day Off which falls on a Public Holiday and is to accrue an additional day of annual leave.

RDO/ADO Taken on a Public Holiday (extra day)

Select this shift condition when an employee is taking a Rostered Day Off or an Accrued Day Off which falls on a Public Holiday and is to be paid an extra day's pay.

Tool Allowance

Cooks required to use their own tools should add this shift condition against their timesheet to automate the payment of the tool allowance, in accordance with clause 21.1(b)(i) of the Award.

Tags

The following tags are available for application to employees under the Hospitality Industry (General) Award.

7 day shiftworker

Assign this tag if the employee is employed as a shift worker who is regularly rostered to work on Sundays and public holidays. As per the national employment standards, a 7 day shiftworker is entitled to an extra 1 week of annual leave per year. Refer section 34.1 of the Award.

Accrue AL on PH worked

Assign this tag to any permanent employees who agree to work on a public holiday and be paid an additional 25% penalty as opposed to a 225% penalty. Additionally, these employees will accrue the equivalent time worked on the public holiday as annual leave. Refer to clause 32.2(b) of the Award.

Accrued Day Off

Assign this tag if the FT employee and employer have agreed to a 160 hours each four week period with a minimum of eight days off each four week period plus an accrued day off.

Airport Catering Supervisor (20+ employees)

Assign this tag to an airport catering employee required to supervise more than 20 employees. Refer to clause 21.2(c) of the Award.

Airport Catering Supervisor (11-20 employees)

Assign this tag to an airport catering employee required to supervise up to 20 employees. Refer to clause 21.2(c) of the Award.

Airport Catering Supervisor (6-10 employees)

Assign this tag to an airport catering employee required to supervise up to 10 employees. Refer to clause 21.2(c) of the Award.

Airport Catering Supervisor (up to 5 employees)

Assign this tag to an airport catering employee required to supervise up to 5 employees. Refer to clause 21.2(c) of the Award.

First Aid Officer

Assign this tag if the employee has an appropriate first aid qualification and will be the designated ongoing first aid officer during every shift they are rostered to work.

Food & Beverage Attendant Grade 2

Assign this tag if the employee has the Food and Beverage Attendant grade 2 classification. Such employees are exempt from being paid higher duties in accordance with section 25.1 of the Hospitality Industry award.

Food & Beverage Attendant Grade 3

Assign this tag if the employee has the Food and Beverage Attendant grade 3 classification. Such employees are exempt from being paid higher duties in accordance with section 25.1 of the Hospitality Industry award.

Fork-lift Driver

Assign this tag if the PT or casual employee was employed immediately prior to 23 January 2020 and elected the all-purpose hourly amount or not employed immediately prior to 23 January or any FT employee. Refer section 21.2(a) of the Hospitality Industry Award.

Fork-lift Driver (NOT all-purpose)

Assign this tag if the PT or casual employee is to receive a Fork-lift driver allowance and was employed immediately prior to 23 January 2020 and has not elected the all-purpose hourly amount.

4/8 - 1/6

Assign this tag to a full time employee whose 38 hour week are based on 4 days at 8 hours and 1 day at 6 hours rather than the default overtime arrangements which are based on hours over 11.5 in a day and hours over 152 in a 4 week period.

4/9.5

Assign this tag to a full time employee whose 38 hour week are based on 4 days at 9.5 hours rather than the default overtime arrangements which are based on hours over 11.5 in a day and hours over 152 in a 4 week period.

5/7.6

Assign this tag to a full time employee whose 38 hour week are based on 5 days at 7.6 hours rather than the default overtime arrangements which are based on hours over 11.5 in a day and hours over 152 in a 4 week period.

Motel Laundry Allowance Uniform Allowance Catering Laundry Allowance Uniform Allowance

RDOs - days off

Assign this tag if the full-time employee has days off as RDOs. This tag will ensure that the employee when submitting a time sheet for a Public Holiday, will not be paid any ordinary earnings. Only conditions under clause 35.3.

Tool Allowance Apply this tag to a cook or apprentice required to use their own tools as per clause 21.1(b)(i) of the Award.

Key Updates

August 2023

1st

From 1 August, all employees are entitled to 10 days of paid family and domestic violence leave each year. The (Unpaid) Family and Domestic Violence Leave configuration settings under awards have been updated - the leave category is disabled from award leave allowance templates, and the work type is not enabled automatically for all employees. Please ensure that employees no longer use the unpaid leave category or work type.

