What is Single Touch Payroll (STP)?

STP is a government initiative to streamline business reporting obligations. It starts from 1 July 2019 for employers with 19 or less employees (businesses with 20 or more employees were required to be STP compliant in July 2018).

In a nutshell, STP requires employers (or their registered agent/intermediary) to report payments such as salaries and wages, PAYG withholding and super information directly to the ATO from their payroll system. This must be reported after every pay run has been finalised but no later than the employee's payment date.

There is plentiful information on STP that can be found on the ATO's website.

STP Guide

STP is not a trivial change for employers!

As such, we have prepared this guide to help you navigate through all the necessary components required to undertake STP reporting including:

- Configuration Settings

- Creating & Lodging Events

- End of year processes and lodging finalisation events

Section 1: Configuration Settings

First thing's first - you need to ensure all settings are complete before jumping ahead and lodging pay events. We strongly suggest you complete each of the following and in the order we have presented:

Step 1: Enable STP. Instructions on how to do this can be found here.

Step 2: Complete/Update your ATO Supplier settings. Instructions on how to do this can be found here.

Step 3: Enable the requirement for Two-Factor Authentication upon lodging a pay event. This is an optional step and does not apply to QBO users. You can configure this setting via Payroll Settings > Manage Users > Manage Two-Factor Authentication. Refer here for detailed instructions.

Step 4: Ensure the payment summary classification setting against each pay category is correct. Pay particular attention to allowance based pay categories as the ATO has changed the reporting requirements for allowances. N.B. The new allowance settings do not affect how allowances are recorded on any new or existing payment summaries. Phase 2 configuration of pay category classifications can be accessed here.

Step 5: This step is only required for businesses:

- whose ATO Supplier settings (in Step 2) are set to "As a registered Tax/BAS Agent"; and

- that have not set up a Standing Authority; and/or

- that require a Client Authority to authorise pay events prior to lodgement.

A full access user, by default, has the permission to approve/reject a pay event prior to lodgement. If, however, a Client Authority does not have full access to the payroll system, they can be granted restricted access. Restricted access is granted via the Manage Users screen. Instructions on how to do this can be found here.

Step 6: This step is only required for businesses with closely held employees. Ensure closely held employees are classified accordingly and the correct reporting method has been selected. Instructions on how to do this can be found here.

Step 7: Full access users can choose to receive email notifications pertaining specifically to STP pay events. These notifications relate to:

- when a lodgement fails. This will allows users who process the lodgements to move away from the screen to carry on with other work. Additionally, it allows users who are not lodging pay events to stay up to date with any lodgement issues. To activate this notification, click on "Email me when there is a Lodgement error" from the My Notifications screen.

- when an STP Pay Event Approver approves or rejects a pay/update event. This setting is only relevant to businesses using a registered Tax/BAS Agent to lodge pay events on the business's behalf. This will allows users responsible for lodgements to be notified when a requested pay event approver has either approved or rejected the event. If the event has been approved, the lodger can continue with the lodgement process. If the event has been rejected, further action will be required before the event can be lodged. To activate this notification, click on "Email me when a pay event is approved or rejected" from the My Notifications screen.

Section 2: Creating & Lodging Events

There are two types of events that can be lodged with the ATO:

- a Pay Event;

- an Update Event.

A summary of all events can be found via Reports > Single Touch Payroll. This article provides a detailed explanation of each component on that screen.

Pay Event

Whenever an employer creates a pay run and makes a payment to an employee that is subject to withholding, they are required to lodge a pay event with the ATO on or before the date the payment is made. Once a pay run is finalised, a pay event should be lodged with the ATO.

For detailed information on pay events for non-closely held employees being reported on a quarterly basis, including how to create and lodge them, refer here.

For detailed information on pay events for closely held employees being reported on a quarterly basis, including how to create and lodge them, refer here.

Update Event

An update event is used to report changes to employee YTD amounts previously reported to the ATO. Update events are not associated to any pay runs and thus can only be created when an employee payment has not been made.

