Lets take a look at some of the new Employment Hero Payroll features announced in Febuary 2023

Record Paid and Unpaid Breaks

What is it?

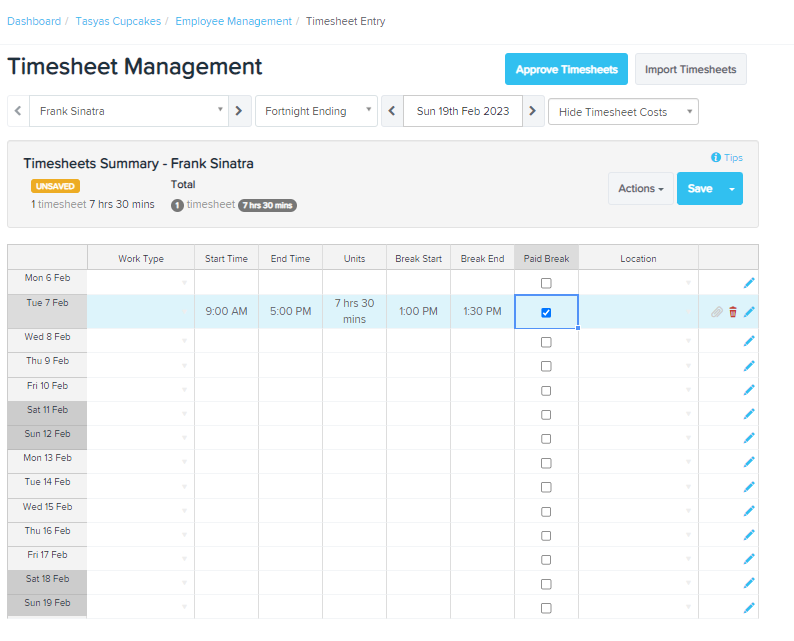

Previously, users could only enter breaks that were either categorised as paid or unpaid and not a combination of the two.

Why does it matter?

Due to compliance and auditing purposes, businesses need to record both. When an employee record's a break in their timesheets, the break duration is automatically deducted from paid hours unless the business has created a rule to pay employees for all breaks. By enabling the paid break feature, employees will be able to record both paid and unpaid breaks in timesheets and ensure they are paid accordingly.

How does it work?

This new feature will be made available to:

- Businesses that have time and attendance enabled on their subscription plan; and

- In timesheets that have start/finish times (as opposed to entering units/hours)

This feature is not automatically switched on for eligible businesses. Rather, users will need to select the new setting "Enable employees to include both paid and unpaid breaks in their timesheet" which is available in the Payroll Settings > Timesheets screen.

Email Verification Update

What is it?

When updating an employee's email address, there is currently no confirmation or verification sent to the employee which can lead to security issues.

Why does it matter?

This will add security enhancements to alert the end user of potential malicious breaches or incorrect updates to their account. Once these security enhancements are released, users will be required to verify changes to their account email addresses.

How does it work?

This new process will be triggered whenever a user updates an existing users' email address. This email change will need to be verified by following an emailed link within 72 hours.

New Employer Contributions Type

What is it?

Employment Hero Payroll are releasing a new non-reportable employer contribution type. Currently, any amounts associated with an employer contribution are classified as reportable by default.

Why does it matter?

This new contribution type allows users to distinguish between reportable and non-reportable employer contributions and will ensure contributions are reported accordingly with the ATO.

How does it work?

- Contributions required by collectively negotiated industrial agreements

- Matching contributions under a collective agreement (matching contributions under an individual agreement are reportable)

- To a defined benefit fund (exceptions may apply)

- Contributions required by super fund rules or a law

- Extra contributions that the employee could not influence, such as extra contributions for administrative simplicity or accepted e