27 July 2023

We have updated the First Aid Allowance to correct an error with the decimal place, so that the rate matches the Fair Work pay guide.

24 July 2023

A new rule "Maximum Daily Engagement - Part Time" has been created, for part-time employees to trigger overtime on daily engagement after 11.5 hours.

19 July 2023

We have updated the hourly rate for the pay rate template "Hospo Casual L5 20yrs & over" and the rate for First Aid Allowance on the pay rate template "Hospo Perm L5 20yrs & over".

12 July 2023

We have updated the hourly rate for the pay rate template "Salaried Hotel Manager".

1 July 2023

We have updated the award to reflect the Fair Work Commission’s National Minimum Wage increase detailed in the Annual Wage Review 2022-23 decision and also includes updates to expense-related allowances. You can find information on the Determinations here and here. These changes come into effect from the first full pay period on or after the 1st July 2023. Please install these updates after you have finalised your last pay run before the first full pay period beginning on or after the 1st July 2023.

23 September 2022

The below changes have been removed to correctly trigger Annualised Wage and Outer Limits Penalties.

The ruleset Annualised Wage Arrangement ordering has been updated to trigger Outer Limits Penalties above 18 hours and remove the duplicate Annualised Wage pay category.

19 September 2022

Annualised Wage Arrangements

The ruleset Annualised Wage Arrangement has been updated to include No Meal Break rules, these payments aren't covered by the annualised wage arrangement and are paid on top of the annualised wage.

The ruleset has also been updated to trigger outer limits payments for both Outer Limits Penalties above 18 hours and Outer Limits Overtime above 12 hours, these payments are exclusive of each other and must be paid once each outer limit has been reached.

1 September 2022

Annualised Wage Arrangements

Significant changes have been made to the configuration of this award to accommodate for the changes made to Clause 24 - Annualised salary arrangements. Prior to this change made to the award, the Annualised salary arrangement could be paid in lieu of all entitlements listed in clause 24, as long as the employee was better off on this arrangement than on hourly pay at minimum wages. The new clause (now termed Annualised Wage Arrangements) requires employers to pay additional hours (termed Outer Limit hours) in addition to their standard salary for Penalty and Overtime hours exceeding a certain criteria. More information can be found here .

Prior to these changes, Employment Hero Payroll did not cater for the setup of employees under clause 24. We have now introduced a new ruleset, pay categories, pay rate templates and employment agreements to accommodate employees paid under this clause. Please note, this new configuration does not apply to employees who are paid under Clause 25 - Salaries absorption (Managerial Staff (Hotels)).

Summary of New Configuration in Employment Hero Payroll

New Pay Rate Templates, Employment Agreements and Pay Categories

We have created new Employment Agreements and pay rate templates for employees on an annualised wage arrangement. The new Pay Rate Templates are named in the following format, Hospo Perm Annualised Wage L1 20yrs & over. The base rate for the employee’s salary has been set at the award minimum (125% of the ordinary rate). If an employee is paid a salary higher than this amount, you may override the employees base rate using the instructions in this article .

The new Employment Agreements are named in the following format, Hospitality Level 1 - Annualised Wage - Full Time.

We have also created the following pay categories:

- Annualised Wage

- Annualised Wage Outer Limit - Ordinary Hours

- Annualised Wage Outer Limit - Saturday

- Annualised Wage Outer Limit - Sunday

- Annualised Wage Outer Limit - Public Holiday

- Annualised Wage Outer Limit - Overtime x1.5

- Annualised Wage Outer Limit - Overtime x2

New Rule Set

We have created a new rule set called Annualised Wage Arrangements. This new ruleset will:

- Pay employees an annualised wage of 38 hours per week (unless an unpaid leave request has been made)

- In addition to their regular salary, the employee will also be paid for any additional Outer Limit Hours where the employee:

- Works more than an average of 18 ordinary hours which would attract a penalty rate under clause 29.2(a) of the award per week, excluding hours worked between 7.00pm to midnight

- Works more than an average of 12 overtime hours per week in excess of ordinary hours

- These additional Outer Limit hours will be paid at the relevant penalty or overtime rates, however, these rates are based on the minimum award base rate for their classification rather than their annualised wage rate.