For detailed information on Update Events, including how to create and lodge them, refer here.

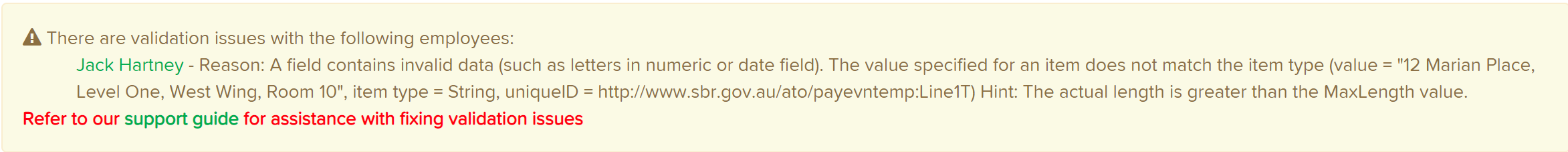

Validation Warnings

When a pay/update event is created, you may notice a "Warnings" tab on the screen:

This indicates there are validation issues in the event. If the warning pertains to a business setting, this will need to be rectified before lodging the event. If the warning pertains to a specific employee, the employee will be excluded from the lodgement until the issue is fixed. The warning will also contain a link to our support article detailing all potential validation warnings. The article can also be found here.

Dashboard Notifications

Once you have sent a client authority request and/or lodged an event with the ATO, rest assured that you can leave the screen and move on to other exciting payroll activities. Your payroll dashboard will provide updates on the status of a lodgement up until it is deemed successfully lodged. Examples include:

Additionally, the "Pay Runs" summary tab includes icon indicators to detail the status of each pay run event, as follows:

![]() = Pay run has successfully been lodged with the ATO

= Pay run has successfully been lodged with the ATO

![]() = Pay run has successfully been lodged with the ATO but contains some errors

= Pay run has successfully been lodged with the ATO but contains some errors

![]() = Pay run lodgement with the ATO has failed

= Pay run lodgement with the ATO has failed

Lodgement Errors

There may be times when lodgements don't go 100% smoothly and an error may occur. We have started compiling a troubleshooting guide in case this does occur.

There may also be instances where you have reported incorrect information to the ATO, such as the BMS ID, the employing entity of the employee, etc. Refer to this article for further information and how can you correct these errors.

Managing Failed or Partially Successful Lodgements

The ATO states that:

- An employer needs to report data fixes within 14 days from when the issue is detected; or

- An employer may choose to report a fix in the next pay event for an employee where this is later than 14 days from when the error is detected. Additional time will be allowed to the next regular pay cycle for the employee. For example, monthly pay cycle; or

- An employer may report a fix in an update event.

Refer to this article for instructions on how to manage an event that has failed or was partially successful.

Section 3: End of year processes and lodging finalisation events

Refer here to access the end of year guide, including instructions on how to lodge finalisation events.

A few notables:

- STP does not remove the requirement of lodging employee tax file declarations. If you have enabled electronic lodgement, the process is very straightforward. Instructions on this can be found here.

- Employers who report and finalise employee payments (and amounts withheld from them) throughout the year in line with their payroll process, will not need to provide corresponding payment summaries to employees nor a payment summary annual report to the ATO.

- The ATO have reported that users lodging STP reports on behalf of clients are considered to be providing a payroll service and will therefore need to be registered as an agent with the Tax Practitioner Board (TPB). For further information, visit Registered agents providing a payroll service on the ATO website.

- WPN holders are exempt from lodging STP events. If you have a WPN because you are registered for PAYG withholding and are not entitled to an ABN, you are exempt from STP reporting for the 2018–19, 2019–20, 2020-21, 2021-22 and 2022-23 financial years. You will, however, need to start reporting these payments through STP from 1 July 2023. If WPN holders want to start reporting through STP earlier, this can only be done via a registered tax/BAS agent.

If you have any questions or feedback, please let us know via support@yourpayroll.com.au.