This new ruleset will not do the following (unless customised under guidance from the support team):

- Pay employees an annualised wage of less than or greater than 38 hours per week

- Pay the additional hours based on custom outer limit agreements, e.g. if the employer has agreed to pay additional Outer Limit hours for overtime worked in excess of 10 hours a week rather than 12.

- Pay any allowances listed in clause 26

Instructions to Configure Employees on the Annualised Wage Arrangement

Employees under this arrangement must be set up with following settings. Note that these employees must be paid via timesheets rather than by default in a pay run (i.e. auto-pay).

Tables can't be imported directly. Please insert an image of your table which can be found here.

Item

Selection

Employment Basis

Full Time

Award

Hospitality Industry (General) Award 2020 [MA000009]

Employment Agreement

Agreements named in the following format, Hospitality Level 1 - Annualised Wage - Full Time

Pay Rate Template

Pay Rate Templates named in the following format, Hospo Perm Annualised Wage L1 20yrs & over (will auto-populate)

Timesheets

Use timesheets to submit all time worked

Override pay rate

Leave unticked to pay at the minimum annualised wage rate.

Tick “override” to pay at an above award annualised wage rate

Normally works

38 hours per week

Pay these earnings by default in a pay run

Must be unticked

Pay Condition Rule Set

Annualised Wage Arrangements (will auto-populate)

Tags

As per table below

Instructions to Configure Averaging Method

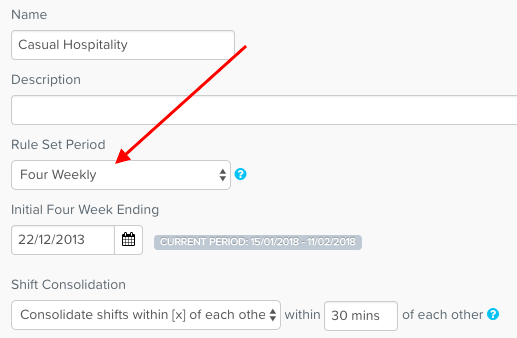

In order for the system to analyse the Outer Limits based on the correct averaging method, you will need to select the appropriate rule set period and apply employee tags as noted below. Instructions to update this can be found here .

Tables can't be imported directly. Please insert an image of your table which can be found here.

Rostering Arrangement Per Clause 15.1

Rule Set Period

Employee Tag

A 19 day month,of 8 hours per day

N/A - Not Catered for

N/A - Not Catered for

4 days of 8 hours and one day of 6 hours

Weekly

4/8 - 1/6

4 days of 9.5 hours per day

Weekly

4/9.5

5 days of 7 hours and 36 minutes per day

Weekly

5/7.6

76 hours over a 2 week period with a minimum of 4 days off each 2 week period

Fortnightly

N/A

152 hours each 4 week period with a minimum of 8 days off each 4 week period

Four Weekly

N/A

160 hours each 4 week period with a minimum of 8 days off each 4 week period plus an accrued day off

N/A - Not Catered for

N/A - Not Catered for

July 2022

The pay categories Weekday 12am-7am Allowance and Weekday 7pm-12am Allowance have been updated to reflect the payment classification as Default, this will ensure these earnings are reported correctly on employee income statements.

June 2022

The award has been updated to remove the $350 superannuation threshold, please install this update into your business prior to the first pay run in July.

The allowance rates have been updated for Vehicle Allowance (above and within ATO limit). Further information can be found here.

Unpaid Pandemic Leave has been disabled as this entitlement has now expired within this award. Additional information can be found on the Fairwork website.

May 2022

The pay condition rule set Casual Hospitality has been updated to ensure the penalty for no meal break taken is not applied when an employee is on leave.

April 2022

The Laundry - Motel employees allowance has been updated for both Casual & Permanent Hospitality employment to include both the up to ATO threshold and the above ATO threshold amount.

February 2022

The base rate for the pay rate template Salaried Hotel Manager has been updated from $31.55 per hour to $32.35 per hour, in line with the correct rate payable per the award.

January 2022

The Unpaid Pandemic Leave pay category has been updated and counts as service for entitlements under awards and the National Employment Standards.

If any staff have used this category previously, please adjust their Annual, Personal and Long Service Leave balances for any period of unpaid pandemic leave previously taken.

To identify affected employees and enter the leave accrual see: Calculating Missing Leave Accrual for Unpaid Pandemic Leave Taken

December 2021

The pay condition rule set Permanent Hospitality has been updated to ensure the period overtime ruling for part timers is applied correctly based on all available roster cycles (1-4 weeks).

November 2021

The Award has been updated in line with the ATO's requirements for STP Phase 2 reporting. The reporting of gross earnings are now being disaggregated into distinguishable categories. The Pay Category payment classifications have been updated in line with the ATO specification categories found here. For further information please see our STP support article.

1 November 2021

The Award has been updated to reflect the Fair Work Commission’s National Minimum Wage increase of 2.5% detailed in the Annual Wage Review 2020-21 decision. This also includes updates to expense-related allowances. Information on the Determinations can be found here and here. These changes come into effect from the first full pay period on or after 1 November 2021.

Please install these updates AFTER you have finalised your last pay run prior to the first full pay period commencing on or after 1 November 2021.

August 2021

The award name "Hospitality Industry (General) Award 2020 (MA000009)" has been updated to reflect changes made as part of the Fair Work Decision 4 year review of modern awards.

Updates have been made to the Unpaid Pandemic Leave allowance Templates so that the balance is displayed in weeks instead of hours in line with the Fair Work Commission's guidelines.

Once the award update is installed, all employee’s Unpaid Pandemic leave balances will be displayed in weeks not hours. This will mean that an employee’s balance may now show as 76 weeks. In order to correct the balance please see How to Fix Unpaid Pandemic Leave Balance Data.

Updates have also been made to the Leave Category Family & Domestic Violence Leave, so that the balance is displayed in days instead of hours in line with the National Employment Standards.

Once the update is installed, all employee’s FDV leave balances will be displayed in days not hours. This will mean that an employee’s balance may now show as 38 days. In order to correct the balance please see How to Fix Family & Domestic Violence Leave Balance Data.

The pay condition rule set Permanent Hospitality has been updated to ensure that when an employee works on a Rostered Day Off a minimum shift engagement of 4 hours is paid.

July 2021

The pay condition rule set Permanent Hospitality has had a number of updates. This rule set has been updated to ensure that the no meal break penalty does not apply to timesheets with leave taken work types. Additionally, it has been updated to ensure that a break is not deducted from a timesheet entered with the work type RDO/ADO Taken on a Public Holiday (extra day). Finally, the Maximum Daily Engagement rules has been updated so that the penalty applied for work on a rostered day off is not overridden by overtime provisions. This includes the rules for employees with the work patterns; 5 x 7.6hr days, 4 x 9.5hr days and 4 x 8hr days + 1 x 6hr day.

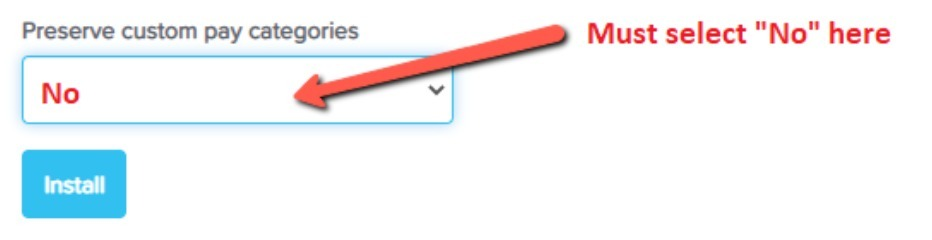

This update is to ensure that any new installs of this award conducted since 1 July are now captured with the SG increase from 9.5% to 10% for all pay categories. If you have installed this award between 1 July 2021 to 8 July 2021 for the first time, please ensure you select "NO" to preserve custom pay categories. If you were using this award prior to 1 July 2021, then you do not need to select "NO." Further information can be found in Incorrect SG rate used in pay runs article here.

May 2021

The award pay rate templates have been updated to ensure that the legislated superannuation guarantee (SG) rate will increase automatically from 9.5% to 10% effective from 1 July 2021. Please ensure you install this update prior to 1 July 2021 for this change to take effect.

What does this mean? Any pay run with a date paid on or from 1 July 2021 will automatically calculate SG at 10% of OTE. Additionally, on the 1st of July, we will update references to 9.5% on all applicable screens in Employment Hero Payroll.

March 2021

The pay condition rule sets Permanent Hospitality and Casual Hospitality have been updated in line with Clause 26.6 Special Clothing Allowance. The rules have been updated to ensure that you can either assign a tag to an employee to automatically pay them the laundry allowance or the employee can select a laundry allowance work type in order to receive the laundry allowance sporadically. The pay condition rule set Hospitality Managerial Staff Annualised Salaries has also been updated to ensure that an employee is topped up to 38 hours worked per week, including any leave hours taken.

February 2021

Rounding of $0.01 for some linked pay categories has been updated in line with the new pay rate changes effective as of 1 February 2021. If you have not updated the new pay rates yet, do not install this update until you have finalised your last pay run prior to the first full pay period commencing on or after 1 February 2021.

1 February 2021

The Award, as part of Group 3 Awards, has been updated to reflect the Fair Work Commission’s National Minimum Wage increase of 1.75% detailed in the Annual Wage Review 2019-20 decision. This also includes updates to expense-related allowances. Information on the Determinations can be found here and here. These changes come into effect from the first full pay period on or after 1 February 2021. Please install these updates AFTER you have finalised your last pay run prior to the first full pay period commencing on or after 1 February 2021.

January 2021

The pay condition rule set for Permanent Hospitality has been updated with a new rule to ensure that full-time employees are not paid ordinary earnings when a public holiday falls on their RDO. The employee will need to be assigned the tag RDOs - days off.

August 2020

The award has been updated to reflect the High Court's decision on the accrual of personal/carer's leave which overturns the decision made by the Full Federal Court of Australia, with personal/carer's leave being calculated on working days not hours. Information on the decision can be found here. As such, we have removed the Personal/Carer's (10 days) Leave Allowance Templates and updated associated Employment Agreements. Please note, this update will not remove any of the above from a business where the award was already installed prior to 25 August 2020. However, any new award installs from 25 August 2020 will not display personal/carer's (10 days) leave details.

For further information on migrating from daily personal/carers leave accruals to hourly please refer here

June 2020

The award pay rate templates have been updated to reflect the Australian Taxation Office's decision to increase the cents per kilometre rate for work-related car expense deductions to 72 cents per kilometre. The new rate applies from the first paid date in the 2020-21 financial year.

April 2020

The award has been updated to reflect changes made as part of the Fair Work Decision around flexibility during coronavirus. The new schedule allows employees to take up to two (2) weeks unpaid pandemic leave. A new pay category (Unpaid Pandemic Leave Taken), leave category and work type (Unpaid Pandemic Leave) have been created. Also, the rule sets have been updated, where necessary, to include/exclude the work type and leave category to some pay conditions. Further, the Leave Allowance Templates have been updated to ensure this new leave category is enabled and is now accessible for employees to take this leave when required.

The award has been updated to reflect changes made as part of the Fair Work Decision around flexibility during coronavirus. The new schedule allows employers to temporarily reduce permanent employees’ hours during this coronavirus period. A new work type has been created - COVID-19 Not Worked, which is to be used for ordinary hours not worked, enabling employees to still accumulate their leave entitlements at their ordinary hours, however, they will not be paid for those hours.

Under this new schedule, employees can take up to twice as much annual leave at a proportionally reduced rate if their employer agrees. The employee's pay rate and leave balance will need to be manually adjusted to half in each pay run for the period of leave.

March 2020

The pay condition rule set for Permanent Hospitality has been updated for clause 29 - minimum engagements so that when a shift spans midnight on a public holiday the public holiday minimum engagement is applied

February 2020

Due to recent changes to the interpretation of personal/carer's leave accrual under the National Employment Standards, updates have been made to the setup of the Award.

A new Leave Category called Personal/Carer's (10 days) Leave has been created. Also, new Leave Allowance Templates (LATs) have been created specific to 10 days accrual per year for each state and the LATs have been attached to the current Employment Agreements for selection options for an employee's LAT in their Employee Default Pay Run screen. Any rules impacted by Personal/Carer's Leave have also been updated with the new leave category.

Instructions on converting the accruals to the 10 day method can be found here.

The Award has been updated to reflect changes made as part of the Fair Work Decision 4 year review of modern awards. The determination can be found here. The changes come into effect from the first full pay period on or after 23 January 2020. Further information can be found at Fair Work.

Clause 14.12 & 20.4 Apprentice Wages - the Pay Rate Templates and Employment Agreements have been updated to include all apprentice classifications and wages under the new clauses, which also includes competency based progression. If the apprentice moves to a higher stage of progression faster than the maximum time requirement, then you may change their anniversary date in their employee details screen to match the stage the employee has reached to ensure the correct pay rate is applied.

Clause 21.1(b)(i) Tool Allowance - the Pay Rate Templates have been updated to reflect the new rates for Cooks and Apprentice Cooks when they use their own Tools. The maximum limits in the Permanent Hospitality and Casual Hospitality rule set pay conditions reflect the changes as well.

Clause 21.2(a) Fork-Lift Driver - a new tag for Fork-Lift Driver (NOT all-purpose) has been created for part-time or casual employees electing to not receive the fork-lift allowance on a per hour basis but as a daily allowance. The part-time and casual employees can also elect to be paid the allowance as an all-purpose allowance. The employer will need to assign the tag Fork-Lift Driver in this case. The Permanent Hospitality and Casual Hospitality rule set pay conditions have been updated.

Clause 29.1 Full-Time Employees - new rules in the Permanent Hospitality rule set pay conditions have been created to accommodate the different options available to a full-time employee when averaging the 38 hours per week to be worked.

Clause 37.1(b)(i) Public Holidays - two new shift conditions have been created; RDO/ADO Taken on a Public Holiday (accrue AL) and RDO/ADO Taken on a Public Holiday (extra day). A full-time employee whose RDO or ADO falls on a Public Holiday will have the option to either accrue an extra day of Annual Leave, be paid an extra day's pay or be provided with a substituted day off. The Permanent Hospitality rule set pay conditions have been updated to reflect these options.

August 2019

Update to the Permanent Hospitality rule set update of clause 29.1(a) Period overtime (FT) and the 12.2(a) Period overtime - Based on 1,2,3,4 week roster cycle (PT) to exclude leave from the Apply Overtime Penalties 33.3 of the Hospitality Industry (General) Award 2010

Update to rule set pay conditions Permanent Hospitality and Casual Hospitality to rule 12.3(a) Top Up of Standard Hours - Part Time has been amended to ensure that when time worked in a week that includes leave that the leave is included as part of the standard hours worked.

The update has also included the rule 33.3 Pay Overtime - Public Holiday this rule will now pay public holiday rate for the whole shift, no overtime rate applies.

July 2019

Rounding update for Casual Pay Rate Templates.

Correction to the rate for Casual Hotel Manager and Salaried Hotel Manager

30 June 2019

The Award has been updated to reflect the Fair Work Commission’s National Minimum Wage increase of 3% from its Annual Wage Review 2018-19 decision. This also includes updates to expense-related allowances. Information on the Determinations can be found here and here.

These changes come into effect from the first full pay period on or after 1 July 2019. Please install these updates AFTER you have finalised your last pay run prior to the first full pay period commencing on or after 1 July 2019.

May 2019

Update to rule set pay conditions Permanent Hospitality and Casual Hospitality to rule 31.2(a) Automatic Meal Break. The rule will automatically apply an unpaid meal break after six (6) hours of work if the employee has not recorded a meal break for the shift, does not have a work type No meal break selected and does not have an associated leave request.

February 2019

Update to rule set pay condition Permanent Hospitality in line with clause 29.1(a) Ordinary Hours of work for Full-Time employees. The averaging of 38 hours per week may be worked:

- four days of nine and a half hours per day

- five days of seven hours and 36 minutes per day

Tags have also been created: 4/9.5 and 5/7.6 respectively, to assign to employees who work these patterns of 38 hours per week. These employees will be excluded from the maximum daily engagement of 11.5 hours and 152 hours for period overtime.

A new rule: NES base + loading for leave taken has been added to ensure that all paid leave hours under the National Employment Standards are paid at the employee's base rate (plus loading, if applicable) when the employee works over 152 hours in a four week period.

December 2018

The setup of the Payroll Tax Exempt field in Payroll Settings>Pay Categories was replicating the PAYG Exempt field rather than creating a unique identity; when installed into the business settings. An audit has been carried out across the system and the issue has now been resolved with this update.

November 2018

Update to rule set pay condition “Casual Hospitality” and “Permanent Hospitality” in line with Clause 32.3 Other penalty of the Award.

It now allows for the full hour of the penalty payment for pay category Weekday 12am-7am Allowance and Weekday 7pm-12am Allowance to be processed when only part of an hour is worked, the rule now allows for rounding of units.

October 2018

Update to the Permanent Hospitality rule set update of clause 29.1(a) Period overtime (FT) and the 12.2(a) Period overtime - Based on 1,2,3,4 week roster cycle (PT) to exclude annual leave, personal/carer's leave, compassionate leave, long service leave, paid community service leave and time in lieu leave from the Apply Overtime Penalties 33.3(a) of the Hospitality Industry (General) Award 2010

September 2018

Update to Casual Higher Duties pay condition rule and Higher Duties (Junior Serving/Selling Alcohol) Employment Agreement Ranks.

August 2018

Allowance rate update for Kilometre Allowance - Car (above and below ATO limit).

1 August 2018

The award has been updated to reflect changes made as part of the Fair Work Decision 4 year review of modern awards. The determination for the new clause in the modern award allowing employees to take unpaid leave to deal with family and domestic violence can be found here. Family and Domestic Violence leave applies from the first full pay period on or after 1 August 2018. Further information can be found at Fair Work.

Employees, including part-time and casual employees are entitled to 5 days unpaid family and domestic violence leave each year of their employment. The 5 days renews each 12 months of their employment but does not accumulate if the leave is not used.

A new leave category has been created - “Family and Domestic Violence Leave” and a new Work Type - “Family and Domestic Violence Leave taken”. The Leave Allowance Templates and any impacted rule conditions have also been updated.

July 2018

PAY RATE TEMPLATE update for Hospitality Casual L3 20yrs & over rounding $0.01.

28 June 2018

The Award has been updated to reflect the Fair Work Commission’s national minimum wage increase of 3.5% from its Annual Wage Review 2017-18 decision. This also includes updates to expense-related allowances.

These changes come into effect from the first full pay period on or after 1 July 2018. Please install these updates AFTER you have finalised your last pay run prior to the first full pay period commencing on or after 1 July 2018.

Additionally, the following changes have been made as part of this update:

- New laundry allowance pay categories and rule conditions were created to reflect the ATO threshold maximum limits for claiming of laundry (not dry cleaning) for deductible clothing under the Award.

- The Sunday penalty for permanent employees has reduced from 70% to 60%.

- The Payment Classification settings for Allowance based pay categories have been updated as per STP requirements.

23 March 2018

A change was made in line with Fair Work advice to reflect late shift penalties and early morning penalties (which we apply as an allowance on top of the employees base wage) should not be cumulative with other penalties. i.e. If overtime or public holidays are applied to these times, the late shift penalty or early morning penalty will not apply.

6 February 2018

We have included a new rule in the Permanent Hospitality pay condition rule set to cover the provisions of clause 32.2(b) of the Award. This relates to permanent employees agreeing to be paid a 25% penalty when working on a public holiday and also accruing the equivalent time of annual leave for each hour worked. This rule is activated when an employee has been assigned the tag "Accrue AL on PH worked".

5 February 2018

The following changes are a result of a general award overview and incorporate new enhancements made to pay conditions rules:

- The automated meal break rule now is automatically excluded from timesheets created from a leave request. Additionally, the rule will search any manual break recorded before automatically applying a meal break;

- Users can choose to have the 38 hour week averaged over a 1, 2, 3 or 4 week period for casual and part time employees. This setting can be adjusted via the Rule Set Period setting:

- Created a shift condition for Tool Allowance, as detailed further below;

- The name of the existing Vehicle Allowance pay category has been amended to A new pay category called Vehicle Allowance (above ATO limit) with a unit rate of $0.12 has been created. This is a taxable pay category and will be paid in addition to the Vehicle Allowance (within ATO limit) pay category. The purpose of separating the pay categories is to ensure the PAYG is calculated in accordance with ATO requirements;

- The pay category Overtime Meal Allowance has been amended so that it is excluded from the income statement;

- A new pay category Forklift Driver (All Purpose Allowance) has been created specifically for full time employees as this allowance is an all purpose allowance and should be added to the minimum rate before penalties and overtime are calculated;

- Created rules for the Airport Catering Supervisory Allowance in accordance with clause 21.2(c) of the Award. Employees will need to be assigned the relevant tag for the rules to be activated and all purpose allowance paid, as detailed further below;

- Adjusted the first aid allowance rules for part time and casual employees so they were being paid on a per day basis as opposed to a per week basis.

- Added a new tag "Tool Allowance" to automate the payment of the tool allowance and thereby removing the need for employees to select the work type against each timesheet;

- Added new rules to cover the Overnight Stay provisions as per clause 21.3(b) of the Award;

- Added a rule for part time employees to be paid overtime if they work on their rostered day off, in accordance with clause 33.3(b) of the Award;

- Added a rule for permanent employees to be paid overtime if broken shifts are worked and the spread of hours are greater than 12 hours per day. Refer to clauses 33.2(a) and 33.2(b) of the Award.

- "Added new rules to Created new tag "5/7.6" to be assigned to employees whose 38 hours week is made up of 5 days at 7.6 hours each day. Otherwise employees will be paid overtime after working in excess of 38 hours per week;

- Award clause numbers have now been added to the title of the relevant rule set. This makes it easier to correlate the interpretation with the specific Award clauses;

- Tags descriptions have been added.

1 January 2018

The award has been updated to reflect changes made as part of the Fair Work Decision 4 year review of modern awards.

Casual employees

The changes are a replacement of Clause 13 - Overtime to include overtime paid for casuals. This now provides for casual staff to be paid overtime in excess of the following:

- For a maximum of 38 hours per week or, where the casual employee works in accordance with a roster, an average of 38 hours per week over the roster cycle (which may not exceed 4 weeks)

- 12 hours in one day

NB: We have applied the rule using 152 hours worked over a 4 week period to remain consistent with the rule set for permanent staff.

Implicitly, this also means overtime can be converted to TIL by using the 'Time off in lieu of Overtime' employee tag, and this has also been reflected in the rules.

These changes are reflected in the "Casual Hospitality" rule set. We've also automatically enabled the work types relating to meal allowances for casual staff. To be paid a meal allowance, the 'Overtime Meal Allowance' needs to be selected on a separate line of the timesheet and a unit of 1 recorded.

These changes have also meant a set of new pay categories for casual overtime and the pay rate templates for casual employees have been updated.

Part time employees

Clause 12 has been updated for part time employees, and mandates the idea of 'guaranteed hours' reflected as the employee standard hours in the system, and the 'employees availability'. We have interpreted the employees availability as only affecting the hours available to roster the part time employee (use 'unavailability' in rostering to achieve this), so no changes are reflected in the pay condition rule set.

The new changes do mean that an employee can work hours in excess of their guaranteed hours and not attract overtime, until they've worked in excess of 38 hours or an average of 38 hours per roster cycle.

This means we've removed the 'overtime in excess of standard hours' and replaced this with 'overtime in excess of 152 hours over 4 weeks'.

These changes have been reflected in the 'Permanent Hospitality' rule set.

Please note that the changes come into effect on the first full pay period on or after 1 January 2018. This means that you should only install these updates once you've completed the last pay period that pays shifts worked during December 2017.

7 August 2017 (a) Apply a minimum 1 unit evening penalty when working Monday to Friday between 7pm to midnight; (b) Apply a minimum 1 unit night penalty when working Monday to Friday between midnight to 7am. We have applied the minimum 1 unit to the penalty periods based on advice from Fair Work, as follows:"We have referred to clause 32.3(a), which states: 'Monday–Friday—7.00 pm to midnight: 10% of the standard hourly rate per hour or any part of an hour for such time worked within the said hours ...' It is the Fair Work Ombudsman's view that if an employee works part of an hour between 7pm and midnight Mondays to Fridays, they are entitled to be paid the full 10% penalty for that part hour, not a percentage for how much of the hour they worked. We consulted with stakeholders in 2013 to establish this view, including the Australian Hotels Association. We note that divisions of the AHA at that time held differing views - some divisions also held this view and other divisions did not. The actual definition of how it is to be paid can only be determined by a judge. If a Court or tribunal were asked to consider this issue, they may come to a different conclusion to the Fair Work Ombudsman's. To avoid doubt, we recommend paying the full 10% penalty rate."